Your Endowment insurance definition images are available. Endowment insurance definition are a topic that is being searched for and liked by netizens today. You can Download the Endowment insurance definition files here. Get all royalty-free vectors.

If you’re looking for endowment insurance definition pictures information linked to the endowment insurance definition interest, you have pay a visit to the right blog. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

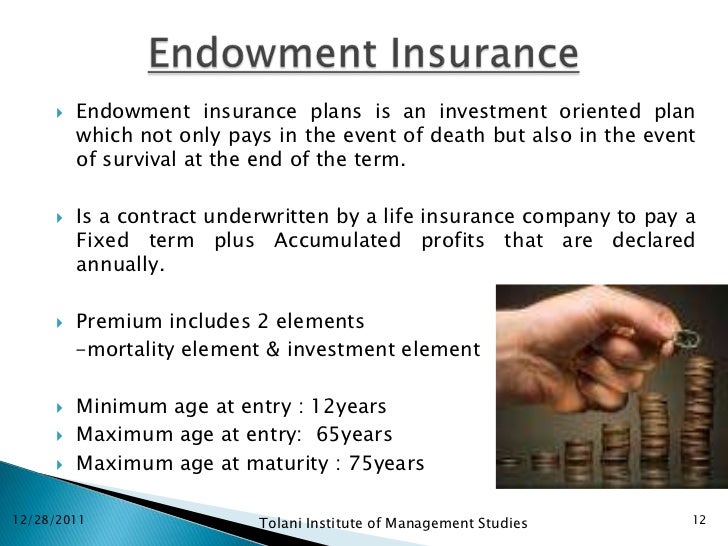

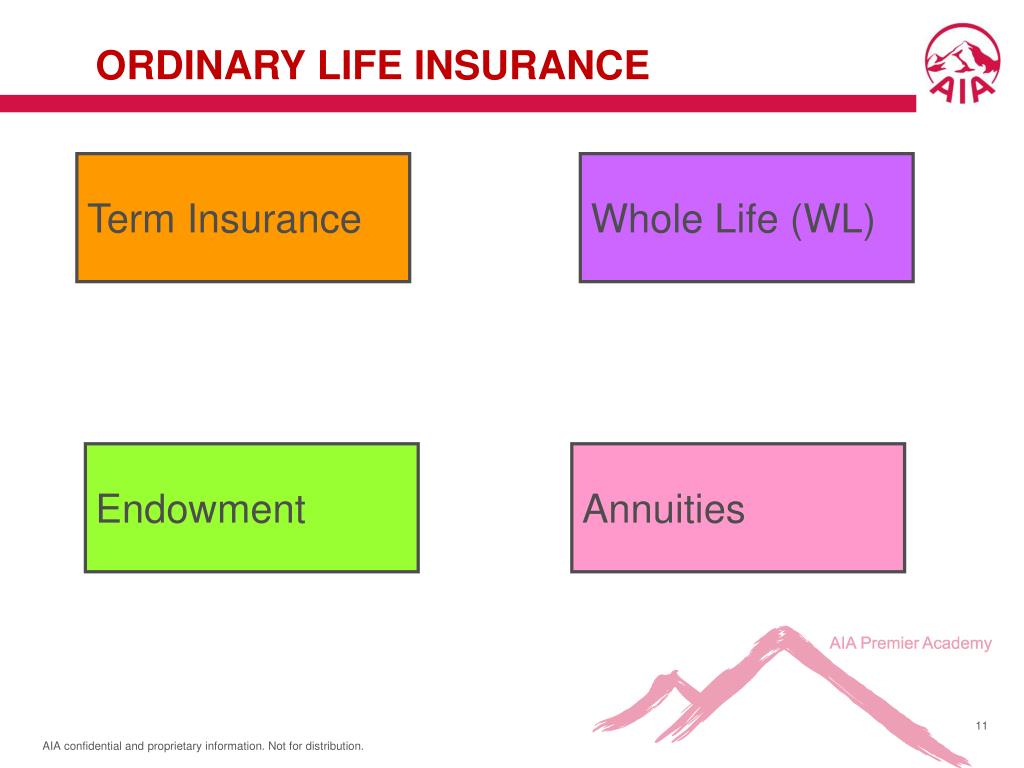

Endowment Insurance Definition. This money is then paid out at the end of the policy term. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. Its premiums are more expensive compared to similar policies. Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death.

