Your Employers insurance north carolina images are ready in this website. Employers insurance north carolina are a topic that is being searched for and liked by netizens now. You can Find and Download the Employers insurance north carolina files here. Download all free vectors.

If you’re searching for employers insurance north carolina images information related to the employers insurance north carolina topic, you have come to the right blog. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Employers Insurance North Carolina. However, if any healthcare insurance is offered, north carolina�s insurance laws require policies to cover certain benefits (mandated benefits) and give employees the right to continue group coverage or to convert to individual policies in certain. Our agents work leads to help our clients choose the best insurance coverage for their cars, home, and family. The renters insurance nc cost for a $20,000 personal property policy with $100,000 in liability and a. North carolina household employers are not required by law to have workers� compensation insurance, but you may want to consider obtaining this coverage.

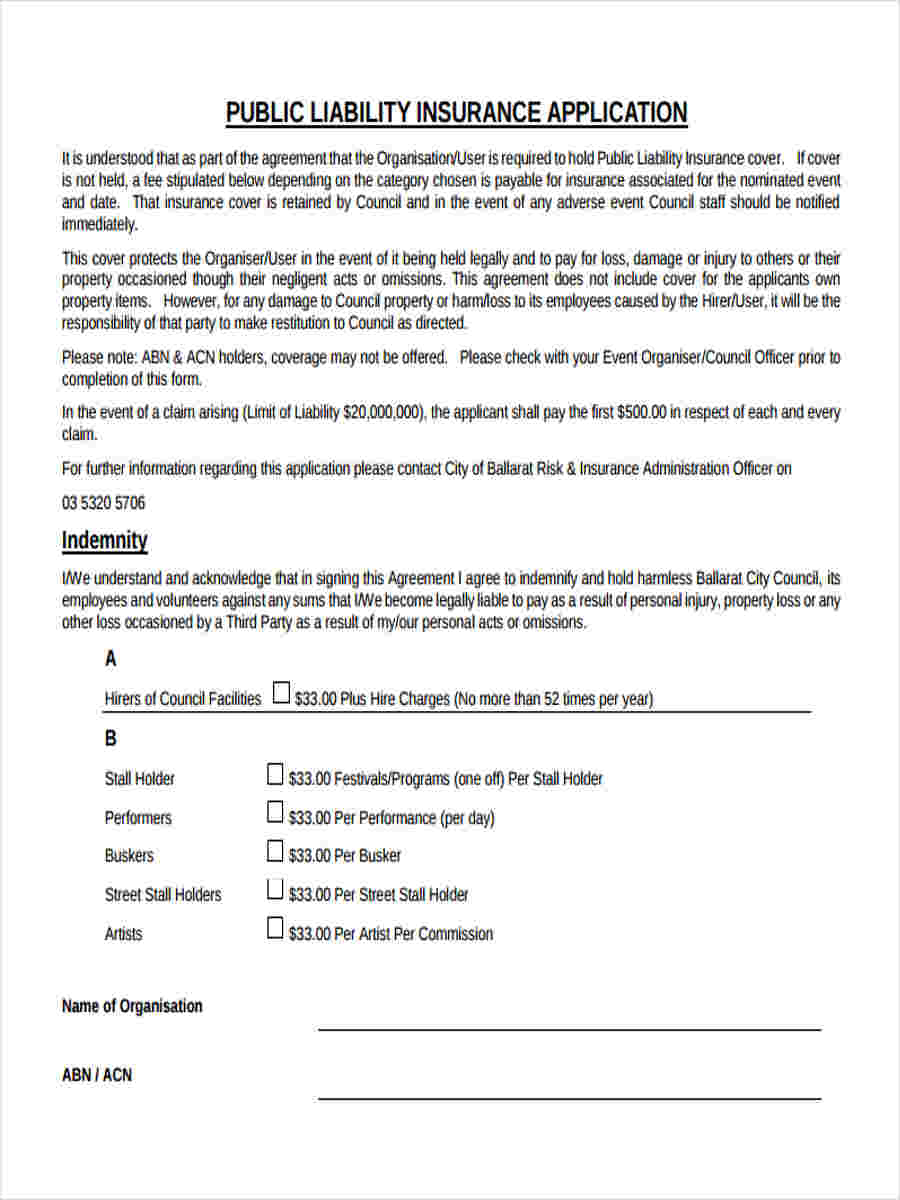

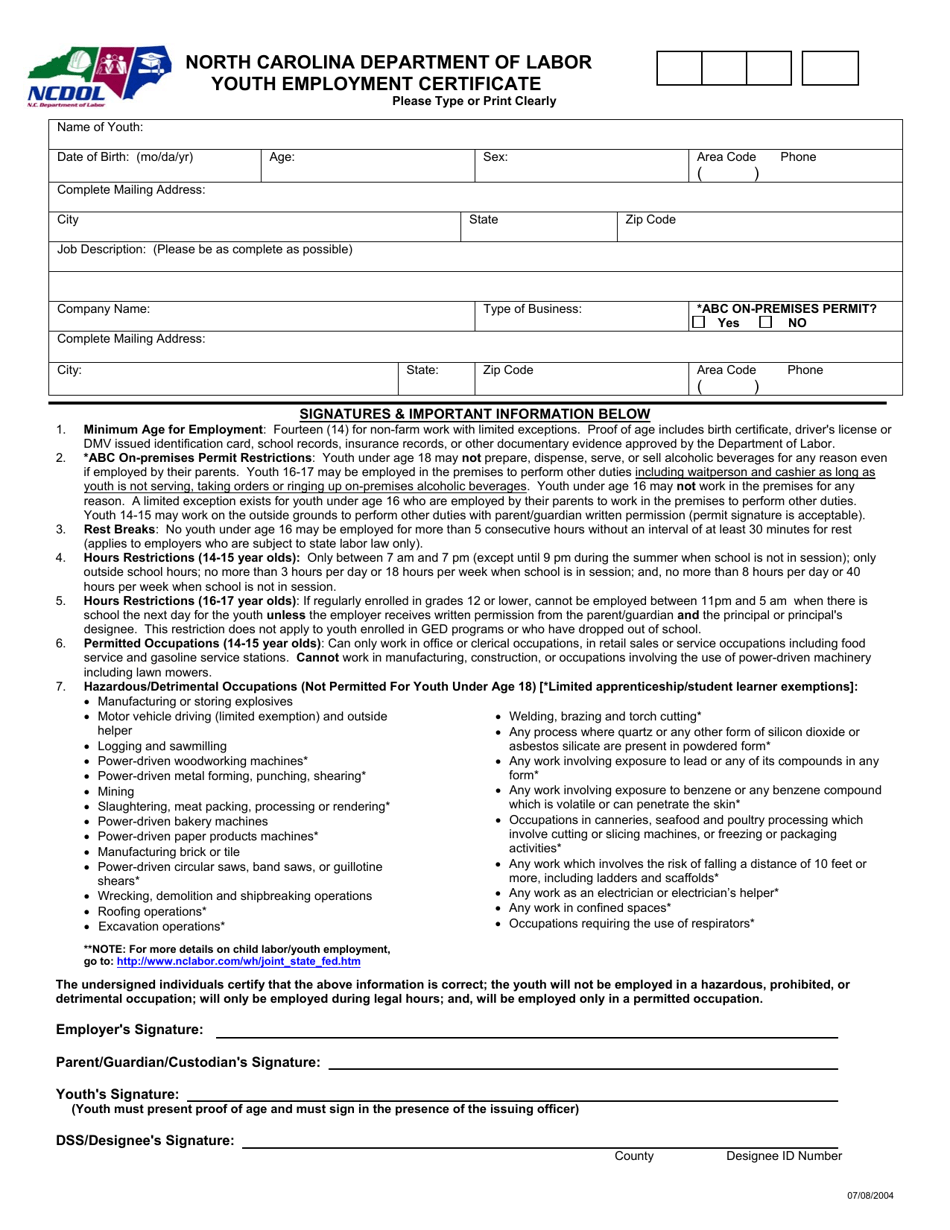

North Carolina Youth Employment Certificate Download From templateroller.com

North Carolina Youth Employment Certificate Download From templateroller.com

