Your Employer portion of health insurance on w2 images are available in this site. Employer portion of health insurance on w2 are a topic that is being searched for and liked by netizens now. You can Get the Employer portion of health insurance on w2 files here. Find and Download all free images.

If you’re searching for employer portion of health insurance on w2 images information related to the employer portion of health insurance on w2 topic, you have come to the right site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

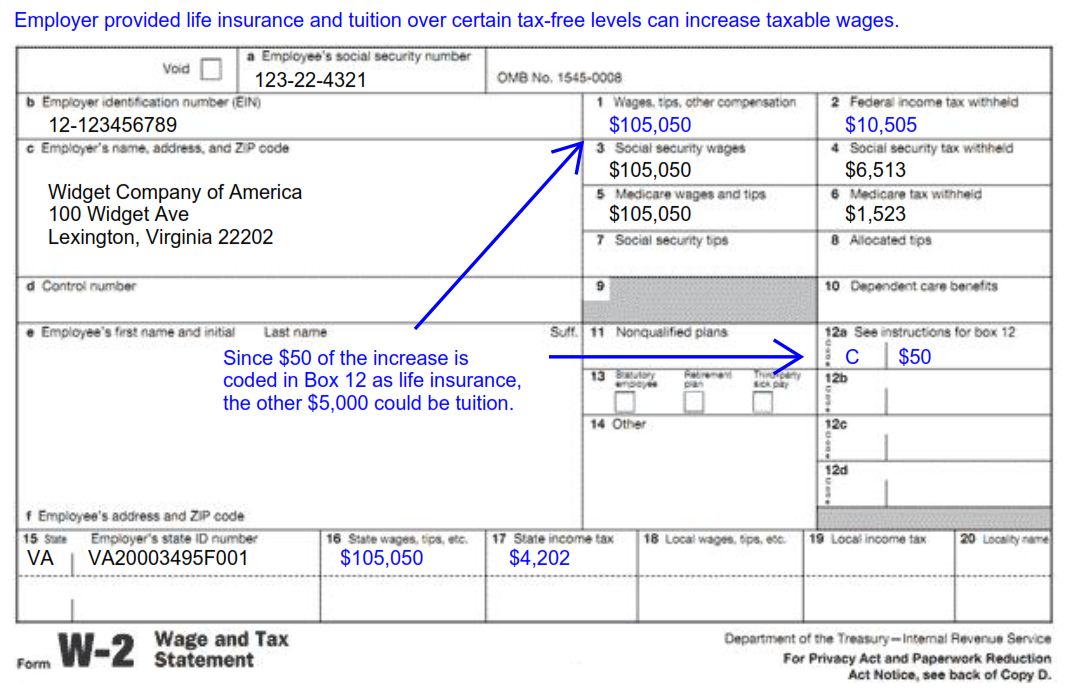

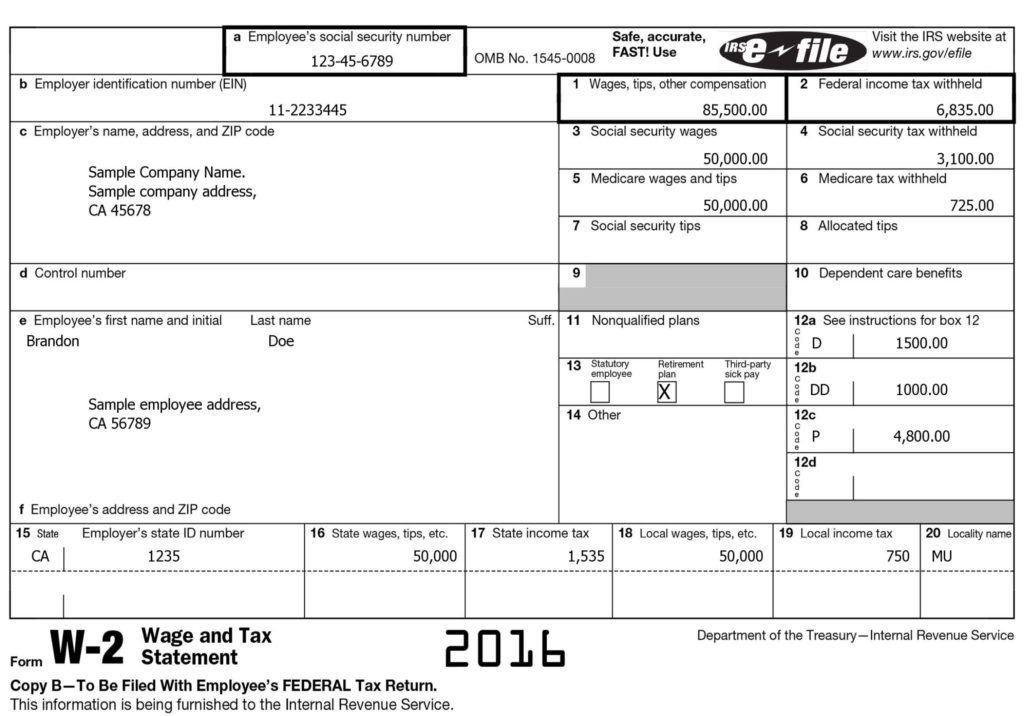

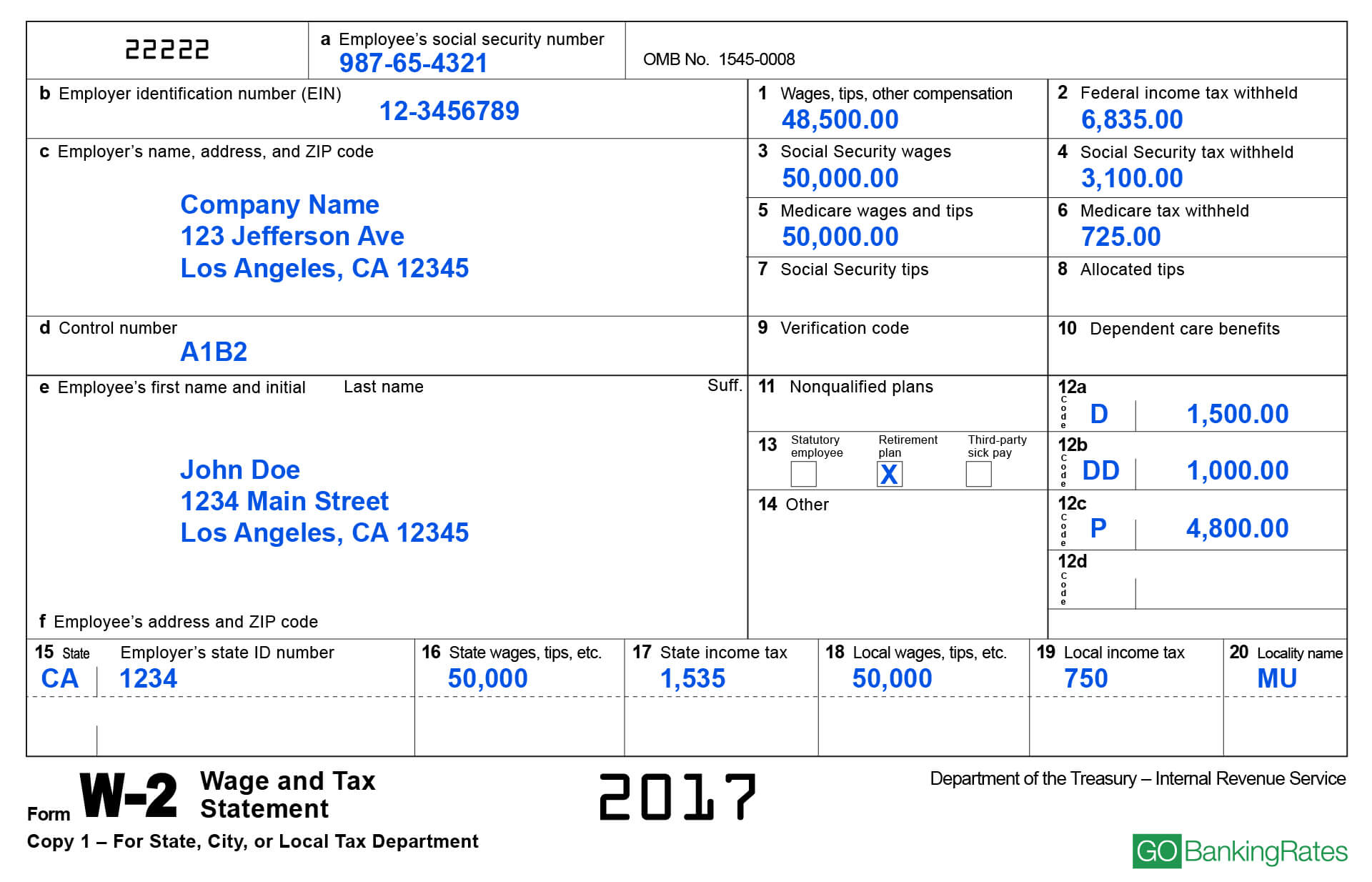