PPT PCE Part C Life Insurance PowerPoint Presentation From slideserve.com

PPT PCE Part C Life Insurance PowerPoint Presentation From slideserve.com

Endowment insurance is a type of life insurance that pays a particular sum directly to the policyholder at a stated date, or to a beneficiary if the policyholder dies before this date. Typical maturities are ten, fifteen or twenty years up to a certain age limit. The terms of payment may vary somewhat, in that the term to maturity may be anywhere between ten to twenty years, or be set at a specific. In term plan which is a pure insurance there is no maturity benefit. An endowment policy is a life insurance contract designed to pay a lump sum after a specific term (on its �maturity�) or on death. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan.

This is in contrast to life insurance, which pays the face value only in the event of the insured�s death.

But unlike deposits, you may not get back what you put in. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death. But unlike deposits, you may not get back what you put in. Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets.

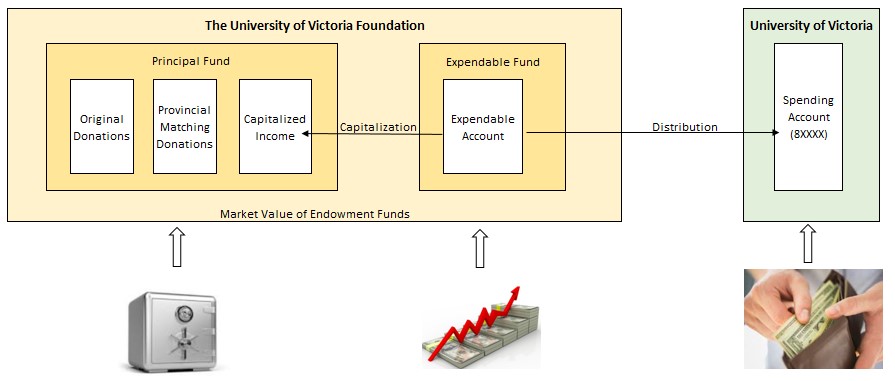

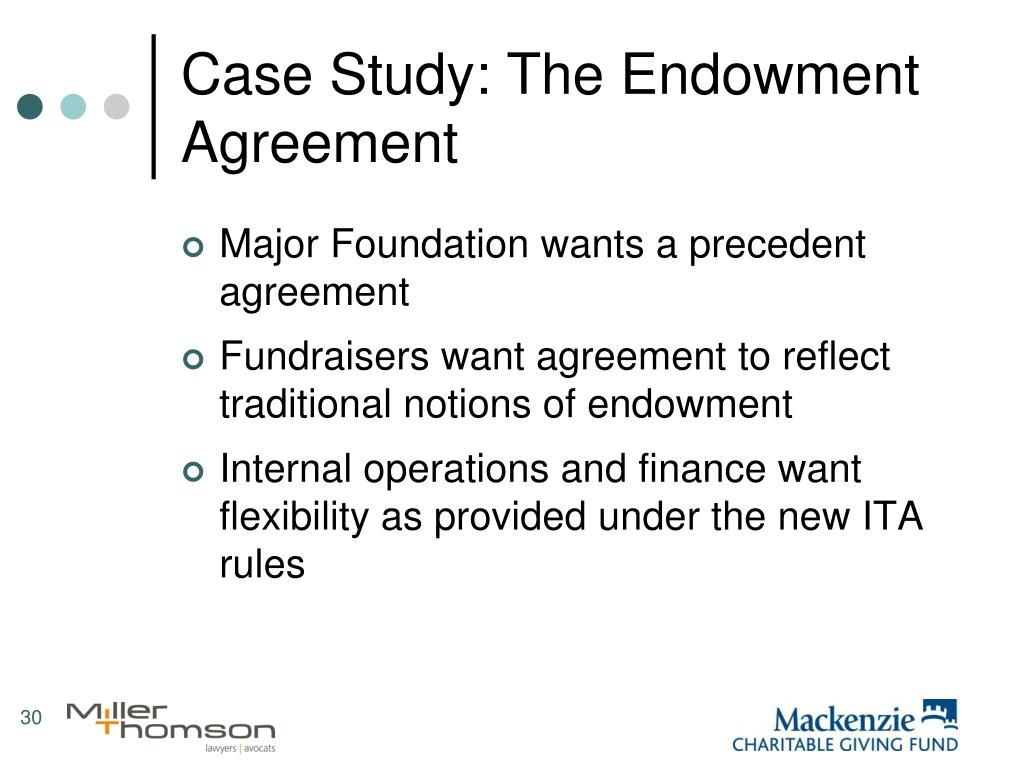

Source: uvic.ca

Source: uvic.ca

