Your Employee national insurance rates 2019 20 images are available in this site. Employee national insurance rates 2019 20 are a topic that is being searched for and liked by netizens today. You can Download the Employee national insurance rates 2019 20 files here. Find and Download all royalty-free vectors.

If you’re searching for employee national insurance rates 2019 20 images information linked to the employee national insurance rates 2019 20 interest, you have pay a visit to the ideal blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

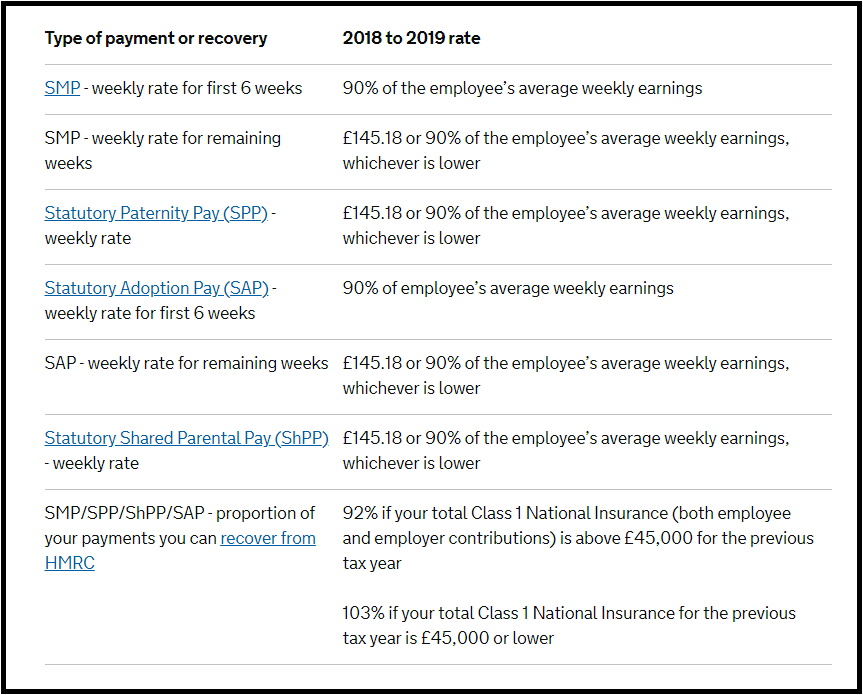

Employee National Insurance Rates 2019 20. This table shows how much employers deduct from employees’ pay for the 2021 to 2022 tax year. As a result, this shift will bring about an increase in contributions payable by government permanent and temporary employees. £166 per week £719 per month £8,632 per year. The secondary threshold is £732/month.

