Your Employee supplemental life and ad d insurance images are available in this site. Employee supplemental life and ad d insurance are a topic that is being searched for and liked by netizens today. You can Get the Employee supplemental life and ad d insurance files here. Get all royalty-free photos.

If you’re searching for employee supplemental life and ad d insurance images information linked to the employee supplemental life and ad d insurance interest, you have pay a visit to the right site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

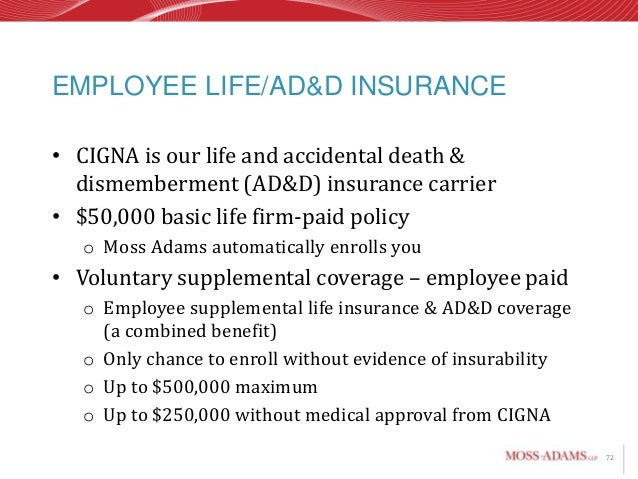

Employee Supplemental Life And Ad D Insurance. This is an employee paid benefit. Supplemental accidental death and dismemberment insurance covers you in addition to your basic policy. Supplemental employee life — $10,000 to $500,000, in increments of $10,000 supplemental employee ad&d — $10,000 to $600,000, in increments of $10,000 If you elect an amount that exceeds the guaranteed issue amount of $80,000 , you will need to

Supplemental Ad&D Insurance / What Is AD&D Insurance From imprecisaoemelodia.blogspot.com

Supplemental Ad&D Insurance / What Is AD&D Insurance From imprecisaoemelodia.blogspot.com

