Your Effective rate change insurance images are ready in this website. Effective rate change insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Effective rate change insurance files here. Find and Download all free vectors.

If you’re looking for effective rate change insurance images information connected with to the effective rate change insurance topic, you have come to the ideal site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

Effective Rate Change Insurance. “territorial rating,” as the method is known, is used in most states to calculate a base rate used as the starting point for drivers buying insurance. This generally means higher reserving factors for new business. Effective october 1, 2021, fegli premium rates will change for some types of coverage. The income cap (normally 400% of the poverty level) for subsidy eligibility has been eliminated through the end of 2022.

MEDICARE SUPPLEMENT PREMIUM RATE CHANGE Golden Age From goldenagemarketing.com

MEDICARE SUPPLEMENT PREMIUM RATE CHANGE Golden Age From goldenagemarketing.com

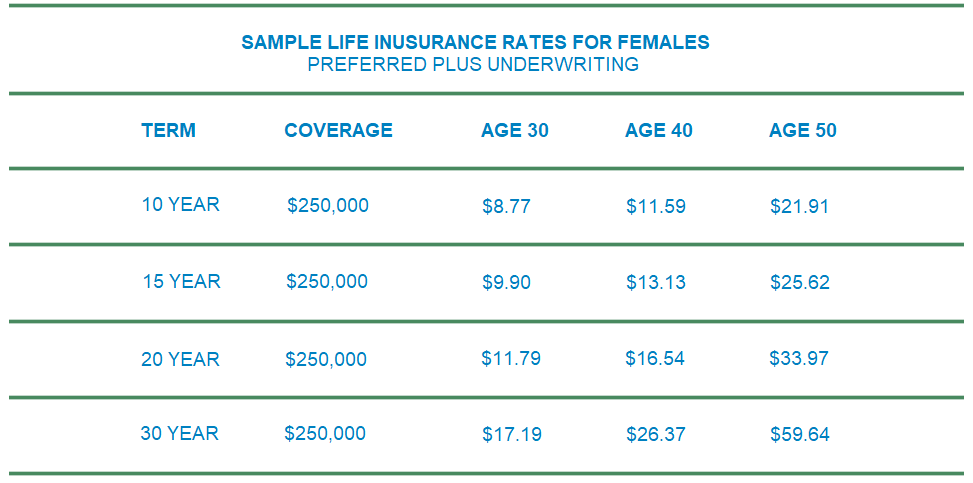

Differences in accident and theft claims for different regions within the same city account for dramatic rate changes from zip code to. There’s no need for sad stories. Typically, drivers in their 40s and 50s pay the lowest rates. Compare rates the differences in premiums are even greater if you smoke. For example, the average life insurance quote only increases by 6% between ages 25 and 30, but it jumps much higher between ages 60 and 65 — an average increase of 86%, or $275 per month. We understand that certain credit events can impact your rate negatively, but may not entirely reflect how risky you are (like divorce, for example).

Drivers 24 years of age and under often pay the highest insurance rates.

One way you may want to employ when increasing your rate is by adding more value to the services you offer. Individual rate changes currently are subject to a 10% cap, excluding coverage changes, mitigation adjustments, rate changes for sinkhole loss coverage, assessments and. The slightest change in credit history could cause a policy to increase. Rate changes (all policy types) the rate increase, citizens’ first since 2019, applies to new and renewal policies. The current filing is for annual certification of the rates. Notice of assessment rate change effective january 1, 2022 to:

Source: slideserve.com

Source: slideserve.com

The slightest change in credit history could cause a policy to increase. Your car insurance rate may increase in your golden years. The real effective exchange rate is a measure of the relative strength of a nation�s currency. Insurance premiums by credit history There’s no need for sad stories.

Source: icbc.com

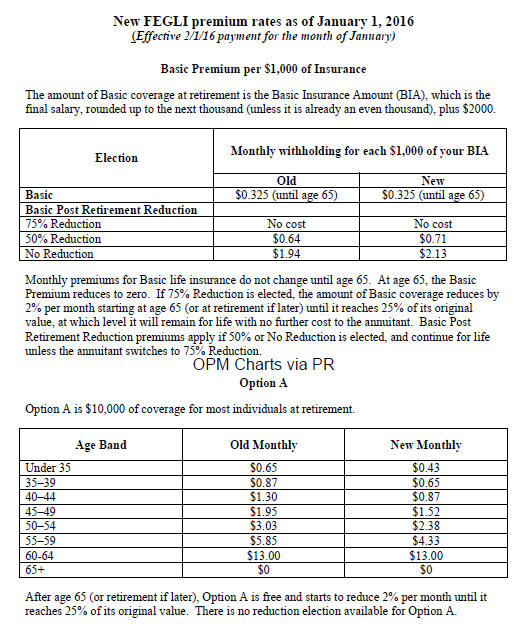

Most premium rates for option a, option b, and option c will decrease. Fallen, the valuation interest rate is reducing from 3.5% to 3% for new business effective january 1, 2021. We understand that certain credit events can impact your rate negatively, but may not entirely reflect how risky you are (like divorce, for example). Place your numbers into the following equation: Your age plays a major role in the rate you’ll pay for car insurance:

Source: choicelifequote.com

Source: choicelifequote.com

Some panels you can send your request via email and others have a more formal process; There’s no need for sad stories. For example, the average life insurance quote only increases by 6% between ages 25 and 30, but it jumps much higher between ages 60 and 65 — an average increase of 86%, or $275 per month. One way you may want to employ when increasing your rate is by adding more value to the services you offer. The real effective exchange rate is a measure of the relative strength of a nation�s currency.

Source: slideserve.com

Source: slideserve.com

Drivers 24 years of age and under often pay the highest insurance rates. The american rescue plan has made some important changes to health insurance subsidies, which continue to be in effect for 2022 coverage: Reversals in the age of roof factors, with a rate change of +8.8% effective for new business on september 1, 2021. Auto premiums often start dropping after you turn 25. Compare rates the differences in premiums are even greater if you smoke.

Source: pdffiller.com

Source: pdffiller.com

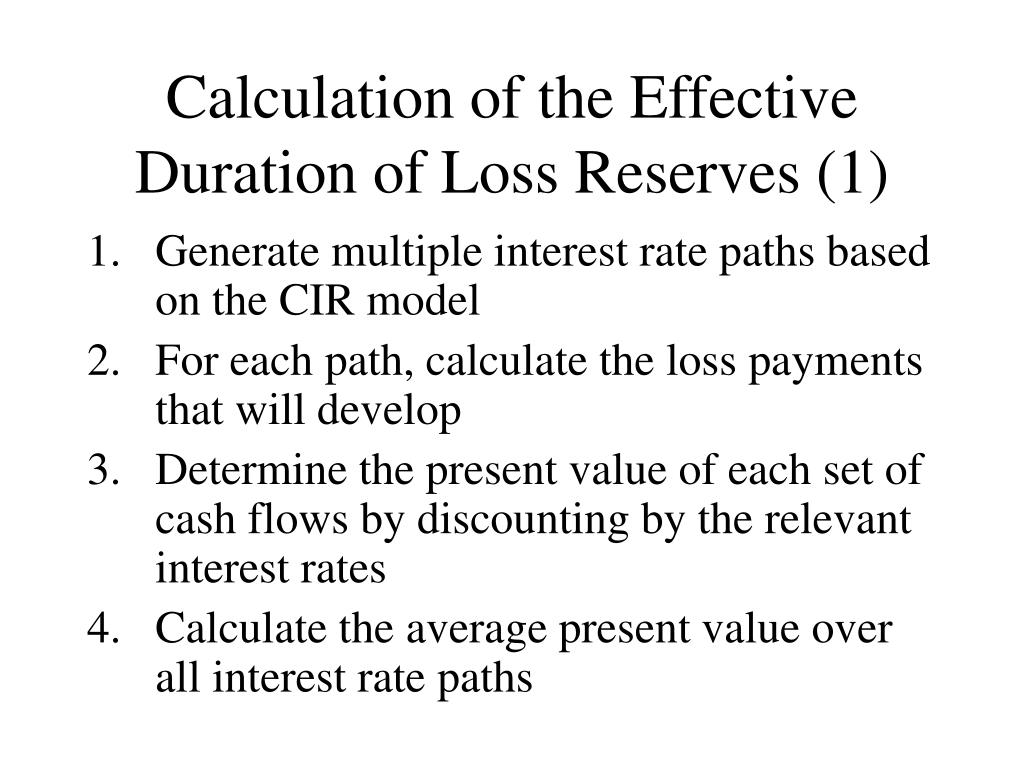

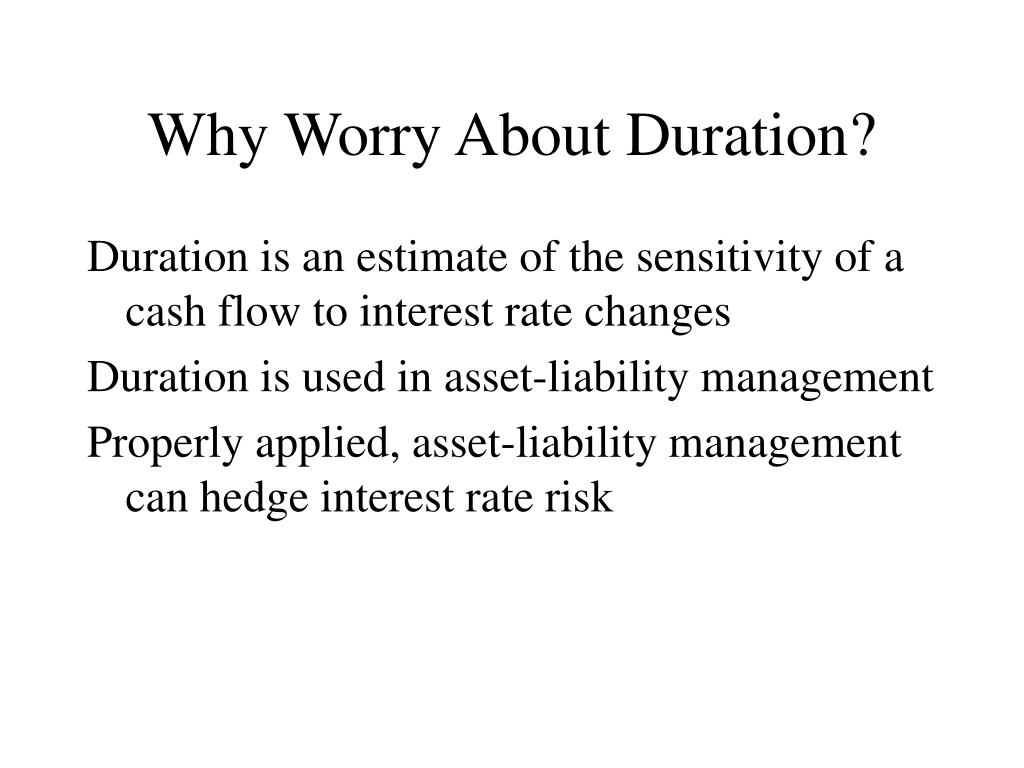

We understand that certain credit events can impact your rate negatively, but may not entirely reflect how risky you are (like divorce, for example). The current filing is for annual certification of the rates. This measure specifically reflects the fact that the cash flows can change as interest rates change (fabozzi 1995). The real effective exchange rate is a measure of the relative strength of a nation�s currency. Reversals in the age of roof factors, with a rate change of +8.8% effective for new business on september 1, 2021.

Source: ncbase.org

Source: ncbase.org

The american rescue plan has made some important changes to health insurance subsidies, which continue to be in effect for 2022 coverage: This new single 4% insurance premium tax rate applies to all insurance premiums, with no additional rate for property and fire coverage. We understand that certain credit events can impact your rate negatively, but may not entirely reflect how risky you are (like divorce, for example). Reversals in the age of roof factors, with a rate change of +8.8% effective for new business on september 1, 2021. On your companies’ letterhead via fax.

Source: propertycasualty360.com

Source: propertycasualty360.com

