Your Employer paid health insurance on w 2 images are ready. Employer paid health insurance on w 2 are a topic that is being searched for and liked by netizens now. You can Download the Employer paid health insurance on w 2 files here. Find and Download all free images.

If you’re searching for employer paid health insurance on w 2 images information related to the employer paid health insurance on w 2 topic, you have come to the ideal site. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

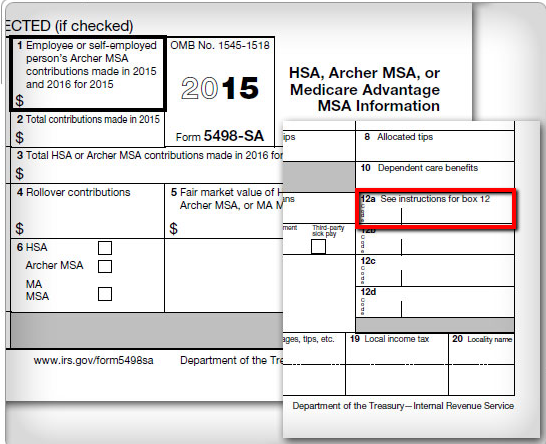

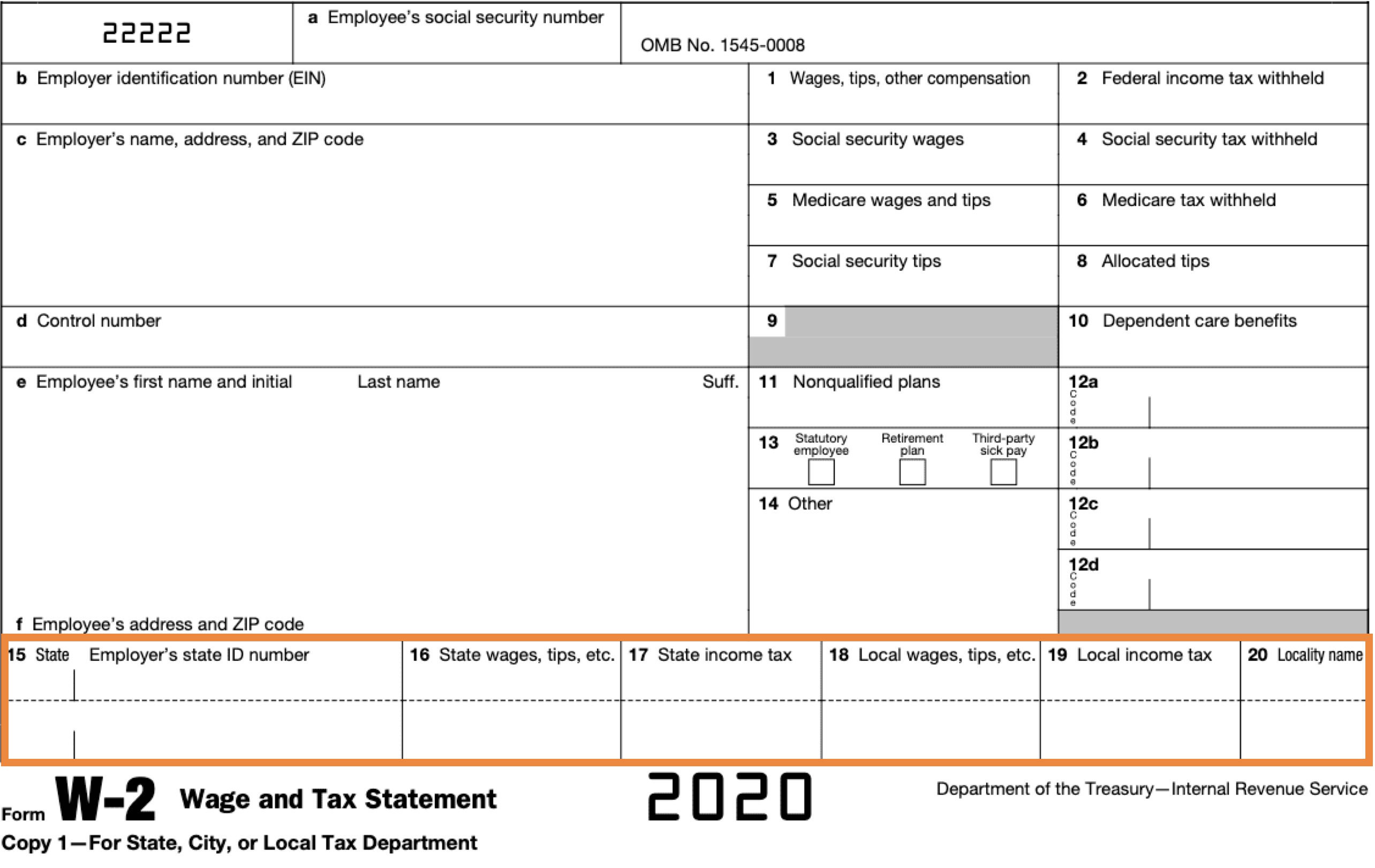

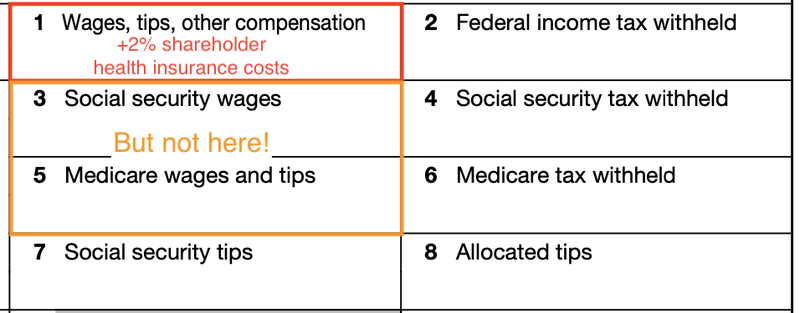

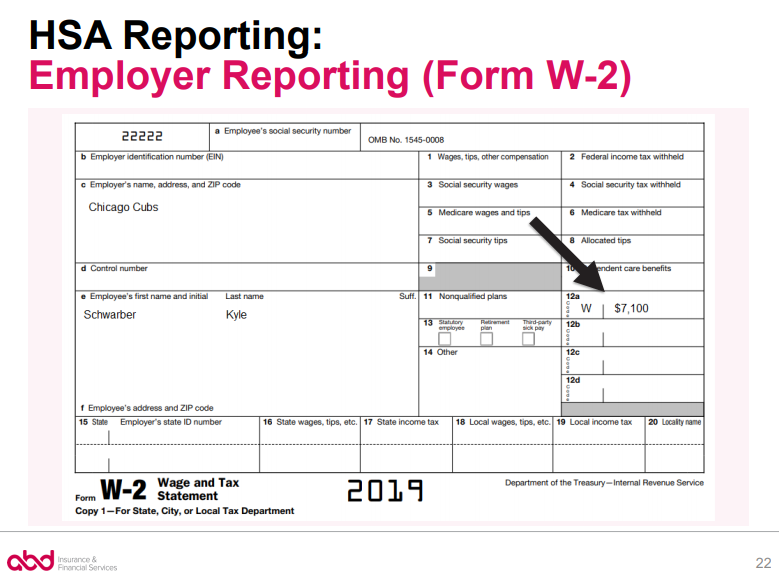

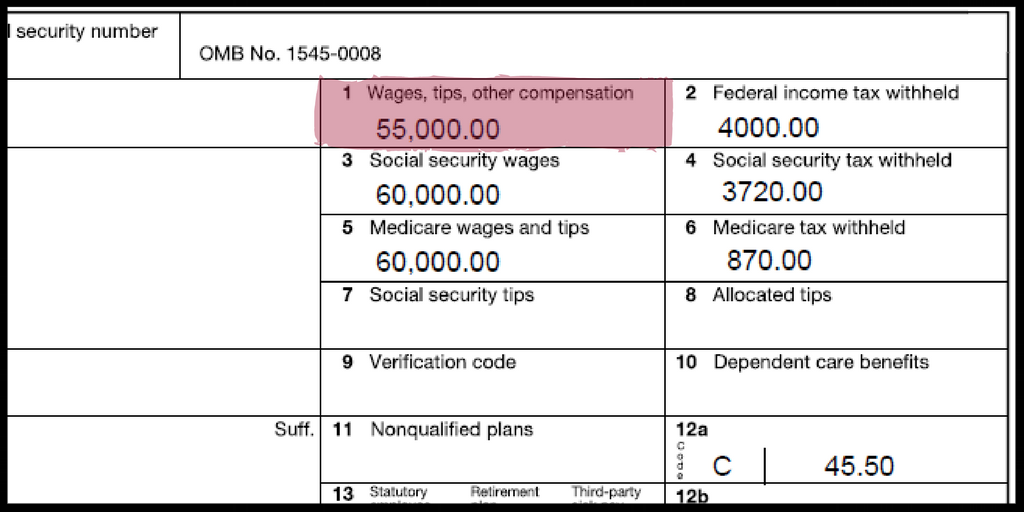

Employer Paid Health Insurance On W 2. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. It is included in box 12 in order to provide comparable consumer information on the. This amount is reported for informational purposes only and is not taxable. What is the 2% shareholder health insurance taxability?

