Your Employee benefits liability insurance images are available. Employee benefits liability insurance are a topic that is being searched for and liked by netizens today. You can Get the Employee benefits liability insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for employee benefits liability insurance images information connected with to the employee benefits liability insurance topic, you have come to the ideal site. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

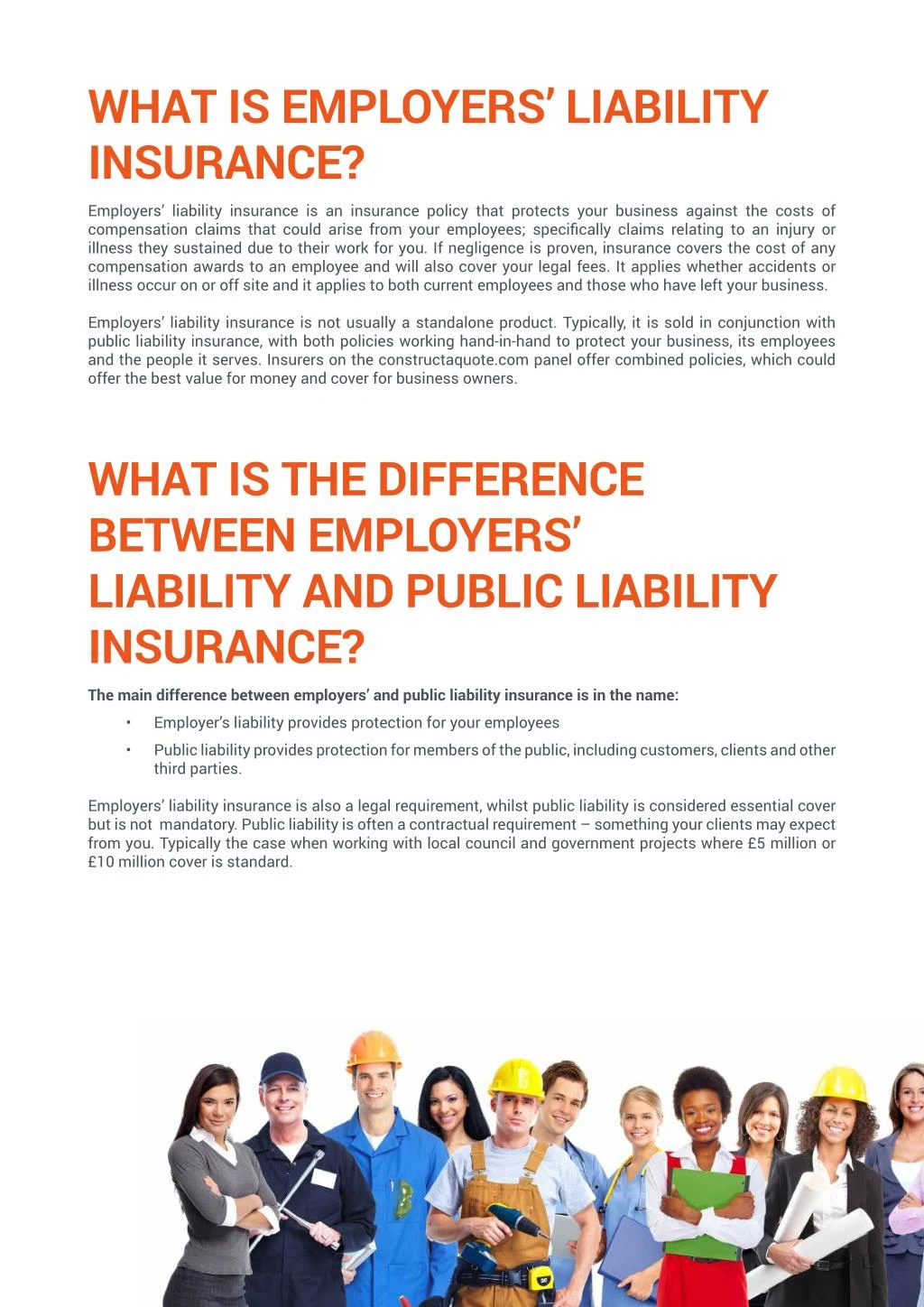

Employee Benefits Liability Insurance. Employee benefits liability coverage can be a standalone policy or added as an endorsement on another policy such as commercial general liability insurance. Therefore, telling you an average price will be challenging, as it depends on the number of covered employees. These errors and omissions may include failing to enroll, maintain or terminate employees in a plan, and failing to correctly describe benefit plans and eligibility rules to employees. The employer displays a show of trustworthiness by participating in the provincial workplace compensation fund and getting employer’s liability insurance.