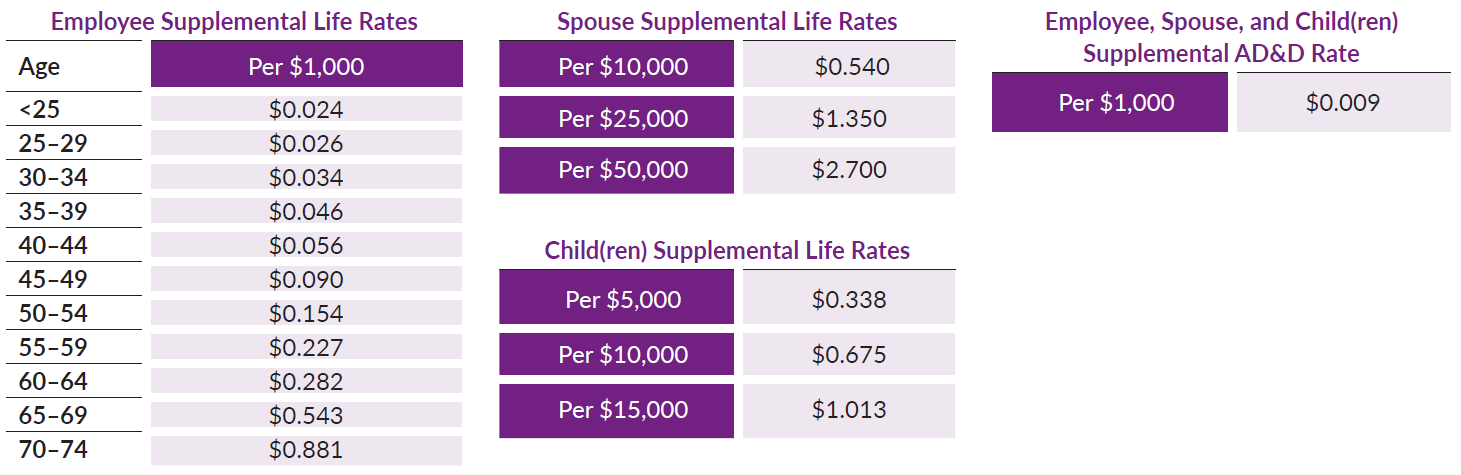

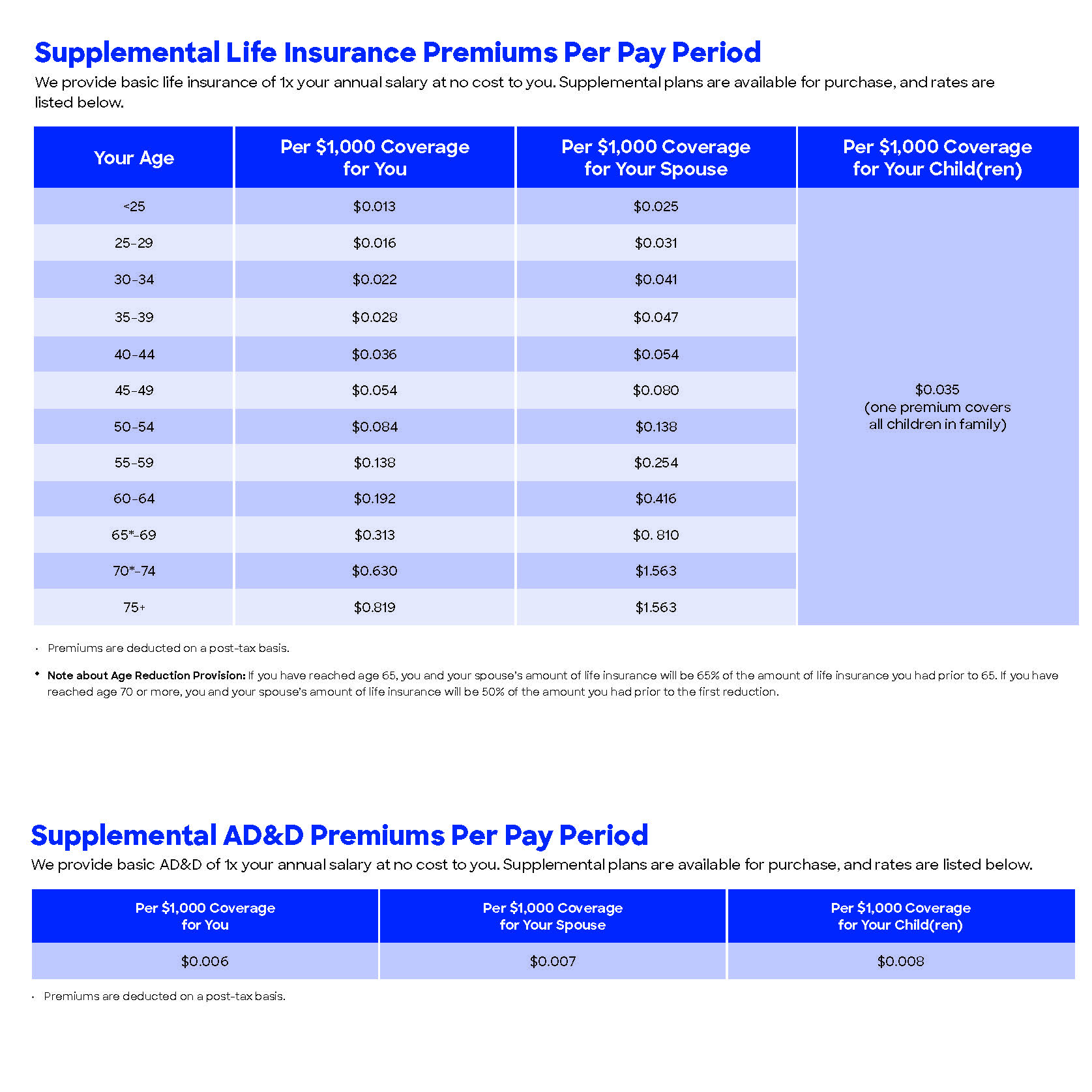

You may elect different amounts for life and ad&d. Supplemental life insurance may be purchased through payroll deductions for the employee and his/her spouse up to $500,000 each or five (5) times the employee’s annual salary, whichever is less. To 50% of the original amount at age 70; Maximum $500,000) there�s no medical underwriting and coverage begins on your first day of employment. The rate for ad&d is $0.25 (25 cents) and the employee supplemental is $0.44 annually for every $1,000 of coverage. We provide basic life insurance, plus the opportunity to purchase supplemental life insurance.

If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance.

If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance. Voluntary supplemental life and ad d insurance voluntary supplemental life insurance allows you to purchase additional life insurance to protect your family’s financial security. In many instances, the supplemental life insurance that your employer offers you is in reality an ad&d insurance policy, and shouldn�t be confused with a standard life insurance policy. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000. Supplemental employee life and ad&d. As a stanford employee, you are automatically enrolled in our basic life insurance program.