Endowment insurance definition, life insurance providing for the payment of a stated sum to the insured if he or she lives beyond the maturity date of the policy, or to a beneficiary if the insured dies before that date. An endowment policy is a life insurance contract designed to pay a lump sum after a specific term (on its �maturity�) or on death. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. Endowment insurance is a type of life insurance that pays a particular sum directly to the policyholder at a stated date, or to a beneficiary if the policyholder dies before this date. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets.

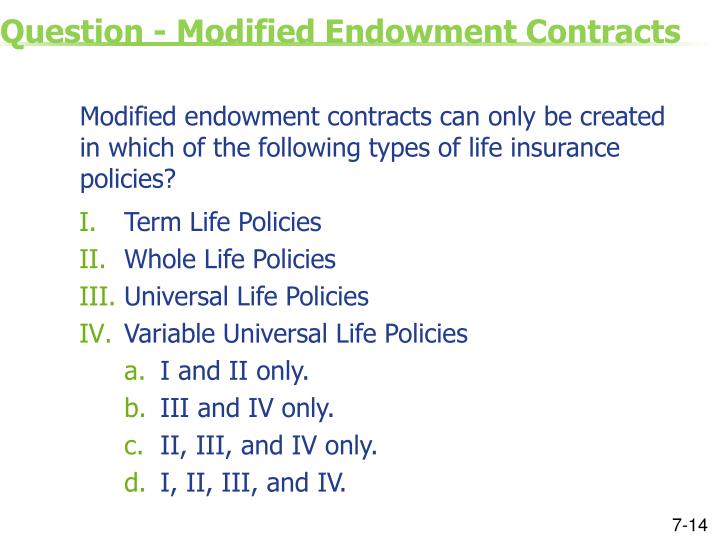

Source: slideshare.net

Source: slideshare.net

But unlike deposits, you may not get back what you put in. Legal definition of endowment insurance. Its premiums are more expensive compared to similar policies. Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital.

Source: slideserve.com

Source: slideserve.com

This money is then paid out at the end of the policy term. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Legal definition of endowment insurance. Endowment insurance is a type of life insurance that pays the face amount of insurance to the beneficiary if the insured dies within a specified period or to the policyholder if the insured survives to the end of the period. Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years)