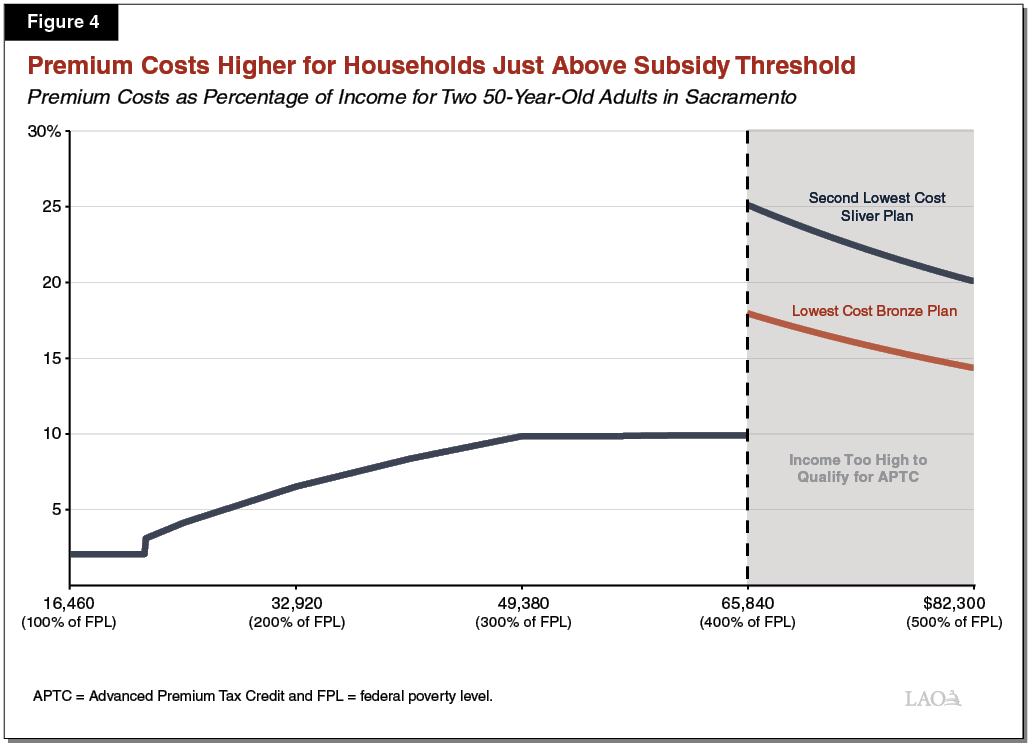

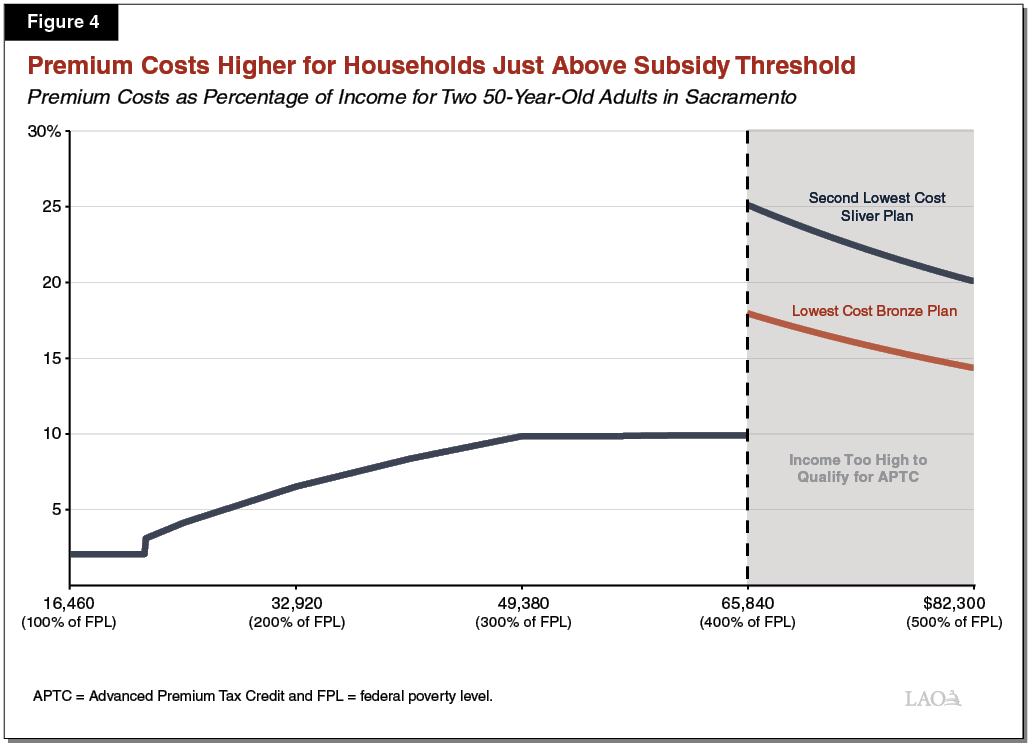

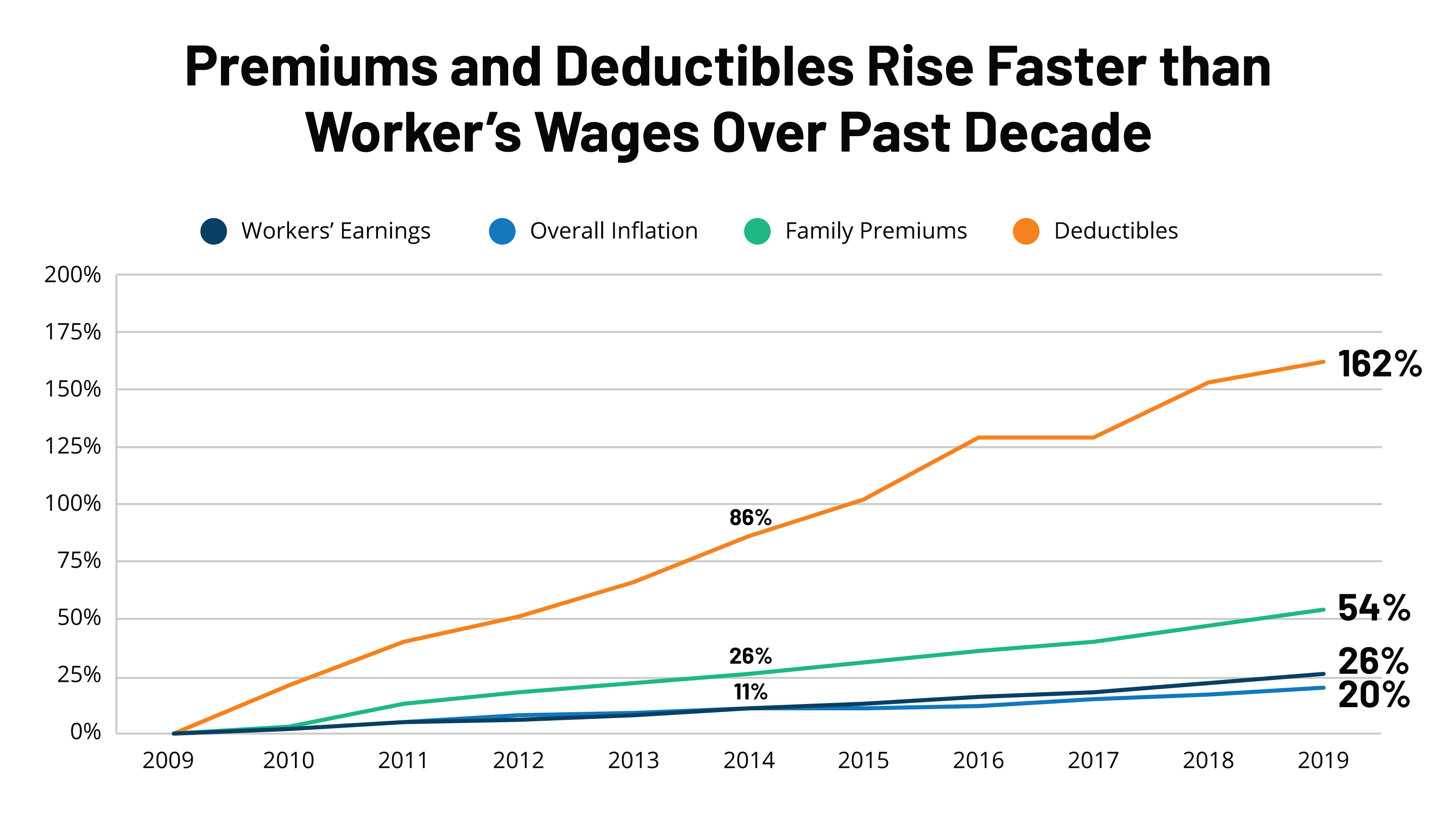

The 201920 Budget The Governor�s Individual Health From lao.ca.gov

The 201920 Budget The Governor�s Individual Health From lao.ca.gov

This rate will be shared equally between the employer and the employee. 7 national insurance contributions (nics) class 1 nics: 45 pence for all business miles: 45 pence for all business miles: If you earned more, you paid 12% of your earnings between £9,500 and £50,00. National insurance and employers national insurance contributions also remain unchanged, you can see the 2020 budget income tax rates here.