How do Employer Contributions Affect my HSA Limit HSA Edge From hsaedge.com

How do Employer Contributions Affect my HSA Limit HSA Edge From hsaedge.com

The amount reported includes both the portion paid by the employer and the portion paid by the employee. You should record both you and your employees’ contribution to healthcare. You don’t have to report healthcare coverage for retirees or former employees. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect.

This requirement applies to federal, state and local government entities, churches and other religious organizations, and employers that are not subject to cobra continuation requirements.

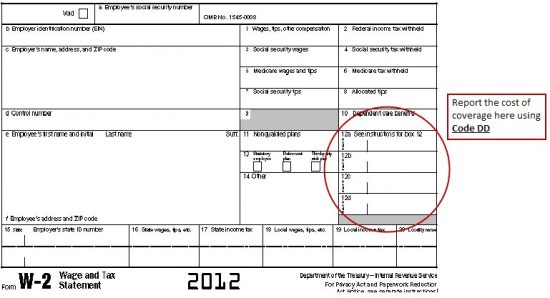

Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. What is included in the w2 dd code total? From the irs publication below: Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. The amount reported includes both the portion paid by the employer and the portion paid by the employee. Where on the w2 do i include the amount an employer pays on behalf of the employee?

Source: redwingsoftware.com

Source: redwingsoftware.com

You don’t have to report healthcare coverage for retirees or former employees. The amount reported includes both the portion paid by the employer and the portion paid by the employee. This amount is reported for informational purposes only and is not taxable. What is the 2% shareholder health insurance taxability? Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan).

Source: help.onpay.com

Source: help.onpay.com

The cadillac tax will be a 40% excise tax imposed on health insurance plans whose annual premium costs exceed $10,200 for an individual or $27,500 for family coverage (these. This amount is reported for informational purposes only and is not taxable. You don’t have to report healthcare coverage for retirees or former employees. This requirement applies to federal, state and local government entities, churches and other religious organizations, and employers that are not subject to cobra continuation requirements. That is about $1426.00 per month for medical, dental and vision for a family of 4.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer. Is it recorded in box 12 as well with the code dd?? 2014 group healthflex annual policy value by tier level single coverage $7,176.00 single + one coverage $15,084.00 family (three or. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. What is the 2% shareholder health insurance taxability?

Source: fool.com

Source: fool.com

What types of coverage must the employer report? What is the 2% shareholder health insurance taxability? Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. This amount is reported for informational purposes only and is not taxable. If you�re using an intuit quickbooks payroll solution, such as basic, standard, enhanced.

Source: taxirin.blogspot.com

Source: taxirin.blogspot.com

You should record both you and your employees’ contribution to healthcare. The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out. You don’t have to report healthcare coverage for retirees or former employees. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. The amount reported includes both the portion paid by the employer and the portion paid by the employee.

Source: cs.thomsonreuters.com

Source: cs.thomsonreuters.com

The amount reported includes both the portion paid by the employer and the portion paid by the employee. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. What is the 2% shareholder health insurance taxability? Which employers must report health insurance on w2? The cadillac tax will be a 40% excise tax imposed on health insurance plans whose annual premium costs exceed $10,200 for an individual or $27,500 for family coverage (these.

Source: doctoredmoney.org

Source: doctoredmoney.org

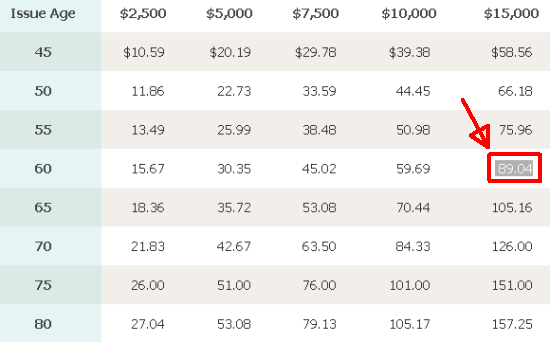

What is the 2% shareholder health insurance taxability? What is included in the w2 dd code total? The amount reported includes both the portion paid by the employer and the portion paid by the employee. 2014 group healthflex annual policy value by tier level single coverage $7,176.00 single + one coverage $15,084.00 family (three or. That is about $1426.00 per month for medical, dental and vision for a family of 4.