Employee Benefits Liability Insurance Coverage for From fr.slideshare.net

Employee Benefits Liability Insurance Coverage for From fr.slideshare.net

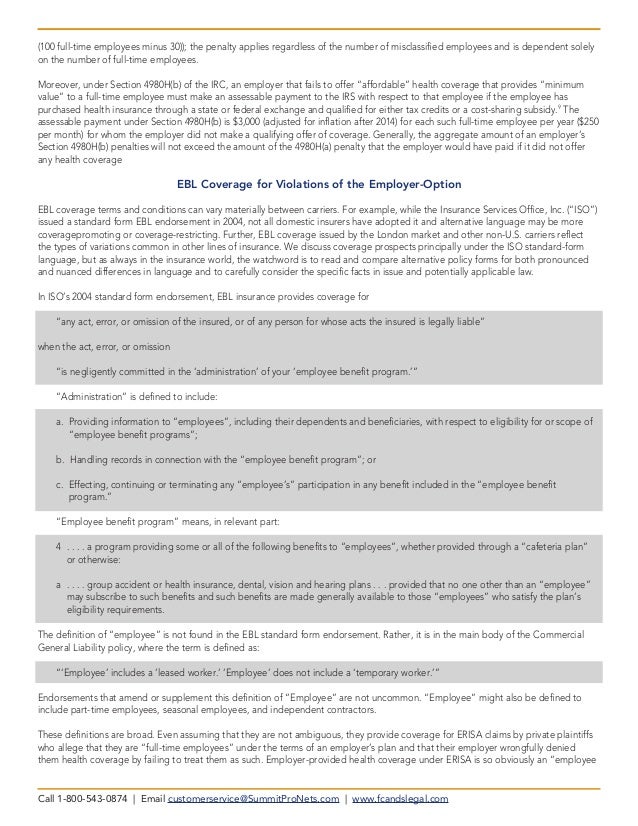

Employee benefits liability coverage form this form provides claims made coverage. Therefore, telling you an average price will be challenging, as it depends on the number of covered employees. Employment benefits liability, or ebl for short, is a type of insurance designed to cover employers from errors and omissions that may occur during the administration of employee benefit plans. Benefits of employer’s liability insurance. Excess of the deductible amount stated in item 6 of the declarations as applicable to each employee. the limits of insurance applicable to each employee will be reduced by the amount of this deductible. Employee benefits liability (ebl) insurance protects a business against lawsuits resulting from negligence, errors, or omissions made during the administration of employee benefits.

It covers grievances directly related to the management of.

Employee benefits liability insurance is usually added to commercial general liability insurance or fiduciary liability insurance. This policy typically protects the organization and its administrative staff from errors and omissions that can arise from employee benefit plans. Employee benefits liability insurance is usually added to commercial general liability insurance or fiduciary liability insurance. That said, the average employee benefits liability insurance cost is about $20 per hour for each. The plan is also referred to as employee benefits liability coverage or employee liability insurance. A majority of companies offer their employees benefits including health insurance and retirement plans.

Source: slideserve.com

Source: slideserve.com

Typically, these claims against your business are filed by the employees about the way your company. That said, the average employee benefits liability insurance cost is about $20 per hour for each. Employee benefits liability insurance helps to protect your company and provide peace of mind. Since employee benefits liability insurance typically covers retirement plans, group health and life plans, disability benefits and workers compensation, there are a variety of claims that can be filed. Employee benefits liability (ebl) is insurance that covers businesses from errors and omissions that occur when employee benefit plans are administered.

