Your Employer uses wrong national insurance number images are available in this site. Employer uses wrong national insurance number are a topic that is being searched for and liked by netizens now. You can Get the Employer uses wrong national insurance number files here. Download all royalty-free photos and vectors.

If you’re looking for employer uses wrong national insurance number images information connected with to the employer uses wrong national insurance number topic, you have come to the right site. Our site always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

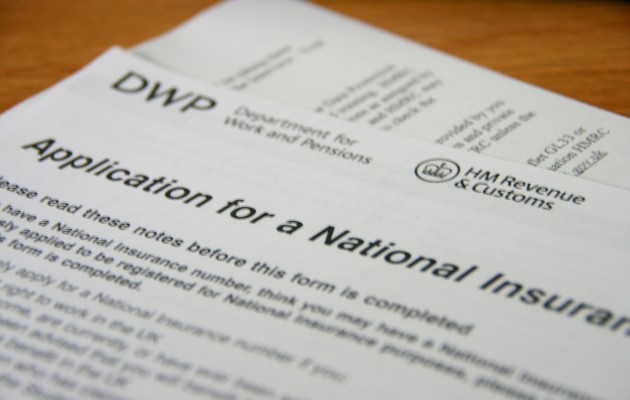

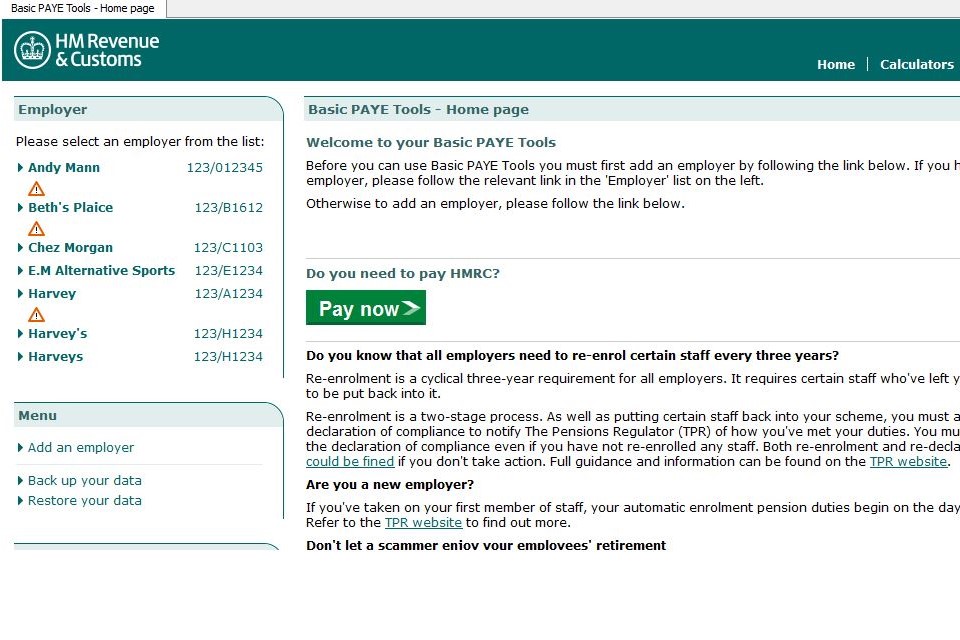

Employer Uses Wrong National Insurance Number. If they use your nino and they know enough about you to claim benefits and they then get advances, overpayments or fraud penalties then unless you can prove that you had absolutely nothing to do with it, that debt will be pursued and you will end up. Are making an ‘employer error’ enquiry. This guide explains what to do if an employee can�t give you their national insurance number, and what they should do. If your employee has never had a national insurance number please ask them to contact the department for work and pensions (dwp) contact centre on telephone:

What Your National Insurance Category Letter Means Class 1 From nationalinsurancenumber.org

What Your National Insurance Category Letter Means Class 1 From nationalinsurancenumber.org

