Your Equipment insurance policy images are available. Equipment insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Equipment insurance policy files here. Find and Download all royalty-free photos.

If you’re searching for equipment insurance policy pictures information connected with to the equipment insurance policy keyword, you have visit the ideal blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

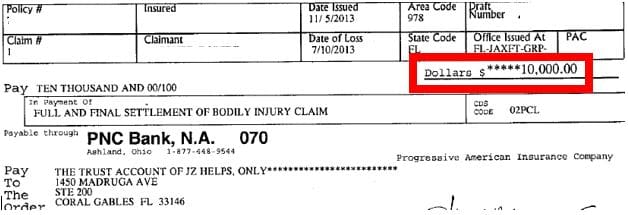

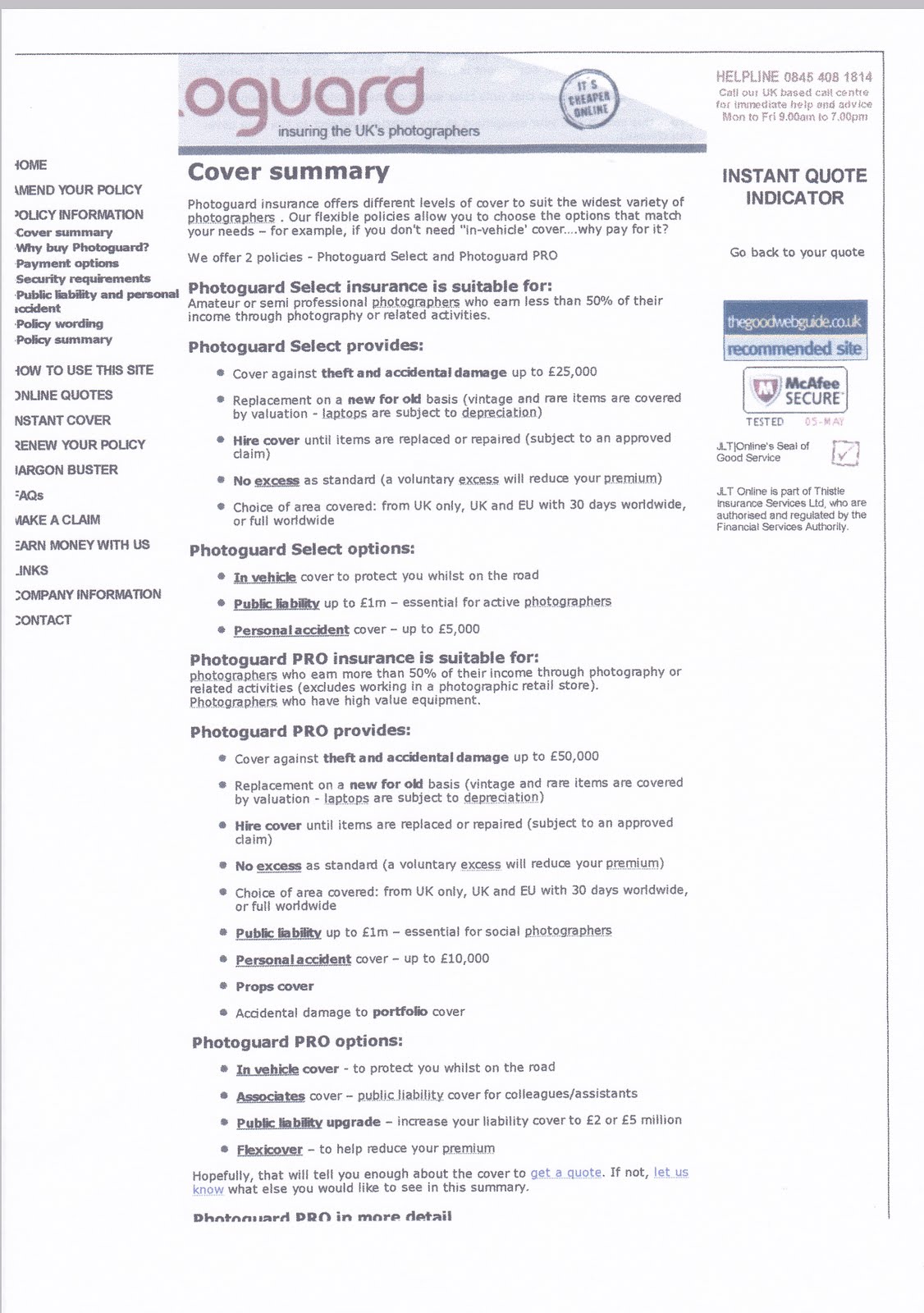

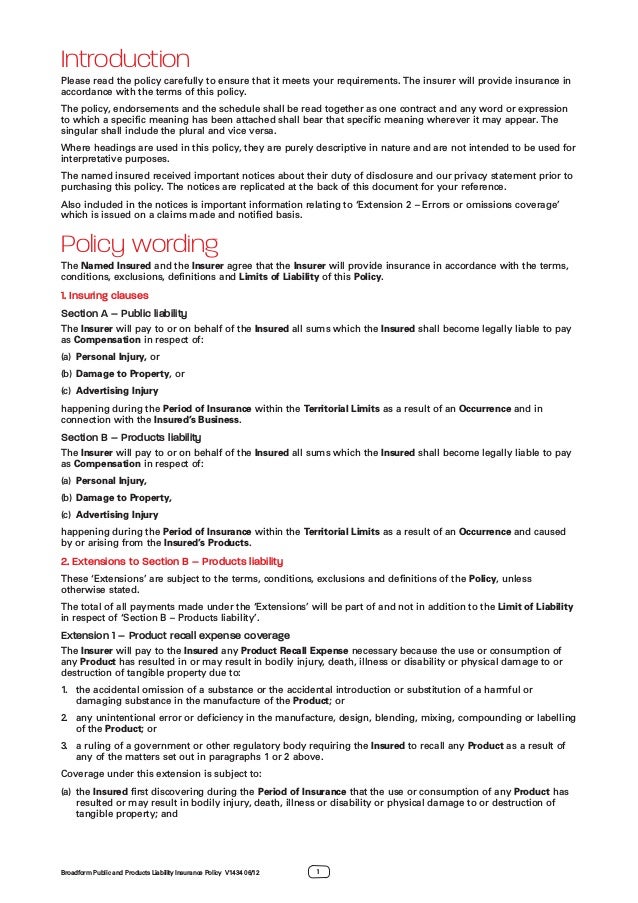

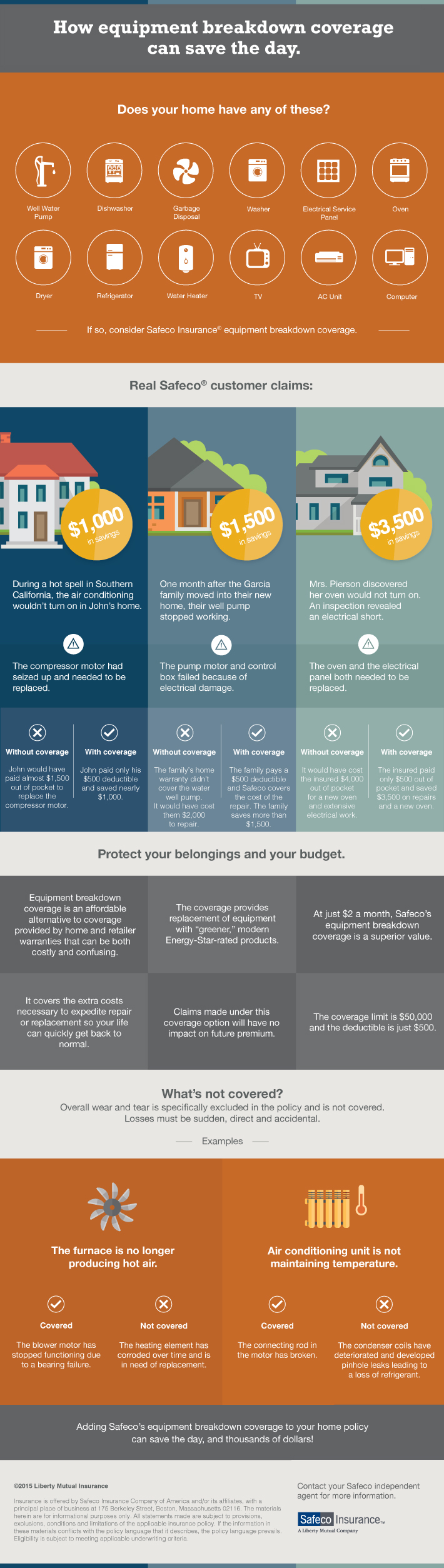

Equipment Insurance Policy. Cover this policy covers insured equipment as described in the schedule against insured damage as specified in the schedule, subject to the terms, conditions and exclusions of the policy. Electronic equipment insurance policy whereas the insured named in the schedule hereto has made to the pt.