Your Elements of insurance risk ppt images are ready. Elements of insurance risk ppt are a topic that is being searched for and liked by netizens now. You can Download the Elements of insurance risk ppt files here. Get all royalty-free vectors.

If you’re searching for elements of insurance risk ppt images information linked to the elements of insurance risk ppt interest, you have come to the ideal site. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

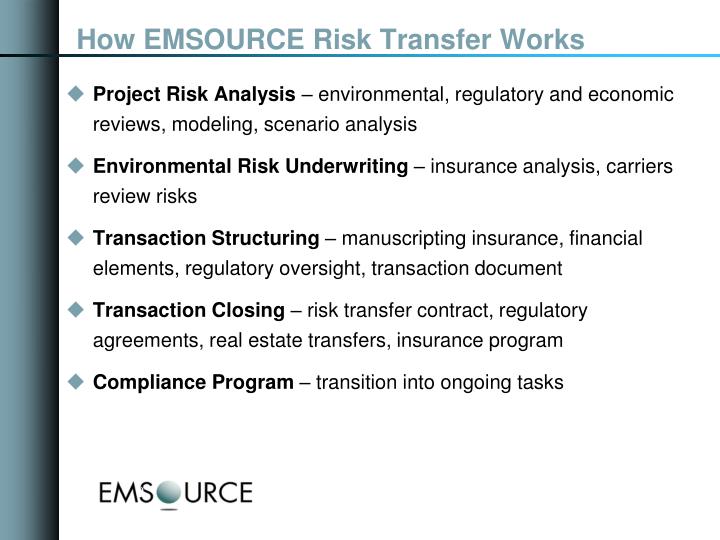

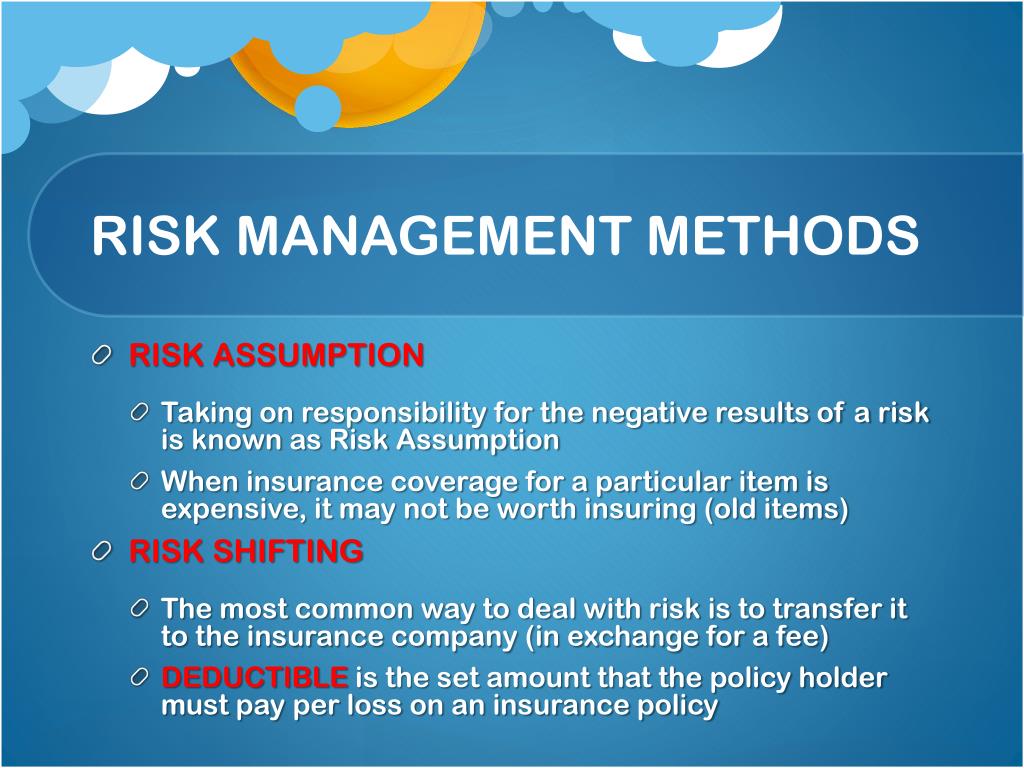

Elements Of Insurance Risk Ppt. There are four parts to any good risk assessment and they are asset identification, risk analysis, risk likelihood & impact, and cost of solutions. From there you’ll want to evaluate what the asset is worth. (d) in personal accident insurance: Avoidance (eliminate the risk or cease the activity) reduction (reduce the likelihood or impact) transfer (shift the risk to a third party) retention (accept the risk as is) a key component of this assessment and mitigation step is the development of a recovery or action plan in the instance where a risk event has occurred.

