Your Elimination period insurance images are ready. Elimination period insurance are a topic that is being searched for and liked by netizens now. You can Download the Elimination period insurance files here. Find and Download all free vectors.

If you’re looking for elimination period insurance images information linked to the elimination period insurance interest, you have visit the right blog. Our site always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

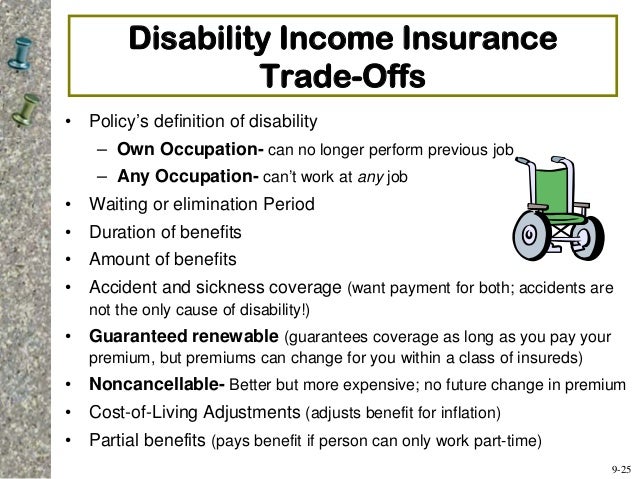

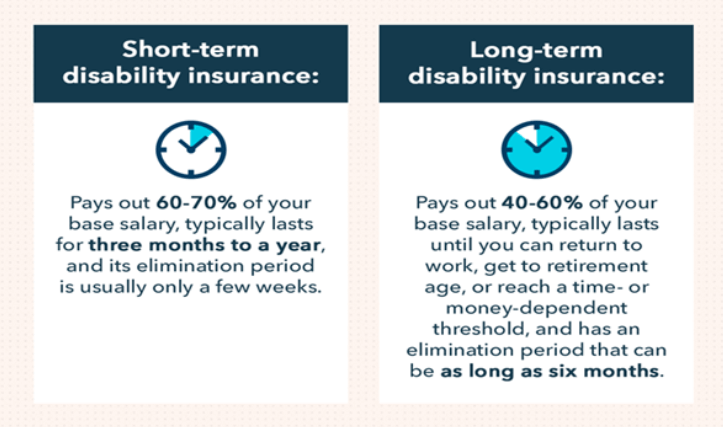

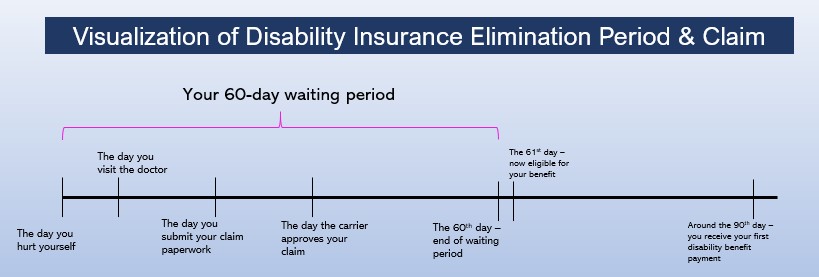

Elimination Period Insurance. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits. Elimination period is a term used in insurance to refer to the time period between an injury and the receipt of benefit payments. The elimination period varies from 30 days to two years, with 90 days being the most typical. The elimination period is not the same for every policy.

If you are looking for disability insurance, here are 12 tips From insuranceblogbychris.com

If you are looking for disability insurance, here are 12 tips From insuranceblogbychris.com

Nov 26, 2019 — an elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can (2). An elimination period refers to the duration of time starting from the time an injury or illness commences to the time the insurance company provides the relevant benefit payments to the policyholder. These options vary from state to state. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. The elimination period varies from 30 days to two years, with 90 days being the most typical. Elimination period is most commonly similar to a deductible period in which you need to satisfy first the deductible before the insurance policy will cover the excess expenses above the amount of your deductible.

30/30 elimination period * certain restrictions, limitations & exclusions apply.

In some policies the elimination period is called the waiting period. An insurance elimination period is the time after coverage begins until the insurance company will start paying benefits. When you apply for a disability policy, you’ll be given a choice of elimination periods. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits. How does the elimination period work? The elimination period runs concurrently with any pay received for accrued leave, sick leave and compensatory leave.

Source: ltcinsurancece.com

Source: ltcinsurancece.com

During this time, you’ll have to cover your own living and medical expenses. During this time, the policyholder is still responsible for all services provided. Costs questions alternatives about contact. We can say that it is the time between the beginning of injury and receiving the benefit of payment from an insurer. Elimination period is a term used in insurance to refer to the time period between an injury and the receipt of benefit payments.