………………. Accidental collision, overturning and collision, or overturning resulting from mechanical derangement. Annual photography equipment (hobbyist and/or for private event use):

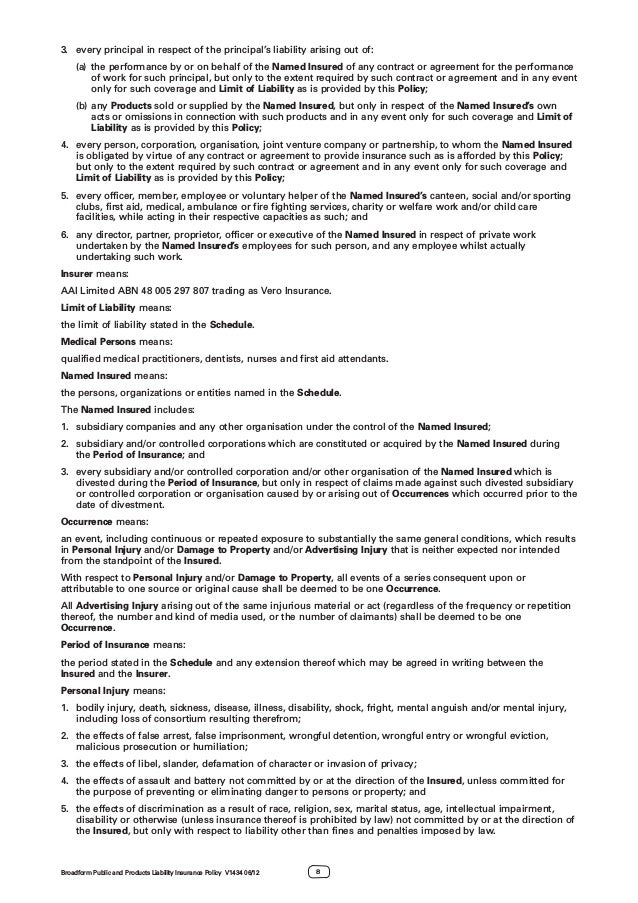

Equipment and Machinery Insurance Policies From slideshare.net

Equipment and Machinery Insurance Policies From slideshare.net

In the event of a covered loss, contractors equipment. Annual photography equipment (hobbyist and/or for private event use): Portable electronic equipment insurance policy. Basically, heavy equipment insurance is covered under an inland marine policy that provides protection to loaders, cranes, and other heavy equipment that is often used in construction and during other tasks. You can purchase cover online now or by calling our team of small business specialists on 1300 131 000. Electronic equipment can be very expensive and is easily susceptible to theft and damage.

Annual photography equipment (hobbyist and/or for private event use):

Covers loss of or damage to. Customized insurance solutions for niche equipment marketplaces. Allianz general property insurance is not available for purchase as a standalone policy outside of the business insurance pack. In the event of a covered loss, contractors equipment. To protect your interests, hdfc ergo’s portable electronic equipment policy covers accidental damage and breakdown including fire, theft, robbery and malicious damage to new portable electronic equipment such as. Basically, heavy equipment insurance is covered under an inland marine policy that provides protection to loaders, cranes, and other heavy equipment that is often used in construction and during other tasks.