Employers determined to be liable under the employment security law (chapter 96 of the north carolina general statutes) are required to prominently display the certificate of coverage and notice to workersposter in their workplace. However, if any healthcare insurance is offered, north carolina�s insurance laws require policies to cover certain benefits (mandated benefits) and give employees the right to continue group coverage or to convert to individual policies in certain. There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. Employers are required to carry workers� compensation insurance in north carolina they have three or more employees. Allstate could be a good choice for homeowners looking for heavily personalized coverage. North carolina household employers are not required by law to have workers� compensation insurance, but you may want to consider obtaining this coverage.

There is no state law requiring employers to offer group healthcare insurance to their employees, but most employers do provide this benefit.

Rates can and do vary from one insurance company to another. Ad see new 2022 insurance to see if you could save in north carolina. When analyzing north carolina home insurance, there are a few guidelines from insurance experts that are tried and true. If your small business has employees working in north carolina, you�ll need to pay north carolina unemployment insurance (ui) tax. There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. As it turns out, compass group looks to the be the biggest company in north carolina clocking in with 595,841 employees.

Source: templateroller.com

Source: templateroller.com

Allstate could be a good choice for homeowners looking for heavily personalized coverage. In north carolina, state ui tax is just one of several taxes that. The ui tax funds unemployment compensation programs for eligible employees. Through our national network of delta dental companies, we offer dental coverage in all 50 states, puerto rico and other u.s. We are a proud member of the independent insurance agents association of north carolina.

Source: templateroller.com

Source: templateroller.com

North carolina farm bureau is the largest insurance company in the state and has the cheapest renters insurance in nc of all carriers we studied. The cheapest car insurance companies in north carolina are geico, nc farm bureau and erie. The ui tax funds unemployment compensation programs for eligible employees. The best home insurance companies in north carolina. Employers are required to carry workers� compensation insurance in north carolina they have three or more employees.

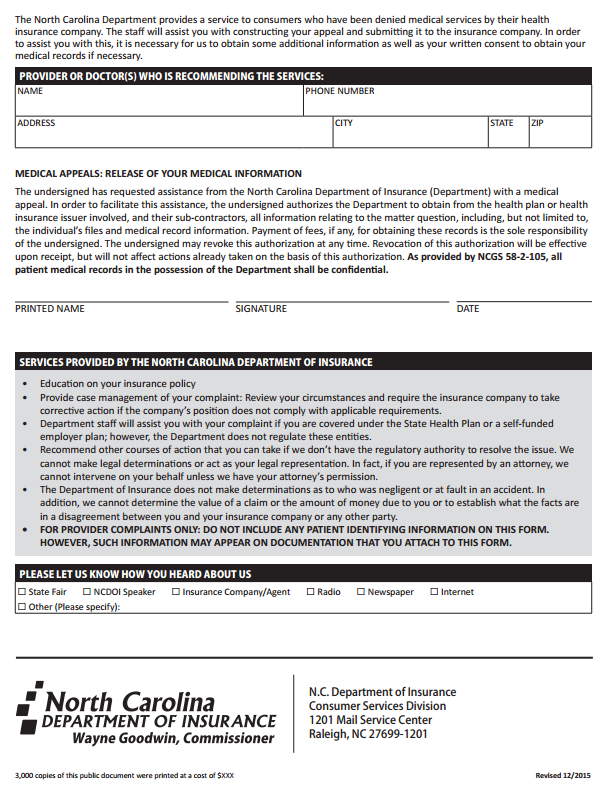

Source: inspeopleofnc.com

Source: inspeopleofnc.com

The top five north carolina homeowners insurance companies selected all had strong financial strength ratings and ranked well for customer satisfaction in j.d. As it turns out, compass group looks to the be the biggest company in north carolina clocking in with 595,841 employees. Ad see new 2022 insurance to see if you could save in north carolina. There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. The division of employment security is responsible for the administration of the unemployment insurance program in the state of north carolina.

