Your Elizabeth is the beneficiary of a life insurance policy images are ready. Elizabeth is the beneficiary of a life insurance policy are a topic that is being searched for and liked by netizens now. You can Get the Elizabeth is the beneficiary of a life insurance policy files here. Find and Download all free images.

If you’re searching for elizabeth is the beneficiary of a life insurance policy images information related to the elizabeth is the beneficiary of a life insurance policy topic, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Elizabeth Is The Beneficiary Of A Life Insurance Policy. The insurance company informs you that you have two options for receiving the insurance proceeds. Online beneficiary changes are not available for all policies. Naming your beneficiary the three most important factors when you. Elizabeth is the beneficiary of a life insurance policy.

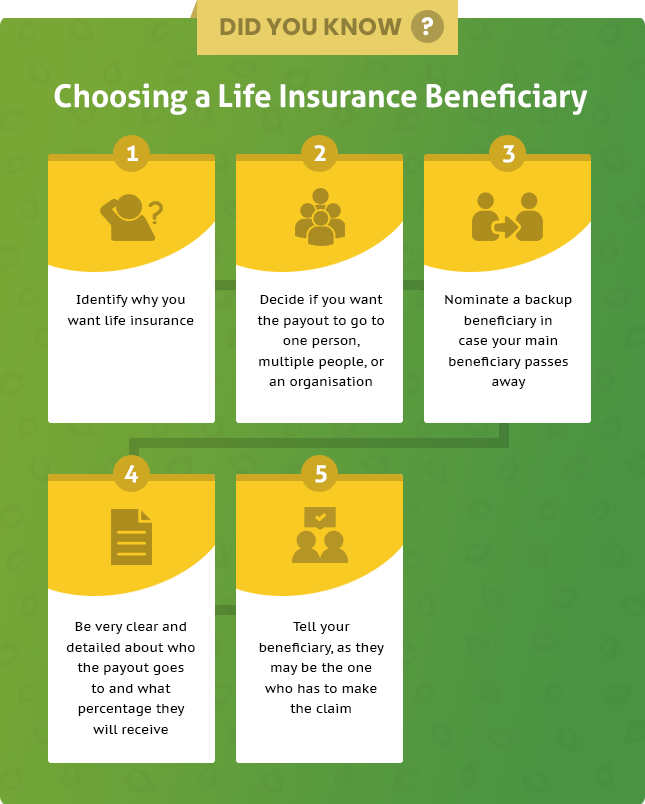

When Should I Nominate a Life Insurance Beneficiary? From lifeinsurancecomparison.com.au

When Should I Nominate a Life Insurance Beneficiary? From lifeinsurancecomparison.com.au

Box 20 minneapolis, minnesota 55440 Barnes, as the named beneficiaries of the two jefferson standard life insurance company policies, filed. Dallas life insurance lawyers have another old case to be aware of. The laws of some states do not permit naming a funeral home as beneficiary of a life insurance policy. Instructions this form is used to change the beneficiary on 1) life insurance policies that cover a single insured or jointly cover two insureds and 2) annuity policies. A life insurance beneficiary is a person or organization who will collect the money from your life insurance policy when you pass away.

Yes, if payable to beneficiary other than insured or person effecting insurance (unless effected on life of spouse) or the executors or administrators of the same :

It reasoned that, when the holder of an insurance policy does not specify a beneficiary, the policyholder is the beneficiary. Learn more about group life insurance. Ter, jessica, as a contingent beneficiary. Life insurance policy settlement options inspire ideas 2022 from haztesociounicef.org Name of employer or association policy number social security number for each beneficiary give full name, address (street, city, state and zip code), date of birth, social security number and relationship to insured. You can receive a lump sum of $200,000 today or receive payments of $1,400 a month for 20 years.

Source: agarkautauu.blogspot.com

Source: agarkautauu.blogspot.com

Frances hall was the primary beneficiary of the life insurance policy. Learn more about group life insurance. You can receive a lump sum of $200,000 today or receive payments of $1,400 a month for 20 years. John gregg, the person who died in 1977 while still being married to shirley, had changed the beneficiary on his life insurance policy from shirley to someone else at the last minute. The insurance company informs you that you have two options for receiving the insurance proceeds.

Source: motherhoodtherealdeal.com

Source: motherhoodtherealdeal.com

You are the beneficiary of a life insurance policy. This is a 1953, texas supreme court case styled, creighton et al. Online beneficiary changes are not available for all policies. The investment account is a transfer on death account with elizabeth and james as the listed beneficiaries of both darrin and kathi’s shares. She is receiving the death benefit in payments of $10,000 per month until the principal and.

Source: mutualtrust.com

Source: mutualtrust.com

You can receive a lump sum of $200,000 today or receive payments of $1,400 a month for 20 years. When a beneficiary is irrevocable, it means they are fully entitled to the death benefit as outlined in the contract. She has a problem, however. Box 20 minneapolis, minnesota 55440 Elizabeth is the beneficiary of a life insurance policy.