Source: youtube.com

Source: youtube.com

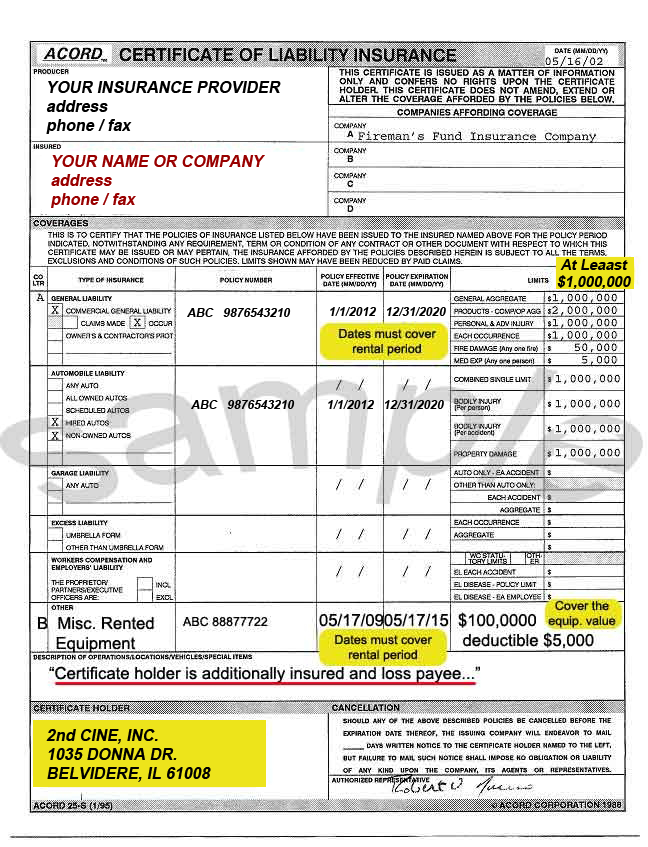

The contractor relies on being able Other expenses incurred to limit loss or speed restoration. Electronic equipment insurance policy (policy wordings) a. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. Electronic equipment insurance policy whereas the insured named in the schedule hereto has made to the pt.……………….

