Your Employers national insurance rates 2018 19 images are available. Employers national insurance rates 2018 19 are a topic that is being searched for and liked by netizens now. You can Download the Employers national insurance rates 2018 19 files here. Get all free photos.

If you’re looking for employers national insurance rates 2018 19 images information related to the employers national insurance rates 2018 19 topic, you have pay a visit to the right blog. Our website always provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

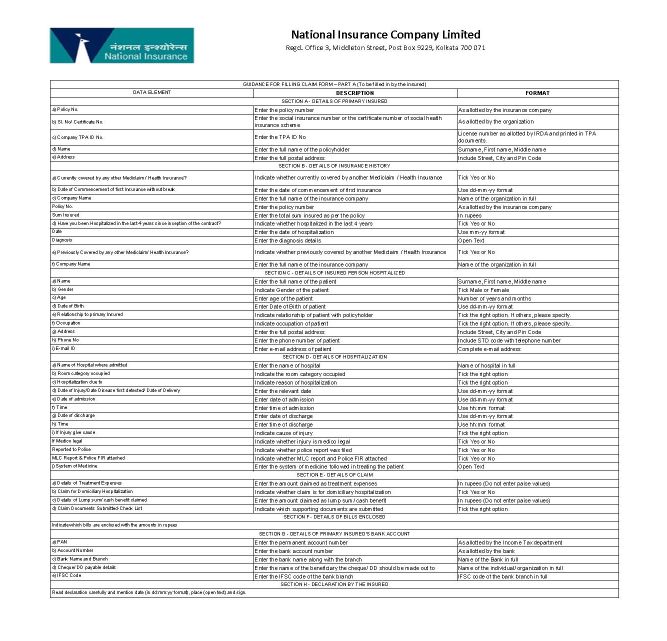

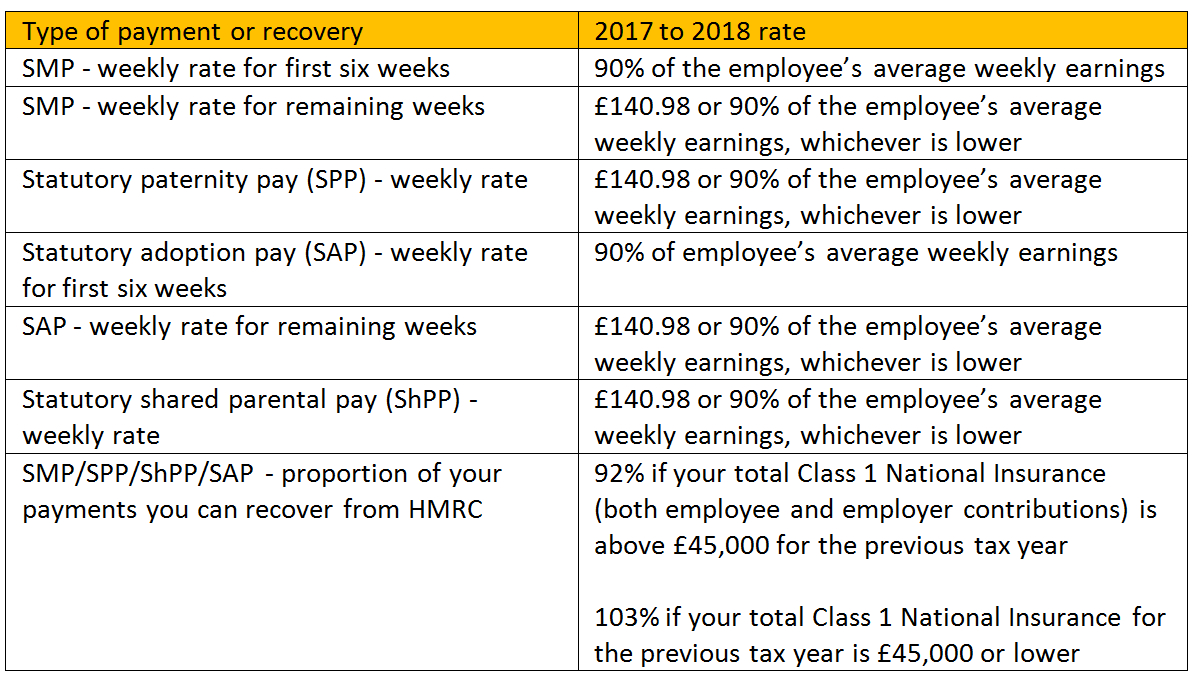

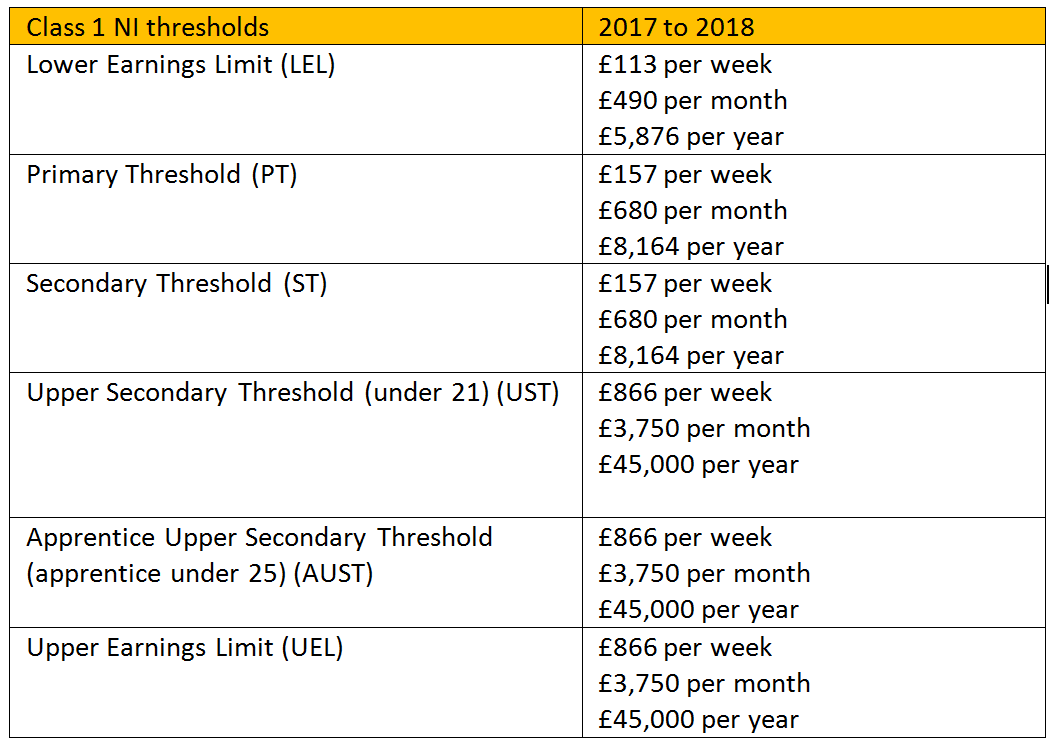

Employers National Insurance Rates 2018 19. 92% if your total class 1 national insurance (both employee and employer contributions) is above £45,000 for the previous tax year 103% if your total class 1 national insurance for the previous. C born up to 31/12/1961 € 162.20: If you earned more, you paid 12% of your earnings between £9,500 and £50,00. Staff costs are not just salaries,.

National Insurance Rates 2018 2019 Class 2 National From impossible-harry-styles-fanfiction.blogspot.com

National Insurance Rates 2018 2019 Class 2 National From impossible-harry-styles-fanfiction.blogspot.com

Use from 6 april 2019 to 5 april 2020 inclusive standard rate nics tables ca38 Employees start paying national insurance: All employees who earn £11,500 or more: Over £242 gross per week: 6 rows 92% if your total class 1 national insurance (both employee and employer contributions) is. The recipient receives a tax bill deduction of 20 percent of the amount transferred

Income tax [basic rate] £32,000:

£6,365 + £3.00 per week. If you pay your employee £184 or more you must now deduct national insurance on behalf of your employee, as well as pay employer’s ni. This means employers nics will increase to 15.3% on all earnings above the secondary threshold for most employees. 10%* self employed (rising to 11% in april 2019) personal allowance: The recipient receives a tax bill deduction of 20 percent of the amount transferred Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary.