PPT Risk Management Principles and The Role of Insurance From slideserve.com

PPT Risk Management Principles and The Role of Insurance From slideserve.com

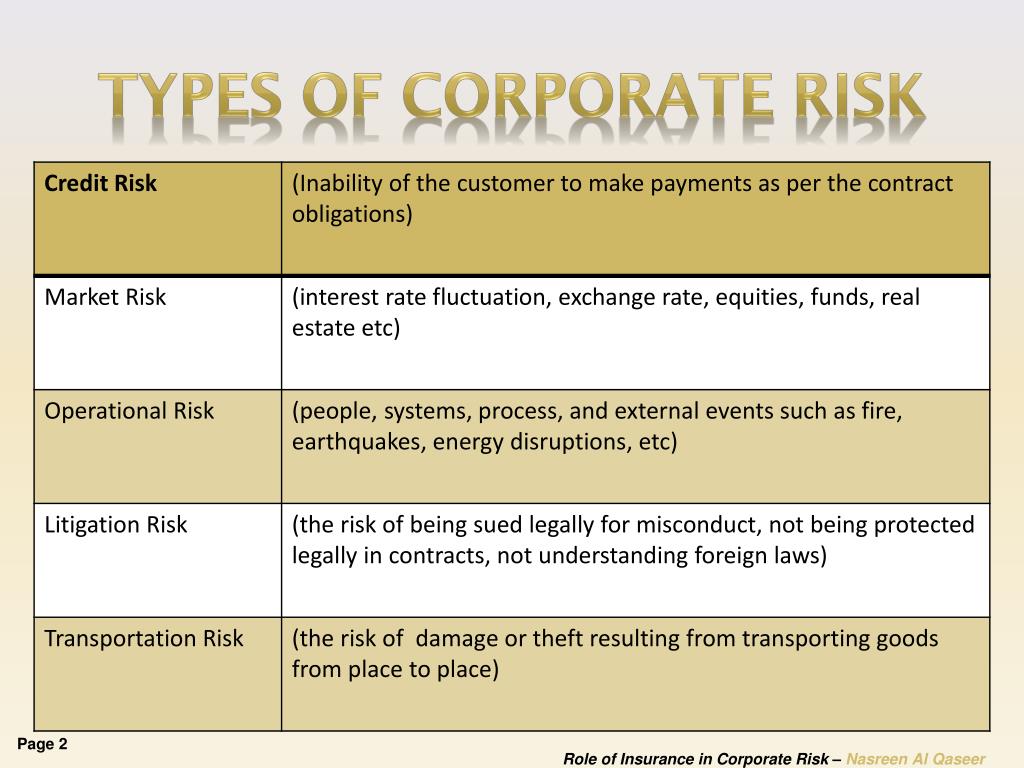

Element of insurance contract the insured must have insurable interest in the subject of insurance. Risk management involves identifying, assessing, and mitigating risk. View fundamentals of risk and insurance. Careers in risk management and insurance 16 chapter 2 insurance and risk 22 definition of insurance 23 basic characteristics of insurance 23 law of large numbers 24 characteristics of an ideally insurable risk 25 two applications: In simple words risk is danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. Such specialists assumed the peril risk through the maritime loan, repayable upon the safe return of a vessel and its cargo

If the event happens the insurance company will make a payment to the policyholder (person who owns the policy) to cover all or part of the resulting loss.