Source: slideshare.net

Source: slideshare.net

Excess of the deductible amount stated in item 6 of the declarations as applicable to each employee. the limits of insurance applicable to each employee will be reduced by the amount of this deductible. Displaying coherent compliance with the law. Therefore, telling you an average price will be challenging, as it depends on the number of covered employees. Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Employee benefits liability coverage can be a standalone policy or added as an endorsement on another policy such as commercial general liability insurance.

Source: canalhr.com

Source: canalhr.com

These errors and omissions may include failing to enroll, maintain or terminate employees in a plan, and failing to correctly describe benefit plans and eligibility rules to employees. These errors and omissions may include failing to enroll, maintain or terminate employees in a plan, and failing to correctly describe benefit plans and eligibility rules to employees. Click to go to the #1 insurance dictionary on the web. The coverage applies to life insurance, health benefits, retirement plans, disability insurance, and lots more. Employee benefits liability insurance | as a leading benefits adviser, you gain from our experience in designing plans that support your company’s sustained success.

Source: slideshare.net

Source: slideshare.net

Displaying coherent compliance with the law. Employee benefits liability insurance from pension plans and profit sharing to healthcare plans and retirement accounts, there are many benefits you may be offering your employees. In the event an employer fails to add a new employee or update an existing employee benefit plan, an employee may be denied a medical claim submitted by their health insurance company. Benefits of employer’s liability insurance. Medical health insurance, group term life insurance, prescription drug plan, and accidental death and dismemberment policies.

Source: proinsgrp.com

Source: proinsgrp.com

Most likely you have a specific individual or group of people who are responsible for overseeing the employee benefits plans. We walk you through the most relevant market trends and implications for your employee benefits program and help you to develop your strategy. A majority of companies offer their employees benefits including health insurance and retirement plans. To be protected by the law, it is important to show compliance. In the event an employer fails to add a new employee or update an existing employee benefit plan, an employee may be denied a medical claim submitted by their health insurance company.

Source: youtube.com

Source: youtube.com

Employee benefits liability insurance is usually added to commercial general liability insurance or fiduciary liability insurance. Employee benefits liability insurance protects the management of employee benefit plans against omissions, negligence, or liability from errors. Displaying coherent compliance with the law. The plan is also referred to as employee benefits liability coverage or employee liability insurance. Employee benefits liability (ebl) is insurance that covers businesses from errors and omissions that occur when employee benefit plans are administered.

Source: waconference.com

Source: waconference.com

Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Displaying coherent compliance with the law. Employee benefit liability insurance is coverage an employer can purchase to protect claims made by employees over administrative errors regarding their group insurance coverage, pension plans, stock options, and other benefits. Excess of the deductible amount stated in item 6 of the declarations as applicable to each employee. the limits of insurance applicable to each employee will be reduced by the amount of this deductible. Therefore, telling you an average price will be challenging, as it depends on the number of covered employees.

Source: proinsgrp.com

Source: proinsgrp.com

The employer displays a show of trustworthiness by participating in the provincial workplace compensation fund and getting employer’s liability insurance. An employee benefit insurance plan typically includes the following basic coverage package: Employee benefit liability insurance is coverage an employer can purchase to protect claims made by employees over administrative errors regarding their group insurance coverage, pension plans, stock options, and other benefits. Looking for information on employee benefits liability? A majority of companies offer their employees benefits including health insurance and retirement plans.

Source: slideshare.net

Source: slideshare.net

Displaying coherent compliance with the law. Employee benefits liability insurance from pension plans and profit sharing to healthcare plans and retirement accounts, there are many benefits you may be offering your employees. Employee benefits liability insurance is usually added to commercial general liability insurance or fiduciary liability insurance. This coverage is usually added as an endorsement to an existing liability insurance policy. Employee benefits liability insurance protects the management of employee benefit plans against omissions, negligence, or liability from errors.

Source: eastharleminsurance.com

Source: eastharleminsurance.com

Employee benefits liability insurance provides coverage to an employer for errors or omissions in the employer’s administration of its employee benefit program. These errors and omissions may include failing to enroll, maintain or terminate employees in a plan, and failing to correctly describe benefit plans and eligibility rules to employees. Employee benefits liability (ebl) insurance protects a business against lawsuits resulting from negligence, errors, or omissions made during the administration of employee benefits. The specific terms of your policy spell out your coverage limits. To be protected by the law, it is important to show compliance.

