Your Elevation difference flood insurance images are ready. Elevation difference flood insurance are a topic that is being searched for and liked by netizens now. You can Get the Elevation difference flood insurance files here. Download all free vectors.

If you’re searching for elevation difference flood insurance images information related to the elevation difference flood insurance keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

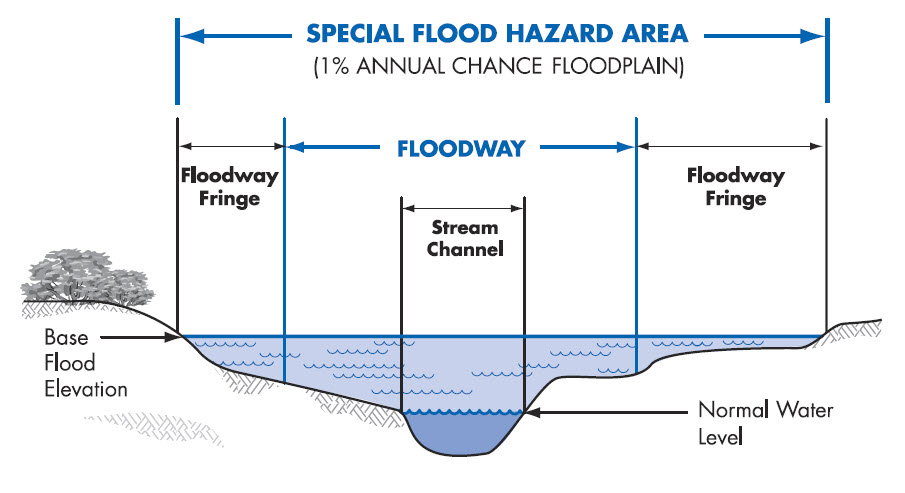

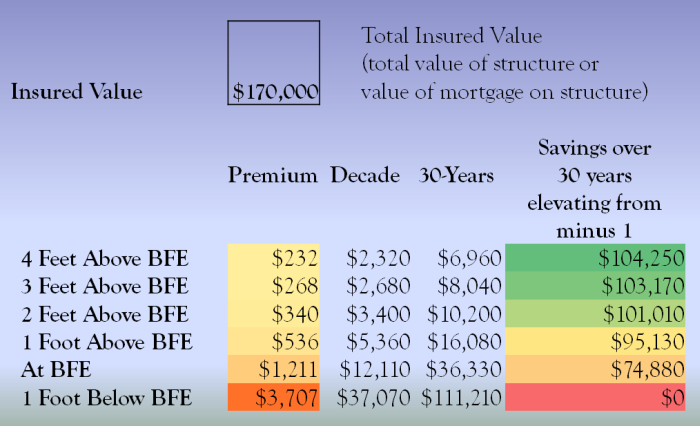