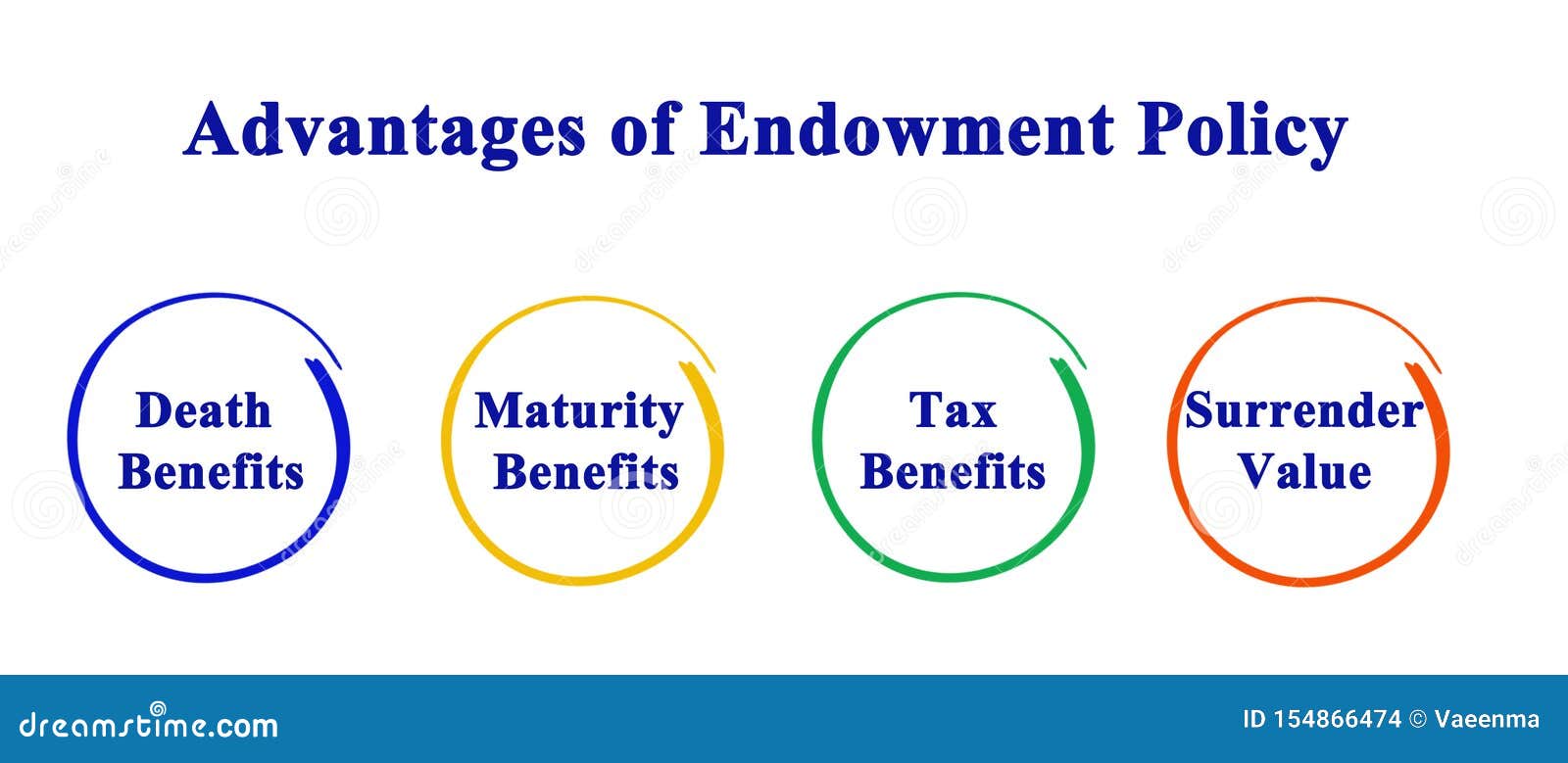

Source: dreamstime.com

Source: dreamstime.com

Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death. Typical maturities are ten, fifteen or twenty years up to a certain age limit. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. Endowment insurance is one of many common types of insurance used in the united states and across the world.

Source: slideserve.com

Source: slideserve.com

Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. Endowment insurance is a type of life insurance contract designed to pay a lump sum after a specified term. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

Legal definition of endowment insurance. Life assurance , life insurance insurance paid to named beneficiaries when the insured person dies Endowment insurance is a type of life insurance that pays the face amount of insurance to the beneficiary if the insured dies within a specified period or to the policyholder if the insured survives to the end of the period. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Endowment insurance can be considered a type of savings plan, as it provides for a lump sum payment in the event the insured survives to the end of the specified.