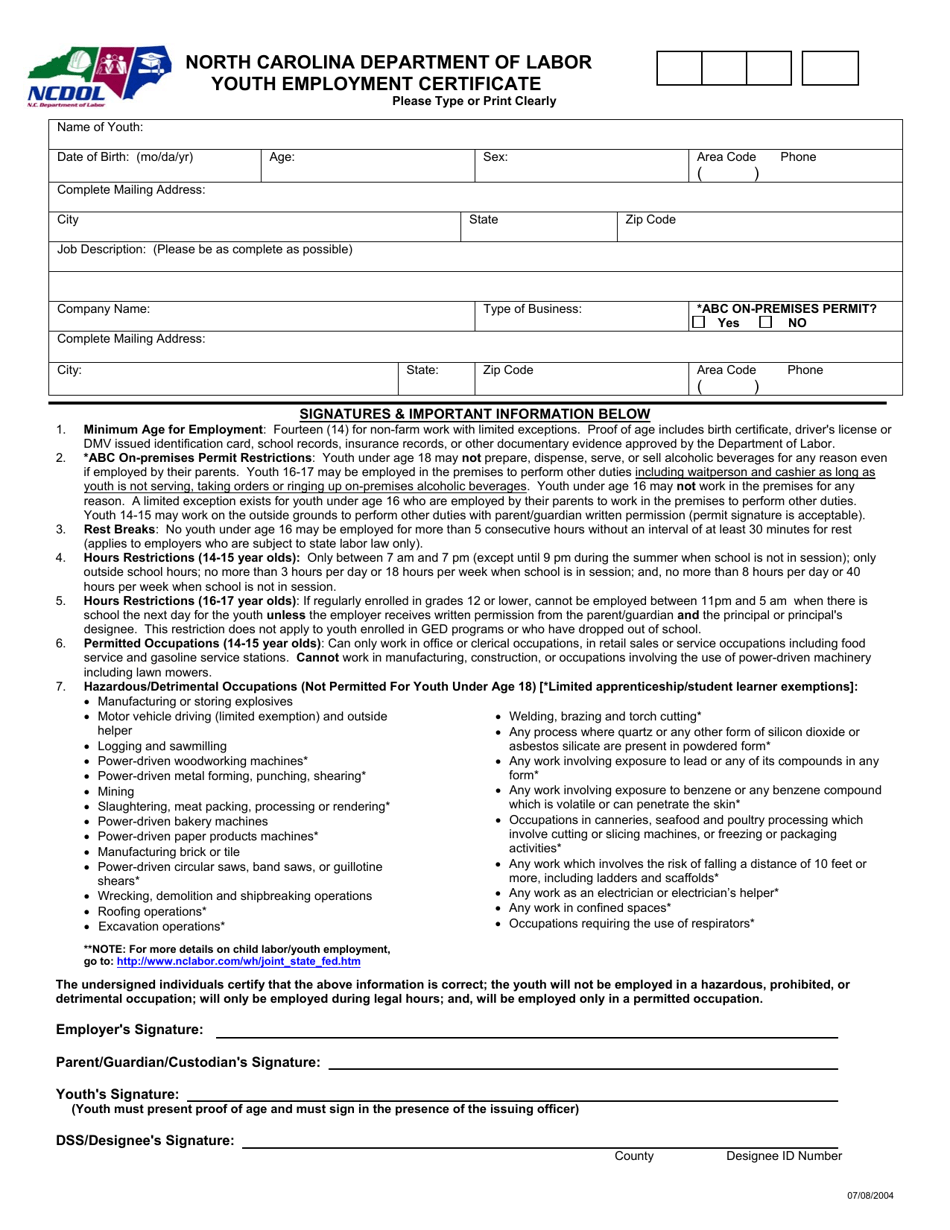

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

Benefits are paid to eligible workers who lose their job through no fault of their own and are able,. However, if any healthcare insurance is offered, north carolina�s insurance laws require policies to cover certain benefits (mandated benefits) and give employees the right to continue group coverage or to convert to individual policies in certain. With many carriers to choose from, we search for the best products and. That�s over $200 above the national average of. North carolina farm bureau is the largest insurance company in the state and has the cheapest renters insurance in nc of all carriers we studied.

