Your Equipment rental insurance policy images are available. Equipment rental insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the Equipment rental insurance policy files here. Download all free photos.

If you’re searching for equipment rental insurance policy images information related to the equipment rental insurance policy topic, you have come to the ideal blog. Our site always gives you hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

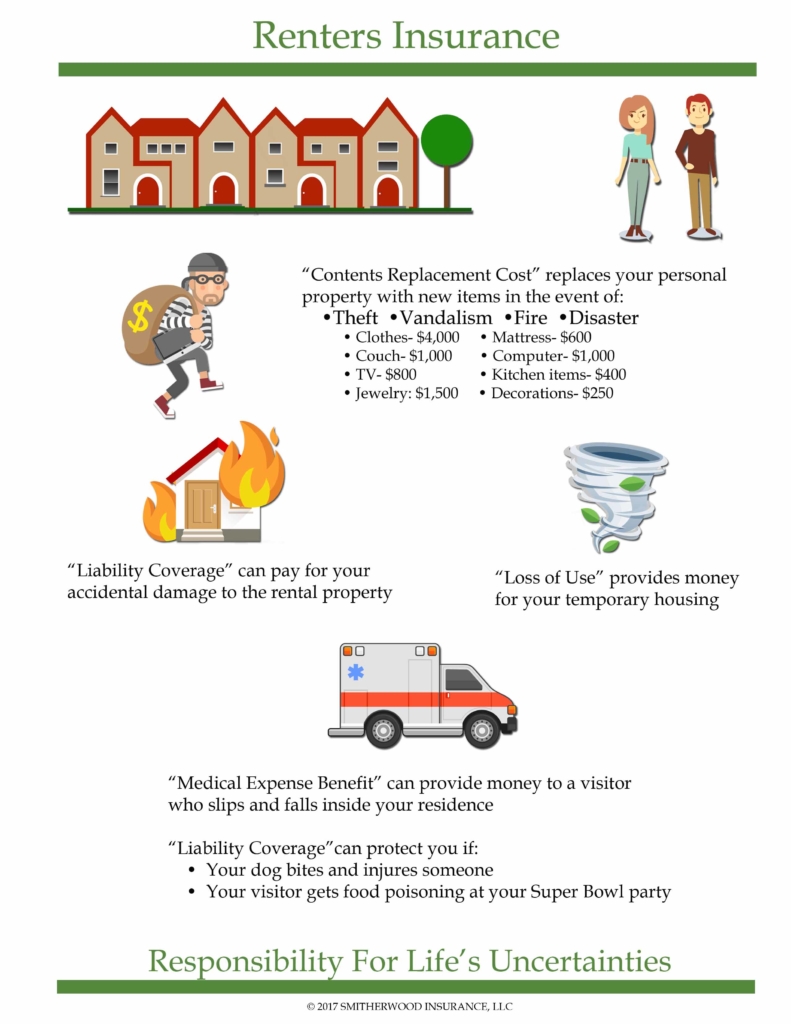

Equipment Rental Insurance Policy. General liability insurance will protect your equipment rental business from slip and fall claims and other liability risks. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. It is for you and your company, to cover the repair or replacement costs resulting from equipment damages or theft, that can occur during an equipment rental. Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our cover can protect their valuable assets.

