Your Employers liability insurance brokers images are ready in this website. Employers liability insurance brokers are a topic that is being searched for and liked by netizens now. You can Find and Download the Employers liability insurance brokers files here. Get all royalty-free vectors.

If you’re searching for employers liability insurance brokers images information connected with to the employers liability insurance brokers keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Employers Liability Insurance Brokers. Companies that employ one or more members of staff, whether paid or volunteers, require this cover. Employers liability insurance provides protection to employers from claims made by employees who have suffered injury or ill health due to negligence by the tel: Most importantly, that they don�t get sick or injured because of the work they do for you. This cover is sometimes referred to as workers compensation insurance.

Employers� Liability Insurance VING Insurance Brokers Ltd. From vinginsurance.com

Employers� Liability Insurance VING Insurance Brokers Ltd. From vinginsurance.com

Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work. Employers’ liability insurance is one of few compulsory insurances. Employers liability insurance provides cover for businesses if a claim for compensation is made by an employee as a result of an injury or illness suffered due to the work they carry out in your organization. Every employer should understand that employees also bring with them a number of risks than that could prove to be financially catastrophic to their business unless they have an adequate employers’ liability insurance in place. Employers liability needs to be urgently addressed. Despite your best efforts, if one of your employees suffers an injury or becomes ill and.

We can help you cover the costs of damages and legal fees if employees are injured

How do i arrange employers’ liability insurance cover? Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work. Most importantly, that they don�t get sick or injured because of the work they do for you. Our employers� liability cover can be tailored to fit the needs of your customer�s business. At aligned, our dedicated insurance brokers work with you to provide the coverage you need to protect you from liabilities as an employer. Companies that employ one or more members of staff, whether paid or volunteers, require this cover.

Source: growthmastery.net

Source: growthmastery.net

Employers’ liability is a compulsory form of insurance in the uk for the majority of businesses. But when a worker does suffer an injury, workers employers liability insurance will provide compensation for injuries to your employees which protects there needs, and provides you with peace of mind that they’ll be covered, if you are sued. Aligned has the insurance solutions for you. Every employer should understand that employees also bring with them a number of risks than that could prove to be financially catastrophic to their business unless they have an adequate employers’ liability insurance in place. Employers’ liability policies cover claims made against your company in the event of accident, injury or illness sustained by your staff at work or as a result of work.

Source: wealdinsurance.com

Source: wealdinsurance.com

This cover is sometimes referred to as workers compensation insurance. If you employ staff, you�re legally required to have employers liability cover in place. Our employers� liability cover can be tailored to fit the needs of your customer�s business. Employers liability insurance provides protection to employers from claims made by employees who have suffered injury or ill health due to negligence by the tel: Employers’ liability insurance is one of few compulsory insurances.

Source: royalassociates.co.ke

Source: royalassociates.co.ke

At aligned, our dedicated insurance brokers work with you to provide the coverage you need to protect you from liabilities as an employer. At aligned, our dedicated insurance brokers work with you to provide the coverage you need to protect you from liabilities as an employer. Aligned has the insurance solutions for you. Why do you need employers liability insurance? 1 as an employer, you�re responsible for ensuring your staff are safe and well;

Source: allianz.co.uk

Source: allianz.co.uk

Employers’ liability insurance is one of few compulsory insurances. It protects your business against legal defence costs and costs of compensation awards. Our employers� liability cover can be tailored to fit the needs of your customer�s business. Bollington are leading employers liability insurance brokers. Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work.

Source: kedicdreamland.blogspot.com

Source: kedicdreamland.blogspot.com

Biba (the british insurance brokers’ association) and individual broker members have been approached in recent weeks by numerous businesses threatened with closure because they have been unable to obtain el insurance. By working with a broker like romero, you have total peace of mind that you have the right cover in place. Employers’ liability insurance is one of few compulsory insurances. Employers liability needs to be urgently addressed. Protect your people and your business by making sure your employers’ liability insurance meets your individual needs.

Source: lansdowne-woodward.co.uk

Source: lansdowne-woodward.co.uk

Our employers� liability cover can be tailored to fit the needs of your customer�s business. Call us on 01625 400206 for assistance Ultimately, if an employee suffers an injury and/or illness during working hours, your business could be responsible and liable. Companies that employ one or more members of staff, whether paid or volunteers, require this cover. If you employ staff, you�re legally required to have employers liability cover in place.