Source: nishiohmiya-golf.com

Source: nishiohmiya-golf.com

Barnes, as the named beneficiaries of the two jefferson standard life insurance company policies, filed. Learn more about group life insurance. Yes, if payable to beneficiary other than insured or person effecting insurance (unless effected on life of spouse) or the executors or administrators of the same : The laws of some states do not permit naming a funeral home as beneficiary of a life insurance policy. You can receive a lump sum of $200,000 today or receive payments of $1,400 a month for 20 years.

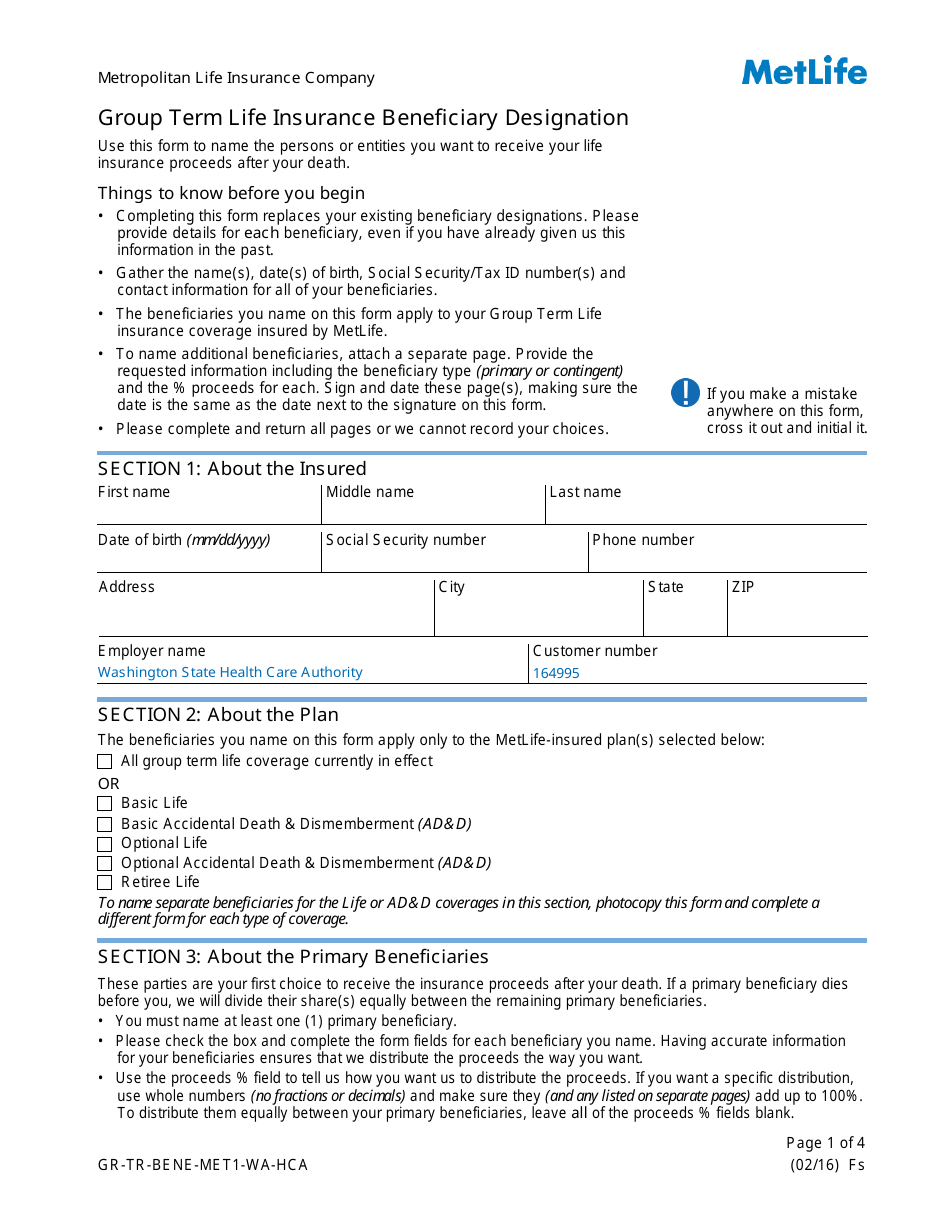

Source: templateroller.com

Source: templateroller.com

Dallas life insurance lawyers have another old case to be aware of. She makes these beneficiary designations revocable so she can change her decision when and if her situation changes in life. Otherwise, when you die, the policy becomes part of your estate and subject to prob. Yes, if payable to beneficiary other than insured or person effecting insurance (unless effected on life of spouse) or the executors or administrators of the same : The money can be used for any purpose and it is usually tax.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

It is crucial to name a beneficiary on your life insurance policy. The money can be used for any purpose and it is usually tax. Elizabeth is the beneficiary of a life insurance policy. But after her conviction, her son — justin hall — sought to have the death benefits awarded to him. Name of employer or association policy number social security number for each beneficiary give full name, address (street, city, state and zip code), date of birth, social security number and relationship to insured.

