Your Equipment rental insurance images are ready in this website. Equipment rental insurance are a topic that is being searched for and liked by netizens now. You can Get the Equipment rental insurance files here. Download all free photos and vectors.

If you’re looking for equipment rental insurance pictures information connected with to the equipment rental insurance interest, you have come to the ideal blog. Our site always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

Equipment Rental Insurance. Every small camp equipment rental business should have enough professional liability insurance to cover a single claim of $25,000, with annual cover of $50,000. This policy will cover production equipment rented from a third party such as a rental house or individual owner. The hartford provides a wide range of specialized services designed to help businesses improve. “rental shield was created at the request of heavy equipment renters so they can get the coverage they need to rent the equipment that helps them get the job done.”

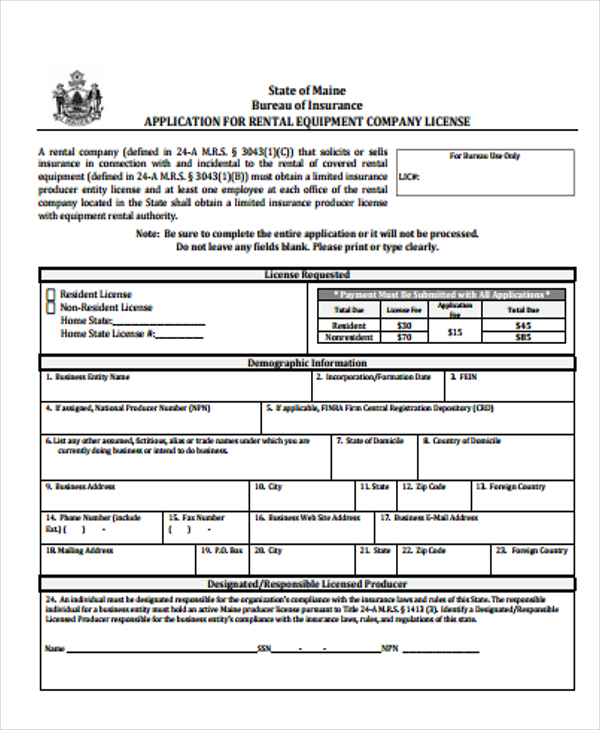

Equipment Rental Insurance Tomins From tomins.com

Equipment Rental Insurance Tomins From tomins.com

We are here to help you get the right insurance cover at the right price for your business. Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost. If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company. This equipment rental agreement (“agreement”) is effective as of the date of last signature. Tools and equipment insurance covers a lot — but it won’t provide coverage for corrosion, rust, wear and tear or rental equipment. Insurance premiums are prorated for the rental period and are based on the value of equipment, so you’ll never pay more than you have to.

Just like you would if it were your own.

We are here to help you get the right insurance cover at the right price for your business. A rental equipment protection plan is not an insurance policy. “rental shield was created at the request of heavy equipment renters so they can get the coverage they need to rent the equipment that helps them get the job done.” As a hireguard appointed representative, you will get advice, guidance and comprehensive training from our team. Equipment insurance is a policy that helps cover the tools, equipment and other inventory that a business may rent out. See the table in the cost of camp equipment rental insurance section below for average prices of professional liability insurance for your camp equipment rental operations.

Source: contractorinsuranceproviders.com

Source: contractorinsuranceproviders.com

With hundreds of insureds across the nation, we speak the rental equipment language (aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc.), and can tie that knowledge to rental equipment insurance. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. If you do plan to rent equipment from someone else, you may want to opt for insurance through the rental company. If you’re renting out your home for short stints, you’ll need to make sure you’re protected. “rental shield was created at the request of heavy equipment renters so they can get the coverage they need to rent the equipment that helps them get the job done.”

Source: template.net

Source: template.net

We are the california rental association’s (cra) only endorsed insurance broker. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. The equipment rental dealers insurance program which is part of the overall prorental program has been in effect since 1986. Our specialist team has a deep knowledge and understanding of the hire and rental industry. As a hireguard appointed representative, you will get advice, guidance and comprehensive training from our team.