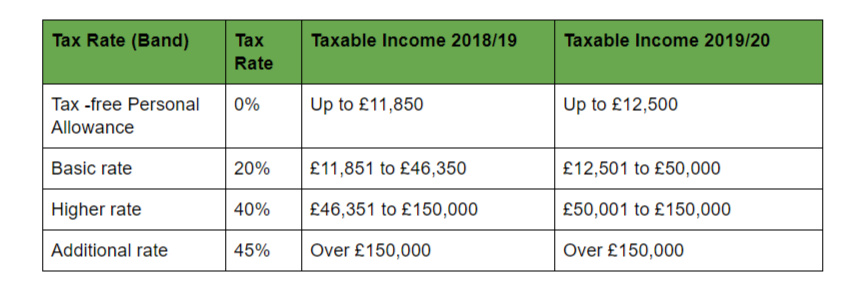

Chancellor rishi sunak announced no changes to the personal allowance, income tax rates and thresholds announced in autumn 2019.

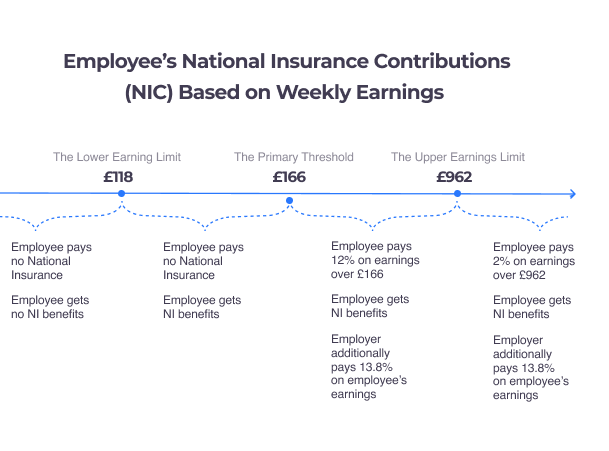

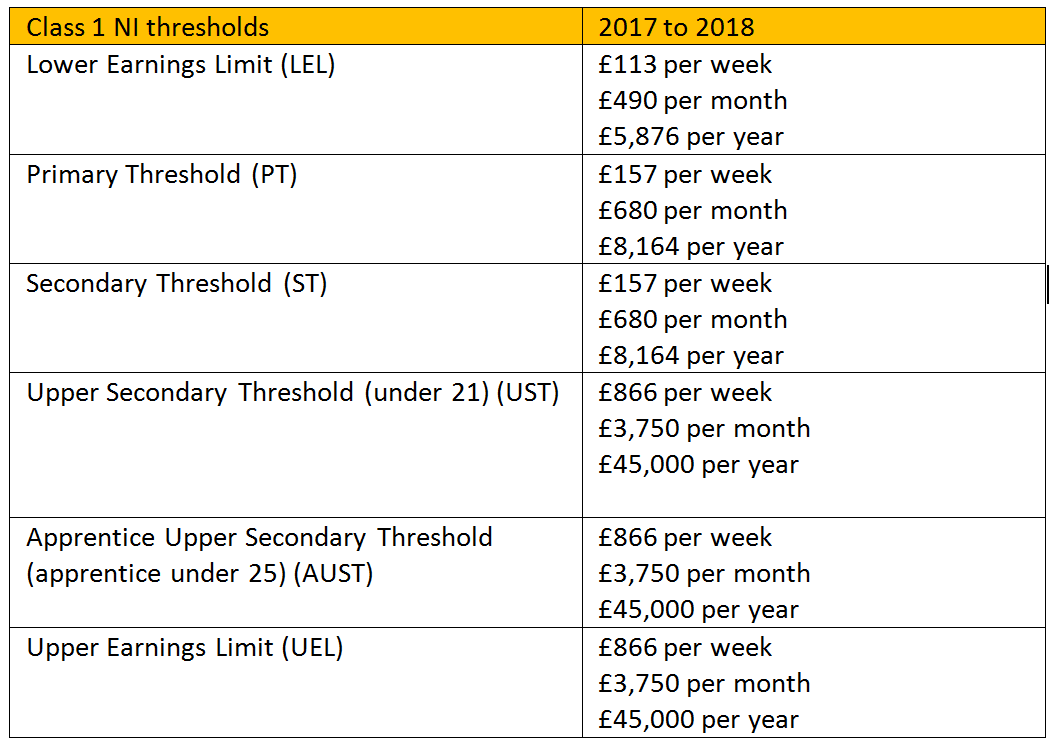

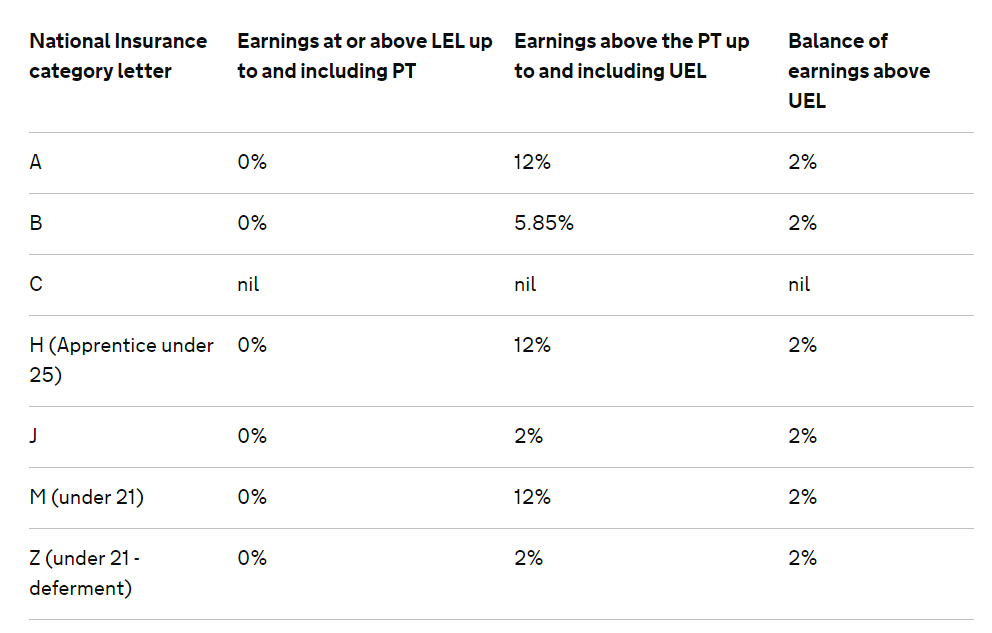

Class 1 contributions are paid at the rate of 12% of weekly earnings for employees earning between £153 and £805. £170 per week, £737 per month or £8,840 per year; National insurance contributions tables a, h, j, m and z these tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. What is the current rate of employers ni? Employees do not pay national insurance but get the benefits of paying: Chancellor rishi sunak announced no changes to the personal allowance, income tax rates and thresholds announced in autumn 2019.

Source: insurancebae.blogspot.com

Source: insurancebae.blogspot.com

The current rate of employer national insurance is 13.8%, this is valid for the 2022 tax year which runs from the 1st april 2022 to 31 march 2023. £169 per week £732 per month £8,788 per year. A percentage breakdown of the contributory benefit payments paid from this total is shown above. If you earned more, you paid 12% of your earnings between £9,500 and £50,00. Each national insurance contributions calculation provides a full breakdown of employee and employer nic�s, so that you have a full picture of exactly what your employee cost.

Source: suryaandco.co.uk

Source: suryaandco.co.uk

Since 1st january 2003, the national insurance contribution rate was increased by 1% per year for four years. Employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees. £6,365 + £3.00 per week. Employees do not pay national insurance but get the benefits of paying: £183 per week £792 per month £9,500 per year.