Source: moneylogue.com

Source: moneylogue.com

Elizabeth is the beneficiary of a life insurance policy. She decides to name her mother for half the life insurance benefits and her best friend for the other half. It reasoned that, when the holder of an insurance policy does not specify a beneficiary, the policyholder is the beneficiary. The insurance company informs you that you have two options for receiving the insurance proceeds. When a beneficiary is irrevocable, it means they are fully entitled to the death benefit as outlined in the contract.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Reliastar life insurance company p.o. Naming your beneficiary the three most important factors when you. It reasoned that, when the holder of an insurance policy does not specify a beneficiary, the policyholder is the beneficiary. You can name ifaw as primary beneficiary of your life insurance policy or as contingent beneficiary should your other beneficiaries not survive you. It is crucial to name a beneficiary on your life insurance policy.

Source: britneyspearspictyde.blogspot.com

Source: britneyspearspictyde.blogspot.com

She has a problem, however. If you want to change the beneficiary on a policy that has a separate rider covering an insured, including your spouse and/or children, Frances hall was the primary beneficiary of the life insurance policy. You are the beneficiary of a life insurance policy. Online beneficiary changes are not available for all policies.

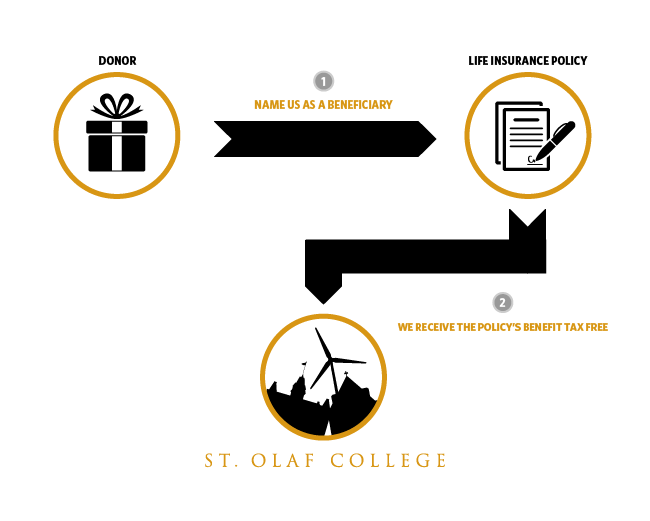

Source: wp.stolaf.edu

Source: wp.stolaf.edu

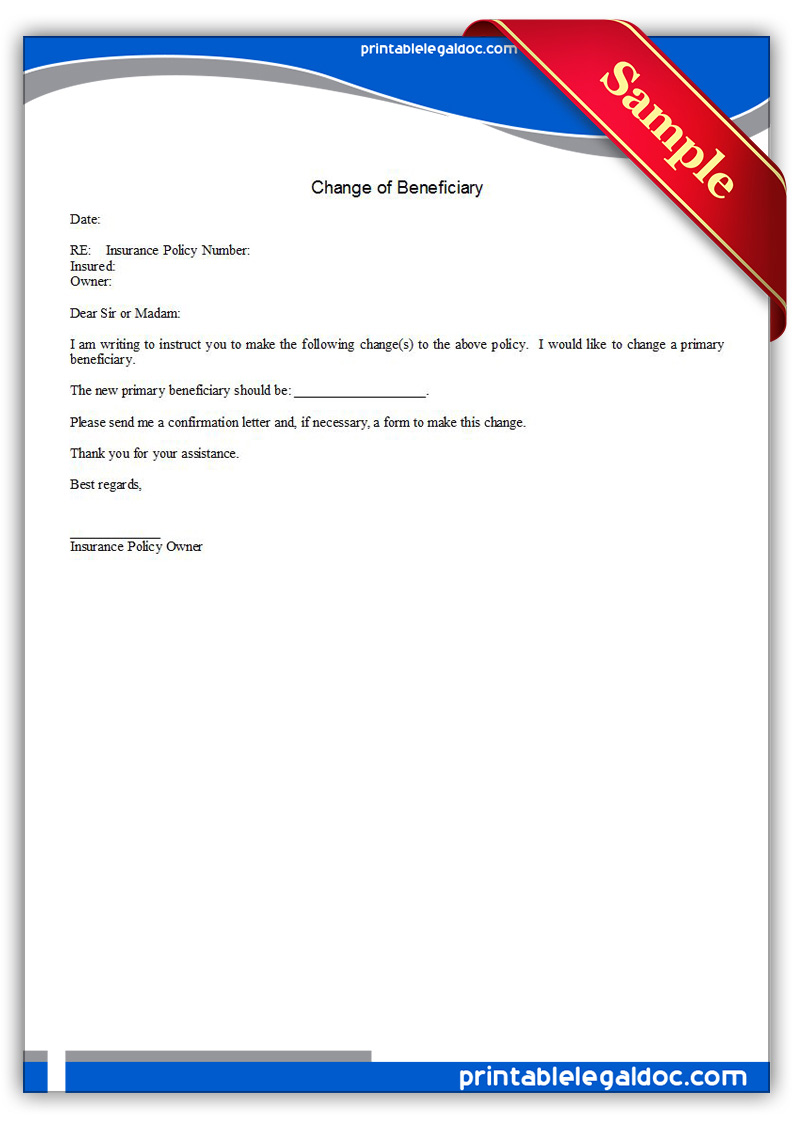

She has a problem, however. When a beneficiary is irrevocable, it means they are fully entitled to the death benefit as outlined in the contract. Box 20 minneapolis, minnesota 55440 Instructions this form is used to change the beneficiary on 1) life insurance policies that cover a single insured or jointly cover two insureds and 2) annuity policies. Petitioners in this case, the mother, daughter and a sister of b.

Source: kochamdramione.blogspot.com

Source: kochamdramione.blogspot.com

Naming your beneficiary the three most important factors when you. Here is some relevant information to know on this case: Ter, jessica, as a contingent beneficiary. Instructions this form is used to change the beneficiary on 1) life insurance policies that cover a single insured or jointly cover two insureds and 2) annuity policies. But after her conviction, her son — justin hall — sought to have the death benefits awarded to him.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

This is a 1953, texas supreme court case styled, creighton et al. She decides to name her mother for half the life insurance benefits and her best friend for the other half. This is a 1953, texas supreme court case styled, creighton et al. Yes, if payable to beneficiary other than insured or person effecting insurance (unless effected on life of spouse) or the executors or administrators of the same : The investment account is a transfer on death account with elizabeth and james as the listed beneficiaries of both darrin and kathi’s shares.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

