Your Employer life insurance taxable images are available. Employer life insurance taxable are a topic that is being searched for and liked by netizens today. You can Download the Employer life insurance taxable files here. Download all royalty-free photos and vectors.

If you’re searching for employer life insurance taxable images information related to the employer life insurance taxable interest, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

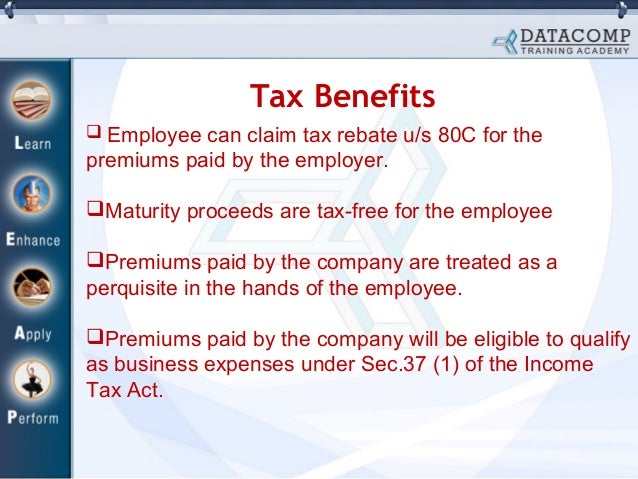

Employer Life Insurance Taxable. On the reverse page, it is considered to be carried by the employer and any group term life insurance coverage provided by the employer in excess of $50,000 must be included in employees’ gross income. If an employer pays life insurance premiums on. Any claim amount will be tax free! As assignment is not done, maturity amount goes to the company.

Is Life Insurance Taxable? What You Need To Know About From paystubs.net

Is Life Insurance Taxable? What You Need To Know About From paystubs.net

As an employer pays these life insurance premiums, the employer may deduct premium payments for up to $50,000 of coverage per employee under the condition that the employer is not the beneficiary. 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l. In other words the person or people who receive the payout do not automatically have to. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. Is employee life insurance taxable? If you are the beneficiary,

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged).

For the first $50,000 of coverage, the irs excludes the group life insurance premiums your employer pays on your behalf. If you are the beneficiary, In order for your life insurance offered by your employer to be taxable as income, certain conditions need to be met. Want to see the chart in action? The entire amount is taxable, not just the amount that exceeds $2,000. Any claim amount will be tax free!

Source: rogerrossmeislcpa.com

Source: rogerrossmeislcpa.com

The entire amount is taxable, not just the amount that exceeds $2,000. If an employer pays life insurance premiums on. On the reverse page, it is considered to be carried by the employer and any group term life insurance coverage provided by the employer in excess of $50,000 must be included in employees’ gross income. The entire amount is taxable, not just the amount that exceeds $2,000. As assignment is not done, maturity amount goes to the company.

Source: slideshare.net

Source: slideshare.net

The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. Remember not to include the first $50,000 in the employee’s taxable income. But premiums your employer pays for any face amount of insurance over $50,000 are treated by the internal revenue service as income paid to you, and you will have to pay income tax on this amount. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. Life insurance proceeds are not taxable with respect to income tax so long as the proceeds are paid out entirely as a lump sum one time payment.

Source: bdhealthinsurance.com

Source: bdhealthinsurance.com

The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. This general rule changed when sec. 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. On the reverse page, it is considered to be carried by the employer and any group term life insurance coverage provided by the employer in excess of $50,000 must be included in employees’ gross income.

Source: paystubs.net

Source: paystubs.net

But premiums your employer pays for any face amount of insurance over $50,000 are treated by the internal revenue service as income paid to you, and you will have to pay income tax on this amount. If the plan doesn’t exceed this $50,000 threshold, regardless of all of the other details, the premiums aren’t taxable. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. But there are times when money from a policy is taxable, especially if you�re accessing cash value in. The entire amount is taxable, not just the amount that exceeds $2,000.

Source: blogpapi.com

Source: blogpapi.com

Want to see the chart in action? On the reverse page, it is considered to be carried by the employer and any group term life insurance coverage provided by the employer in excess of $50,000 must be included in employees’ gross income. Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit. Any claim amount will be tax free! As an employer pays these life insurance premiums, the employer may deduct premium payments for up to $50,000 of coverage per employee under the condition that the employer is not the beneficiary.

Source: blog.bankbazaar.com

Source: blog.bankbazaar.com

But there are times when money from a policy is taxable, especially if you�re accessing cash value in. But premiums your employer pays for any face amount of insurance over $50,000 are treated by the internal revenue service as income paid to you, and you will have to pay income tax on this amount. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. Any claim amount will be tax free! This general rule changed when sec.

