Your Errors and omissions insurance canada images are ready. Errors and omissions insurance canada are a topic that is being searched for and liked by netizens today. You can Get the Errors and omissions insurance canada files here. Find and Download all royalty-free images.

If you’re searching for errors and omissions insurance canada images information connected with to the errors and omissions insurance canada keyword, you have come to the ideal blog. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Errors And Omissions Insurance Canada. Your clients might also demand an errors and omissions insurance proof. As the world becomes more and more specialized, so grows the experts or professional ranks. This insurance is also called professional liability insurance & professional indemnity insurance in ontario, canada. Examples of professional negligence situations include:

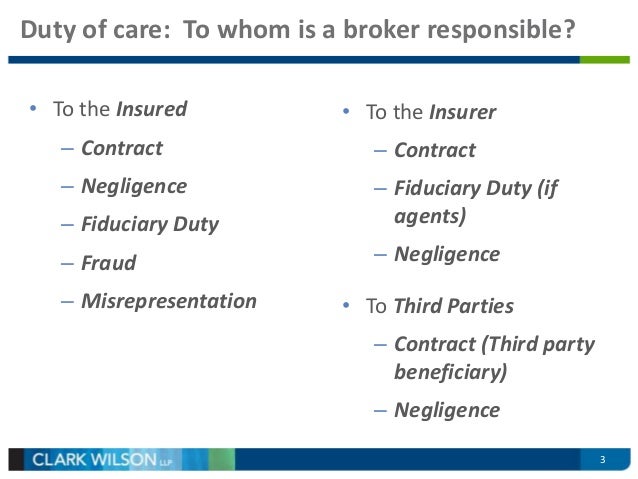

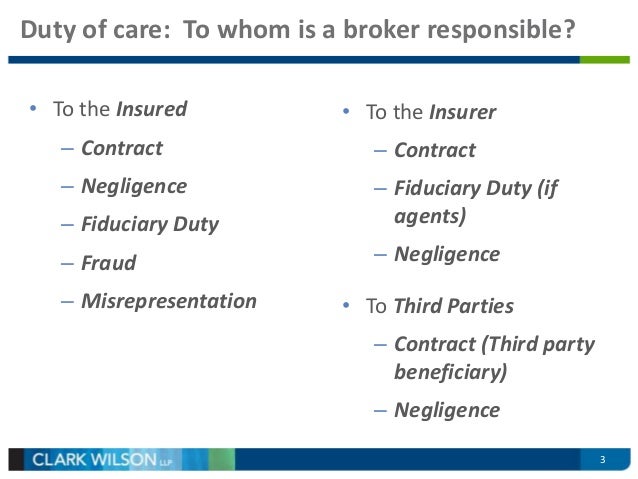

Errors & Omissions Insurance Update Brokers� E&O Exposure From slideshare.net

Errors & Omissions Insurance Update Brokers� E&O Exposure From slideshare.net

Ial general liability insurance employment practices (for firms with more than two employees but. We offer several e&o products to best fit your organization, which include: Travelers canada e&o typically covers losses incurred from a lawsuit. Your corporation provides financial advice. Examples of professional negligence situations include: Errors and omissions policies come with a range of typical coverage limits, as per the following:

Your clients might also demand an errors and omissions insurance proof.

Errors and omissions insurance canada. Examples of professional negligence situations include: Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage. Victor has more than 35 years of experience in offering e&o insurance to associations and affinity groups, as well as individuals in a diverse range of professions—from ambulance operators to zoologists and everything in between. We offer several e&o products to best fit your organization, which include: Please indicate if you are also applying for the following optional coverages:

Source: slideshare.net

Source: slideshare.net

Ask your covermarket licensed insurance professional on how your insurer defines your business and whether it requires professional liability insurance. Errors and omissions (e&o) insurance protects against these threats, whether or not they have merit. Through our creative errors and omissions (e&o) solutions, we’re committed to providing professionals with the reliable coverage they need. Kbd is a canadian professional liability insurance broker with over 40 years of experience in the industry. Errors and omissions insurance canada.