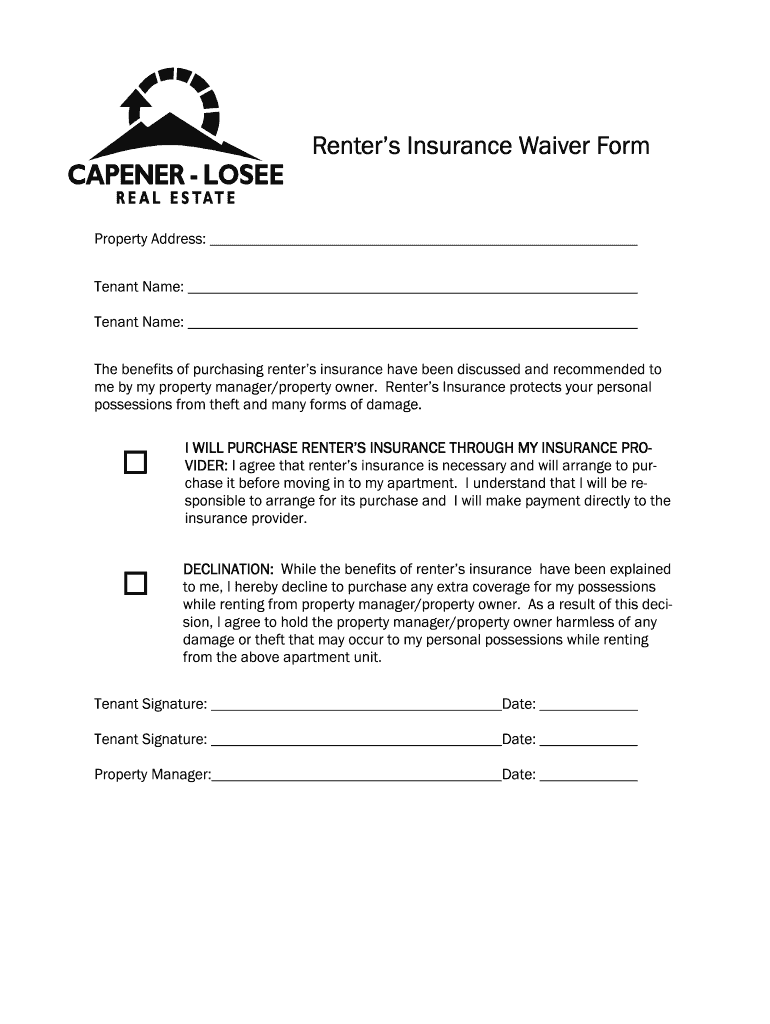

Renters Insurance Policy Form Insurance Forms From dandzelia-z.blogspot.com

Renters Insurance Policy Form Insurance Forms From dandzelia-z.blogspot.com

If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company. Designed to protect commercial operations owning valuable mobile equipment, the contractors equipment insurance policy provides business coverage for construction machinery, equipment and tools of a mobile nature used in contracting, installation, erection. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. Or, do you need to call your agent to add it? It will also help cover equipment that is both on business property and at a rental location. Is rented, leased or borrowed machinery included on your policy?

Minimum equipment insurance premiums starting at:

These policies typically include leased equipment insurance coverage that covers $50,000 or in some instances up to $300,000 worth of equipment. This insurance policy often serves as the necessary insurance that most equipment dealers require in order to rent equipment. With a 25+ year focus on rental equipment insurance, we thoroughly understand the nuances of your business and can speak your language: General liability insurance will protect your equipment rental business from slip and fall claims and other liability risks. Experts advise that, ideally, you should contact an insurance agent whenever you think you might begin using subcontractors. Attending closely to your coverage plan with your agent assures that all your items are properly protected and you are not at risk even if something were to happen with dangerous rental equipment.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. These are just some of the needed insurances that can help reduce equipment rental risks. To give you ballpark figures: It will also help cover equipment that is both on business property and at a rental location.

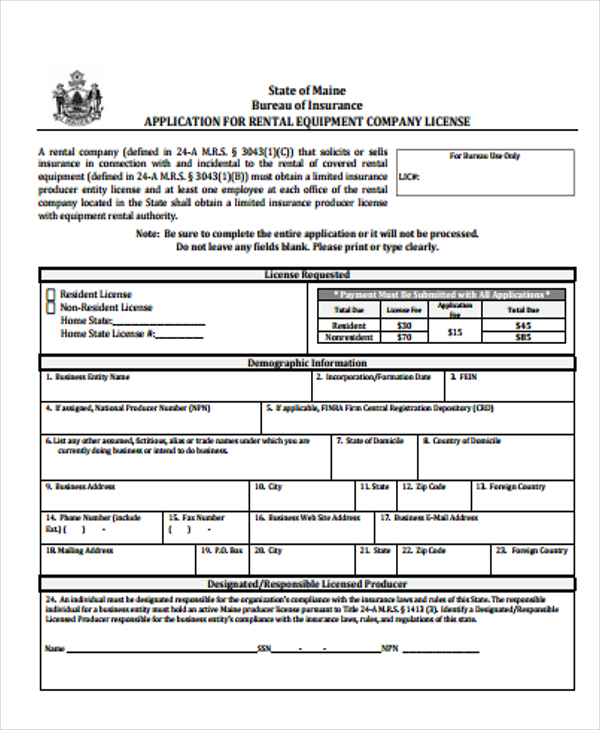

Source: 100000-renters-insurance.blogspot.com

A rental equipment protection plan is not an insurance policy. You should set your policy’s rented equipment limit to $100,000 and issue two certificates of insurance; General liability insurance will protect your equipment rental business from slip and fall claims and other liability risks. Employee theft and damage to employee tools can be covered under this policy as well. A rental equipment protection plan is not an insurance policy.