Source: hoorayinsurance.co.uk

Source: hoorayinsurance.co.uk

Any claim amount will be tax free! 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l. If you are an employer, it’s best to talk to your tax adviser. Ways to avoid or minimize tax on life insurance For the first $50,000 of coverage, the irs excludes the group life insurance premiums your employer pays on your behalf.

Source: canalhr.com

Source: canalhr.com

If you are an individual paying life insurance premiums on your personal policy, no. As an employer pays these life insurance premiums, the employer may deduct premium payments for up to $50,000 of coverage per employee under the condition that the employer is not the beneficiary. Illustration of calculation of imputed income for voluntary term life insurance coverage plans employer sponsors a group term life insurance plan under. Any claim amount will be tax free! The maturity amount will be considered as business income and the company will have to pay tax on the maturity amount.

Source: thismylife-lovenhate.blogspot.com

Source: thismylife-lovenhate.blogspot.com

If you are the beneficiary, Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. The entire amount is taxable, not just the amount that exceeds $2,000. First, the actual death benefit that the employee receives through the policy must exceed $50,000.

Source: everquote.com

Source: everquote.com

The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. In other words the person or people who receive the payout do not automatically have to. On the reverse page, it is considered to be carried by the employer and any group term life insurance coverage provided by the employer in excess of $50,000 must be included in employees’ gross income. A group term life insurance policy is one for which the only amounts payable by the insurer are policy dividends, experience rating refunds, and amounts payable on the death or disability of an employee, former employee, retired employee,. This interview will help you determine if the life insurance proceeds received are taxable or nontaxable.

Source: universalcpareview.com

Source: universalcpareview.com

Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit. Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged). If you are an employer, it’s best to talk to your tax adviser. As an employer pays these life insurance premiums, the employer may deduct premium payments for up to $50,000 of coverage per employee under the condition that the employer is not the beneficiary. But there are times when money from a policy is taxable, especially if you�re accessing cash value in.

Source: stwserve.com

Source: stwserve.com

On the life of the employee is treated as a perquisite and taxable in the hands of the employee under sec 17 of the income tax act. The first $50,000 of group term life insurance coverage that your employer provides is excluded from. The maturity amount will be considered as business income and the company will have to pay tax on the maturity amount. First, the actual death benefit that the employee receives through the policy must exceed $50,000. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

For the first $50,000 of coverage, the irs excludes the group life insurance premiums your employer pays on your behalf. A group term life insurance policy is one for which the only amounts payable by the insurer are policy dividends, experience rating refunds, and amounts payable on the death or disability of an employee, former employee, retired employee,. The entire amount is taxable, not just the amount that exceeds $2,000. On the life of the employee is treated as a perquisite and taxable in the hands of the employee under sec 17 of the income tax act. In other words the person or people who receive the payout do not automatically have to.

Source: youtube.com

Source: youtube.com

If you are the beneficiary, This interview will help you determine if the life insurance proceeds received are taxable or nontaxable. First, the actual death benefit that the employee receives through the policy must exceed $50,000. On the life of the employee is treated as a perquisite and taxable in the hands of the employee under sec 17 of the income tax act. But premiums your employer pays for any face amount of insurance over $50,000 are treated by the internal revenue service as income paid to you, and you will have to pay income tax on this amount.

Source: planmoneytax.com

Source: planmoneytax.com

Any claim amount will be tax free! The entire amount is taxable, not just the amount that exceeds $2,000. Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. Is employee life insurance taxable?

Source: smartwealthfinancial.ca

Source: smartwealthfinancial.ca

This interview will help you determine if the life insurance proceeds received are taxable or nontaxable. Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit. If the plan doesn’t exceed this $50,000 threshold, regardless of all of the other details, the premiums aren’t taxable. Want to see the chart in action? If an employer pays life insurance premiums on.

Source: visual.ly

Source: visual.ly

In other words the person or people who receive the payout do not automatically have to. Is employee life insurance taxable? If you are an individual paying life insurance premiums on your personal policy, no. 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l. This general rule changed when sec.

Source: myfinancemd.com

Source: myfinancemd.com

This interview will help you determine if the life insurance proceeds received are taxable or nontaxable. First, the actual death benefit that the employee receives through the policy must exceed $50,000. Any claim amount will be tax free! On the life of the employee is treated as a perquisite and taxable in the hands of the employee under sec 17 of the income tax act. Premiums you pay for employees� group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employer life insurance taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.