Source: moneysoft.co.uk

Source: moneysoft.co.uk

10%* self employed (rising to 11% in april 2019) personal allowance: D born up to 31/12/1961: Over £242 gross per week: This table shows how much employers deduct from employees’ pay for the 2021 to 2022 tax year. This means employers nics will increase to 15.3% on all earnings above the secondary threshold for most employees.

Source: parasolgroup.co.uk

Source: parasolgroup.co.uk

Staff costs are not just salaries,. Over £242 gross per week: 2017/18 [* 2018/19] who it directly impacts; The current rates employers pay towards most employees� national insurance are 13.8% above the secondary threshold. Staff costs are not just salaries,.

You’ll still pay the same rate of tax on dividend income and savings interest as the rest of the uk. The 2020/21 tax calculator includes the tax figures and personal allowances for 2020/21 as published on gov.uk This table shows how much employers deduct from employees’ pay for the 2021 to 2022 tax year. £6,365 + £3.00 per week. 2017/18 [* 2018/19] who it directly impacts;

Source: wellsins.com

Source: wellsins.com

Scottish income tax and national insurance. The employers national insurance contributions calculator is configured to calculate national insurance contributions calculations for the 2022/23 tax year. Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary. Staff costs are not just salaries,. £2,000* director shareholders [see combinded paye & dividend tax calculator] national insurance contributions:

Marriage allowance (transferable tax allowance) available to a qualifying spouses/civil partners born after 5th april 1935 equivalent to 10% of the personal allowance spouses or civil partners not liable to taxes in the higher rate or above can transfer up to the amount available to their spouse or civil partner. Use from 6 april 2019 to 5 april 2020 inclusive standard rate nics tables ca38 If you earn less than this amount you�ll pay no national insurance contributions. D born up to 31/12/1961: Scottish income tax applies to your wages, pension and most other taxable income.

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

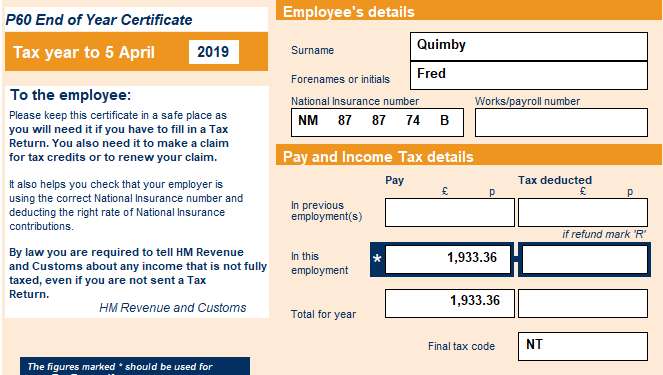

Marriage allowance (transferable tax allowance) available to a qualifying spouses/civil partners born after 5th april 1935 equivalent to 10% of the personal allowance spouses or civil partners not liable to taxes in the higher rate or above can transfer up to the amount available to their spouse or civil partner. • replaces the april 2018 edition of ca44, ‘national insurance for company directors’ • gives detailed. The 2018/19 tax calculator provides a full payroll, salary and tax calculations for the 2018/19 tax year including employers nic payments, p60 analysis, salary sacrifice, pension calculations and more. This means employers nics will increase to 15.3% on all earnings above the secondary threshold for most employees. Continue reading self employed ni rates.

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

If you earned more, you paid 12% of your earnings between £9,500 and £50,00. You paid 2% on any earnings above £50,000. Income tax [basic rate] £32,000: Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary. £6,365 + £3.00 per week.

Source: brightpay.co.uk

Source: brightpay.co.uk

D born up to 31/12/1961: Pay bill is defined as earnings. Earnings subject to employer nic: 6 rows 92% if your total class 1 national insurance (both employee and employer contributions) is. Secondary threshold (st) employers start paying national insurance:

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

£2,000* director shareholders [see combinded paye & dividend tax calculator] national insurance contributions: Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary. Use from 6 april 2019 to 5 april 2020 inclusive standard rate nics tables ca38 Staff costs are not just salaries,. If you pay your employee £184 or more you must now deduct national insurance on behalf of your employee, as well as pay employer’s ni.

