Your Employer paid qualified long term care insurance premiums are typically images are available in this site. Employer paid qualified long term care insurance premiums are typically are a topic that is being searched for and liked by netizens today. You can Download the Employer paid qualified long term care insurance premiums are typically files here. Download all free images.

If you’re looking for employer paid qualified long term care insurance premiums are typically pictures information linked to the employer paid qualified long term care insurance premiums are typically keyword, you have come to the ideal site. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Employer Paid Qualified Long Term Care Insurance Premiums Are Typically. North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. The employees pay premiums with aftertax dollars and supplement not pay there tax follow the benefits they receive. Ltc insurance cannot be included in a cafeteria plan.

The Difference Between A Long Term and Short Term Disability From smartmarketerz.com

The Difference Between A Long Term and Short Term Disability From smartmarketerz.com

Ltc insurance cannot be included in a cafeteria plan. For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. Included on the employee�s gross income c. Similar to traditional health insurance premiums. Currently, only a few larger insurers offer true group ltci coverage. North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer.

Employer paid qualified long term care insurance premiums are typically.

Employees paid the remaining 27% or $5,763 a year. This can apply to the owners, their spouses and dependents, and all employees. Ltc insurance cannot be included in a cafeteria plan. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. Employees paid the remaining 27% or $5,763 a year. Included as a dividend to the employee d.

Source: govexec.com

Source: govexec.com

As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. Credit karma mortgage, your financial planners and employer premiums. For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. This can apply to the owners, their spouses and dependents, and all employees. Ltc insurance cannot be included in a cafeteria plan.

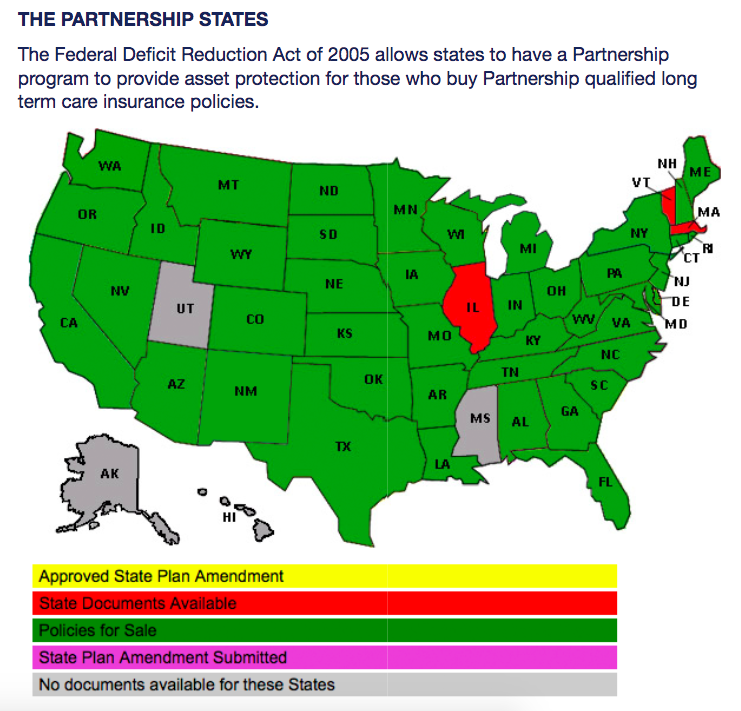

Source: ltcipartners.com

This can apply to the owners, their spouses and dependents, and all employees. The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year. Prudential and genworth are two who make coverage available to new groups. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid.

Source: tpsgroup.com

Source: tpsgroup.com

When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. The yearly maximum deductible amount for each individual depends on the insured�s attained age at the close of the taxable year (see table 1 for current limits). Similar to traditional health insurance premiums. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer.

Source: requestletters.com

Source: requestletters.com

Similar to traditional health insurance premiums. The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year. Currently, only a few larger insurers offer true group ltci coverage. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. Included as a dividend to the employee d.

Source: thehgroup-salem.com

Source: thehgroup-salem.com

Larger employers, generally those with 500 or more employees, typically use traditional true group policies. North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. This can apply to the owners, their spouses and dependents, and all employees. In comparison, the tax year 2020 limit was $10,860.

Source: thedailycpa.com

Source: thedailycpa.com

Larger employers, generally those with 500 or more employees, typically use traditional true group policies. Excluded from the employee�s gross income Premium payments are fully deductible as a reasonable and necessary business expense; This can apply to the owners, their spouses and dependents, and all employees. The employees pay premiums with aftertax dollars and supplement not pay there tax follow the benefits they receive.

Source: imagineprepareenjoy.com

Source: imagineprepareenjoy.com

Deducted from the employee�s net income b. However, some indemnity or cash products that pay a daily or monthly benefit without regard to actual bills are subject to a per diem limitation of $390 a day (down from $400 a day in 2021). Ltc insurance cannot be included in a cafeteria plan. Similar to traditional health insurance premiums. Employer paid qualified long term care insurance premiums are typically.