Source: tomins.com

Source: tomins.com

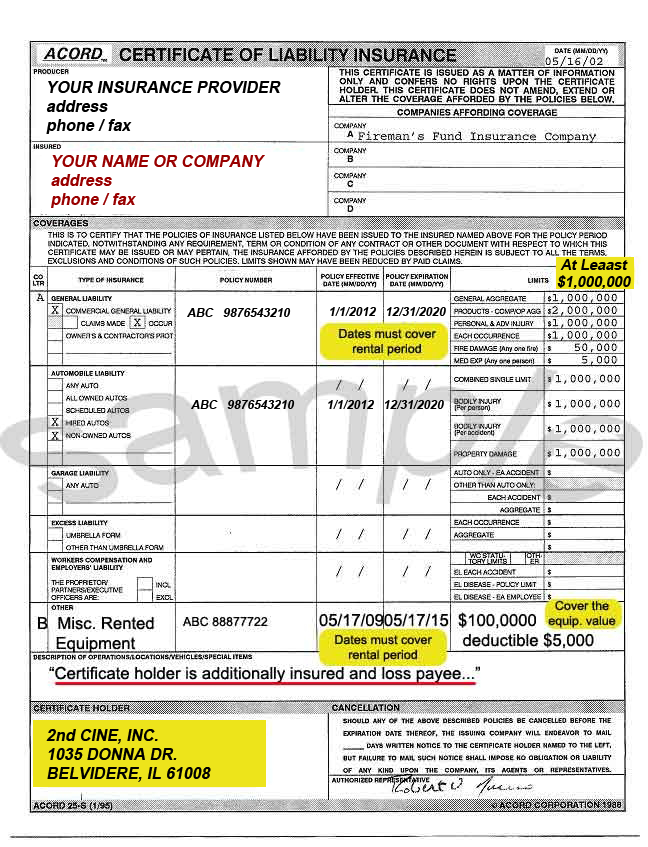

Designed to protect commercial operations owning valuable mobile equipment, the contractors equipment insurance policy provides business coverage for construction machinery, equipment and tools of a mobile nature used in. This equipment rental agreement (“agreement”) is effective as of the date of last signature. Regardless of your company’s specialty, every item you rent out should have appropriate coverage by an insurance policy to keep your profits protected. Equipment rental insurance will protect you and your business against claims associated with injuries or damages from your equipment. Before leaving the store, they will ask for proof of this insurance with their business listed as a loss payee (meaning the insurance company is authorized to write the claim check.

Source: dukecompany.com

Source: dukecompany.com

Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. Hire and rental breeze underwriting understands the unique risks that are associated with the hire & rental industry, offering broad cover & competitive pricing to reflect the needs in this sector. Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life. Designed to protect commercial operations owning valuable mobile equipment, the contractors equipment insurance policy provides business coverage for construction machinery, equipment and tools of a mobile nature used in.

Source: ascinsure.com

Source: ascinsure.com

It�s important to make sure you�re covered with the right policy, especially during a crisis, check with a coverwallet advisor for more information. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. Equipment insurance is a policy that helps cover the tools, equipment and other inventory that a business may rent out. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. This equipment rental agreement (“agreement”) is effective as of the date of last signature.

Source: macallisterrentals.com

Source: macallisterrentals.com

To give you ballpark figures: Party rental companies may rent both indoor and outdoor equipment, like tables, trucks, or tents. Renter must carry insurance satisfactory to owner equal to the value of the equipment to ensure its full replacement, unless agreed otherwise in writing by owner. Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost. Whether your client hires earthmoving or other large assets, through to hire of tools and equipment for small builders and diy enthusiasts, our.

Source: ascinsure.com

Source: ascinsure.com

We are here to help you get the right insurance cover at the right price for your business. If you’re renting out your home for short stints, you’ll need to make sure you’re protected. With a 25+ year focus on rental equipment insurance, we thoroughly understand the nuances of your business and can speak your language: The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life.

Source: wikstrominsurance.com

Source: wikstrominsurance.com

From construction to landscaping and excavation, businesses often rely on equipment to generate revenue. See the table in the cost of camp equipment rental insurance section below for average prices of professional liability insurance for your camp equipment rental operations. This policy will cover production equipment rented from a third party such as a rental house or individual owner. We are here to help you get the right insurance cover at the right price for your business. Protection for your business if equipment breaks down.

Source: 2ndcine.com

Source: 2ndcine.com

Equipment rental businesses want you to carry insurance on the equipment while it is in your care, custody, and control; To give you ballpark figures: Equipment rental businesses want you to carry insurance on the equipment while it is in your care, custody, and control; Select your own policy term, as short as a few days, up to one year select your own limit of insurance, deductibles and additional coverage Equipment hire insurance that puts you in control.