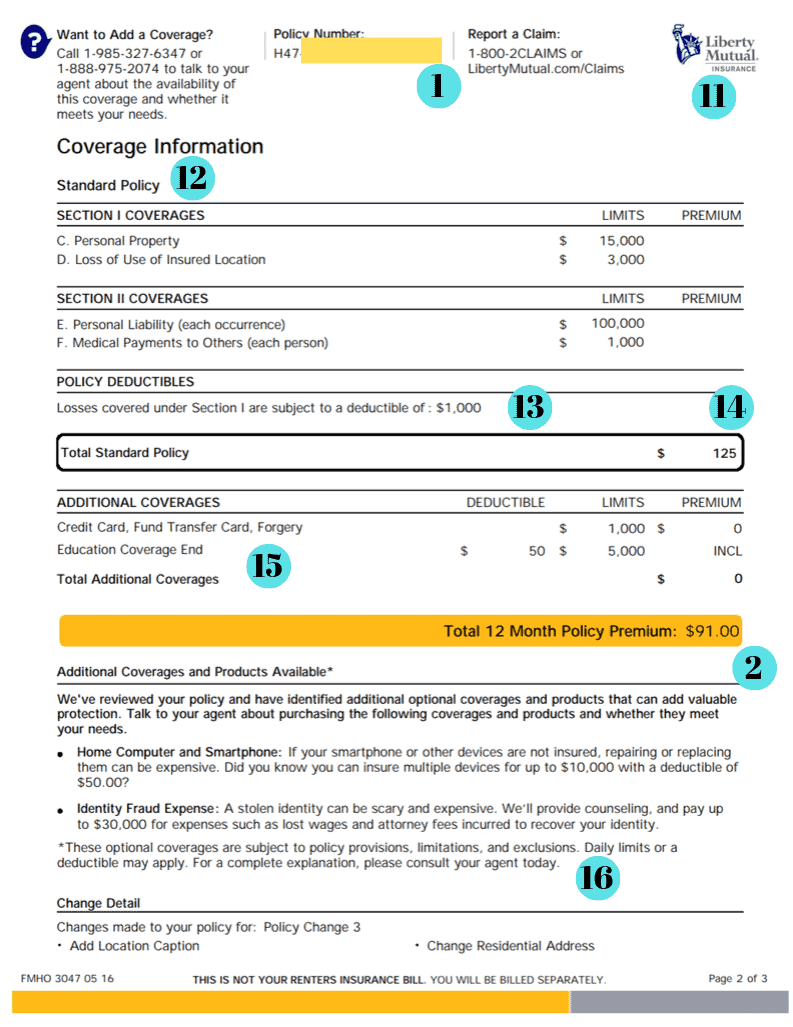

Source: buildium.com

Source: buildium.com

Corrosion, rust or wear and tear. These are just some of the needed insurances that can help reduce equipment rental risks. Plus equipment and party rental businesses can tailor coverage to fit their unique needs. You should set your policy’s rented equipment limit to $100,000 and issue two certificates of insurance; One to each vendor you’re renting from.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Plus equipment and party rental businesses can tailor coverage to fit their unique needs. While this can be thought of as an exemption, it is simply a type of business umbrella policy that extends to leased or rented equipment under control of the policyholder. You are involved with productions throughout the year. Minimum equipment insurance premiums starting at: This policy will cover production equipment rented from a third party such as a rental house or individual owner.

Source: template.net

Source: template.net

You can expect to pay just $100 for your deductible per instrument that’s insured and premiums. It is for you and your company, to cover the repair or replacement costs resulting from equipment damages or theft, that can occur during an equipment rental. Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our cover can protect their valuable assets. One to each vendor you’re renting from. You are involved with productions throughout the year.

Source: in.pinterest.com

Source: in.pinterest.com

You should set your policy’s rented equipment limit to $100,000 and issue two certificates of insurance; Commercial auto insurance will cover your vehicles in case of an accident. Under some rental contracts, the renters can provide their own insurance and name the rental agency as the payee for a specified amount on equipment. It will also help cover equipment that is both on business property and at a rental location. Rental shield offers renters the most extensive coverage at a price that fits the customer’s timeline.