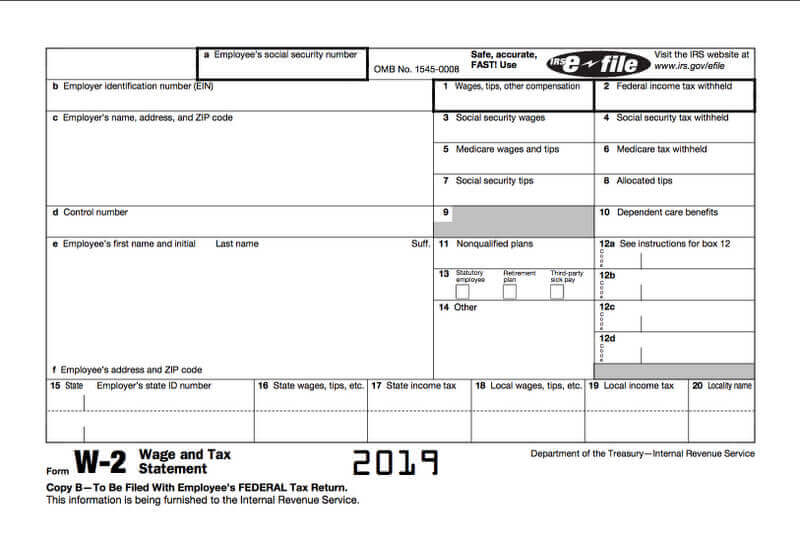

Employer Portion Of Health Insurance On W2. This reporting of the employer paid amount for health insurance is for informational purposes only and is not being added to the employee�s gross income for income tax purposes. Employers only covers a portion of health insurance roughly 50%. In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. If 1099 i understand, but not sure about w2.

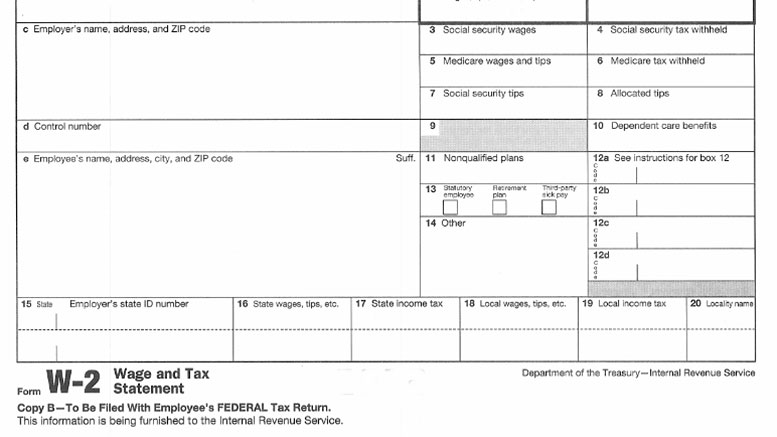

Understanding Tax Season Form W2 Remote Financial Planner From remotefinancialplanner.com

Understanding Tax Season Form W2 Remote Financial Planner From remotefinancialplanner.com

In 2021, minimum affordability means the employee’s total contribution to the group health care plan must not exceed 9.83% of their annual household income. A qualified small employer health reimbursement arrangement (qsehra) is a reimbursement option for eligible employers. Additionally, the portion of premiums employees pay is typically excluded from taxable income. She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). This reporting of the employer paid amount for health insurance is for informational purposes only and is not being added to the employee�s gross income for income tax purposes.