Source: fr.slideshare.net

Source: fr.slideshare.net

Employee benefits liability insurance | as a leading benefits adviser, you gain from our experience in designing plans that support your company’s sustained success. To be protected by the law, it is important to show compliance. The employer displays a show of trustworthiness by participating in the provincial workplace compensation fund and getting employer’s liability insurance. For example, if a new employee requests to receive medical insurance through the employer and the employer failed to add the new employee to the plan. Employee benefits liability coverage helps protect your business in incidents surrounding the management of employee benefits.

Source: wwspi.com

Source: wwspi.com

Typically, these claims against your business are filed by the employees about the way your company. Employment benefits liability, or ebl for short, is a type of insurance designed to cover employers from errors and omissions that may occur during the administration of employee benefit plans. Many employee benefits liability insurance policies also have a retroactive date applied. If an employee was supposed to be added to the retirement plan, but the employer failed to add them, the employee can file a claim for negligence. Most likely you have a specific individual or group of people who are responsible for overseeing the employee benefits plans.

Source: proinsgrp.com

Source: proinsgrp.com

An employee benefit insurance plan typically includes the following basic coverage package: Click to go to the #1 insurance dictionary on the web. Employee benefits liability insurance provides coverage to an employer for errors or omissions in the employer’s administration of its employee benefit program. This type of business insurance covers a wide range of plans, including: Employee benefits liability insurance helps to protect your company and provide peace of mind.

Source: mtginsurance.com

Source: mtginsurance.com

Medical health insurance, group term life insurance, prescription drug plan, and accidental death and dismemberment policies. Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Looking for information on employee benefits liability? Employee benefits liability insurance from pension plans and profit sharing to healthcare plans and retirement accounts, there are many benefits you may be offering your employees. Employee benefits liability coverage form this form provides claims made coverage.

Source: slideshare.net

Source: slideshare.net

Employee benefits liability (ebl) insurance protects a business against lawsuits resulting from negligence, errors, or omissions made during the administration of employee benefits. Employee benefits liability (ebl) is insurance that covers businesses from errors and omissions that occur when employee benefit plans are administered. Medical health insurance, group term life insurance, prescription drug plan, and accidental death and dismemberment policies. This type of business insurance covers a wide range of plans, including: Employee benefits liability insurance helps to protect your company and provide peace of mind.

Source: slideshare.net

Source: slideshare.net

The employer displays a show of trustworthiness by participating in the provincial workplace compensation fund and getting employer’s liability insurance. We walk you through the most relevant market trends and implications for your employee benefits program and help you to develop your strategy. Employee benefits liability insurance is usually added to commercial general liability insurance or fiduciary liability insurance. The employer displays a show of trustworthiness by participating in the provincial workplace compensation fund and getting employer’s liability insurance. Many employee benefits liability insurance policies also have a retroactive date applied.

Source: slideshare.net

Source: slideshare.net

Employee benefits liability insurance provides coverage to an employer for errors or omissions in the employer’s administration of its employee benefit program. Many employee benefits liability insurance policies also have a retroactive date applied. If an employee was supposed to be added to the retirement plan, but the employer failed to add them, the employee can file a claim for negligence. Looking for information on employee benefits liability? Employment benefits liability, or ebl for short, is a type of insurance designed to cover employers from errors and omissions that may occur during the administration of employee benefit plans.

Source: thebalancesmb.com

Source: thebalancesmb.com

Employment benefits liability, or ebl for short, is a type of insurance designed to cover employers from errors and omissions that may occur during the administration of employee benefit plans. It covers grievances directly related to the management of. Many employee benefits liability insurance policies also have a retroactive date applied. Since employee benefits liability insurance typically covers retirement plans, group health and life plans, disability benefits and workers compensation, there are a variety of claims that can be filed. Excess of the deductible amount stated in item 6 of the declarations as applicable to each employee. the limits of insurance applicable to each employee will be reduced by the amount of this deductible.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title employee benefits liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.