Your Employer did not pay health insurance premium images are available. Employer did not pay health insurance premium are a topic that is being searched for and liked by netizens now. You can Download the Employer did not pay health insurance premium files here. Find and Download all free vectors.

If you’re looking for employer did not pay health insurance premium images information related to the employer did not pay health insurance premium topic, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Employer Did Not Pay Health Insurance Premium. If you pay some of your own premiums, and most people do, you may be able to deduct them if you have enough other expenses. Within a span of a few days i received the below two emails requesting advice on what to do about an employer who deducts health and dental insurance premiums from employees’ paychecks but doesn. It’s not typical, but there could be benefits down the road from having a higher reported income despite the additional taxes. My employer didn�t pay our health insurance premium for two months.

7 Million Americans Will Pay a Tax Penalty For Not From blog.affordablehealthinsurance.org

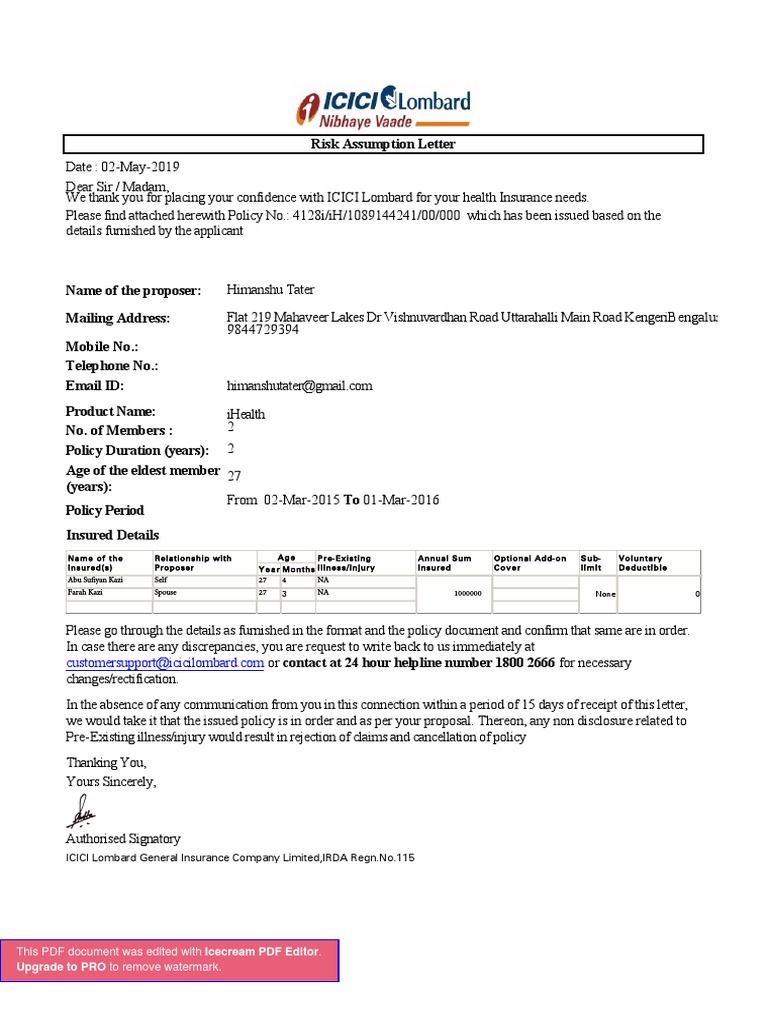

Coverage under an employee benefit plan funded by a voluntary employees’ beneficiary association (veba) that was established through the bankruptcy of your former employer; More to the point, health insurance carriers get tired really quick of people not paying their bills and then having to reinstate them. Coverage under a group health plan available through the employment of your spouse, if the employer did not pay 50% or more of the cost of coverage; Employees might need to sign waive coverage forms annually if they do not want insurance. If in doubt, contact the exchange and/or your tax advisor. Preferably one experienced in the nuances of employee benefits and cobra.

Employer deducting health care premiums from my checks but not paying insurance company.

I am getting bills from doctors office, lab work companies stating my health coverage has been terminated due to nonpayment. Always check with your cpa!) The aca states that employer healthcare plans must meet criteria for minimum value and affordability. Preferably one experienced in the nuances of employee benefits and cobra. (this is the 2nd time my company has done. § 825.212 employee failure to pay health plan premium payments.