Does employer paid health insurance count as income?

It has a maximum reimbursement limit of $5,450 (single) or $11,050 (family) in 2022. If 1099 i understand, but not sure about w2. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). Which employers must report health insurance on w2? You should record both you and your employees’ contribution to healthcare. In 2021, minimum affordability means the employee’s total contribution to the group health care plan must not exceed 9.83% of their annual household income.

.png?width=800&name=2017 W-2 FORM (2).png “W2 Reporting Required for Nanny TaxFree Healthcare Benefits”) Source: info.homeworksolutions.com

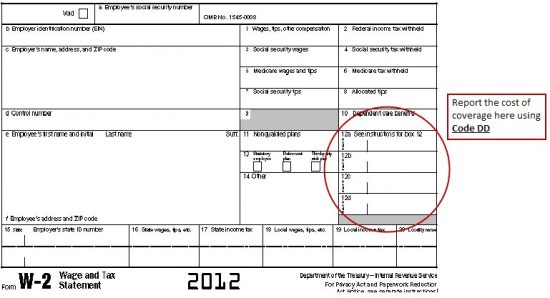

Note on dependent care fsas: The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out. This is why you cannot deduct the amount again on your schedule a. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000.

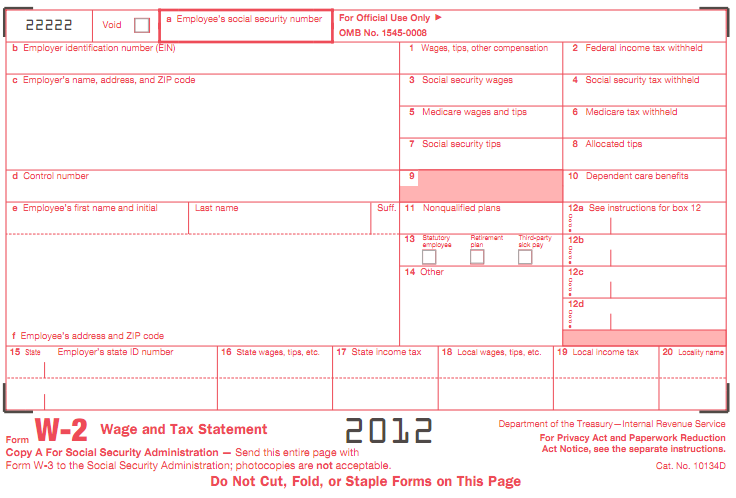

Source: pay-stubs.com

Source: pay-stubs.com

Which employers must report health insurance on w2? You don’t have to report healthcare coverage for retirees or former employees. This amount is reported for informational purposes only and is not taxable. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000.

Source: forbes.com

Source: forbes.com

A qualified small employer health reimbursement arrangement (qsehra) is a reimbursement option for eligible employers. You should record both you and your employees’ contribution to healthcare. This is why you cannot deduct the amount again on your schedule a. It has a maximum reimbursement limit of $5,450 (single) or $11,050 (family) in 2022. Ten percent of her agi is $3,000.

Source: gobankingrates.com

Source: gobankingrates.com

She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000. Ten percent of her agi is $3,000. Or did i get hosed? Your health insurance premiums paid will be listed. The employer portion of health insurance that you pay varies depending on your business’s size and the type of coverage.

Source: mycity4her.com

Source: mycity4her.com

This amount is reported for informational purposes only and is not taxable. We have a small business (under 50 employees) which offers health insurance to our employees. You don’t have to report healthcare coverage for retirees or former employees. This amount is reported for informational purposes only and is not taxable. Which employers must report health insurance on w2?