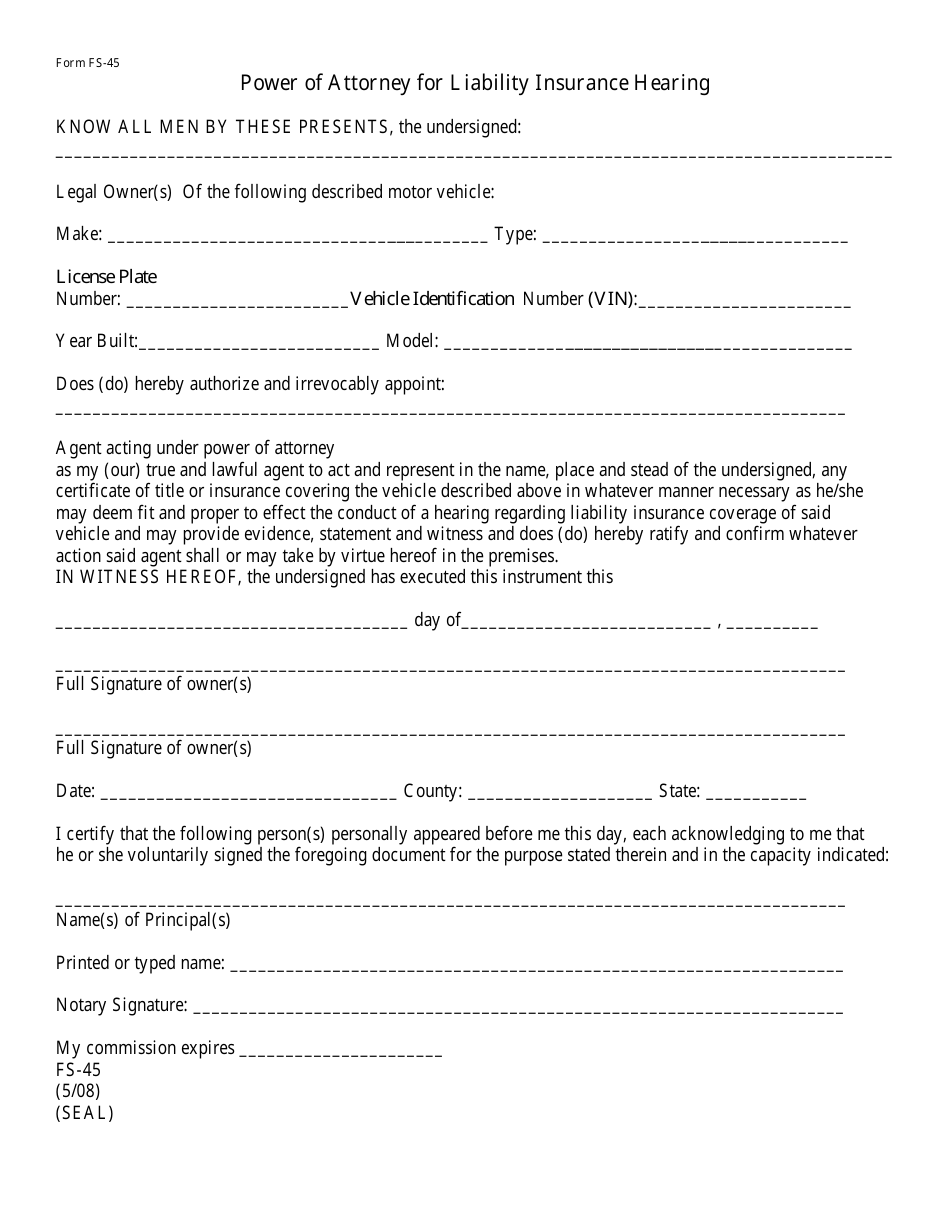

Source: electjohnbell.com

Source: electjohnbell.com

We protect clients throughout north carolina and south carolina. Northgroup insurance is an independent agency. North carolina has harsh penalties for workers’ compensation violations. However, the following situations are exceptions to this rule. As it turns out, compass group looks to the be the biggest company in north carolina clocking in with 595,841 employees.