Concentrations of insurance risk and claims development. The special contract of insurance involves principles: The risk management process undertakes a. In simple words risk is danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. View fundamentals of risk and insurance. The risks of fire and unemployment 27

Source: slideserve.com

Source: slideserve.com

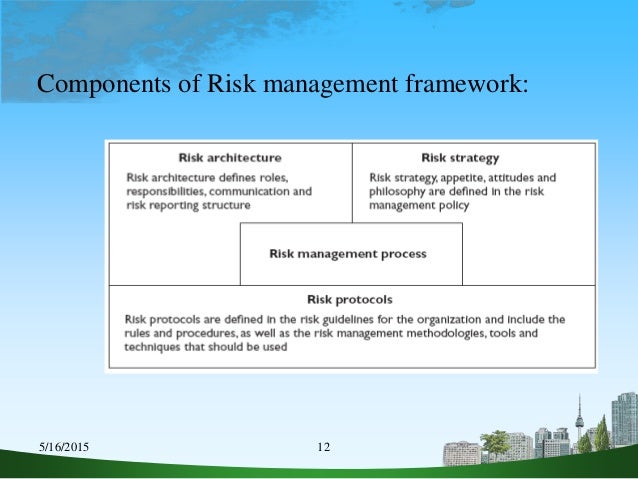

Risk management involves identifying, assessing, and mitigating risk. In this section, we discuss two broad areas: View fundamentals of risk and insurance. The essentials of any insurance contract are discussed as under with reference to the life insurance only. The evolution of insurance together.

Source: slideserve.com

Source: slideserve.com

Economically feasible premium 5 advantage of insurance assures for financial compensation reduction of risks encouragement to saving and investment basis of credit maintains economic stability promotes business activities 6 provides employment opportunities disadvantages insurance leads to negligence as the insured feels that he/she can be compensated for any. There are four parts to any good risk assessment and they are asset identification, risk analysis, risk likelihood & impact, and cost of solutions. “insurance is a social device which combines the risks of individuals into a group, using funds contributed by members of the group to pay for losses.” the essence of the insurance scheme is that it is a 1) social science 2) accumulation of funds 3) it involves a group of risks 4) transfer of risk to the whole group 2.3 background Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc. Download notes pdf for free.

Source: slideserve.com

Source: slideserve.com

Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc. Nature of stock, value of stock, type The special contract of insurance involves principles: (d) in personal accident insurance: Learn new and interesting things.