On your companies’ letterhead via fax. Effective coverage reviews your insurance score and helps to get you an affordable policy in no time. The income cap (normally 400% of the poverty level) for subsidy eligibility has been eliminated through the end of 2022. Your age plays a major role in the rate you’ll pay for car insurance: Premium rates for older age bands of options b and c will

Source: goldenagemarketing.com

Source: goldenagemarketing.com

The american rescue plan has made some important changes to health insurance subsidies, which continue to be in effect for 2022 coverage: Insurance premiums by credit history Most premium rates for option a, option b, and option c will decrease. Auto premiums often start dropping after you turn 25. The income cap (normally 400% of the poverty level) for subsidy eligibility has been eliminated through the end of 2022.

Source: icbc.com

Some panels you can send your request via email and others have a more formal process; Drivers 24 years of age and under often pay the highest insurance rates. The income cap (normally 400% of the poverty level) for subsidy eligibility has been eliminated through the end of 2022. Effective october 1, 2021, fegli premium rates will change for some types of coverage. The current filing is for annual certification of the rates.

Source: payroll.intuit.com

Source: payroll.intuit.com

Fallen, the valuation interest rate is reducing from 3.5% to 3% for new business effective january 1, 2021. Yukon�s 2020 budget increased its insurance premium tax to 4% (from 2% and an additional 1% tax rate for property and fire coverage) effective january 1, 2021. People with income above 400% of the poverty level can qualify for a premium subsidy if. This measure specifically reflects the fact that the cash flows can change as interest rates change (fabozzi 1995). Typically, drivers in their 40s and 50s pay the lowest rates.

Source: postal-reporter.com

Source: postal-reporter.com

This will soften the impact of any rate change. Individual rate changes currently are subject to a 10% cap, excluding coverage changes, mitigation adjustments, rate changes for sinkhole loss coverage, assessments and. Some panels you can send your request via email and others have a more formal process; Effective coverage reviews your insurance score and helps to get you an affordable policy in no time. Again, use simple sentences which are direct to the point.