Source: specialforu2.blogspot.com

Source: specialforu2.blogspot.com

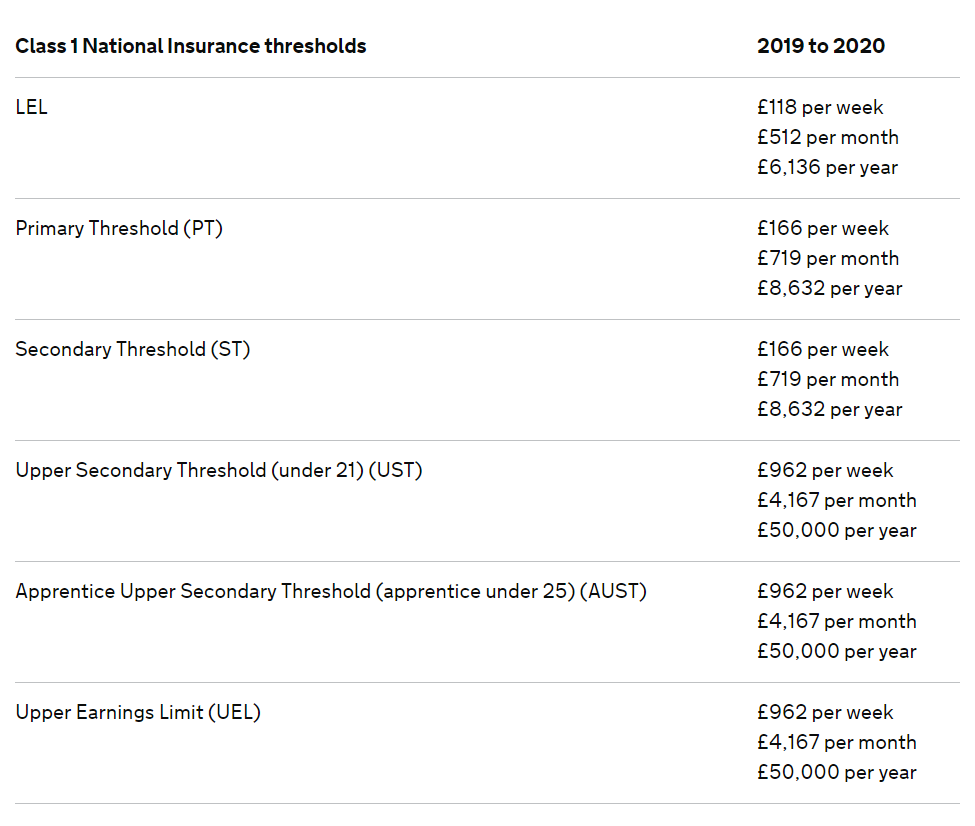

National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits. The current rates employers pay towards most employees� national insurance are 13.8% above the secondary threshold. A percentage breakdown of the contributory benefit payments paid from this total is shown above. £118 per week £512 per month £6,136 per year. £120 per week £520 per month £6,240 per year.

Source: brightpay.co.uk

Source: brightpay.co.uk

£6,365 + £3.00 per week. The secondary threshold is £732/month. National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits. 24 pence for both tax and national insurance purposes and for all business miles: During 2019/20 national insurance contributions totalled £221,554,000.

Employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees. The current rates employers pay towards most employees� national insurance are 13.8% above the secondary threshold. This table shows how much employers deduct from employees’ pay for the 2021 to 2022 tax year. 45 pence for all business miles: The secondary threshold is £732/month.

Source: blog.pricespin.net

Source: blog.pricespin.net

[3] the benefit component includes several contributory benefits, availability and amount of which is determined by the claimant�s contribution record and circumstances. [3] the benefit component includes several contributory benefits, availability and amount of which is determined by the claimant�s contribution record and circumstances. As a result, this shift will bring about an increase in contributions payable by government permanent and temporary employees. If you earned more, you paid 12% of your earnings between £9,500 and £50,00. Employer class 1 national insurance rates.

Source: specialforu2.blogspot.com

Source: specialforu2.blogspot.com

This rate will be shared equally between the employer and the employee. National insurance contributions tables a, h, j, m and z these tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Yes, the employers ni rate is subject to change and is reviewed annually by the scottish sitting government but it changes infrequently. Chancellor rishi sunak announced no changes to the personal allowance, income tax rates and thresholds announced in autumn 2019. Employer class 1 national insurance rates.