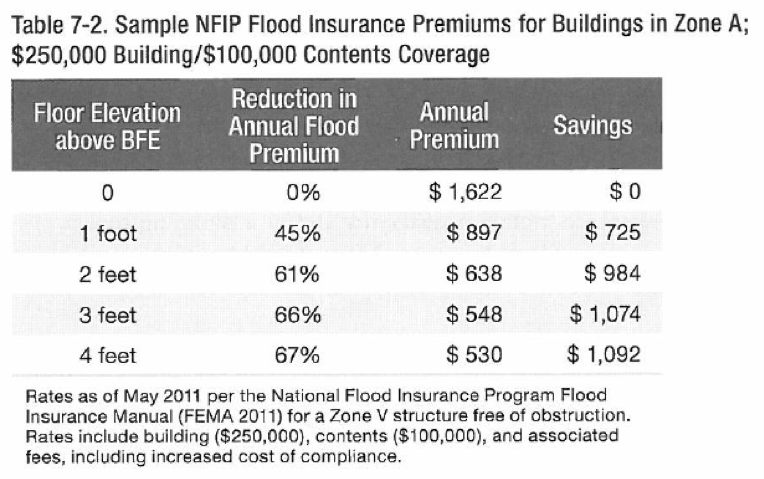

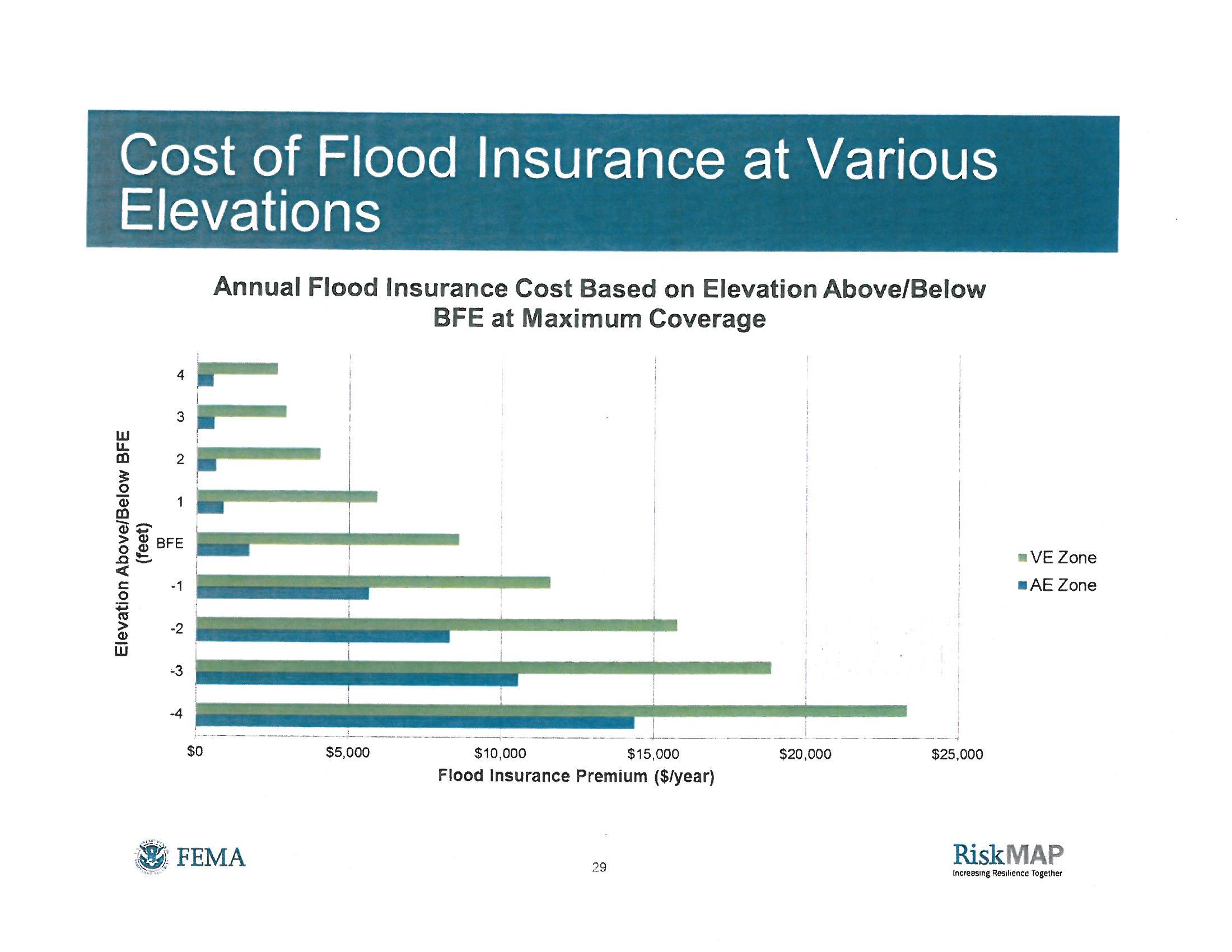

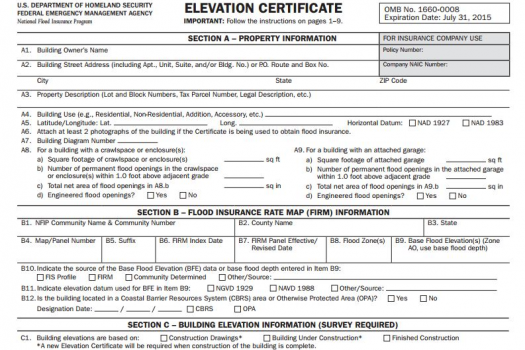

Elevation Difference Flood Insurance. How to calculate elevation difference for flood insurance? Fema compares the elevation of the ground to the bfe of the surrounding area. The document�s most important factor affecting your flood insurance premium will be the lowest floor elevation. Your insurer uses ecs to compare your home�s elevation to the base flood elevation (bfe) to determine their cost to cover you.