Source: slideshare.net

Source: slideshare.net

We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more. This is an application for errors and omissions insurance. We provide errors and omissions insurance (e&o insurance) to ontario engineers, consultants, building designers, accountants, home inspectors, auditors, it consultants, computer consultants, contractors across ontario, canada. As the world becomes more and more specialized, so grows the experts or professional ranks. Your life agents licence may require e&o insurance canada errors and omissions insurance for life agents not only protects you, but depending on where your business is located, it may be also mandated by your provincial government.

Source: llrenaissance.com

Source: llrenaissance.com

We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more. Get errors and omissions insurance quotes from the top insurers in canada. Your corporation provides financial advice. Council rule 7 (11) establishes the requirement for all insurance licensees to maintain or be covered by errors and omissions insurance that includes minimum coverage of $1,000,000.00 per claim and $2,000,000.00 in the aggregate (“minimum e&o insurance”) that extends to all insurance activities. Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage.

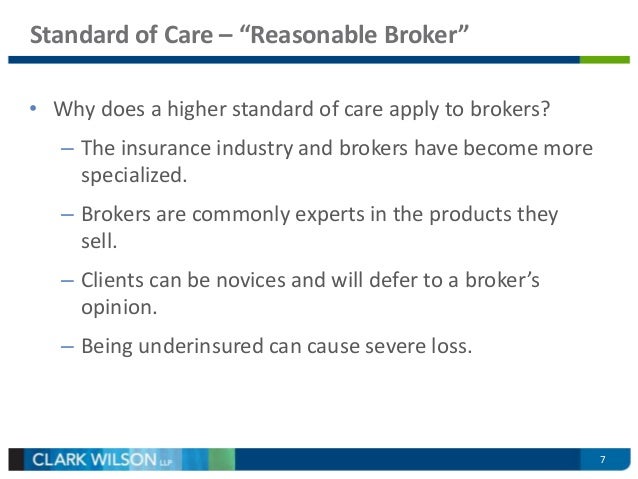

Source: slideshare.net

Source: slideshare.net

Find the best errors & omissions insurance rates for your business. Errors and omissions insurance is a type of professional liability insurance, which protects professionals from client claims alleging financial loss due to a service you provided, as well as lawsuits alleging misconduct, negligence, errors, omissions, and. Travelers canada e&o typically covers losses incurred from a lawsuit. Every day, your clients rely on your advice and expertise. We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more.

Source: slideshare.net

Source: slideshare.net

Professional liability insurance (pli), also called professional indemnity insurance (pii) but more commonly also known as errors & omissions (e&o) insurance in the canada, is a form of liability insurance that helps to protect each professional and companies offering advice and service from bearing the full cost of defending against a. Council rule 7 (11) establishes the requirement for all insurance licensees to maintain or be covered by errors and omissions insurance that includes minimum coverage of $1,000,000.00 per claim and $2,000,000.00 in the aggregate (“minimum e&o insurance”) that extends to all insurance activities. Errors and omissions policies come with a range of typical coverage limits, as per the following: The purpose of errors and omissions insurance is to protect businesses, professionals, and workers from costs associated with lawsuits and losses a client may suffer due to an error or mistake made in the work produced or advice given. Errors and omissions insurance (e&o), also commonly known as professional liability, is a vital insurance coverage for businesses that provide a professional service to clients that include giving advice.

Source: slideshare.net

Source: slideshare.net

Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage. In addition to settlements or judgments, losses can include. Professional liability insurance (pli), also called professional indemnity insurance (pii) but more commonly also known as errors & omissions (e&o) insurance in the canada, is a form of liability insurance that helps to protect each professional and companies offering advice and service from bearing the full cost of defending against a. Please indicate if you are also applying for the following optional coverages: Your clients might also demand an errors and omissions insurance proof.

Source: liabilitycover.ca

Source: liabilitycover.ca

Errors and omissions insurance (e&o insurance) protects professionals & their businesses financially if they get sued because of negligence, errors, mistakes, and other reasons. Ask your covermarket licensed insurance professional on how your insurer defines your business and whether it requires professional liability insurance. We help professionals get proper e&o insurance for a better rate. Council rule 7 (11) establishes the requirement for all insurance licensees to maintain or be covered by errors and omissions insurance that includes minimum coverage of $1,000,000.00 per claim and $2,000,000.00 in the aggregate (“minimum e&o insurance”) that extends to all insurance activities. Victor has more than 35 years of experience in offering e&o insurance to associations and affinity groups, as well as individuals in a diverse range of professions—from ambulance operators to zoologists and everything in between.