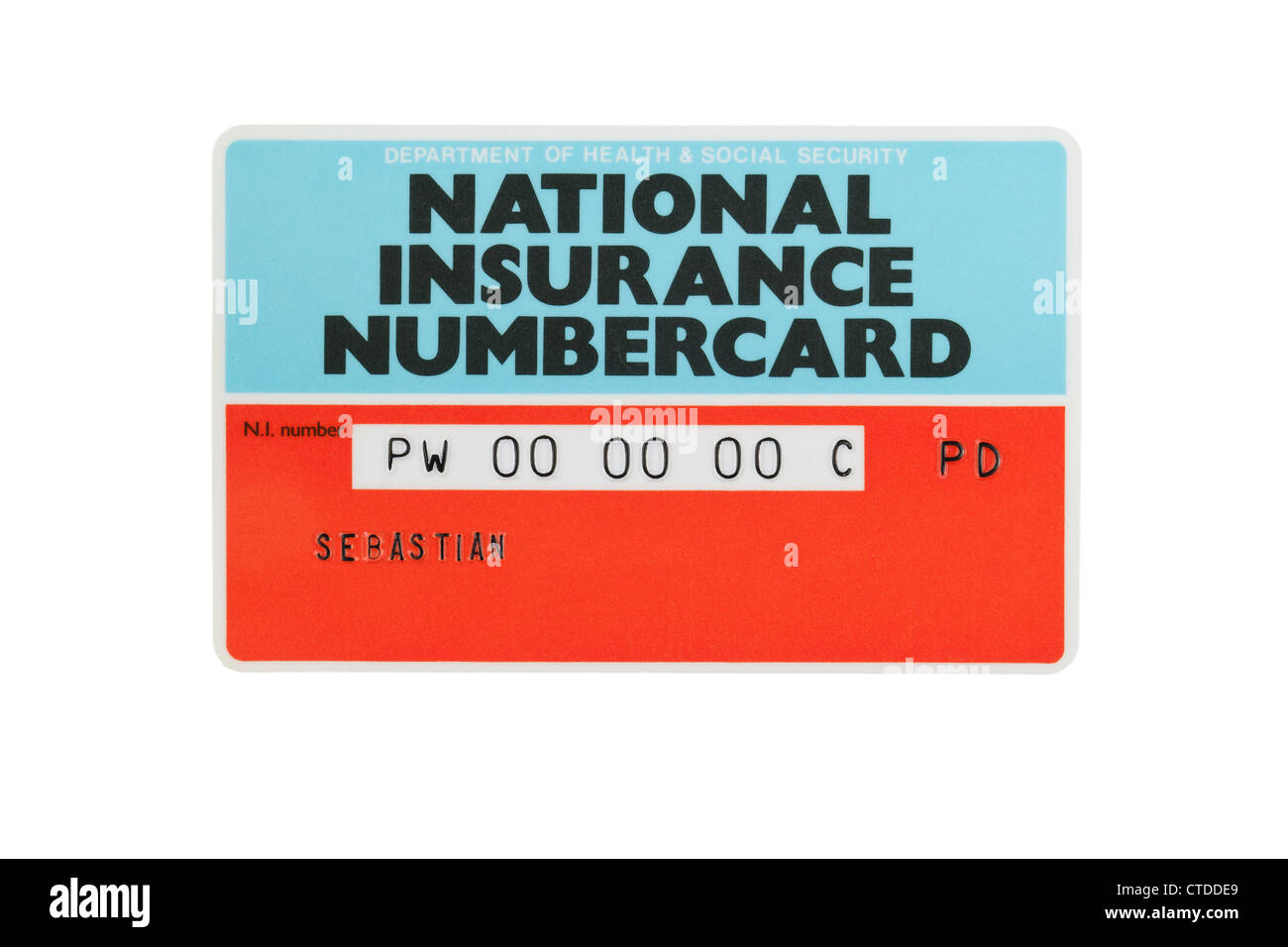

I�ve requested a national insurance statement online and stated my employer had been using the wrong nino i don�t know what she�s playing at to be honest. There is only one digit wrong which was why it was hard to spot before. They will need to explain that their payroll data has been processed with an incorrect ni number, and they must give hmrc the incorrect ni number. Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance I just realised today that the ni number in my payslip is wrong. 1250 w1, 1250 m1 and 1250 x are emergency codes, so i�m not sure what to make of it.