This is a 1953, texas supreme court case styled, creighton et al. Name of employer or association policy number social security number for each beneficiary give full name, address (street, city, state and zip code), date of birth, social security number and relationship to insured. Barnes, as the named beneficiaries of the two jefferson standard life insurance company policies, filed. An irrevocable beneficiary is a person, organization, or other entity that will receive the funds from your life insurance policy after your death. Here is some relevant information to know on this case:

Source: printablelegaldoc.com

Source: printablelegaldoc.com

If you want to change the beneficiary on a policy that has a separate rider covering an insured, including your spouse and/or children, Elizabeth is the beneficiary of a life insurance policy. A life insurance beneficiary is a person or organization who will collect the money from your life insurance policy when you pass away. Naming your beneficiary the three most important factors when you. If you have a life insurance policy, your beneficiary is the person who will receive the benefits in the event of your death.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

But after her conviction, her son — justin hall — sought to have the death benefits awarded to him. Elizabeth is an insurance writer for coverage.com, where she covers insurance providers and reviews policies to help consumers find comprehensive and affordable coverage for every area of their life. John gregg, the person who died in 1977 while still being married to shirley, had changed the beneficiary on his life insurance policy from shirley to someone else at the last minute. The investment account is a transfer on death account with elizabeth and james as the listed beneficiaries of both darrin and kathi’s shares. Reliastar life insurance company p.o.

Source: bankonyourself.com

Source: bankonyourself.com

Elizabeth is the beneficiary of a life insurance policy. Elizabeth is the beneficiary of a life insurance policy. Elizabeth is the beneficiary of a life insurance policy. Learn more about group life insurance. Whether irwin also had an ownership interest in elizabeth’s life insurance policy is less certain.

Source: printablee.com

Source: printablee.com

Elizabeth is the beneficiary of a life insurance policy. Otherwise, when you die, the policy becomes part of your estate and subject to prob. Whether irwin also had an ownership interest in elizabeth’s life insurance policy is less certain. Yes, but accrued dividends and loan values exempt only up to $500,000 ; The investment account is a transfer on death account with elizabeth and james as the listed beneficiaries of both darrin and kathi’s shares.

Source: everquote.com

Source: everquote.com

But after her conviction, her son — justin hall — sought to have the death benefits awarded to him. We want you and the people you love to avoid this circumstance—talk to your attorney about making the proper arrangements. The laws of some states do not permit naming a funeral home as beneficiary of a life insurance policy. Petitioners in this case, the mother, daughter and a sister of b. Elizabeth is the beneficiary of a life insurance policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title elizabeth is the beneficiary of a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.