Source: ww2.cfo.com

Source: ww2.cfo.com

Is it generally standard to have to pay 50% of the remaining monthly premium for health insurance as w2? This amount is reported for informational purposes only and is not taxable. Is it generally standard to have to pay 50% of the remaining monthly premium for health insurance as w2? B bostonspine full member verified member 5+ year member physician joined feb 22, 2016 messages 105 reaction score This adds up to a total of $9,800 for the year.

Source: military.com

Source: military.com

This is why you cannot deduct the amount again on your schedule a. This adds up to a total of $9,800 for the year. If 1099 i understand, but not sure about w2. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. This amount is reported for informational purposes only and is not taxable.

Source: staffmarket.com

Source: staffmarket.com

Though there is no single answer to how much do employers pay for health insurance, there are average amounts. Does my w2 show how much i paid for health insurance? In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. Which employers must report health insurance on w2? Does employer paid health insurance count as income?

Source: freechurchaccounting.com

Source: freechurchaccounting.com

We have a small business (under 50 employees) which offers health insurance to our employees. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). B bostonspine full member verified member 5+ year member physician joined feb 22, 2016 messages 105 reaction score This is why you cannot deduct the amount again on your schedule a. If 1099 i understand, but not sure about w2.

Source: intuitiveaccountant.com

Source: intuitiveaccountant.com

Employers only covers a portion of health insurance roughly 50%. Most insurance companies require employers to cover at least half of the employee’s premium. This amount is reported for informational purposes only and is not taxable. Does employer paid health insurance count as income? If 1099 i understand, but not sure about w2.

Source: forbes.com

Source: forbes.com

This adds up to a total of $9,800 for the year. Eventually all employers who provide health insurance to their employees will be required to report this information on the employee�s w2. If 1099 i understand, but not sure about w2. Note on dependent care fsas: Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan).

Source: tenenz.com

Source: tenenz.com

She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000. You should record both you and your employees’ contribution to healthcare. What is included in the w2 dd code total? In 2021, minimum affordability means the employee’s total contribution to the group health care plan must not exceed 9.83% of their annual household income. She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000.

![45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX 45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX](https://www.hsaedge.com/wp-content/uploads/2018/04/HSA-employer-contributions-W2-example.png) Source: healthforms-0.blogspot.com

Source: healthforms-0.blogspot.com

Additionally, the portion of premiums employees pay is typically excluded from taxable income. Employers only covers a portion of health insurance roughly 50%. Your health insurance premiums paid will be listed. She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000. Note on dependent care fsas:

Source: www1.nyc.gov

Source: www1.nyc.gov

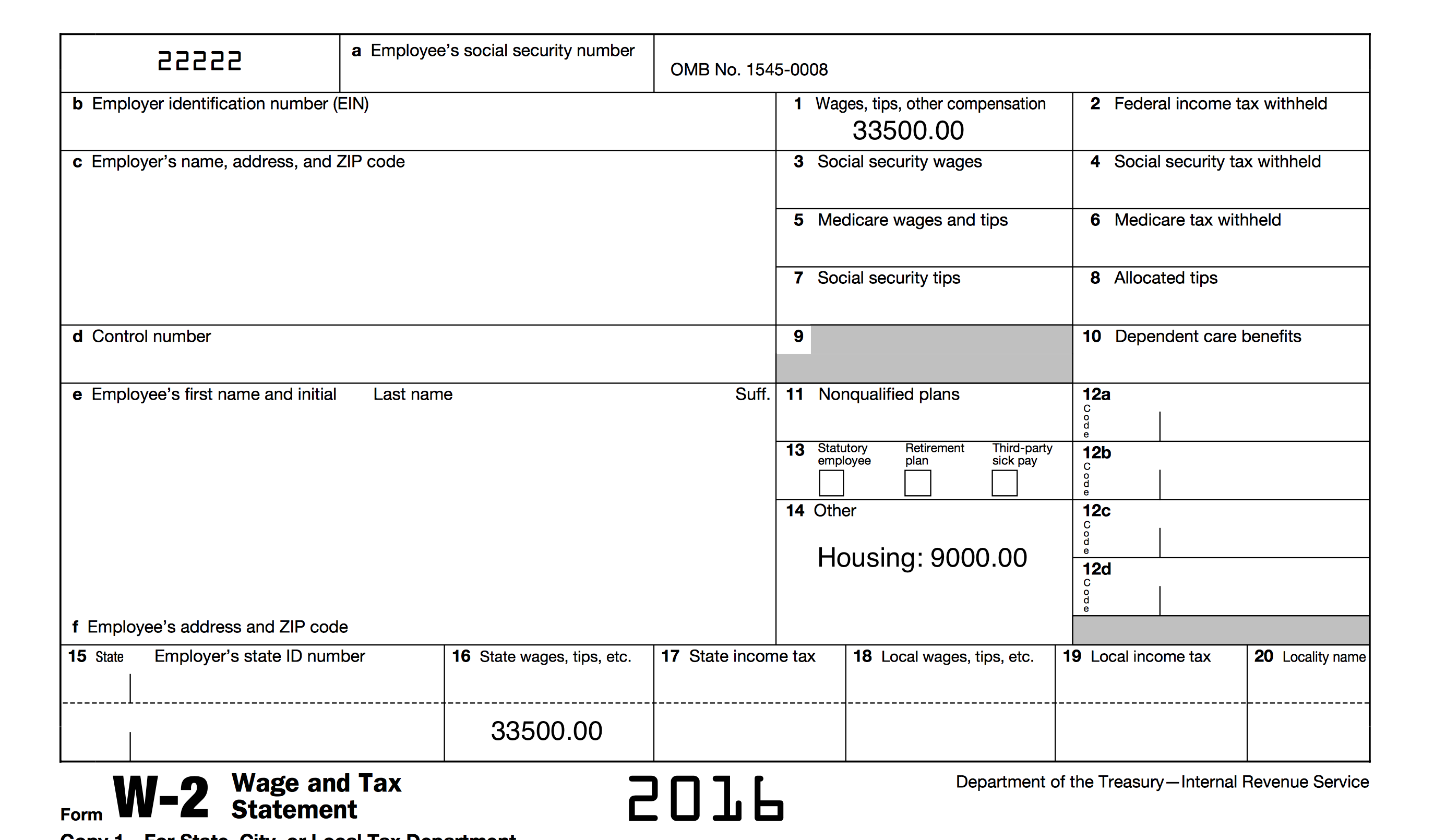

B bostonspine full member verified member 5+ year member physician joined feb 22, 2016 messages 105 reaction score Does employer paid health insurance count as income? Though there is no single answer to how much do employers pay for health insurance, there are average amounts. This is your total taxable wages this represents the employer paid. The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out.