Source: laborposters.org

Source: laborposters.org

Northgroup insurance is an independent agency. There is no state law requiring employers to offer group healthcare insurance to their employees, but most employers do provide this benefit. The difference between the cheapest and most expensive car insurance in north carolina can be hundreds of dollars a year, so it pays to shop around and compare quotes. Find the top rated 2022 plans & save! Find the top rated 2022 plans & save!

Source: corporatecostcontrol.com

Source: corporatecostcontrol.com

Ad see new 2022 insurance to see if you could save in north carolina. When analyzing north carolina home insurance, there are a few guidelines from insurance experts that are tried and true. That�s over $200 above the national average of. There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. However, the following situations are exceptions to this rule.

Source: anyinsuranceadvice.com

Source: anyinsuranceadvice.com

Delta dental of north carolina is a part of delta dental plans association. We protect clients throughout north carolina and south carolina. The ui tax funds unemployment compensation programs for eligible employees. The renters insurance nc cost for a $20,000 personal property policy with $100,000 in liability and a. The best home insurance companies in north carolina.

Source: pinterest.com

Source: pinterest.com

There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. With many carriers to choose from, we search for the best products and. Get an online quote today. However, if any healthcare insurance is offered, north carolina�s insurance laws require policies to cover certain benefits (mandated benefits) and give employees the right to continue group coverage or to convert to individual policies in certain. The difference between the cheapest and most expensive car insurance in north carolina can be hundreds of dollars a year, so it pays to shop around and compare quotes.

Source: pinterest.com

Source: pinterest.com

Get an online quote today. North carolina household employers are not required by law to have workers� compensation insurance, but you may want to consider obtaining this coverage. The renters insurance nc cost for a $20,000 personal property policy with $100,000 in liability and a. By candace baker, car insurance writer feb 18, 2022. A workers� compensation insurance company.

Source: templateroller.com

Source: templateroller.com

That�s over $200 above the national average of. A nerdwallet analysis of 12 insurance companies in the state found homeowners in north carolina pay an average of $1,812 per year for home insurance; Insurance rates are developed by taking all losses from similar employers and aggregating them. The cheapest car insurance companies in north carolina are geico, nc farm bureau and erie. Find north carolina health insurance options at many price points.