Source: slideshare.net

Source: slideshare.net

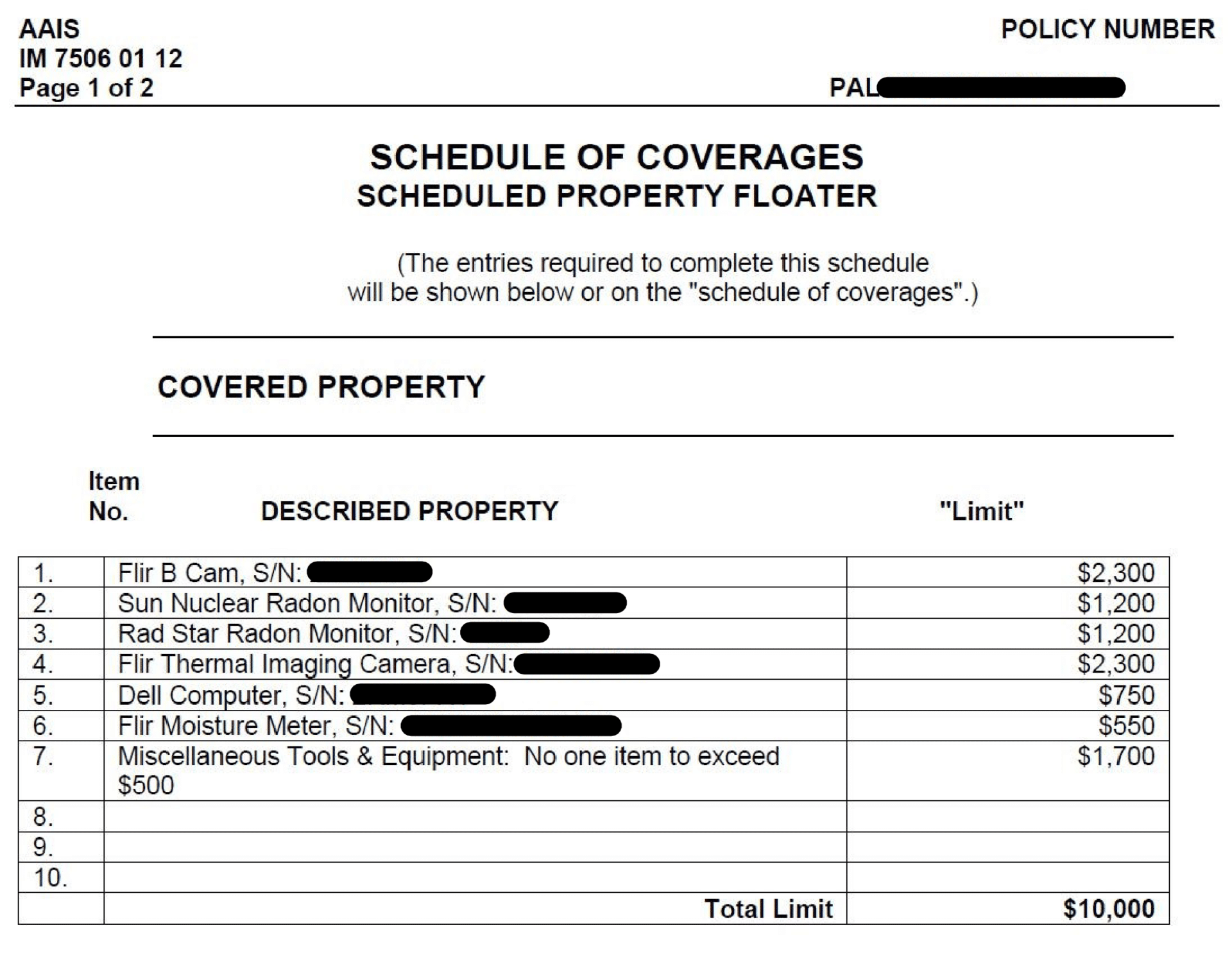

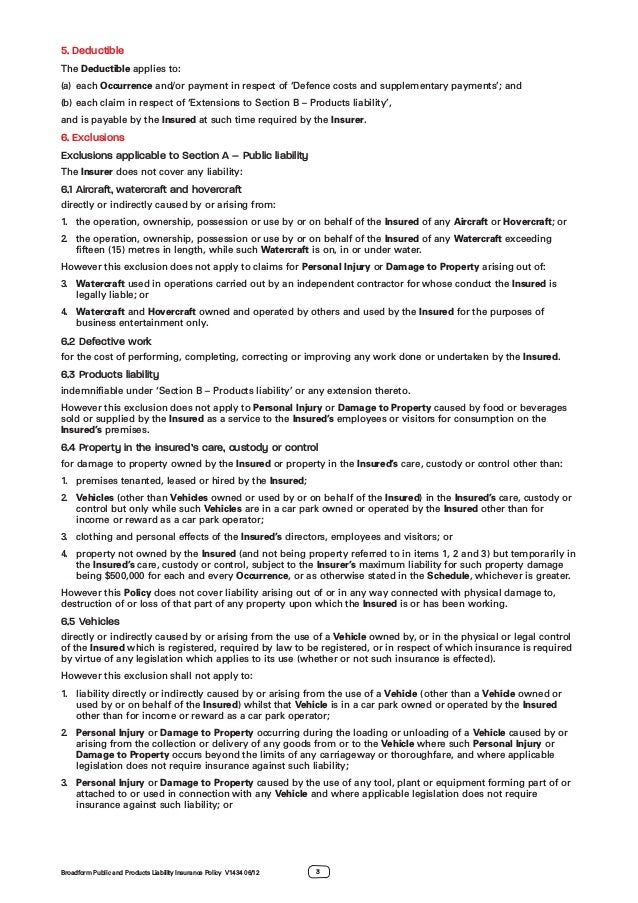

Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life. This policy usually offers coverage for: Basically, heavy equipment insurance is covered under an inland marine policy that provides protection to loaders, cranes, and other heavy equipment that is often used in construction and during other tasks. Equipment breakdown coverage can pay for: In the event of a covered loss, contractors equipment.

Source: rougephotos.blogspot.com

Source: rougephotos.blogspot.com

These policies typically include leased equipment insurance coverage that covers $50,000 or in some instances up to $300,000 worth of equipment. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. Cover this policy covers insured equipment as described in the schedule against insured damage as specified in the schedule, subject to the terms, conditions and exclusions of the policy. It can also cover small tools, employees’ equipment and clothing, and borrowed equipment. Business equipment cover provides cover for property but does not provide cover for any loss of revenue you may experience if your property sustains damage or is lost.