Source: insuranceerrorsandomissions.ca

Source: insuranceerrorsandomissions.ca

We help professionals get proper e&o insurance for a better rate. Every day, your clients rely on your advice and expertise. Professional liability insurance (pli), also called professional indemnity insurance (pii) but more commonly also known as errors & omissions (e&o) insurance in the canada, is a form of liability insurance that helps to protect each professional and companies offering advice and service from bearing the full cost of defending against a. Council rule 7 (11) establishes the requirement for all insurance licensees to maintain or be covered by errors and omissions insurance that includes minimum coverage of $1,000,000.00 per claim and $2,000,000.00 in the aggregate (“minimum e&o insurance”) that extends to all insurance activities. Please indicate if you are also applying for the following optional coverages:

Source: slideshare.net

Source: slideshare.net

Errors and omissions insurance (e&o insurance) protects professionals & their businesses financially if they get sued because of negligence, errors, mistakes, and other reasons. Errors and omissions insurance aka professional liability insurance aka e&o insurance is a type of liability coverage designed to protect traditional professionals (e.g., accountants, attorneys) and other professionals (e.g., human resource consultants, management consultants etc.) against liability incurred as a result of errors and omissions in. Council rule 7 (11) establishes the requirement for all insurance licensees to maintain or be covered by errors and omissions insurance that includes minimum coverage of $1,000,000.00 per claim and $2,000,000.00 in the aggregate (“minimum e&o insurance”) that extends to all insurance activities. This insurance is also called professional liability insurance & professional indemnity insurance in ontario, canada. We offer several e&o products to best fit your organization, which include:

Source: alignedinsurance.com

Source: alignedinsurance.com

Professional liability insurance (pli), also called professional indemnity insurance (pii) but more commonly also known as errors & omissions (e&o) insurance in the canada, is a form of liability insurance that helps to protect each professional and companies offering advice and service from bearing the full cost of defending against a. We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more. Travelers canada e&o typically covers losses incurred from a lawsuit. Examples of errors and omissions that would require professional liability include miscalculation of assets valuation,. E&o insurance covers the cost of court and settlements specified in an insurance contract.

Source: moreprotection.fct.ca

Source: moreprotection.fct.ca

This is an application for errors and omissions insurance. Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage. We offer several e&o products to best fit your organization, which include: Professional liability insurance (pli), also called professional indemnity insurance (pii) but more commonly also known as errors & omissions (e&o) insurance in the canada, is a form of liability insurance that helps to protect each professional and companies offering advice and service from bearing the full cost of defending against a. The higher your coverage limit, the more premium you’ll pay.

Source: hginspectione.weebly.com

Source: hginspectione.weebly.com

Through our creative errors and omissions (e&o) solutions, we’re committed to providing professionals with the reliable coverage they need. Through our creative errors and omissions (e&o) solutions, we’re committed to providing professionals with the reliable coverage they need. E&o insurance covers the cost of court and settlements specified in an insurance contract. We provide errors and omissions insurance (e&o insurance) to ontario engineers, consultants, building designers, accountants, home inspectors, auditors, it consultants, computer consultants, contractors across ontario, canada. Marsh can help protect you from one of the most overlooked but potentially damaging, liability exposures in business today:

Source: albertamagazines.com

Source: albertamagazines.com

We help professionals get proper e&o insurance for a better rate. An errors and omissions insurance can protect you against an oversight that left your client vulnerable to a few liabilities or bad advice that led to insufficient coverage. Through our creative errors and omissions (e&o) solutions, we’re committed to providing professionals with the reliable coverage they need. Get errors and omissions insurance quotes from the top insurers in canada. Professional liability insurance covers your liability for errors and omissions while providing your specific professional services to your clients.