Source: parasolgroup.co.uk

Source: parasolgroup.co.uk

The current rate of employer national insurance is 13.8%, this is valid for the 2022 tax year which runs from the 1st april 2022 to 31 march 2023. What is the current rate of employers ni? 2% is the rate paid for any earnings over £805. Employers must pay this contribution themselves, for their employees. £120 to £184 (£520 to £797 a.

Source: lao.ca.gov

Source: lao.ca.gov

Since 1st january 2003, the national insurance contribution rate was increased by 1% per year for four years. National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits. National insurance and employers national insurance contributions also remain unchanged, you can see the 2020 budget income tax rates here. £6,365 + £3.00 per week. 2% is the rate paid for any earnings over £805.

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

Class 1 contributions are paid at the rate of 12% of weekly earnings for employees earning between £153 and £805. 45 pence for all business miles: 7 national insurance contributions (nics) class 1 nics: This rate will be shared equally between the employer and the employee. National insurance and employers national insurance contributions also remain unchanged, you can see the 2020 budget income tax rates here.

Source: itscrazyright.com

Source: itscrazyright.com

Since 1st january 2003, the national insurance contribution rate was increased by 1% per year for four years. Employers must pay this contribution themselves, for their employees. The current rate of employer national insurance is 13.8%, this is valid for the 2022 tax year which runs from the 1st april 2022 to 31 march 2023. As a result, this shift will bring about an increase in contributions payable by government permanent and temporary employees. 2% is the rate paid for any earnings over £805.

Source: impossible-harry-styles-fanfiction.blogspot.com

Source: impossible-harry-styles-fanfiction.blogspot.com

24 pence for both tax and national insurance purposes and for all business miles: The employers national insurance contributions calculator is configured to calculate national insurance contributions calculations for the 2022/23 tax year. The current rate of employer national insurance is 13.8%, this is valid for the 2022 tax year which runs from the 1st april 2022 to 31 march 2023. What is the current rate of employers ni? The secondary threshold is £732/month.

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

Class 1 contributions are paid at the rate of 12% of weekly earnings for employees earning between £153 and £805. Class 1 contributions are paid at the rate of 12% of weekly earnings for employees earning between £153 and £805. You paid 2% on any earnings above £50,000. The current rate of employer national insurance is 13.8%, this is valid for the 2022 tax year which runs from the 1st april 2022 to 31 march 2023. National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits.

Source: parasolgroup.co.uk

Source: parasolgroup.co.uk

£118 per week £512 per month £6,136 per year. £118 per week £512 per month £6,136 per year. £170 per week, £737 per month or £8,840 per year; National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits. What is the current rate of employers ni?

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

This table shows how much employers deduct from employees’ pay for the 2021 to 2022 tax year. If you earn less than this amount you�ll pay no national insurance contributions. £120 per week £520 per month £6,240 per year. A percentage breakdown of the contributory benefit payments paid from this total is shown above. You pay national insurance over the age of 16 and under state pension age (currently 66).

Source: kff.org

Source: kff.org

£6,365 + £3.00 per week. Does the employers ni rate ever change? £6,365 + £3.00 per week. 24 pence for both tax and national insurance purposes and for all business miles: Yes, the employers ni rate is subject to change and is reviewed annually by the scottish sitting government but it changes infrequently.

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

A percentage breakdown of the contributory benefit payments paid from this total is shown above. Staff costs are not just salaries,. During 2019/20 national insurance contributions totalled £221,554,000. £118 per week £512 per month £6,136 per year. If you earned more, you paid 12% of your earnings between £9,500 and £50,00.

Source: brightpay.co.uk

Source: brightpay.co.uk

£120 per week £520 per month £6,240 per year. What is the current rate of employers ni? £118 per week £512 per month £6,136 per year. Employees do not pay national insurance but get the benefits of paying: National insurance, including the employers contributions, are used to pay for the nhs, social care, pensions and benefits.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employee national insurance rates 2019 20 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.