Source: pinterest.com

Source: pinterest.com

It covers the insured equipment while at the situation. Basic tools and equipment coverage can start at $12.50 a month. A contractors insurance policy can extend beyond simply covering equipment; The term equipment shall include the entire computer system consisting of. For example, if your carpentry tool box is stolen from a client’s yard, contractor’s equipment insurance can pay for the cost of replacement.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

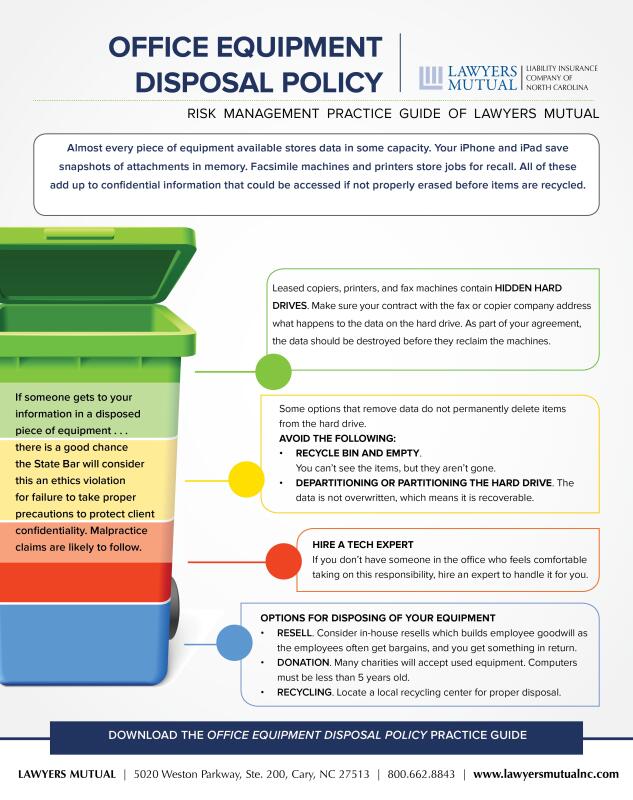

Equipment breakdown coverage can pay for: You should consider each cover in its own right. Costs for time and labor to repair or replace the equipment. Equipment less than five years old Comprehensive coverage will be available against accidental damage resulting from lightning, fire, flood, earthquake etc.

Source: lawyersmutualnc.com

Source: lawyersmutualnc.com

It is an all risk policy the insurance policy broadly covers material damage to electronic equipment (which can include systems software) due to sudden and unforeseen events, cost of external data media,. (hereinafter called the insurers) a written proposal by completing a questionnaire which, together with any other statements made in writing by the insured for the purpose A contractors insurance policy can extend beyond simply covering equipment; Here is an overview of your coverage. Representatives of the company shall at any reasonable time have the right to inspect and examine the risk and the insured shall provide the representatives of the company with all details and information necessary for the assessment of the risk.

Source: slideshare.net

Source: slideshare.net

Business equipment protection is just a simpler alternative to an otherwise confusing term, but it offers the same coverage as a standard inland marine insurance policy: Other expenses incurred to limit loss or speed restoration. Protection for your business if equipment breaks down. The cost to repair or replace the damaged equipment. Business equipment protection is just a simpler alternative to an otherwise confusing term, but it offers the same coverage as a standard inland marine insurance policy:

Source: es.slideshare.net

Source: es.slideshare.net

Business equipment cover provides cover for property but does not provide cover for any loss of revenue you may experience if your property sustains damage or is lost. For example, if your carpentry tool box is stolen from a client’s yard, contractor’s equipment insurance can pay for the cost of replacement. And equipment insurance (cpe) 7 1.1 the benefits of cpe insurance plant and equipment often constitute a considerable part of a building contractor’s investment. Customized insurance solutions for niche equipment marketplaces. Business equipment insurance and business interruption insurance are two completely different types of cover.