Source: esimoney.com

Source: esimoney.com

Ltc insurance cannot be included in a cafeteria plan. Prudential and genworth are two who make coverage available to new groups. Premium payments are fully deductible as a reasonable and necessary business expense; Similar to traditional health insurance premiums. North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer.

Source: skloff.com

Source: skloff.com

The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year. Deducted from the employee�s net income b. Included on the employee�s gross income c. This can apply to the owners, their spouses and dependents, and all employees. Larger employers, generally those with 500 or more employees, typically use traditional true group policies.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

Included as a dividend to the employee d. Premium payments are fully deductible as a reasonable and necessary business expense; North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer. Included on the employee�s gross income c. Prudential and genworth are two who make coverage available to new groups.

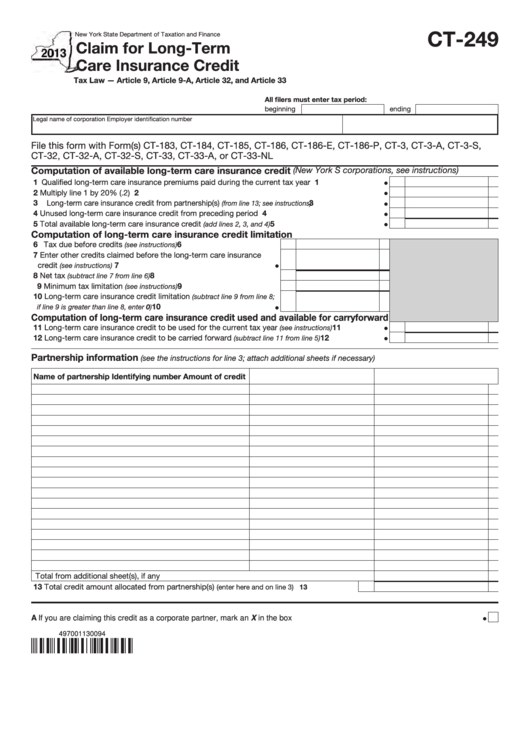

Source: formsbank.com

Source: formsbank.com

North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer. Ltc insurance cannot be included in a cafeteria plan. In comparison, the tax year 2020 limit was $10,860. Included on the employee�s gross income c. Currently, only a few larger insurers offer true group ltci coverage.