Source: eqgroup.com

Source: eqgroup.com

If you’re renting out your home for short stints, you’ll need to make sure you’re protected. Select your own policy term, as short as a few days, up to one year select your own limit of insurance, deductibles and additional coverage The equipment rental dealers insurance program which is part of the overall prorental program has been in effect since 1986. If you’re renting out your home for short stints, you’ll need to make sure you’re protected. We are the california rental association’s (cra) only endorsed insurance broker.

Source: dodgetruckleasedealnokonen.blogspot.com

Source: dodgetruckleasedealnokonen.blogspot.com

If you’re renting out your home for short stints, you’ll need to make sure you’re protected. Customized insurance solutions for niche equipment marketplaces. “rental shield was created at the request of heavy equipment renters so they can get the coverage they need to rent the equipment that helps them get the job done.” The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. We are here to help you get the right insurance cover at the right price for your business.

Source: ascinsure.com

Source: ascinsure.com

Hire and rental breeze underwriting understands the unique risks that are associated with the hire & rental industry, offering broad cover & competitive pricing to reflect the needs in this sector. A rental equipment protection plan is not an insurance policy. “rental shield was created at the request of heavy equipment renters so they can get the coverage they need to rent the equipment that helps them get the job done.” We are the california rental association’s (cra) only endorsed insurance broker. Regardless of your company’s specialty, every item you rent out should have appropriate coverage by an insurance policy to keep your profits protected.

Source: morrisandreynolds.com

Source: morrisandreynolds.com

Designed to protect commercial operations owning valuable mobile equipment, the contractors equipment insurance policy provides business coverage for construction machinery, equipment and tools of a mobile nature used in. See the table in the cost of camp equipment rental insurance section below for average prices of professional liability insurance for your camp equipment rental operations. To give you ballpark figures: Select your own policy term, as short as a few days, up to one year select your own limit of insurance, deductibles and additional coverage Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost.

Source: huckleberry.com

Source: huckleberry.com

The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. It�s important to make sure you�re covered with the right policy, especially during a crisis, check with a coverwallet advisor for more information. Equipment insurance is a policy that helps cover the tools, equipment and other inventory that a business may rent out. Equipment rental insurance will protect you and your business against claims associated with injuries or damages from your equipment.

Source: macallisterrentals.com

Source: macallisterrentals.com

To give you ballpark figures: Designed to protect commercial operations owning valuable mobile equipment, the contractors equipment insurance policy provides business coverage for construction machinery, equipment and tools of a mobile nature used in. The equipment rental dealers insurance program which is part of the overall prorental program has been in effect since 1986. With hundreds of insureds across the nation, we speak the rental equipment language (aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc.), and can tie that knowledge to rental equipment insurance. Tools and equipment insurance covers a lot — but it won’t provide coverage for corrosion, rust, wear and tear or rental equipment.

Source: jtbatesgroup.com

Source: jtbatesgroup.com

Tools and equipment insurance covers a lot — but it won’t provide coverage for corrosion, rust, wear and tear or rental equipment. Aerial reach, inflatables, construction equipment, boom lifts, scissor lifts, tents, etc., we can tie that knowledge to insurance coverage that provides real solutions for your business. Regardless of your company’s specialty, every item you rent out should have appropriate coverage by an insurance policy to keep your profits protected. Obviously, if you are renting out your equipment, one of the primary concerns for your clients is the cost. At no additional cost, commercial auto insurance helps cover electronic equipment in vehicles, along with lease and loan gaps.

Source: prweb.com

Our specialist team has a deep knowledge and understanding of the hire and rental industry. While a commercial property insurance policy protects items that your business owns — such as computers, inventory, documents, and machinery — from damage caused by covered perils, it also covers property owned by others while it’s in your possession, including rental equipment. The equipment rental dealers insurance program which is part of the overall prorental program has been in effect since 1986. As a hireguard appointed representative, you will get advice, guidance and comprehensive training from our team. Equipment rental insurance will protect you and your business against claims associated with injuries or damages from your equipment.

Source: howmuch.net

Source: howmuch.net

It is for you and your company, to cover the repair or replacement costs resulting from equipment damages or theft, that can occur during an equipment rental. In our role as the endorsed broker, we successfully reduce operator costs with aggressive claims handling, loss prevention, employee. Just like you would if it were your own. Our specialist team has a deep knowledge and understanding of the hire and rental industry. Customized insurance solutions for niche equipment marketplaces.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title equipment rental insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.