Source: mts.mybenefitsapp.com

Source: mts.mybenefitsapp.com

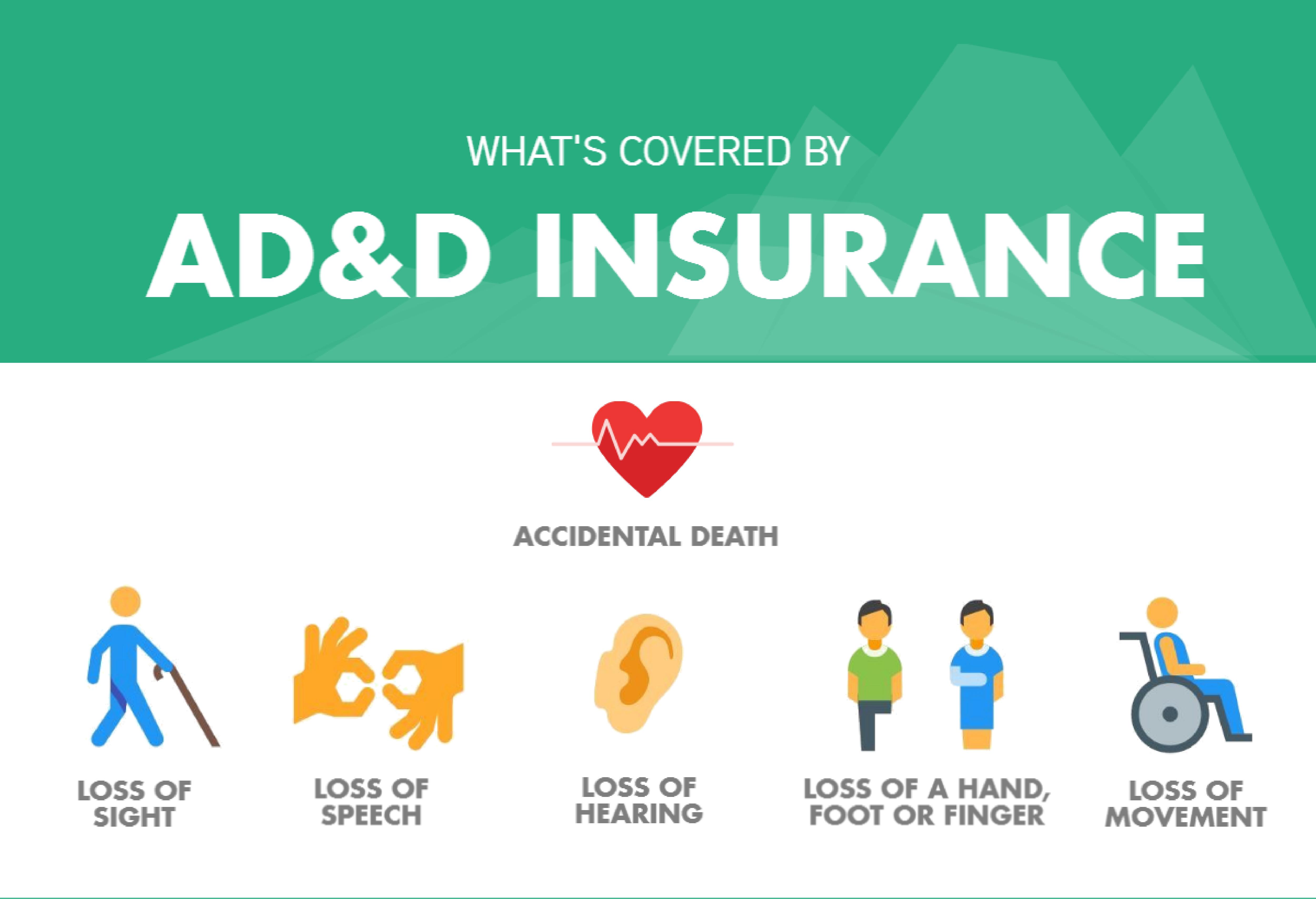

Voluntary supplemental life and ad d insurance voluntary supplemental life insurance allows you to purchase additional life insurance to protect your family’s financial security. Ad&d coverage also provides benefits if you survive an accidental injury but lose the use of a body part (such as the loss of an eye or limb). This means they will only cover you if your death is caused by an. All coverage terminates upon employee’s retirement. If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance.

Source: magazine.pearsonbenefitsus.com

Source: magazine.pearsonbenefitsus.com

Dependent life insurance—this plan allows you to purchase life insurance for your spouse/domestic partner and children; The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance. We provide basic life insurance, plus the opportunity to purchase supplemental life insurance. Ad&d coverage also provides benefits if you survive an accidental injury but lose the use of a body part (such as the loss of an eye or limb).

Source: enmimundoviolettasiempre.blogspot.com

Source: enmimundoviolettasiempre.blogspot.com

You may elect different amounts for life and ad&d. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; Some supplemental policies are specifically for accidental death and dismemberment (ad&d). All coverage terminates upon employee’s retirement.