Source: wardgoodman.co.uk

Source: wardgoodman.co.uk

C born up to 31/12/1961 € 162.20: The employers national insurance contributions calculator is configured to calculate national insurance contributions calculations for the 2022/23 tax year. The recipient receives a tax bill deduction of 20 percent of the amount transferred You pay national insurance over the age of 16. Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary.

Source: paperpkads.pk

Source: paperpkads.pk

Employer national insurance contributions due: National insurance and employers national insurance contributions also remain unchanged, you can see the 2020 budget income tax rates here. If you earn less than this amount you�ll pay no national insurance contributions. Over £242 gross per week: Scottish income tax applies to your wages, pension and most other taxable income.

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

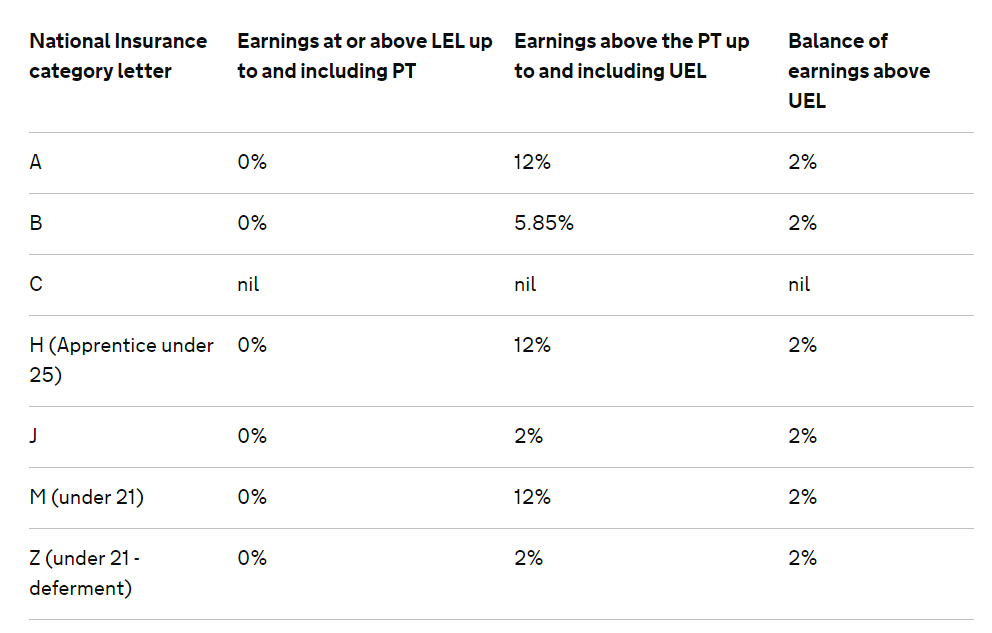

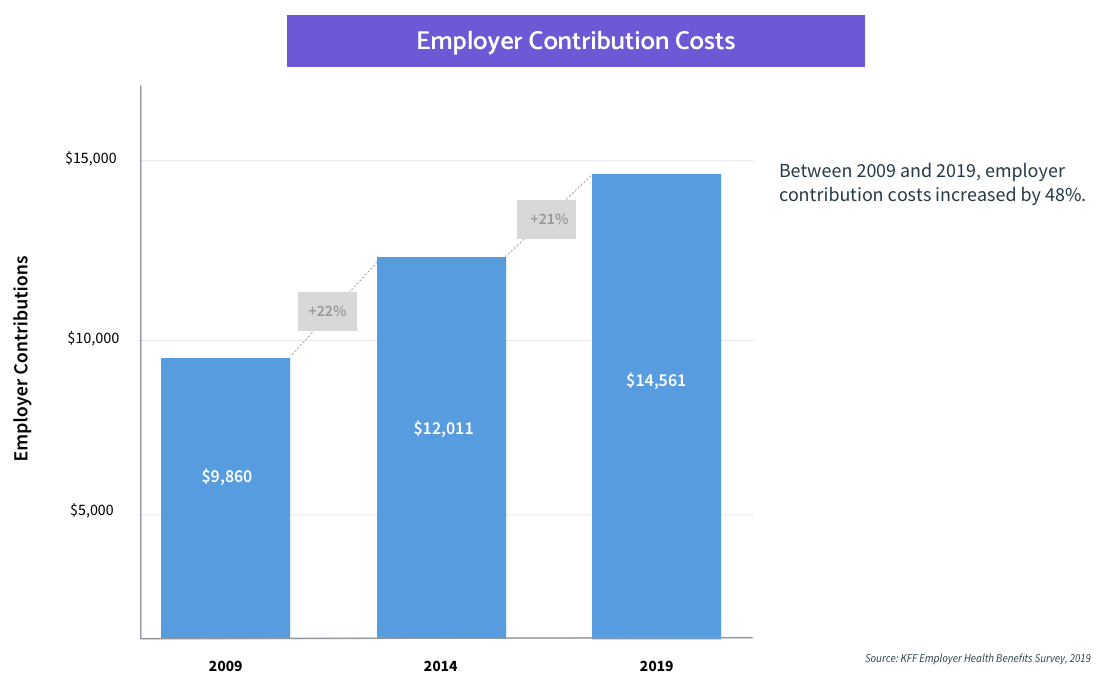

National insurance contributions (nics) employment allowance apprenticeship levy the levy is charged at a rate of 0.5% of an employer’s annual pay bill. You’ll still pay the same rate of tax on dividend income and savings interest as the rest of the uk. The 2020/21 tax calculator includes the tax figures and personal allowances for 2020/21 as published on gov.uk National insurance contributions tables a, h, j, m and z these tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. The government has announced that employers nics and employee nics will be increaseing by 1.5% from april 2022.

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

Based on the standard tax free allowance for this year of £12,570, if you pay your employee £242 or more you must now also deduct tax on from your employee�s salary. • replaces the april 2018 edition of ca44, ‘national insurance for company directors’ • gives detailed. Pay bill is defined as earnings. D born up to 31/12/1961: Use from 6 april 2019 to 5 april 2020 inclusive standard rate nics tables ca38

Source: brightpay.co.uk

Source: brightpay.co.uk

All employees who earn £11,500 or more: You’ll still pay the same rate of tax on dividend income and savings interest as the rest of the uk. All employees who earn £11,500 or more: Each national insurance contributions calculation provides a full breakdown of employee and employer nic�s, so that you have a full picture of exactly what your employee cost. The 2018/19 tax calculator provides a full payroll, salary and tax calculations for the 2018/19 tax year including employers nic payments, p60 analysis, salary sacrifice, pension calculations and more.