Source: advisorsmith.com

Source: advisorsmith.com

Employers’ liability insurance is one of few compulsory insurances. Employers liability needs to be urgently addressed. If you don’t have this type of coverage, you’ll be responsible for paying for costs related to the lawsuit out of pocket. Protect your people and your business by making sure your employers’ liability insurance meets your individual needs. But when a worker does suffer an injury, workers employers liability insurance will provide compensation for injuries to your employees which protects there needs, and provides you with peace of mind that they’ll be covered, if you are sued.

Source: kedicdreamland.blogspot.com

Source: kedicdreamland.blogspot.com

Need help navigating employer liability? Bollington are leading employers liability insurance brokers. Biba (the british insurance brokers’ association) and individual broker members have been approached in recent weeks by numerous businesses threatened with closure because they have been unable to obtain el insurance. 1 as an employer, you�re responsible for ensuring your staff are safe and well; Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work.

Source: lansdowne-woodward.co.uk

Source: lansdowne-woodward.co.uk

Companies that employ one or more members of staff, whether paid or volunteers, require this cover. Do i need employers liability insurance? Bollington are leading employers liability insurance brokers. Our first biba brokers� guide for 2019, in association with dac beachcroft, is here! Ultimately, if an employee suffers an injury and/or illness during working hours, your business could be responsible and liable.

Source: blog.constructaquote.com

Source: blog.constructaquote.com

Employers liability needs to be urgently addressed. Our employers� liability cover can be tailored to fit the needs of your customer�s business. Employers liability insurance provides cover for businesses if a claim for compensation is made by an employee as a result of an injury or illness suffered due to the work they carry out in your organization. How do i arrange employers’ liability insurance cover? Bollington are leading employers liability insurance brokers.

Source: kedicdreamland.blogspot.com

Source: kedicdreamland.blogspot.com

Employers’ liability policies cover claims made against your company in the event of accident, injury or illness sustained by your staff at work or as a result of work. Our employers� liability cover can be tailored to fit the needs of your customer�s business. Do i need employers liability insurance? Employers liability insurance provides cover for businesses if a claim for compensation is made by an employee as a result of an injury or illness suffered due to the work they carry out in your organization. Need help navigating employer liability?

Source: royalassociates.co.ke

Source: royalassociates.co.ke

Do i need employers liability insurance? Our first biba brokers� guide for 2019, in association with dac beachcroft, is here! This cover is sometimes referred to as workers compensation insurance. Protect your people and your business by making sure your employers’ liability insurance meets your individual needs. Biba (the british insurance brokers’ association) and individual broker members have been approached in recent weeks by numerous businesses threatened with closure because they have been unable to obtain el insurance.

Source: bollington.com

Source: bollington.com

Employers liability needs to be urgently addressed. At aligned, our dedicated insurance brokers work with you to provide the coverage you need to protect you from liabilities as an employer. Why do you need employers liability insurance? Employers’ liability policies cover claims made against your company in the event of accident, injury or illness sustained by your staff at work or as a result of work. Companies that employ one or more members of staff, whether paid or volunteers, require this cover.

Source: alignedinsurance.com

Source: alignedinsurance.com

Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work. It protects your business against legal defence costs and costs of compensation awards. Employers’ liability insurance is one of few compulsory insurances. If an employee brings a claim against you after being injured or becoming ill as a result of the work they have undertaken for you. We can help you cover the costs of damages and legal fees if employees are injured

Source: focusorm.co.uk

Source: focusorm.co.uk

Do i need employers liability insurance? If an employee brings a claim against you after being injured or becoming ill as a result of the work they have undertaken for you. Every employer should understand that employees also bring with them a number of risks than that could prove to be financially catastrophic to their business unless they have an adequate employers’ liability insurance in place. Employers liability insurance provides cover for businesses if a claim for compensation is made by an employee as a result of an injury or illness suffered due to the work they carry out in your organization. Despite your best efforts, if one of your employees suffers an injury or becomes ill and.

Source: lansdowne-woodward.co.uk

Source: lansdowne-woodward.co.uk

If an employee brings a claim against you after being injured or becoming ill as a result of the work they have undertaken for you. Biba (the british insurance brokers’ association) and individual broker members have been approached in recent weeks by numerous businesses threatened with closure because they have been unable to obtain el insurance. At aligned, our dedicated insurance brokers work with you to provide the coverage you need to protect you from liabilities as an employer. Protect your people and your business by making sure your employers’ liability insurance meets your individual needs. 1 as an employer, you�re responsible for ensuring your staff are safe and well;