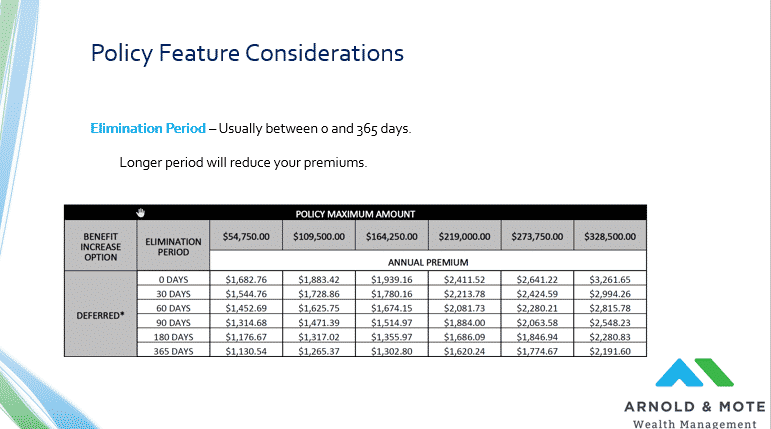

An elimination period is the amount of time a person must wait after contracting an illness or injury before receiving their benefits under an insurance plan. All things being equal, the shorter a policy’s elimination period is, the higher the long term care insurance premium rates will be. A disability insurance elimination period is a similar concept to the deductible on other types of insurance. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits. These options vary from state to state.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

During the elimination period, you are responsible for paying medical expenses. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. How does the elimination period work? All things being equal, the shorter a policy’s elimination period is, the higher the long term care insurance premium rates will be. We can say that it is the time between the beginning of injury and receiving the benefit of payment from an insurer.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

The long term care insurance elimination period is essentially the policy’s deductible. An elimination period is also referred to as the waiting or qualifying period. The elimination period means “the period of your disability during which metlife does not pay benefits.” the elimination period starts on the day you become disabled and continues for the period shown in your schedule of benefits. During this time, the policyholder is still responsible for all services provided. An “elimination period”, whether it is in the context of long term care insurance or disability insurance is the functional equivalent of a “deductible” in property and casualty insurance.

Source: arnoldmotewealthmanagement.com

Source: arnoldmotewealthmanagement.com

An “elimination period”, whether it is in the context of long term care insurance or disability insurance is the functional equivalent of a “deductible” in property and casualty insurance. Carefully consider all options for an elimination period and how they may affect the cost of health care services you may encounter. It is best thought of as a deductible period for your policy. During this time, the policyholder is still responsible for all services provided. The common long term care insurance elimination period options are:

Source: emmi-dulce.blogspot.com

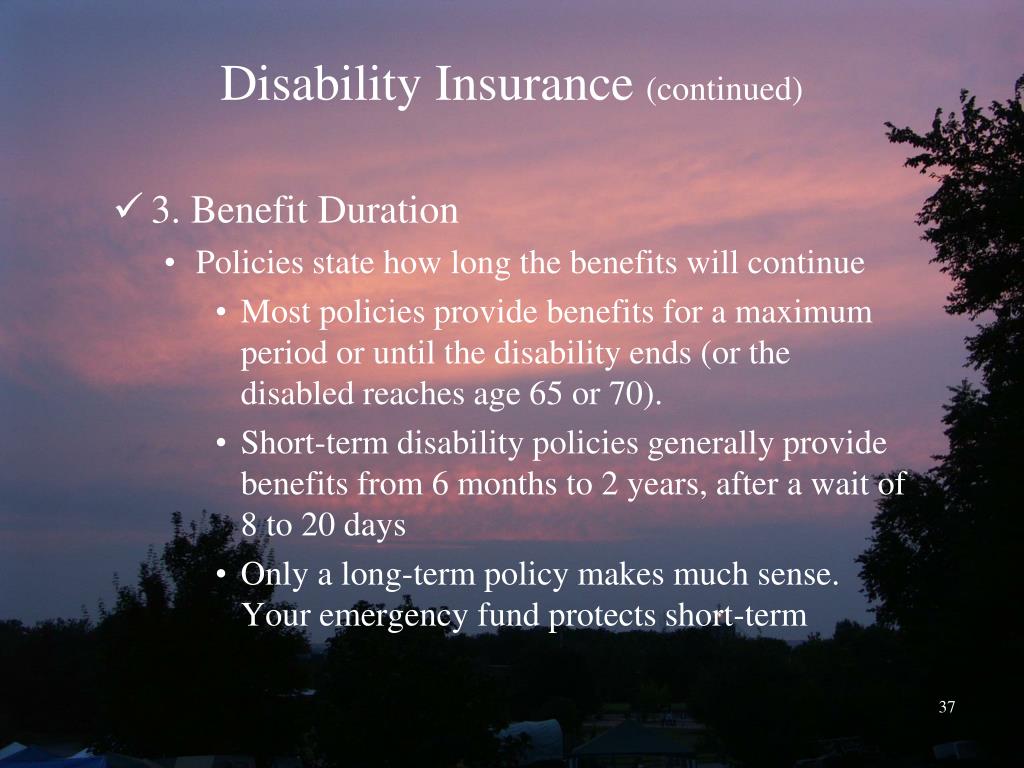

The common long term care insurance elimination period options are: An elimination period refers to the duration of time starting from the time an injury or illness commences to the time the insurance company provides the relevant benefit payments to the policyholder. Its usual timeframe is either 90 or 180 days. The difference between a short and long elimination period is the difference between going into catastrophic debt or not. In some policies the elimination period is called the waiting period.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Disability insurance for federal employees. An “elimination period”, whether it is in the context of long term care insurance or disability insurance is the functional equivalent of a “deductible” in property and casualty insurance. An elimination period is also referred to as the waiting or qualifying period. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. It is measured in a number of days that a person will need to receive care before the policy will pay benefits.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

This term is also specified as a waiting or qualifying period. The elimination period runs concurrently with any pay received for accrued leave, sick leave and compensatory leave. When you apply for a disability policy, you’ll be given a choice of elimination periods. These options vary from state to state. An insurance elimination period is the time after coverage begins until the insurance company will start paying benefits.

Source: winsurtech.com

Source: winsurtech.com

An insurance elimination period is the time after coverage begins until the insurance company will start paying benefits. Nov 26, 2019 — an elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can (2). An elimination period refers to the duration of time starting from the time an injury or illness commences to the time the insurance company provides the relevant benefit payments to the policyholder. The elimination period is a very important part of your disability insurance policy, and you need to know what it is. In a long term disability (ltd) claim, the elimination period is the number of consecutive days over which a claimant must be disabled in order to begin receiving monthly benefits.

Source: emmi-dulce.blogspot.com

For an individual disability insurance policy the industry has made the most attractive offer a. It is measured in a number of days that a person will need to receive care before the policy will pay benefits. Nov 26, 2019 — an elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can (2). The elimination period is not the same for every policy. The period that must elapse before disability income is payable under a health insurance policy cove

Source: myfamilylifeinsurance.com

Source: myfamilylifeinsurance.com

An elimination period is also referred to as the waiting or qualifying period. Disability insurance for federal employees. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits. These options vary from state to state. The elimination period means “the period of your disability during which metlife does not pay benefits.” the elimination period starts on the day you become disabled and continues for the period shown in your schedule of benefits.

Source: keepingtstars.blogspot.com

Source: keepingtstars.blogspot.com

Elimination period insurance.think of an elimination period like your deductible on your car insurance, except it’s measured in time. The elimination period is said to be a waiting period, that is the time between the start of your injury and the day the insurance policy starts paying you benefits. Elimination period insurance.think of an elimination period like your deductible on your car insurance, except it’s measured in time. 0, 30, 60, 90 or 180 days. It is measured in a number of days that a person will need to receive care before the policy will pay benefits.

Source: kitces.com

Source: kitces.com

Elimination period insurance.think of an elimination period like your deductible on your car insurance, except it’s measured in time. Elimination period is most commonly similar to a deductible period in which you need to satisfy first the deductible before the insurance policy will cover the excess expenses above the amount of your deductible. This term is also specified as a waiting or qualifying period. Elimination period insurance.think of an elimination period like your deductible on your car insurance, except it’s measured in time. During this time, the policyholder is still responsible for all services provided.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Its usual timeframe is either 90 or 180 days. Disability insurance for federal employees. The most common elimination period is 90 days — which means your benefits won’t be paid out for three months — but the options available to you will depend on your insurer and policy. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits. How does the elimination period work?

Source: myfamilylifeinsurance.com

Source: myfamilylifeinsurance.com

For an individual disability insurance policy the industry has made the most attractive offer a. Its usual timeframe is either 90 or 180 days. It is best thought of as a deductible period for your policy. The elimination period term refers to the period between an injury and receipt of benefits. The period that must elapse before disability income is payable under a health insurance policy cove

During the elimination period, you are responsible for paying medical expenses. In a long term disability (ltd) claim, the elimination period is the number of consecutive days over which a claimant must be disabled in order to begin receiving monthly benefits. During this time, you’ll have to cover your own living and medical expenses. An elimination period is a term used in the insurance industry to refer to the length of time between when an injury or illness begins and receiving benefit (1). It is measured in a number of days that a person will need to receive care before the policy will pay benefits.

Source: bradeninsurance.com

Source: bradeninsurance.com

The period that must elapse before disability income is payable under a health insurance policy cove The elimination period is said to be a waiting period, that is the time between the start of your injury and the day the insurance policy starts paying you benefits. The elimination period runs concurrently with any pay received for accrued leave, sick leave and compensatory leave. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. We can say that it is the time between the beginning of injury and receiving the benefit of payment from an insurer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title elimination period insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.