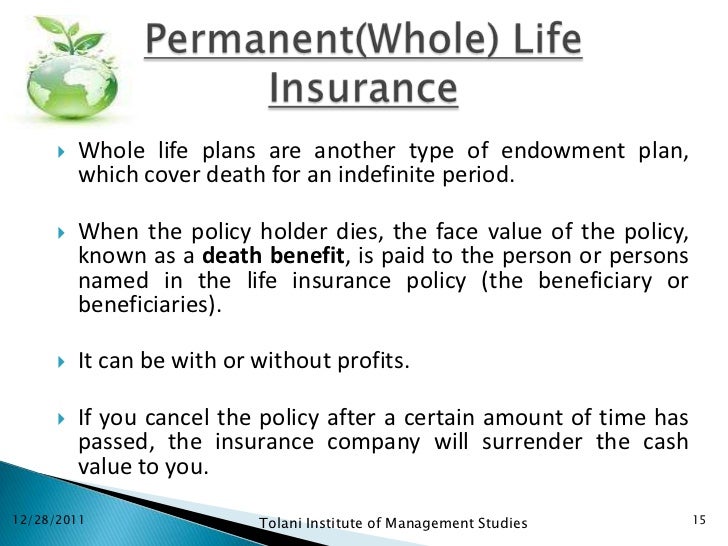

Source: slideshare.net

Source: slideshare.net

Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date. Endowment insurance is a type of life insurance that pays a particular sum directly to the policyholder at a stated date, or to a beneficiary if the policyholder dies before this date. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of: Endowment insurance is a type of life insurance that pays the face amount of insurance to the beneficiary if the insured dies within a specified period or to the policyholder if the insured survives to the end of the period. Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years)

Source: slideserve.com

Source: slideserve.com

Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years) In term plan which is a pure insurance there is no maturity benefit. This money is then paid out at the end of the policy term. Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of:

Source: turtlemint.com

Source: turtlemint.com

Legal definition of endowment insurance. Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets. Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death.

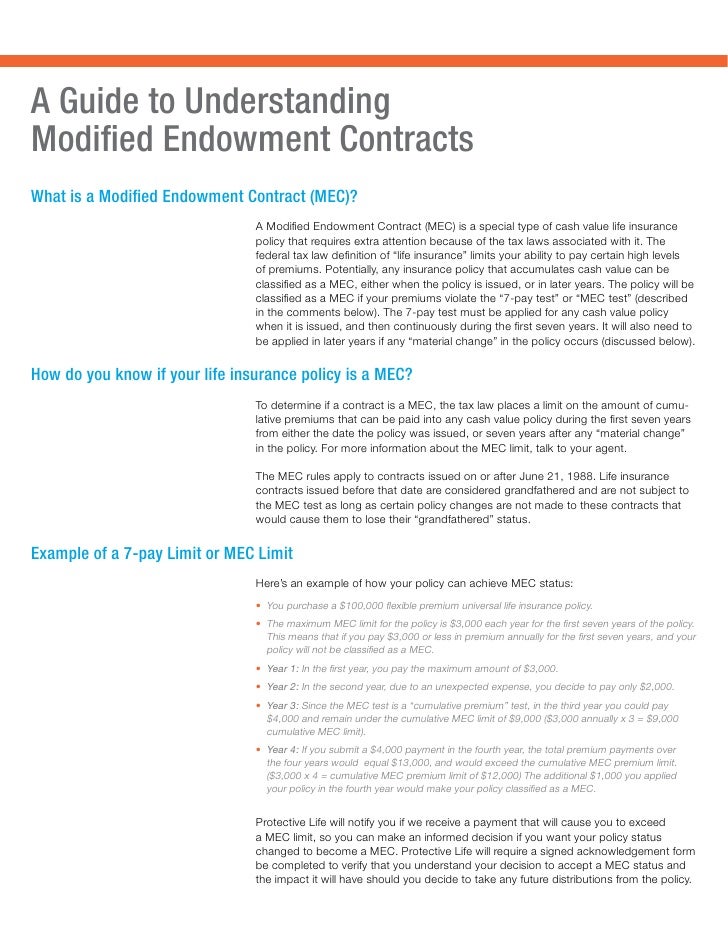

Source: slideshare.net

Source: slideshare.net

An endowment is a nonprofit�s investable assets, which are used for operations or programs that are consistent with the wishes of the donor(s). This is in contrast to life insurance, which pays the face value only in the event of the insured�s death. Legal definition of endowment insurance. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. Endowment insurance is one of many common types of insurance used in the united states and across the world.