Source: thebalancecareers.com

Source: thebalancecareers.com

Additionally, the portion of premiums employees pay is typically excluded from taxable income. Asked in cedar falls, ia | feb 7, 2015. “if the employer is making a deduction from wages for health insurance and not sending it to the insurance company, the employee can file a wage claim with wage and hour at michigan.gov/wageclaim. Additionally, the portion of premiums employees pay is typically excluded from taxable income. Employer deducting health care premiums from my checks but not paying insurance company.

Source: myfederalretirement.com

Source: myfederalretirement.com

Coverage under an employee benefit plan funded by a voluntary employees’ beneficiary association (veba) that was established through the bankruptcy of your former employer; The aca states that employer healthcare plans must meet criteria for minimum value and affordability. If you pay some of your own premiums, and most people do, you may be able to deduct them if you have enough other expenses. Keep a copy of their health insurance waiver form in your payroll records for at least three years. Preferably one experienced in the nuances of employee benefits and cobra.

Source: ennajapan.blogspot.com

Source: ennajapan.blogspot.com

Employer deducting health care premiums from my checks but not paying insurance company. It’s not typical, but there could be benefits down the road from having a higher reported income despite the additional taxes. (this is the 2nd time my company has done. Money that an employer spends on their employees’ health insurance premiums is not considered wages and is exempt from federal income tax and payroll taxes. Coverage under a group health plan available through the employment of your spouse, if the employer did not pay 50% or more of the cost of coverage;

Source: blog.affordablehealthinsurance.org

If in doubt, contact the exchange and/or your tax advisor. The lawsuit was brought by the u.s. § 825.212 employee failure to pay health plan premium payments. They are deducting money from the employees pay, but. I am getting bills from doctors office, lab work companies stating my health coverage has been terminated due to nonpayment.

Source: template.net

Source: template.net

(this is the 2nd time my company has done. There is only so many times they will be able to pull this crap before the carrier tells them too bad. More to the point, health insurance carriers get tired really quick of people not paying their bills and then having to reinstate them. The aca states that employer healthcare plans must meet criteria for minimum value and affordability. Employer deducting health care premiums from my checks but not paying insurance company.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The lawsuit was brought by the u.s. The exclusion of premiums lowers most workers’ tax. Asked in cedar falls, ia | feb 7, 2015. A forbes mag article found that for every dollar your employer pays in health ins premium, that one less dollar in take home pay. On november 9, 2015, minnesota federal district judge susan richard nelson ruled that the president and ceo of faribault woolen mills company breached his fiduciary duties under erisa by diverting employee health insurance premiums toward corporate and personal use.

Source: thestreet.com

Source: thestreet.com

Within a span of a few days i received the below two emails requesting advice on what to do about an employer who deducts health and dental insurance premiums from employees’ paychecks but doesn. Coverage under an employee benefit plan funded by a voluntary employees’ beneficiary association (veba) that was established through the bankruptcy of your former employer; Additionally, the portion of premiums employees pay is typically excluded from taxable income. A forbes mag article found that for every dollar your employer pays in health ins premium, that one less dollar in take home pay. Pretax income isn’t the only way employees pay for medical insurance.

Asked in cedar falls, ia | feb 7, 2015. The bottom line is that any insurance premiums paid by your employer can never be considered taxable income or deducted in any way. Employees might need to sign waive coverage forms annually if they do not want insurance. A forbes mag article found that for every dollar your employer pays in health ins premium, that one less dollar in take home pay. (this is the 2nd time my company has done.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The lawsuit was brought by the u.s. It’s not typical, but there could be benefits down the road from having a higher reported income despite the additional taxes. I am getting bills from doctors office, lab work companies stating my health coverage has been terminated due to nonpayment. (this is the 2nd time my company has done. Now have no health insurance.

Source: ednaalves14.blogspot.com

Source: ednaalves14.blogspot.com

(this is the 2nd time my company has done. It’s not typical, but there could be benefits down the road from having a higher reported income despite the additional taxes. S corp employees who own more than 2% of the company will have health insurance benefits included in their federal wage calculations. On november 9, 2015, minnesota federal district judge susan richard nelson ruled that the president and ceo of faribault woolen mills company breached his fiduciary duties under erisa by diverting employee health insurance premiums toward corporate and personal use. Additionally, the portion of premiums employees pay is typically excluded from taxable income.