Source: vinginsurance.com

Source: vinginsurance.com

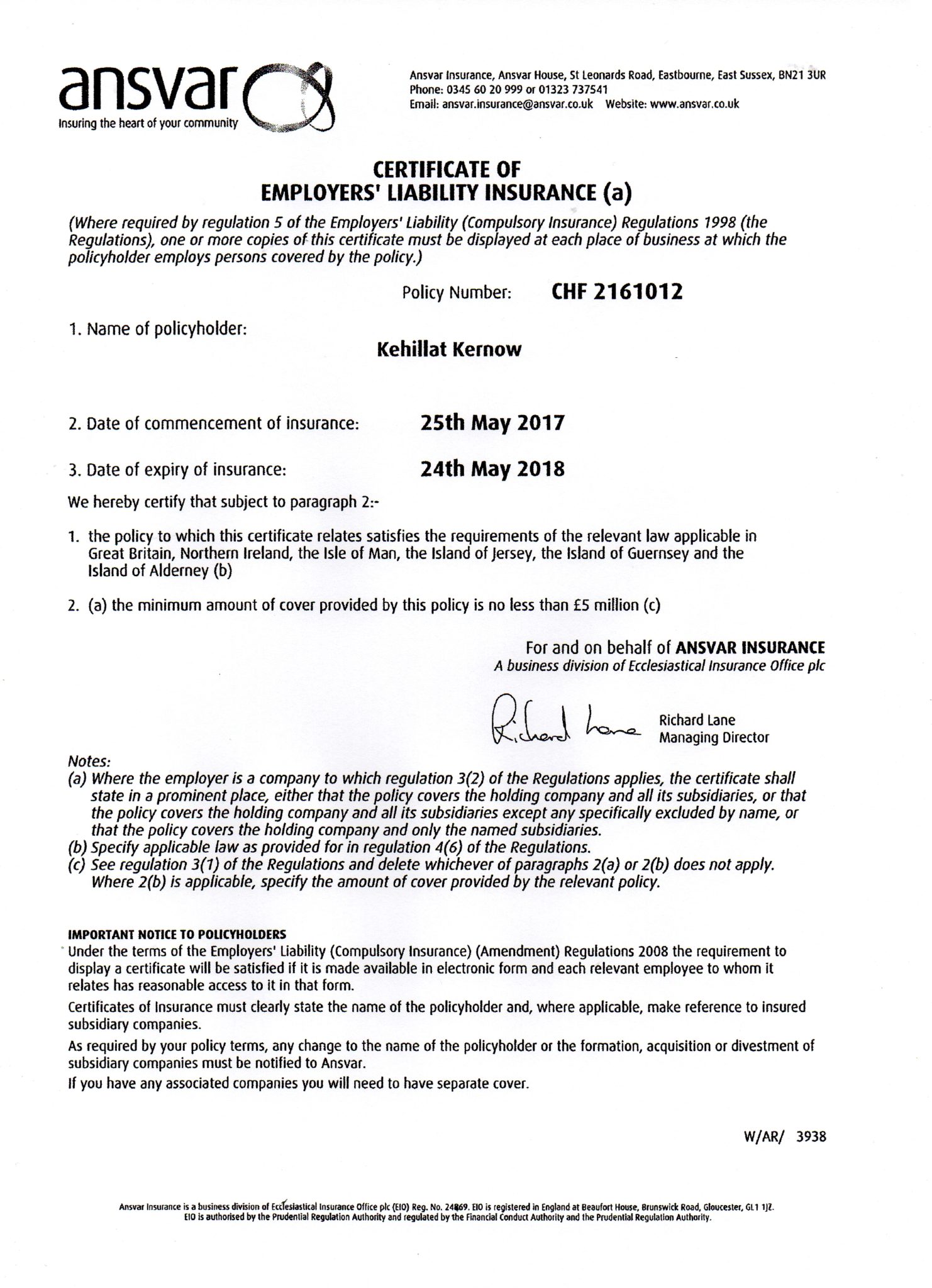

Employers liability insurance covers the cost of compensating employees who are injured at or become ill through work. Biba (the british insurance brokers’ association) and individual broker members have been approached in recent weeks by numerous businesses threatened with closure because they have been unable to obtain el insurance. Protect your people and your business by making sure your employers’ liability insurance meets your individual needs. The minimum legal requirement for employers liability cover is £5 million, however the standard cover provided by most policies is £10 million. This cover is sometimes referred to as workers compensation insurance.

Aligned has the insurance solutions for you. Do i need employers liability insurance? Employers liability needs to be urgently addressed. If you don’t have this type of coverage, you’ll be responsible for paying for costs related to the lawsuit out of pocket. Employers’ liability is a compulsory form of insurance in the uk for the majority of businesses.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employers liability insurance brokers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.