Building Insurance Certificate Master of From tutore.org

Building Insurance Certificate Master of From tutore.org

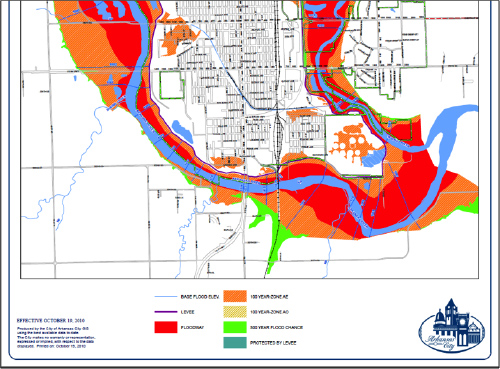

Each one of the elevations we are going to discuss is going to be compared to the bfe in determining the flood insurance rate through fema. The document�s most important factor affecting your flood insurance premium will be the lowest floor elevation. Get a flood insurance quote for a house you are purchasing building in an ae flood zone These elevations are indicated per location within a flood zone on the flood insurance rate maps or firms. Fema compares the elevation of the ground to the bfe of the surrounding area. [2] updating your elevation certificate after a retrofit can save you tens of thousands of dollars down the road.

What does elevation e mean?

Lower risk typically means lower flood insurance premiums. What is elevation difference for flood insurance? The document�s most important factor affecting your flood insurance premium will be the lowest floor elevation. Do i need an elevation certificate if i have private flood insurance? The higher your lowest floor is above the bfe, the lower the risk of flooding. These designations in the flood insurance rate map (firm) show a base flood elevation in relation to the national geodetic vertical datum (ngvd), which is the mean sea level in the u.s.

Source: researchgate.net

Source: researchgate.net

Each one of the elevations we are going to discuss is going to be compared to the bfe in determining the flood insurance rate through fema. How to calculate elevation difference for flood insurance? Dwelling type & # of floors amount of coverage build/content (in thousands) deductible build/content flood zone elevation difference of lowest floor and bfe (feet) cost of flood insurance. The higher your lowest floor is above the bfe, the lower the risk of flooding. The building diagram number on the elevation certificate represents the type of foundation you have on a property.

Source: gadsdenlandsurveying.com

Source: gadsdenlandsurveying.com

This means that you and your neighbor can very easily be in different flood zones because of differences in the ground elevation. There are over 40 private flood insurance companies providing. You want your lower floor to be situated comfortably above your local base flood elevation. The bfe is the elevation that floodwaters are estimated to have a 1% chance of reaching or exceeding in any given year. What are the different elevation numbers and what do they mean?

Source: floodready.vermont.gov

Source: floodready.vermont.gov

In other words, homes in areas with a bfe have a one percent annual chance of seeing a flood reach the area. In general, private flood insurance is going to cost less. Lower risk typically means lower flood insurance premiums. An elevation certificate measures the difference in elevation between your home and the base flood elevation of your area. A base flood elevation (bfe) is the level of surface water is anticipated to reach during a base flood.

Source: s3.amazonaws.com

Source: s3.amazonaws.com

This certification must be submitted with the flood insurance application. Lower risk typically means lower flood insurance premiums. The building diagram number on the elevation certificate represents the type of foundation you have on a property. How to calculate elevation difference for flood insurance? What is elevation difference for flood insurance?

Source: summitengineeringinc.com

Source: summitengineeringinc.com

You want your lower floor to be situated comfortably above your local base flood elevation. The building diagram number on the elevation certificate represents the type of foundation you have on a property. Get a flood insurance quote for a house you are purchasing building in an ae flood zone Dwelling type & # of floors amount of coverage build/content (in thousands) deductible build/content flood zone elevation difference of lowest floor and bfe (feet) cost of flood insurance. Click to see full answer

Source: bpoa-drb.com

Source: bpoa-drb.com

Buildings constructed after the publication of the first flood insurance rate map (firm) in a particular community, in certain high risk zones including: Fema compares the elevation of the ground to the bfe of the surrounding area. Click to see full answer The elevation you care about is the elevation of your home’s lowest flood compared against your area’s base flood elevation, or the elevation that has a one percent chance of flooding in any given year. There are over 40 private flood insurance companies providing.

Source: tutore.org

Source: tutore.org

Lower risk typically means lower flood insurance premiums. A flood elevation certificate documents your building’s elevation. Elevation difference from the bfe. An elevation certificate measures the difference in elevation between your home and the base flood elevation of your area. The first elevation is going to be top of the bottom floor.

Source: johnhillagency.com

Source: johnhillagency.com

Fema compares the elevation of the ground to the bfe of the surrounding area. In general, private flood insurance is going to cost less. What does elevation e mean? This will be compared to the base flood elevation (bfe) for your location, the elevation at which the nfip estimates there is a 1% chance of floodwaters reaching in any given year. The further above the bfe your lowest floor is, the less risky your home will.

Source: youtube.com

Source: youtube.com

What is elevation difference for flood insurance? The higher your lowest floor is above the bfe, the lower the risk of flooding. Additionally, the difference between a building’s bfe and actual elevation will. The higher your lowest floor is above the bfe, the lower the risk of flooding. When reviewing the elevation certificate the numbers you will generally be looking for will be in section c2.