Source: quora.com

If you pay some of your own premiums, and most people do, you may be able to deduct them if you have enough other expenses. The aca states that employer healthcare plans must meet criteria for minimum value and affordability. There is only so many times they will be able to pull this crap before the carrier tells them too bad. (this is the 2nd time my company has done. I am getting bills from doctors office, lab work companies stating my health coverage has been terminated due to nonpayment.

Source: news.stanford.edu

Source: news.stanford.edu

Coverage under a group health plan available through the employment of your spouse, if the employer did not pay 50% or more of the cost of coverage; The lawsuit was brought by the u.s. Pretax income isn’t the only way employees pay for medical insurance. They are deducting money from the employees pay, but. A forbes mag article found that for every dollar your employer pays in health ins premium, that one less dollar in take home pay.

Source: peoplekeep.com

Source: peoplekeep.com

They are deducting money from the employees pay, but. The bottom line is that any insurance premiums paid by your employer can never be considered taxable income or deducted in any way. Pretax income isn’t the only way employees pay for medical insurance. Always check with your cpa!) (this is the 2nd time my company has done.

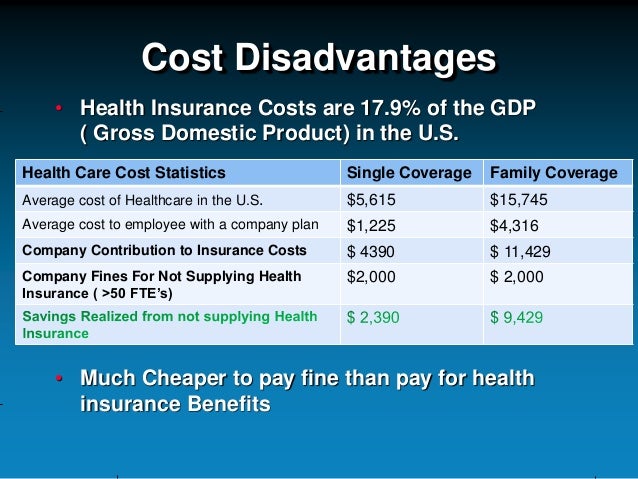

Source: slideshare.net

Source: slideshare.net

Employer deducting health care premiums from my checks but not paying insurance company. They are deducting money from the employees pay, but. Within a span of a few days i received the below two emails requesting advice on what to do about an employer who deducts health and dental insurance premiums from employees’ paychecks but doesn. Coverage under an employee benefit plan funded by a voluntary employees’ beneficiary association (veba) that was established through the bankruptcy of your former employer; On november 9, 2015, minnesota federal district judge susan richard nelson ruled that the president and ceo of faribault woolen mills company breached his fiduciary duties under erisa by diverting employee health insurance premiums toward corporate and personal use.

Source: medindia.net

Source: medindia.net

After the employee fills out the waiver form, do not withhold insurance premiums from their paychecks. It’s not typical, but there could be benefits down the road from having a higher reported income despite the additional taxes. A forbes mag article found that for every dollar your employer pays in health ins premium, that one less dollar in take home pay. If in doubt, contact the exchange and/or your tax advisor. The exclusion of premiums lowers most workers’ tax.

Source: tradingeconomics.com

Source: tradingeconomics.com

Employees might need to sign waive coverage forms annually if they do not want insurance. If you pay some of your own premiums, and most people do, you may be able to deduct them if you have enough other expenses. (this is the 2nd time my company has done. Asked in cedar falls, ia | feb 7, 2015. “if the employer is making a deduction from wages for health insurance and not sending it to the insurance company, the employee can file a wage claim with wage and hour at michigan.gov/wageclaim.

Source: jamanetwork.com

Source: jamanetwork.com

Keep a copy of their health insurance waiver form in your payroll records for at least three years. More to the point, health insurance carriers get tired really quick of people not paying their bills and then having to reinstate them. Preferably one experienced in the nuances of employee benefits and cobra. § 825.212 employee failure to pay health plan premium payments. This will depend on your carrier.

Source: pressherald.com

Source: pressherald.com

The bottom line is that any insurance premiums paid by your employer can never be considered taxable income or deducted in any way. In the 2007 healthy americans act, a bipartisan group of senators proposed requiring employers to give employees pay raises equal to 12dd within two years and allow employees to negotiate their own coverage. The aca states that employer healthcare plans must meet criteria for minimum value and affordability. Now have no health insurance. (1) in the absence of an established employer policy providing a longer grace period, an employer �s obligations to maintain health insurance coverage cease under fmla if an employee �s premium payment is more.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employer did not pay health insurance premium by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.