![45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX 45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX](https://www.hsaedge.com/wp-content/uploads/2018/04/HSA-employer-contributions-W2-example.png) Source: healthforms-0.blogspot.com

Source: healthforms-0.blogspot.com

The cadillac tax will be a 40% excise tax imposed on health insurance plans whose annual premium costs exceed $10,200 for an individual or $27,500 for family coverage (these. What is the 2% shareholder health insurance taxability? You don’t have to report healthcare coverage for retirees or former employees. The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out. What is included in the w2 dd code total?

Source: mycity4her.com

Source: mycity4her.com

What types of coverage must the employer report? The cadillac tax will be a 40% excise tax imposed on health insurance plans whose annual premium costs exceed $10,200 for an individual or $27,500 for family coverage (these. You don’t have to report healthcare coverage for retirees or former employees. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. 2014 group healthflex annual policy value by tier level single coverage $7,176.00 single + one coverage $15,084.00 family (three or.

Source: nerdwallet.com

Source: nerdwallet.com

This requirement applies to federal, state and local government entities, churches and other religious organizations, and employers that are not subject to cobra continuation requirements. Which employers must report health insurance on w2? Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer. 2014 group healthflex annual policy value by tier level single coverage $7,176.00 single + one coverage $15,084.00 family (three or.

Source: healthpopuli.com

Source: healthpopuli.com

Which employers must report health insurance on w2? It is included in box 12 in order to provide comparable consumer information on the. What is the 2% shareholder health insurance taxability? What is included in the w2 dd code total? This requirement applies to federal, state and local government entities, churches and other religious organizations, and employers that are not subject to cobra continuation requirements.

Source: redwingsoftware.com

Source: redwingsoftware.com

It is included in box 12 in order to provide comparable consumer information on the. Is it recorded in box 12 as well with the code dd?? Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. What is included in the w2 dd code total? That is about $1426.00 per month for medical, dental and vision for a family of 4.

Source: pdffiller.com

Source: pdffiller.com

The amount reported includes both the portion paid by the employer and the portion paid by the employee. You should record both you and your employees’ contribution to healthcare. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. That is about $1426.00 per month for medical, dental and vision for a family of 4.

Source: forbes.com

Source: forbes.com

If you�re using an intuit quickbooks payroll solution, such as basic, standard, enhanced. This amount is reported for informational purposes only and is not taxable. 2014 group healthflex annual policy value by tier level single coverage $7,176.00 single + one coverage $15,084.00 family (three or. What is included in the w2 dd code total? The cadillac tax will be a 40% excise tax imposed on health insurance plans whose annual premium costs exceed $10,200 for an individual or $27,500 for family coverage (these.

Source: cs.thomsonreuters.com

Source: cs.thomsonreuters.com

What is included in the w2 dd code total? Which employers must report health insurance on w2? The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer. Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. Where on the w2 do i include the amount an employer pays on behalf of the employee?

Source: checkmatepayroll.com

Source: checkmatepayroll.com

Where this reporting of employer paid health insurance will become a tax issue will be in 2018 when the cadillac tax portion of the health care law goes into effect. The dd code is not only what your employer payed for your health insurance plan, but it includes your share (your premium payments) as well, as the irs points out. The amount reported includes both the portion paid by the employer and the portion paid by the employee. The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer. Where on the w2 do i include the amount an employer pays on behalf of the employee?

Source: remotefinancialplanner.com

Source: remotefinancialplanner.com

Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). It is included in box 12 in order to provide comparable consumer information on the. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. The amount reported includes both the portion paid by the employer and the portion paid by the employee. What is included in the w2 dd code total?

Source: doctoredmoney.org

Source: doctoredmoney.org

Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. Some employees health insurance premiums are paid in full by the company while others the company pays a portion of there health insurance premiums (group employer sponsored health insurance plan). If you�re using an intuit quickbooks payroll solution, such as basic, standard, enhanced. What is included in the w2 dd code total? That is about $1426.00 per month for medical, dental and vision for a family of 4.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employer paid health insurance on w 2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.