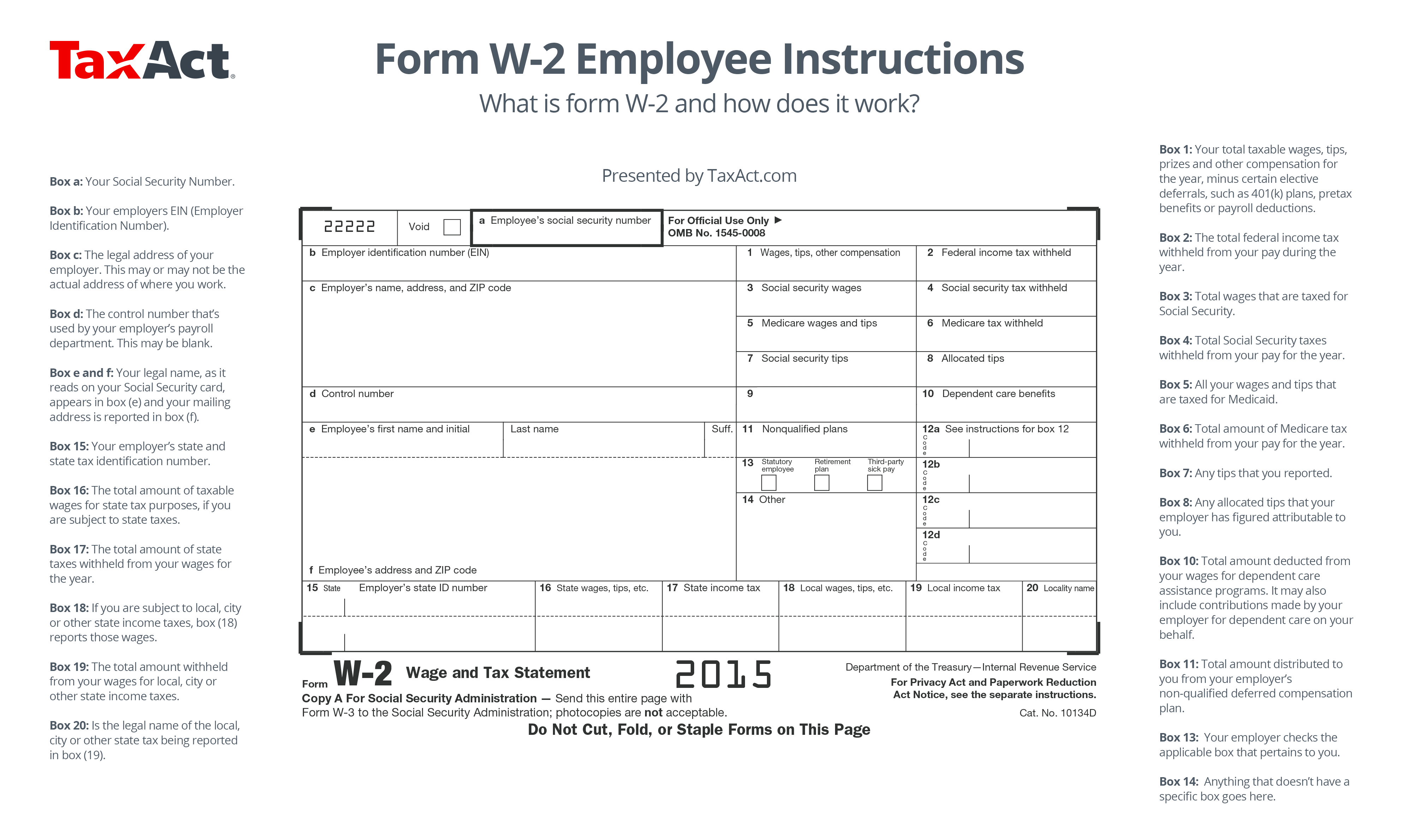

Source: blog.taxact.com

Source: blog.taxact.com

What is included in the w2 dd code total? Most insurance companies require employers to cover at least half of the employee’s premium. The aca states that employer healthcare plans must meet criteria for minimum value and affordability. Or did i get hosed? This amount is reported for informational purposes only and is not taxable.

Source: excelcapmanagement.com

Source: excelcapmanagement.com

This is why you cannot deduct the amount again on your schedule a. Eventually all employers who provide health insurance to their employees will be required to report this information on the employee�s w2. Though there is no single answer to how much do employers pay for health insurance, there are average amounts. A qualified small employer health reimbursement arrangement (qsehra) is a reimbursement option for eligible employers. This is why you cannot deduct the amount again on your schedule a.

Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). Eventually all employers who provide health insurance to their employees will be required to report this information on the employee�s w2. Your health insurance premiums paid will be listed. Her portion of her employer group premiums is $400 per month or $4,800 per year. Note on dependent care fsas:

Source: peoplekeep.com

Source: peoplekeep.com

It is included in box 12 in order to provide comparable consumer information on the. Your health insurance premiums paid will be listed. Eventually all employers who provide health insurance to their employees will be required to report this information on the employee�s w2. B bostonspine full member verified member 5+ year member physician joined feb 22, 2016 messages 105 reaction score Does employer paid health insurance count as income?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employer portion of health insurance on w2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.