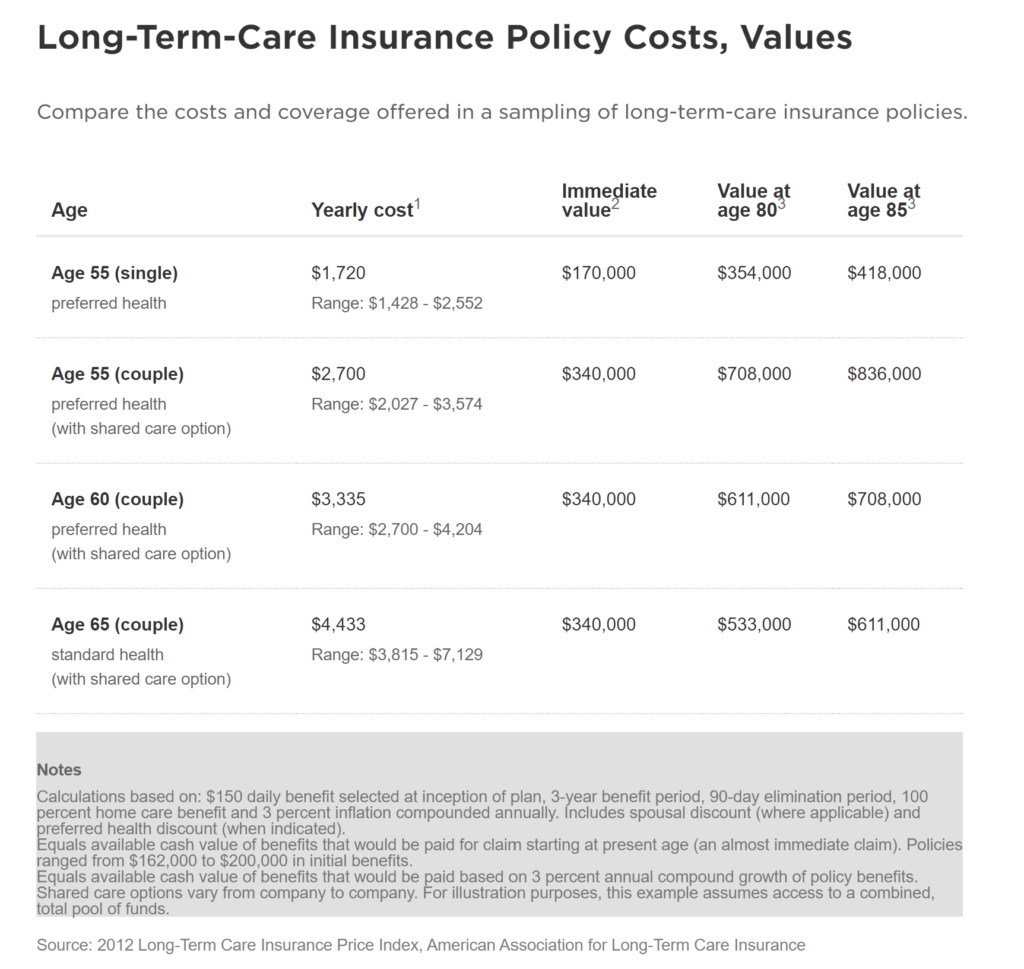

Source: ltcnews.com

Source: ltcnews.com

In comparison, the tax year 2020 limit was $10,860. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. Credit karma mortgage, your financial planners and employer premiums. Ltc insurance cannot be included in a cafeteria plan. Employees paid the remaining 27% or $5,763 a year.

Source: mccannltc.net

Source: mccannltc.net

Included on the employee�s gross income c. Premium payments are fully deductible as a reasonable and necessary business expense; Deducted from the employee�s net income b. The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid.

Source: smartmarketerz.com

Source: smartmarketerz.com

Currently, only a few larger insurers offer true group ltci coverage. Larger employers, generally those with 500 or more employees, typically use traditional true group policies. For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. Similar to traditional health insurance premiums. The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year.

Source: mccannltc.net

Source: mccannltc.net

North dakota’s credit equals the premiums you paid during the year, up to a maximum of $250 per qualified filer. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. Included on the employee�s gross income c.

Source: w7news.com

Source: w7news.com

The employees pay premiums with aftertax dollars and supplement not pay there tax follow the benefits they receive. Credit karma mortgage, your financial planners and employer premiums. Employer paid qualified long term care insurance premiums are typically. For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. Included on the employee�s gross income c.

Source: cpsinsurance.com

Source: cpsinsurance.com

For certain hras, medical expenses include the premiums you pay for insurance that covers the costs of medical care and the amounts paid for transportation to get medical care. Larger employers, generally those with 500 or more employees, typically use traditional true group policies. The 7.5% threshold is scheduled to increase to 10.00% beginning with the 2019 tax year. When a c corporation purchases long term care insurance on behalf of any of its employees, spouses or dependents, the corporation is eligible to take a 100% tax deduction as a business expense on the total of the premiums paid. Ltc insurance cannot be included in a cafeteria plan.

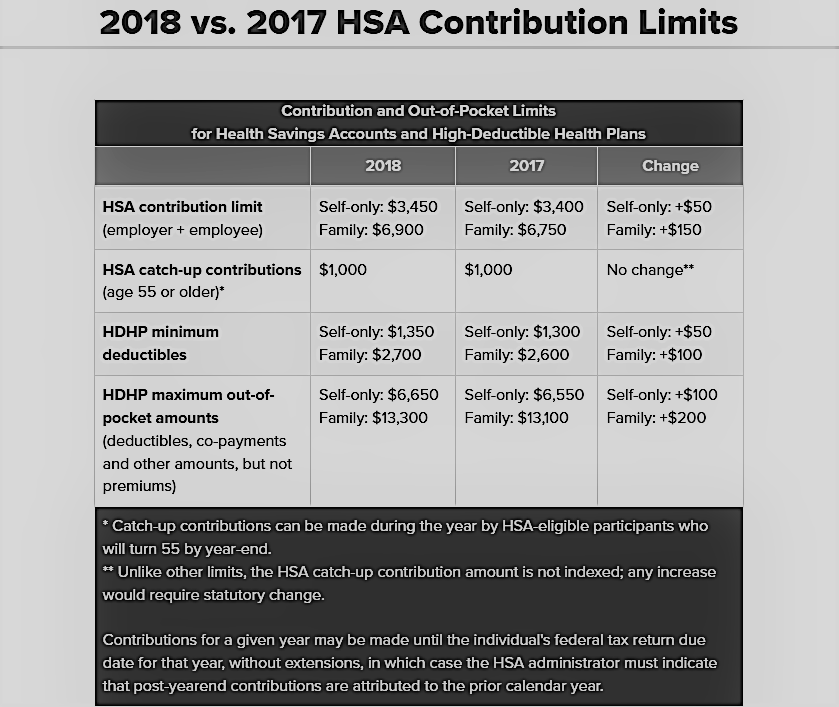

Source: usbank.com

Source: usbank.com

In comparison, the tax year 2020 limit was $10,860. Employees paid the remaining 27% or $5,763 a year. Included on the employee�s gross income c. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. The yearly maximum deductible amount for each individual depends on the insured�s attained age at the close of the taxable year (see table 1 for current limits).

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employer paid qualified long term care insurance premiums are typically by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.