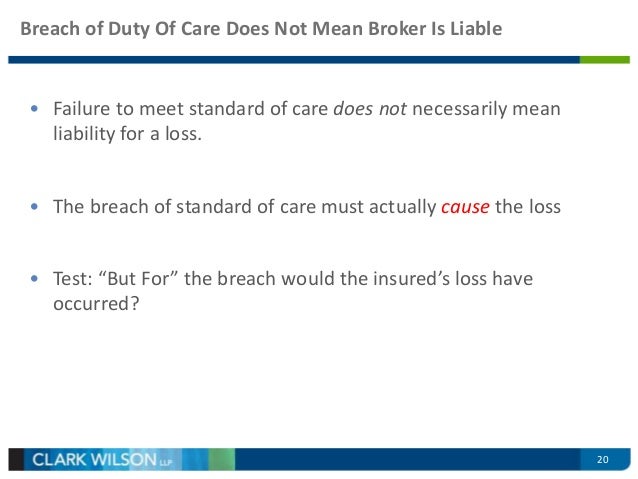

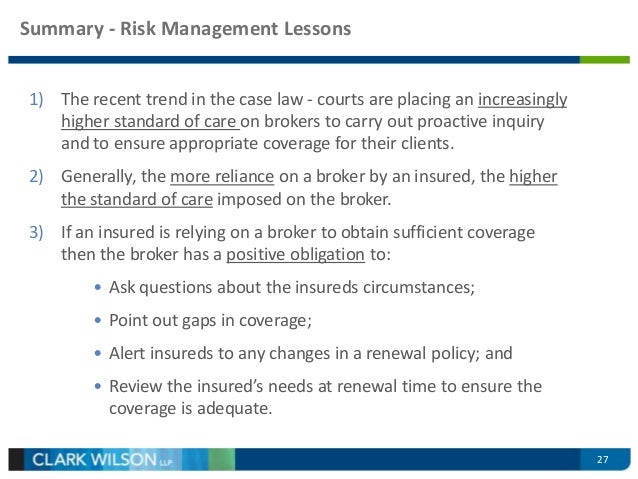

Source: slideshare.net

Source: slideshare.net

We provide errors and omissions insurance (e&o insurance) to ontario engineers, consultants, building designers, accountants, home inspectors, auditors, it consultants, computer consultants, contractors across ontario, canada. It protects you from loss if a customer sues you for mistakes or omissions in your services. Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage. Victor has more than 35 years of experience in offering e&o insurance to associations and affinity groups, as well as individuals in a diverse range of professions—from ambulance operators to zoologists and everything in between. Errors and omissions (e&o) insurance protects against these threats, whether or not they have merit.

Source: excessunderwriting.ca

Source: excessunderwriting.ca

We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more. Errors and omissions (e&o) insurance protects against these threats, whether or not they have merit. E&o insurance covers the cost of court and settlements specified in an insurance contract. Errors and omissions policies come with a range of typical coverage limits, as per the following: An errors and omissions insurance can protect you against an oversight that left your client vulnerable to a few liabilities or bad advice that led to insufficient coverage.

Source: slideshare.net

Source: slideshare.net

Your life agents licence may require e&o insurance canada errors and omissions insurance for life agents not only protects you, but depending on where your business is located, it may be also mandated by your provincial government. Find the best errors & omissions insurance rates for your business. Travelers canada e&o typically covers losses incurred from a lawsuit. Errors and omissions insurance (e&o insurance) protects professionals & their businesses financially if they get sued because of negligence, errors, mistakes, and other reasons. Professional liability insurance covers your liability for errors and omissions while providing your specific professional services to your clients.

Source: revisi.net

Source: revisi.net

We offer errors & omissions insurance to quebec & ontario based consultants, professionals, media + marketing companies, software developers and more. Ial general liability insurance employment practices (for firms with more than two employees but. Errors and omissions policies come with a range of typical coverage limits, as per the following: Errors and omissions insurance (e&o), also commonly known as professional liability, is a vital insurance coverage for businesses that provide a professional service to clients that include giving advice. Errors and omissions, or e&o insurance coverage, is an important supplement to a business�s general liability coverage.

Source: pinterest.com

Source: pinterest.com

Errors and omissions insurance (e&o insurance) protects professionals & their businesses financially if they get sued because of negligence, errors, mistakes, and other reasons. Ask your covermarket licensed insurance professional on how your insurer defines your business and whether it requires professional liability insurance. Errors and omissions insurance canada. The higher your coverage limit, the more premium you’ll pay. The purpose of errors and omissions insurance is to protect businesses, professionals, and workers from costs associated with lawsuits and losses a client may suffer due to an error or mistake made in the work produced or advice given.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title errors and omissions insurance canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.