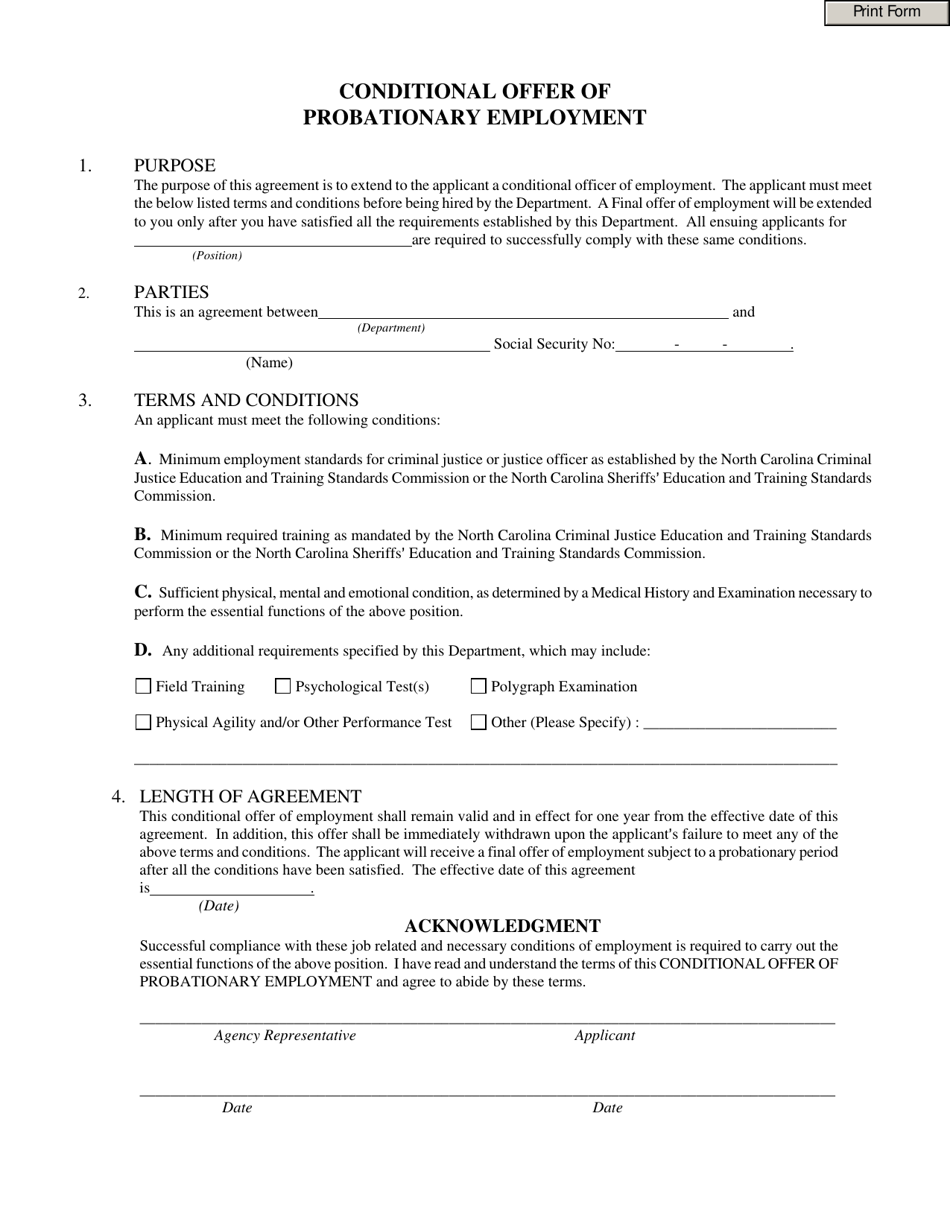

Source: oshr.nc.gov

Source: oshr.nc.gov

Allstate could be a good choice for homeowners looking for heavily personalized coverage. Our agents work leads to help our clients choose the best insurance coverage for their cars, home, and family. 7031 koll center pkwy, pleasanton, ca 94566. The best home insurance companies in north carolina. North carolina farm bureau is the largest insurance company in the state and has the cheapest renters insurance in nc of all carriers we studied.

Source: fill.io

Source: fill.io

There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. North carolina farm bureau is the largest insurance company in the state and has the cheapest renters insurance in nc of all carriers we studied. Benefits are paid to eligible workers who lose their job through no fault of their own and are able,. Now, check out how the 100 biggest companies in north carolina ranked. That�s over $200 above the national average of.

Source: slideshare.net

Source: slideshare.net

It also shields your business from other legal liabilities associated with an injured employee. In north carolina, state ui tax is just one of several taxes that. We protect clients throughout north carolina and south carolina. Rates can and do vary from one insurance company to another. 7031 koll center pkwy, pleasanton, ca 94566.