Source: employeeconnects.com

Source: employeeconnects.com

In many instances, the supplemental life insurance that your employer offers you is in reality an ad&d insurance policy, and shouldn�t be confused with a standard life insurance policy. To 25% of the original amount at age 75. To 50% of the original amount at age 70; As they work through their options and financial needs with our delivering the promise services. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or burial insurance.

Source: telhio.org

Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000. Supplemental employee life rates vary by the specific type of insurance coverage offered (e.g., term, permanent, or ad&d), your age, where you live, the size of the group, and your benefit amount. There is no cost to employees for basic life and coverage is 1x salary up to a max of $50,000. While an ad&d policy provides benefits to your beneficiaries when you die, the caveat is that your death must be caused by an accident. This additional benefit doubles the value of your life insurance coverage if you die in an accident.

Source: hub.jhu.edu

Source: hub.jhu.edu

Who should be beneficiary on accidental death and dismemberment? While an ad&d policy provides benefits to your beneficiaries when you die, the caveat is that your death must be caused by an accident. Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy. Supplemental employee life rates vary by the specific type of insurance coverage offered (e.g., term, permanent, or ad&d), your age, where you live, the size of the group, and your benefit amount. However, coverage cannot exceed 100% of.

Source: bswhealth.com

Source: bswhealth.com

All coverage terminates upon employee’s retirement. Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy. Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; Pros and cons of accidental death and dismemberment insurance Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

To 25% of the original amount at age 75. My employer offers this 2 types of insurance but i don’t know if i need both. We provide basic life insurance, plus the opportunity to purchase supplemental life insurance. You may elect different amounts for life and ad&d. The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Pays a benefit of 1x your annual salary (minimum $20,000; Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000. Supplemental child life insurance that covers eligible dependents. However, these policies often have some exclusions.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

My employer offers this 2 types of insurance but i don’t know if i need both. If you elect employee supplemental life and ad&d insurance, you may purchase spouse supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. The rate for ad&d is $0.25 (25 cents) and the employee supplemental is $0.44 annually for every $1,000 of coverage. Evidence of insurability (eoi) eoi, sometimes called proof of good health, is required in certain circumstances. If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance.

Source: truecoverage.com

Source: truecoverage.com

This means they will only cover you if your death is caused by an. Supplemental employee life rates vary by the specific type of insurance coverage offered (e.g., term, permanent, or ad&d), your age, where you live, the size of the group, and your benefit amount. Supplemental spouse life insurance that covers the life of your spouse or domestic partner. My employer offers this 2 types of insurance but i don’t know if i need both. Coverage is available for your spouse and/or child (ren) if you purchase coverage for yourself.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Apply for supplemental life insurance or apply to increase your current level of coverage by answering six health questions. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Apply for supplemental life insurance or apply to increase your current level of coverage by answering six health questions. If you elect employee supplemental life and ad&d insurance, you may purchase spouse supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. We provide basic life insurance, plus the opportunity to purchase supplemental life insurance.

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. However, coverage cannot exceed 100% of. All coverage terminates upon employee’s retirement. You may elect different amounts for life and ad&d. In many instances, the supplemental life insurance that your employer offers you is in reality an ad&d insurance policy, and shouldn�t be confused with a standard life insurance policy.

Source: namic.org

Source: namic.org

To 25% of the original amount at age 75. My employer offers this 2 types of insurance but i don’t know if i need both. Supplemental accidental death and dismemberment insurance covers you in addition to your basic policy. Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. This means they will only cover you if your death is caused by an.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

Supplemental accidental death and dismemberment insurance (ad&d) that covers you in addition to your basic policy. Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; While an ad&d policy provides benefits to your beneficiaries when you die, the caveat is that your death must be caused by an accident. If you elect an amount that exceeds the guaranteed issue amount of $80,000 , you will need to The basic employee life and supplemental employee life policies have an ad&d (accidental death & dismemberment) rider.

Source: slideshare.net

Source: slideshare.net

Who should be beneficiary on accidental death and dismemberment? The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. This means they will only cover you if your death is caused by an. Supplemental spouse life insurance that covers the life of your spouse or domestic partner. To 25% of the original amount at age 75.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. As a stanford employee, you are automatically enrolled in our basic life insurance program. All coverage terminates upon employee’s retirement. Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy.

Source: michigan.gov

Source: michigan.gov

In many instances, the supplemental life insurance that your employer offers you is in reality an ad&d insurance policy, and shouldn�t be confused with a standard life insurance policy. Voluntary supplemental life and ad d insurance voluntary supplemental life insurance allows you to purchase additional life insurance to protect your family’s financial security. Evidence of insurability (eoi) eoi, sometimes called proof of good health, is required in certain circumstances. As they work through their options and financial needs with our delivering the promise services. Supplemental child life insurance that covers eligible dependents.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title employee supplemental life and ad d insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.