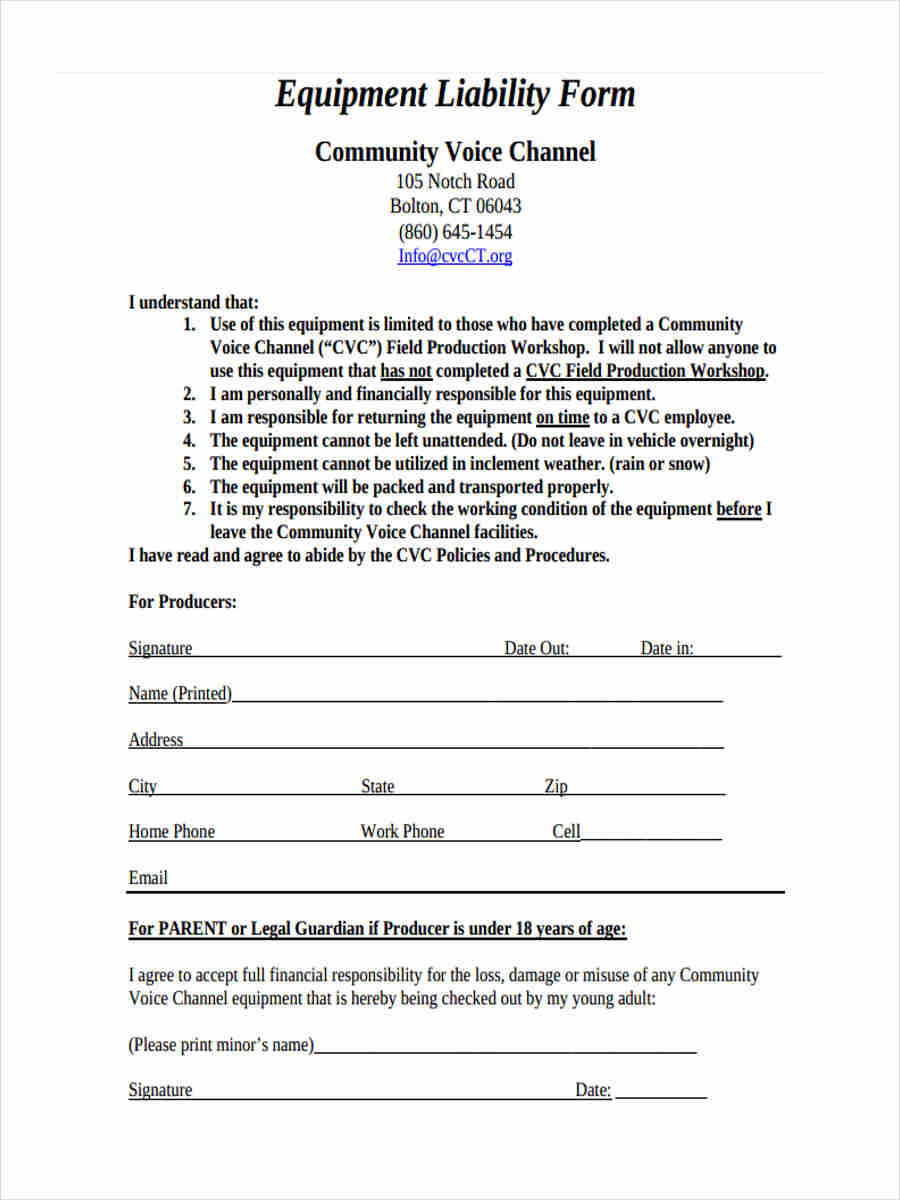

Source: templatelab.com

Source: templatelab.com

This policy will cover production equipment rented from a third party such as a rental house or individual owner. We specialize in covering the difficult risks that other insurance providers typically avoid. While this can be thought of as an exemption, it is simply a type of business umbrella policy that extends to leased or rented equipment under control of the policyholder. These policies typically include leased equipment insurance coverage that covers $50,000 or in some instances up to $300,000 worth of equipment. An equipment insurance policy will help cover costs such as equipment breakdown, repairs and cleanup after accidents.

Source: smitherwoodinsurance.com

Source: smitherwoodinsurance.com

Minimum equipment insurance premiums starting at: The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. Select your own limit of insurance, deductibles and additional coverage. Is rented, leased or borrowed machinery included on your policy? Working with your rental equipment insurance company to create an equipment insurance coverage plan that protects all types of party supplies is prudent.

Source: pdffiller.com

Source: pdffiller.com

That depends on the company and type of policy you have. Employee theft and damage to employee tools can be covered under this policy as well. The hartford offers a robust equipment insurance policy that includes coverage for a broad variety of equipment concerns. Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost. You are involved with productions throughout the year.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Under some rental contracts, the renters can provide their own insurance and name the rental agency as the payee for a specified amount on equipment. With a 25+ year focus on rental equipment insurance, we thoroughly understand the nuances of your business and can speak your language: That depends on the company and type of policy you have. An equipment protection program provides you with financial protection and peace of mind. General liability insurance will protect your equipment rental business from slip and fall claims and other liability risks.