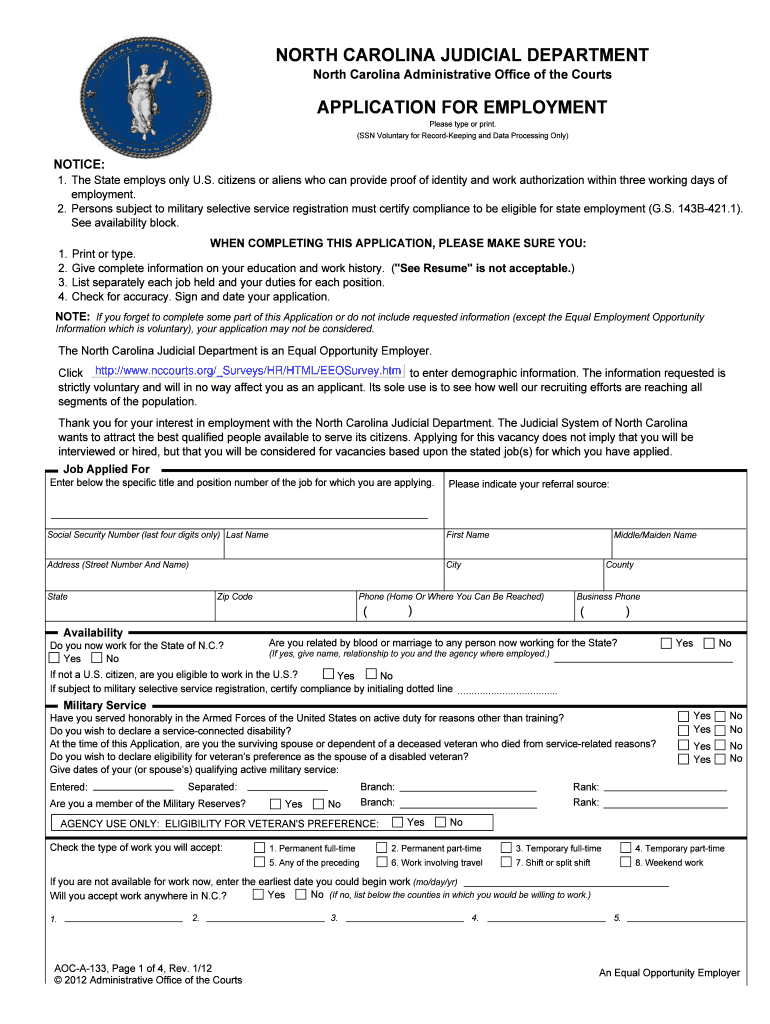

Source: formsbirds.com

Source: formsbirds.com

Find the top rated 2022 plans & save! 7031 koll center pkwy, pleasanton, ca 94566. The difference between the cheapest and most expensive car insurance in north carolina can be hundreds of dollars a year, so it pays to shop around and compare quotes. If your small business has employees working in north carolina, you�ll need to pay north carolina unemployment insurance (ui) tax. Ad see new 2022 insurance to see if you could save in north carolina.

Source: verigent.com

Source: verigent.com

In north carolina, state ui tax is just one of several taxes that. That�s over $200 above the national average of. In north carolina, state ui tax is just one of several taxes that. Our agents work leads to help our clients choose the best insurance coverage for their cars, home, and family. North carolina household employers are not required by law to have workers� compensation insurance, but you may want to consider obtaining this coverage.

Source: signnow.com

Source: signnow.com

North carolina has harsh penalties for workers’ compensation violations. Through our national network of delta dental companies, we offer dental coverage in all 50 states, puerto rico and other u.s. We are a proud member of the independent insurance agents association of north carolina. The division of employment security is responsible for the administration of the unemployment insurance program in the state of north carolina. The cheapest car insurance companies in north carolina are geico, nc farm bureau and erie.

Source: laborposters.org

Source: laborposters.org

However, north carolina law requires employers to provide at least 45 days’ notice to their employees when they plan to cease offering health insurance. Employers determined to be liable under the employment security law (chapter 96 of the north carolina general statutes) are required to prominently display the certificate of coverage and notice to workersposter in their workplace. Benefits are paid to eligible workers who lose their job through no fault of their own and are able,. However, if any healthcare insurance is offered, north carolina�s insurance laws require policies to cover certain benefits (mandated benefits) and give employees the right to continue group coverage or to convert to individual policies in certain. There is no state law requiring employers to offer group healthcare insurance to their employees, but most employers do provide this benefit.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employers insurance north carolina by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.