Source: fr.slideshare.net

Source: fr.slideshare.net

Costs for time and labor to repair or replace the equipment. Electronic equipment insurance policy for consumer insurance contracts (insurance wholly for purposes unrelated to the insured’s trade, business or profession) this policy is issued in consideration of the payment of premium as specified in the policy schedule and pursuant to the answers given in the Equipment less than five years old Simply select the coverage level that’s right for your business when you apply for a quote online. To protect your interests, hdfc ergo’s portable electronic equipment policy covers accidental damage and breakdown including fire, theft, robbery and malicious damage to new portable electronic equipment such as.

Source: fashionmywholeworld.blogspot.com

Minimum equipment insurance premiums starting at: Accidental collision, overturning and collision, or overturning resulting from mechanical derangement. Basically, heavy equipment insurance is covered under an inland marine policy that provides protection to loaders, cranes, and other heavy equipment that is often used in construction and during other tasks. To protect your interests, hdfc ergo’s portable electronic equipment policy covers accidental damage and breakdown including fire, theft, robbery and malicious damage to new portable electronic equipment such as. It is an all risk policy the insurance policy broadly covers material damage to electronic equipment (which can include systems software) due to sudden and unforeseen events, cost of external data media,.

Source: eatonberube.com

Source: eatonberube.com

Protection for your business if equipment breaks down. The cost to repair or replace the damaged equipment. A contractors insurance policy can extend beyond simply covering equipment; Because your business moves to different worksites, you need a policy that can cover your equipment wherever you bring it. (hereinafter called the insurers) a written proposal by completing a questionnaire which, together with any other statements made in writing by the insured for the purpose

Source: pt.slideshare.net

Source: pt.slideshare.net

Tools and equipment insurance is offered as an addition to our general liability insurance policy. Coverage against theft or burglary will be available too. (hereinafter called the insurers) a written proposal by completing a questionnaire which, together with any other statements made in writing by the insured for the purpose Business income losses when a covered breakdown causes a partial or total business interruption. Equipment breakdown coverage can pay for:

Source: pt.slideshare.net

Source: pt.slideshare.net

To protect your interests, hdfc ergo’s portable electronic equipment policy covers accidental damage and breakdown including fire, theft, robbery and malicious damage to new portable electronic equipment such as. Accidents resulting in the loss of plant or equipment or which cause severe damage can have a serious effect on his business. Electronic equipment can be very expensive and is easily susceptible to theft and damage. It covers the insured equipment while at the situation. In the event of a covered loss, contractors equipment.

Source: adjustersinternational.com

Source: adjustersinternational.com

For example, if your carpentry tool box is stolen from a client’s yard, contractor’s equipment insurance can pay for the cost of replacement. Electronic equipment insurance policy whereas the insured named in the schedule hereto has made to the pt.………………. Accidents resulting in the loss of plant or equipment or which cause severe damage can have a serious effect on his business. Equipment breakdown coverage can pay for: Policy for events which occur during the period of insurance shown in your schedule.

Source: fr.slideshare.net

Source: fr.slideshare.net

In the event of a covered loss, contractors equipment. You must purchase public liability cover to add general property insurance to your policy. Policy for events which occur during the period of insurance shown in your schedule. Here is an overview of your coverage. This policy is suitable for electronic equipment like computers, printers, scanners, industrial electronic machines and servers and data storage equipment’s.

Source: 2ndcine.com

Source: 2ndcine.com

Portable electronic equipment insurance policy. Policy for events which occur during the period of insurance shown in your schedule. Electronic equipment can be very expensive and is easily susceptible to theft and damage. For more information about our equipment coverage options, select a. Coverage against theft or burglary will be available too.

Source: cy2204imageculture.blogspot.com

Policy for events which occur during the period of insurance shown in your schedule. Portable electronic equipment insurance policy. Parts in hand due to. Allianz general property insurance is not available for purchase as a standalone policy outside of the business insurance pack. Because your business moves to different worksites, you need a policy that can cover your equipment wherever you bring it.

Source: paisabazaar.com

Source: paisabazaar.com

Policy for events which occur during the period of insurance shown in your schedule. It can also cover small tools, employees’ equipment and clothing, and borrowed equipment. You can purchase cover online now or by calling our team of small business specialists on 1300 131 000. The complete cost of loss/damage to data or electronic equipment are covered, irrespective of the depreciation cost of the equipment. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title equipment insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.