Source: slideserve.com

Source: slideserve.com

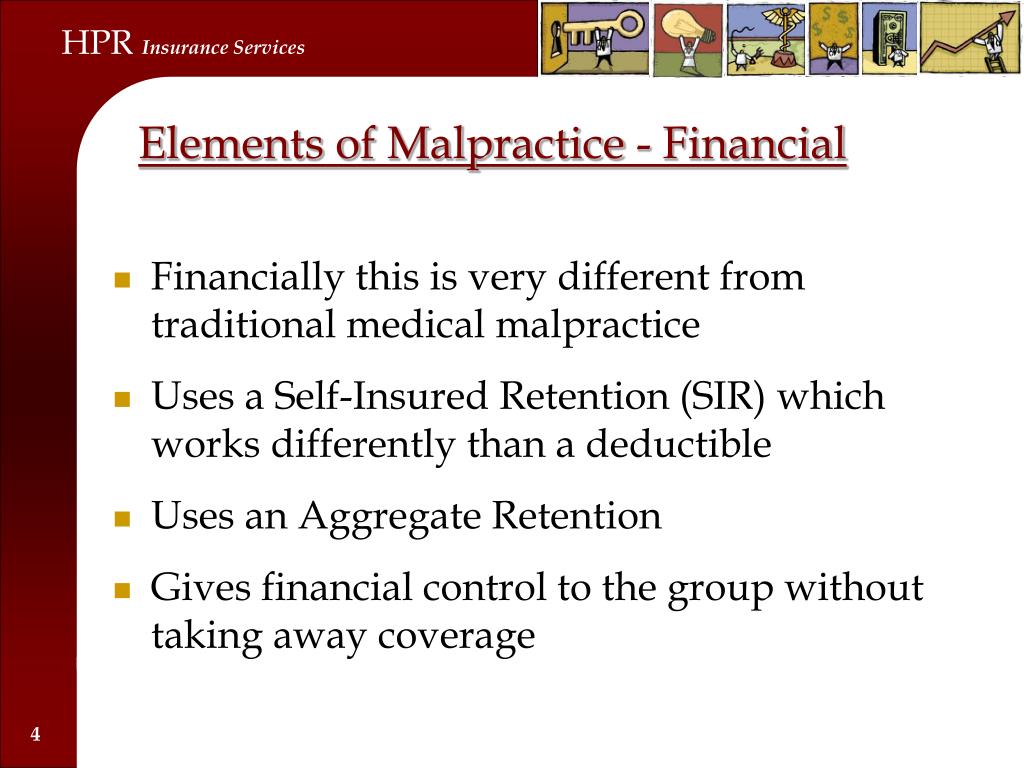

Type of packing, mode of carriage, name of carrier, nature of goods, the route. The essentials of any insurance contract are discussed as under with reference to the life insurance only. Risk analysis makes use of the probability and severity of occurrence. Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). | powerpoint ppt presentation | free to view