Source: slideshare.net

Source: slideshare.net

Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Endowment insurance definition, life insurance providing for the payment of a stated sum to the insured if he or she lives beyond the maturity date of the policy, or to a beneficiary if the insured dies before that date. An endowment is a nonprofit�s investable assets, which are used for operations or programs that are consistent with the wishes of the donor(s). Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. Endowment insurance is a type of life insurance contract designed to pay a lump sum after a specified term.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

The terms of payment may vary somewhat, in that the term to maturity may be anywhere between ten to twenty years, or be set at a specific. Legal definition of endowment insurance. Endowment plans are life insurance policies that not only cover the individual’s life in case of an unfortunate event, but also offer a maturity benefits at the end of the term. Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years) This is in contrast to life insurance, which pays the face value only in the event of the insured�s death.

Source: slideshare.net

Source: slideshare.net

An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date. In term plan which is a pure insurance there is no maturity benefit.

Source: 1investing.in

Source: 1investing.in

This money is then paid out at the end of the policy term. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of: Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years) Legal definition of endowment insurance. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity.

Source: aegonlife.com

Source: aegonlife.com

A life insurance endowment policy is a life insurance policy that helps the policyholder save money over a specified period of time. An endowment policy is a type of life insurance plan that is structured to pay a lump sum once the policy reaches maturity, or if the insured party dies at some point before the policy reaches full maturity. But unlike deposits, you may not get back what you put in. Endowment plans are life insurance policies that not only cover the individual’s life in case of an unfortunate event, but also offer a maturity benefits at the end of the term. Life assurance , life insurance insurance paid to named beneficiaries when the insured person dies

Source: jaxcf.org

Source: jaxcf.org

Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets. Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Endowment insurance n (insurance) a form of life insurance that provides for the payment of a specified sum directly to the policyholder at a designated date.

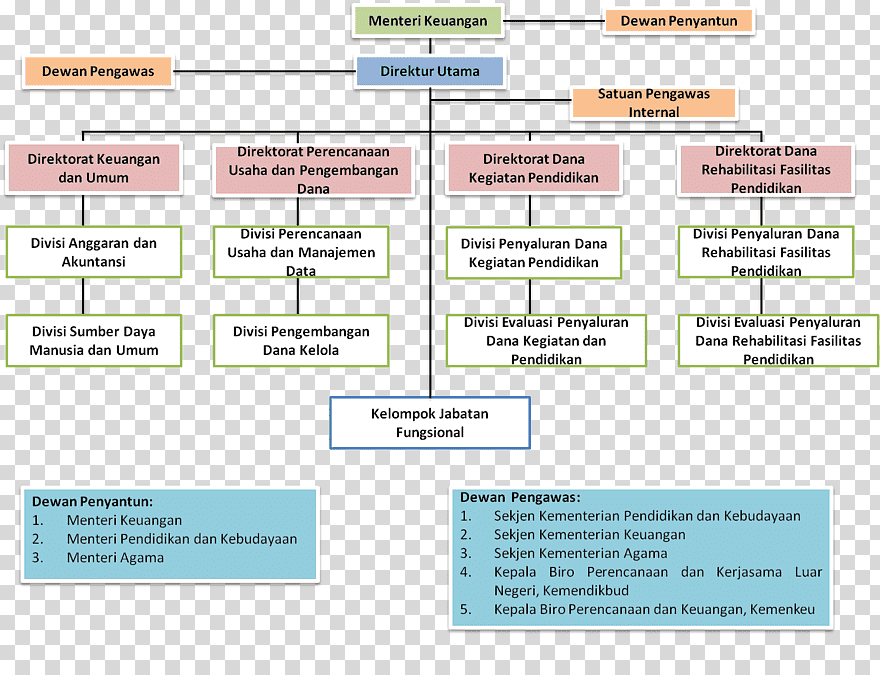

Source: slideshare.net

Source: slideshare.net

This money is then paid out at the end of the policy term. This is in contrast to life insurance, which pays the face value only in the event of the insured�s death. Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured�s death. Endowment plans are life insurance policies that not only cover the individual’s life in case of an unfortunate event, but also offer a maturity benefits at the end of the term. Its premiums are more expensive compared to similar policies.

Source: slideserve.com

Source: slideserve.com

Endowment insurance can be considered a type of savings plan, as it provides for a lump sum payment in the event the insured survives to the end of the specified. The terms of payment may vary somewhat, in that the term to maturity may be anywhere between ten to twenty years, or be set at a specific. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title endowment insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.