Make a note of the date and time you call the office.

Prior to the current company they employed same employee in another business again using wrong ni number.employee left company october 2019 and has applied for contribution based esa but it has been turned down. We are applying for my husbands ilr visa on 6th february in person. I think the correct place to contact to correct this is the national insurance contributions office (on 0845 302 1479), but two weeks won�t make a great deal of difference either way. Was successful and what your national insurance number is. If you use the wrong national insurance number, use a �default� number or make one up your employee�s entitlement to benefits may be adversely affected. My client is a ltd company and they have used the wrong ni number for one of their ex employees for past three years.

Source: sibbald.co.uk

Source: sibbald.co.uk

It should be free if you call from your mobile and have landline calls included in your contract. The m1 means an emergency tax code, however, in another page it states only these tax codes: The prefix is simply two letters that are allocated to each new series of ni number. Several years ago before we met, my wife came to the uk on a visitor visa. I think the correct place to contact to correct this is the national insurance contributions office (on 0845 302 1479), but two weeks won�t make a great deal of difference either way.

Remember to keep the letter telling you what your national insurance number is safe Having looked into my old payslips and p60s it appears it was wrong from the start of job over 8 years ago. Employer uses wrong national insurance number. I think the correct place to contact to correct this is the national insurance contributions office (on 0845 302 1479), but two weeks won�t make a great deal of difference either way. So basically everyone who works in the uk!

Source: customer-care-numberss.blogspot.com

Source: customer-care-numberss.blogspot.com

Having looked into my old payslips and p60s it appears it was wrong from the start of job over 8 years ago. There is only one digit wrong which was why it was hard to spot before. Calls cost up to 12p a minute from landlines and up to 45p a minute from mobiles. Was successful and what your national insurance number is. So basically everyone who works in the uk!

Source: sapling.com

Source: sapling.com

Talk to one of the team for online accounting support. Call 020 3355 4047, or use the live chat button on screen. Tell your employer your national insurance number as soon as you know it. Remember to keep the letter telling you what your national insurance number is safe However for some reason their system was still printing out the wrong ni number.

Source: howtobeginyourgreeklifeinlondon.blogspot.com

Source: howtobeginyourgreeklifeinlondon.blogspot.com

Calls cost up to 12p a minute from landlines and up to 45p a minute from mobiles. Good point about querying the delay in the payslips. This guide explains what to do if an employee can�t give you their national insurance number, and what they should do. If you do not know what this was, you should enter the space bar. Peccleston over 1 year ago.

Source: easyaccountingservices.co.uk

Source: easyaccountingservices.co.uk

I�ve requested a national insurance statement online and stated my employer had been using the wrong nino i don�t know what she�s playing at to be honest. What had happened was for 3 years i had the wrong ni number on paper as my store manager had put it in wrong, since then it had been corrected (they could of let me know). Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance you can call the national insurance contributions office on 0300 200 3500 if you�d prefer. We are applying for my husbands ilr visa on 6th february in person. Was successful and what your national insurance number is.

Source: newyorktribunenews.blogspot.com

Source: newyorktribunenews.blogspot.com

The m1 means an emergency tax code, however, in another page it states only these tax codes: You will need to provide the following information: The prefix is simply two letters that are allocated to each new series of ni number. Having looked into my old payslips and p60s it appears it was wrong from the start of job over 8 years ago. Make a note of the date and time you call the office.

Source: greatbritishmag.co.uk

Source: greatbritishmag.co.uk

It shouldn�t affect how much income tax and national insurance is deducted from your pay, but your nics won�t be allocated to the correct account. My client is a ltd company and they have used the wrong ni number for one of their ex employees for past three years. Calls cost up to 12p a minute from landlines and up to 45p a minute from mobiles. However we just noticed that on his payslips from his recent job he started in april 2015 his national insurance number is wrong! Was successful and what your national insurance number is.