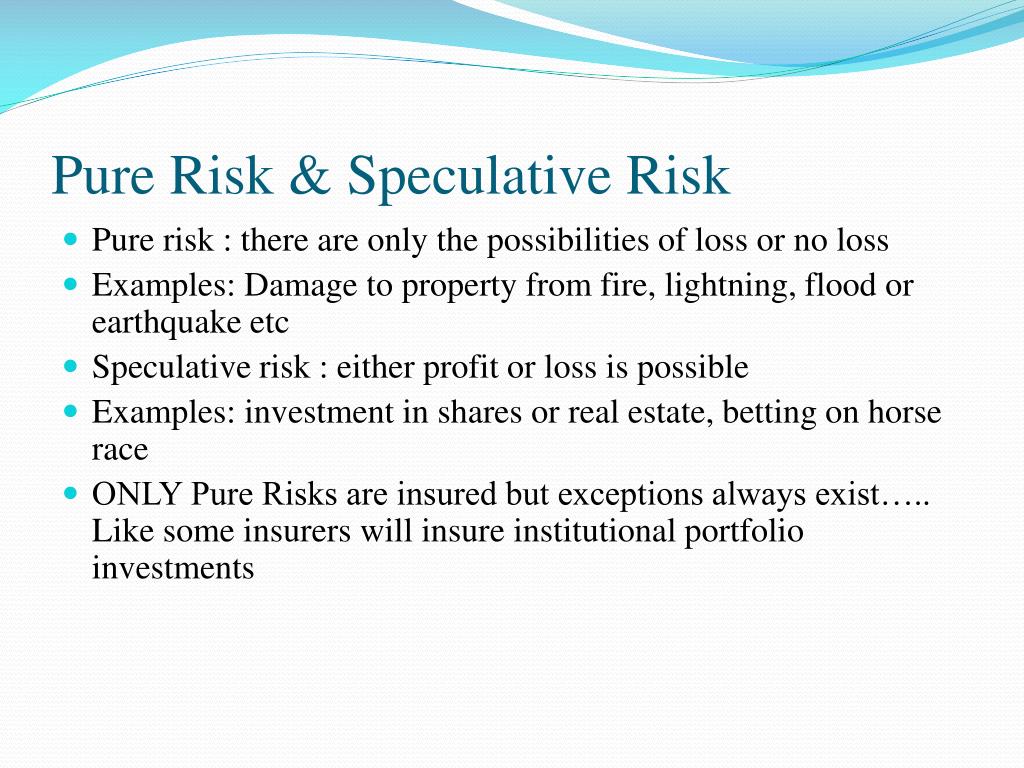

In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. In order for a pure risk to be insurable, it must meet the following criteria. These elements are due to. In simple words risk is danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. “insurance is a social device which combines the risks of individuals into a group, using funds contributed by members of the group to pay for losses.” the essence of the insurance scheme is that it is a 1) social science 2) accumulation of funds 3) it involves a group of risks 4) transfer of risk to the whole group 2.3 background

Source: slideserve.com

Source: slideserve.com

In this section, we discuss two broad areas: The special contract of insurance involves principles: The risk management process undertakes a. The risk is an event or happening which is not planned but eventually happens with financial consequences resulting in loss. General modelliability components of the general model.

Source: slideserve.com

Source: slideserve.com

Careers in risk management and insurance 16 chapter 2 insurance and risk 22 definition of insurance 23 basic characteristics of insurance 23 law of large numbers 24 characteristics of an ideally insurable risk 25 two applications: It is the judgement of the insurance company to take the risk based on the assessment of the extent of risk. The elements of general contract and. There is saying higher the risk more the profit. In order for a pure risk to be insurable, it must meet the following criteria.

Source: slideserve.com

Source: slideserve.com

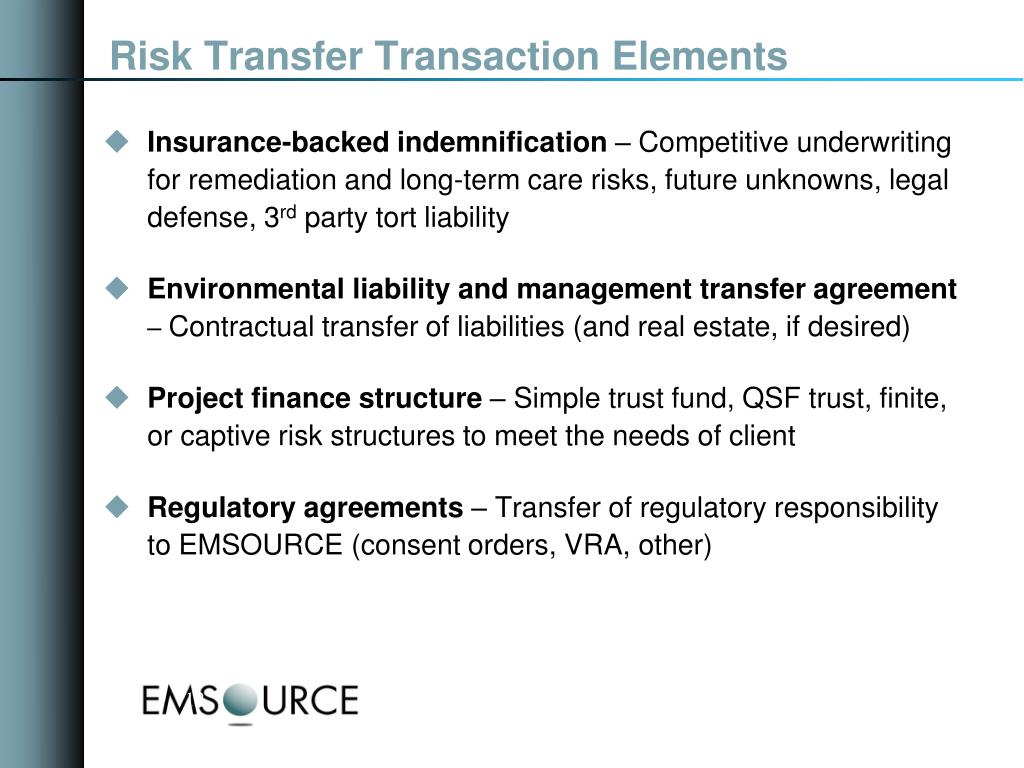

Risk management involves identifying, assessing, and mitigating risk. The risk management process undertakes a. Proximate cause, assignment, and nomination, the return of premium. In order for a pure risk to be insurable, it must meet the following criteria. Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk.