Source: blownmortgage.com

Source: blownmortgage.com

Click to see full answer Elevation difference no estimated bfe estimated bfe $245 $245 $560 $560 +5 feet or more $230 +2 to +4 feet $610 $1,345 submit for rate +1 feet 0 elevation certificate • rate a flood insurance policy • assist a community’s floodplain management program • support a fema letter of map amendment application elevation certificate (cont.) The bfe is used in determining the appropriate design flood elevation for new construction. If the seller has an elevation certificate, a flood nerd can capitalize on that to lower your new flood insurance cost. A flood elevation certificate documents your building’s elevation.

Source: ocnj.us

Source: ocnj.us

The building diagram number on the elevation certificate represents the type of foundation you have on a property. The higher your lowest floodwater floor is above the bfe, the lower your risk of flooding. These designations in the flood insurance rate map (firm) show a base flood elevation in relation to the national geodetic vertical datum (ngvd), which is the mean sea level in the u.s. In other words, homes in areas with a bfe have a one percent annual chance of seeing a flood reach the area. Buildings constructed after the publication of the first flood insurance rate map (firm) in a particular community, in certain high risk zones including:

Source: tylerlandsurveying.com

Source: tylerlandsurveying.com

What does elevation e mean? The further above the bfe your lowest floor is, the less risky your home will. The higher your lowest floor is above the bfe, the lower the risk of flooding. To further illustrate, if the building is certified to be floodproofed to 2 feet above the bfe, flood depth, or comparable community approved floodplain management standards, whichever is highest, then it is credited for floodproofing and Elevation difference no estimated bfe estimated bfe $245 $245 $560 $560 +5 feet or more $230 +2 to +4 feet $610 $1,345 submit for rate +1 feet 0 elevation certificate • rate a flood insurance policy • assist a community’s floodplain management program • support a fema letter of map amendment application elevation certificate (cont.)

Source: floodelevationsurveyors.com

Source: floodelevationsurveyors.com

To further illustrate, if the building is certified to be floodproofed to 2 feet above the bfe, flood depth, or comparable community approved floodplain management standards, whichever is highest, then it is credited for floodproofing and Additionally, the difference between a building’s bfe and actual elevation will. The base flood elevation is the elevation of flood water rise during the “base flood”. Lower risk typically means lower flood insurance premiums. This certification must be submitted with the flood insurance application.

Source: fontanarchitecture.com

Source: fontanarchitecture.com

Elevation difference no estimated bfe estimated bfe $245 $245 $560 $560 +5 feet or more $230 +2 to +4 feet $610 $1,345 submit for rate +1 feet 0 elevation certificate • rate a flood insurance policy • assist a community’s floodplain management program • support a fema letter of map amendment application elevation certificate (cont.) And your closing will never be delayed for lack of flood coverage. These designations in the flood insurance rate map (firm) show a base flood elevation in relation to the national geodetic vertical datum (ngvd), which is the mean sea level in the u.s. A base flood elevation (bfe) is the level of surface water is anticipated to reach during a base flood. If the seller has an elevation certificate, a flood nerd can capitalize on that to lower your new flood insurance cost.

Source: hooverlandsurveying.com

Source: hooverlandsurveying.com

For instance, while the annual cost of flood insurance tends to be less expensive in the south, it costs quite a bit more in the midwest and northeast regions. The document�s most important factor affecting your flood insurance premium will be the lowest floor elevation. Lower risk typically means lower flood insurance premiums. “base flood” refers to a flood that has a one percent chance of being either equaled or exceeded in a given area in a given year. What is elevation difference for flood insurance?

Source: floodinsuranceguru.com

Lower risk typically means lower flood insurance premiums. The building diagram number on the elevation certificate represents the type of foundation you have on a property. Lower risk typically means lower flood insurance premiums. In general, private flood insurance is going to cost less. Flood nerds move like cheetahs to get you covered fast.

Source: epg.modot.org

Source: epg.modot.org

Fema compares the elevation of the ground to the bfe of the surrounding area. [2] updating your elevation certificate after a retrofit can save you tens of thousands of dollars down the road. Flood nerds move like cheetahs to get you covered fast. This certification must be submitted with the flood insurance application. The building diagram number on the elevation certificate represents the type of foundation you have on a property.

Source: fpdesignsbydana.blogspot.com

Source: fpdesignsbydana.blogspot.com

An elevation certificate measures the difference in elevation between your home and the base flood elevation of your area. This certification must be submitted with the flood insurance application. A flood elevation certificate documents your building’s elevation. The higher your lowest floodwater floor is above the bfe, the lower your risk of flooding. When reviewing the elevation certificate the numbers you will generally be looking for will be in section c2.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title elevation difference flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.