Source: br.pinterest.com

Source: br.pinterest.com

Remember to keep the letter telling you what your national insurance number is safe Only by 1 number which is why we never noticed before, so it should have been 41b at the end but instead its written as 91b on his payslips. The prefix is simply two letters that are allocated to each new series of ni number. If your employee has never had a national insurance number please ask them to contact the department for work and pensions (dwp) contact centre on telephone: So basically everyone who works in the uk!

Source: itcontracting.com

Source: itcontracting.com

However for some reason their system was still printing out the wrong ni number. 1250 w1, 1250 m1 and 1250 x are emergency codes, so i�m not sure what to make of it. Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance We are applying for my husbands ilr visa on 6th february in person. It should be free if you call from your mobile and have landline calls included in your contract.

Source: cephalic.co.uk

Source: cephalic.co.uk

I just realised today that the ni number in my payslip is wrong. I would think if you contacted your. So basically everyone who works in the uk! The main switchboard number is 0191 213 5000. The prefix is simply two letters that are allocated to each new series of ni number.

Source: allcustomercarenumbers.net

Source: allcustomercarenumbers.net

We are applying for my husbands ilr visa on 6th february in person. Make a note of the date and time you call the office. I just realised today that the ni number in my payslip is wrong. 1250 w1, 1250 m1 and 1250 x are emergency codes, so i�m not sure what to make of it. I think the correct place to contact to correct this is the national insurance contributions office (on 0845 302 1479), but two weeks won�t make a great deal of difference either way.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

This guide explains what to do if an employee can�t give you their national insurance number, and what they should do. There is only one digit wrong which was why it was hard to spot before. This guide explains what to do if an employee can�t give you their national insurance number, and what they should do. They will need to explain that their payroll data has been processed with an incorrect ni number, and they must give hmrc the incorrect ni number. However, i believe the biggest issue is that i think my employer has an incorrect ni number (one digit is wrong).

Source: pinterest.com

Source: pinterest.com

I just realised today that the ni number in my payslip is wrong. Was successful and what your national insurance number is. The main switchboard number is 0191 213 5000. The prefix is simply two letters that are allocated to each new series of ni number. I would think if you contacted your.

Source: xithemes.com

Source: xithemes.com

I just realised today that the ni number in my payslip is wrong. You can call the national insurance contributions office on 0300 200 3500 if you�d prefer. Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance Several years ago before we met, my wife came to the uk on a visitor visa. Having looked into my old payslips and p60s it appears it was wrong from the start of job over 8 years ago.

Source: allinsurancesforyou.blogspot.com

Source: allinsurancesforyou.blogspot.com

This guide explains what to do if an employee can�t give you their national insurance number, and what they should do. Remember to keep the letter telling you what your national insurance number is safe Good point about querying the delay in the payslips. Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance you can call the national insurance contributions office on 0300 200 3500 if you�d prefer. You will need to provide the following information:

Source: payslips-plus.co.uk

Source: payslips-plus.co.uk

If you do not know what this was, you should enter the space bar. They will need to explain that their payroll data has been processed with an incorrect ni number, and they must give hmrc the incorrect ni number. If you do not know what this was, you should enter the space bar. And if it�s the last 6 months, check your 2009/10 p60, because that might have the wrong ni number on it. Several years ago before we met, my wife came to the uk on a visitor visa.

Source: accountantsetc.com

Source: accountantsetc.com

Your name and national insurance number what tax year and underpayment the enquiry relates to who your employer or pension payer is including their reference if known what the error or mistake is, an incorrect code for instance Your ni number has no personal information about you; You can call the national insurance contributions office on 0300 200 3500 if you�d prefer. However for some reason their system was still printing out the wrong ni number. If you use the wrong national insurance number, use a �default� number or make one up your employee�s entitlement to benefits may be adversely affected.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employer uses wrong national insurance number by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.