Source: livelyme.com

Source: livelyme.com

£120 to £184 (£520 to £797 a month) £184.01. • replaces the april 2018 edition of ca44, ‘national insurance for company directors’ • gives detailed. Employers can benefit from a zero rate of class 1 secondary national insurance contributions on earnings paid up to the apprentice upper secondary threshold (aust) for any apprentice who is following an approved apprenticeship and is under the age of 25. Employees start paying national insurance: 92% if your total class 1 national insurance (both employee and employer contributions) is above £45,000 for the previous tax year 103% if your total class 1 national insurance for the previous.

Source: taxrebates.co.uk

Source: taxrebates.co.uk

You pay national insurance over the age of 16. Scottish income tax applies to your wages, pension and most other taxable income. Use from 6 april 2019 to 5 april 2020 inclusive standard rate nics tables ca38 You’ll still pay the same rate of tax on dividend income and savings interest as the rest of the uk. Employer national insurance contributions due:

Source: kff.org

Source: kff.org

Scottish income tax and national insurance. The employers national insurance contributions calculator is configured to calculate national insurance contributions calculations for the 2022/23 tax year. Each national insurance contributions calculation provides a full breakdown of employee and employer nic�s, so that you have a full picture of exactly what your employee cost. Income tax [basic rate] £32,000: C born up to 31/12/1961 € 162.20:

Source: jf-financial.co.uk

Source: jf-financial.co.uk

The current rates employers pay towards most employees� national insurance are 13.8% above the secondary threshold. This means employers nics will increase to 15.3% on all earnings above the secondary threshold for most employees. Marriage allowance (transferable tax allowance) available to a qualifying spouses/civil partners born after 5th april 1935 equivalent to 10% of the personal allowance spouses or civil partners not liable to taxes in the higher rate or above can transfer up to the amount available to their spouse or civil partner. National insurance contributions tables a, h, j, m and z these tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Over £242 gross per week:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employers national insurance rates 2018 19 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.