Source: slideshare.net

Source: slideshare.net

Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc. “insurance is a social device which combines the risks of individuals into a group, using funds contributed by members of the group to pay for losses.” the essence of the insurance scheme is that it is a 1) social science 2) accumulation of funds 3) it involves a group of risks 4) transfer of risk to the whole group 2.3 background Separating peril risk out of this risk mix lowered the cost of equity by transferring the peril risk to an external party able to bear it at a lower cost. Learn new and interesting things. The risk management process undertakes a.

Source: slideserve.com

Source: slideserve.com

Insurable interest, utmost good faith, indemnity, subrogation, warranties. In simple words risk is danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. Concentrations of insurance risk and claims development. The risk management process undertakes a. Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc.

Source: slideserve.com

Source: slideserve.com

The elements of general contract and. The elements of special contract relating to insurance: From there you’ll want to evaluate what the asset is worth. The risk is an event or happening which is not planned but eventually happens with financial consequences resulting in loss. It is the judgement of the insurance company to take the risk based on the assessment of the extent of risk.

Source: slideserve.com

Source: slideserve.com

In simple words risk is danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. General modelliability components of the general model. In this section, we discuss two broad areas: The insurer’s obligation to indemnify. Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc.

Source: slideserve.com

Source: slideserve.com

Risk analysis makes use of the probability and severity of occurrence. Download notes pdf for free. Age, height, weight, occupation, previous medical history if it is likely to increase the choice of an accident, bad habits such as drinking etc. Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk. Separating peril risk out of this risk mix lowered the cost of equity by transferring the peril risk to an external party able to bear it at a lower cost.

Source: slideserve.com

Source: slideserve.com

In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. • maintain a ratio of credit risk. Managing your risk constitutes a major element of your financial plan. There is saying higher the risk more the profit. (d) in personal accident insurance:

Source: slideserve.com

Source: slideserve.com

The elements of general contract and. The elements of special contract relating to insurance: It is the judgement of the insurance company to take the risk based on the assessment of the extent of risk. Economically feasible premium 5 advantage of insurance assures for financial compensation reduction of risks encouragement to saving and investment basis of credit maintains economic stability promotes business activities 6 provides employment opportunities disadvantages insurance leads to negligence as the insured feels that he/she can be compensated for any. These elements are due to.

Source: slideteam.net

Source: slideteam.net

Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk. From there you’ll want to evaluate what the asset is worth. • maintain a ratio of credit risk. Element of insurance contract the insured must have insurable interest in the subject of insurance. The evolution of insurance together.

Source: slideserve.com

Source: slideserve.com

It is the judgement of the insurance company to take the risk based on the assessment of the extent of risk. Blockchain technology in insurance refers to a decentralised, shared digital distributed ledger that records and provides a historical record of a person�s transactions, such as claims, and thus assists insurers in preventing, detecting, and countering frauds.| powerpoint ppt presentation |. The evolution of insurance together. The risk is an event or happening which is not planned but eventually happens with financial consequences resulting in loss. In order for a pure risk to be insurable, it must meet the following criteria.

Source: slideteam.net

Source: slideteam.net

Nature of stock, value of stock, type Discount future cash flows using rates to reflect the characteristics of the liabilities in terms of timing, currency, and liquidity. The essentials of any insurance contract are discussed as under with reference to the life insurance only. (d) in personal accident insurance: Such specialists assumed the peril risk through the maritime loan, repayable upon the safe return of a vessel and its cargo

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title elements of insurance risk ppt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.