Source: albanord.com

Source: albanord.com

Some policies automatically include that coverage and others only include the coverage if you specifically list the equipment at the time it’s borrowed, rented or leased. In most cases, insurance policies don’t automatically cover subs. Corrosion, rust or wear and tear. An equipment protection program provides you with financial protection and peace of mind. If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company.

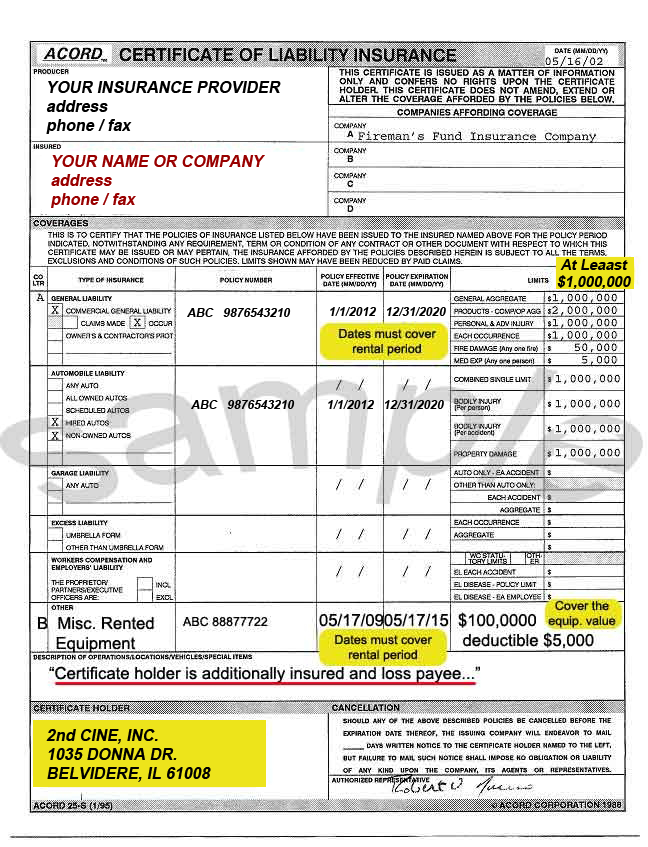

Source: 2ndcine.com

Source: 2ndcine.com

Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our cover can protect their valuable assets. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. These are just some of the needed insurances that can help reduce equipment rental risks. Or, do you need to call your agent to add it? There are certain instances where tools and equipment insurance won’t provide coverage, including:

Source: youngandtheinvested.com

Source: youngandtheinvested.com

Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. Your power cutter has been with you from the beginning, but it’s rusted to the point that it is no longer usable. If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company. General liability insurance policy for your camp equipment rental business insures you against claims coming from injury to clients or damage to their property. Experts advise that, ideally, you should contact an insurance agent whenever you think you might begin using subcontractors.

Source: pinterest.com

Source: pinterest.com

It will also help cover equipment that is both on business property and at a rental location. In most cases, insurance policies don’t automatically cover subs. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. It will also help cover equipment that is both on business property and at a rental location. There are certain instances where tools and equipment insurance won’t provide coverage, including:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Whether you rent or own the equipment, its insurance policy needs to specifically state the coverage of subcontractors who may operate the machines. Select your own limit of insurance, deductibles and additional coverage. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. With a 25+ year focus on rental equipment insurance, we thoroughly understand the nuances of your business and can speak your language: Some policies automatically include that coverage and others only include the coverage if you specifically list the equipment at the time it’s borrowed, rented or leased.

Source: budgetvideo.com

Source: budgetvideo.com

Whether you rent or own the equipment, its insurance policy needs to specifically state the coverage of subcontractors who may operate the machines. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. It will also help cover equipment that is both on business property and at a rental location. We specialize in covering the difficult risks that other insurance providers typically avoid. A rental equipment protection plan is not an insurance policy.

Source: turbotenant.com

Source: turbotenant.com

You are involved with productions throughout the year. You are involved with productions throughout the year. This insurance policy often serves as the necessary insurance that most equipment dealers require in order to rent equipment. Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our cover can protect their valuable assets. General liability insurance will protect your equipment rental business from slip and fall claims and other liability risks.

Source: sampleforms.com

Source: sampleforms.com

It protects your camp equipment rental business from the claims themselves and as well to any associated court costs and legal fees of the lawsuits. To give you ballpark figures: If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company. It protects your camp equipment rental business from the claims themselves and as well to any associated court costs and legal fees of the lawsuits. Helps protect the property a party or equipment rental business owns and leases, including things like computers, equipment, inventory, and furniture.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title equipment rental insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.