Source: republictitle.com

Source: republictitle.com

Reversals in the age of roof factors, with a rate change of +8.8% effective for new business on september 1, 2021. Insurance premiums by credit history Notice of assessment rate change effective january 1, 2022 to: “territorial rating,” as the method is known, is used in most states to calculate a base rate used as the starting point for drivers buying insurance. There’s no need for sad stories.

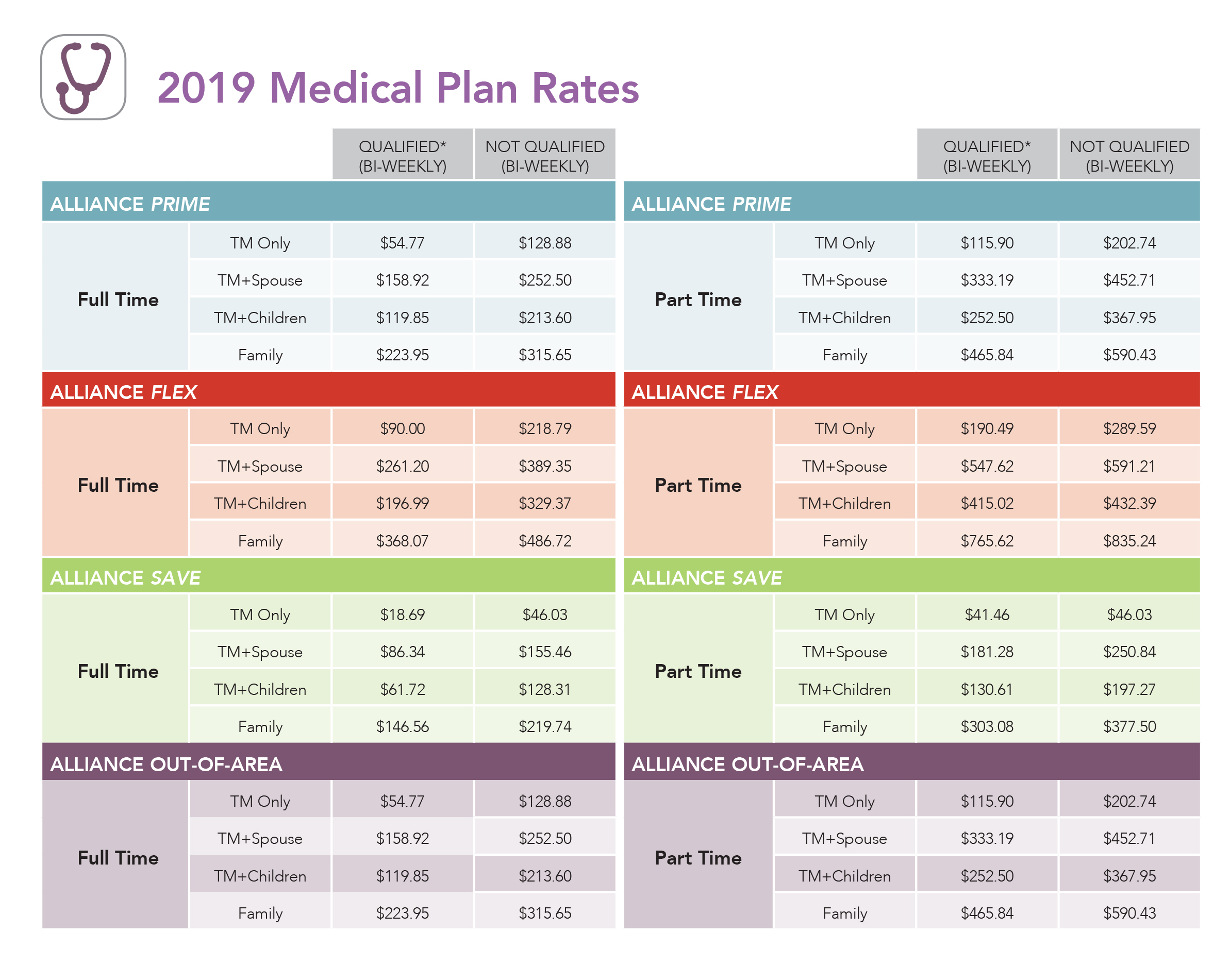

Source: rsfbenefits.com

Source: rsfbenefits.com

One way you may want to employ when increasing your rate is by adding more value to the services you offer. This measure specifically reflects the fact that the cash flows can change as interest rates change (fabozzi 1995). The difference in car insurance rates between drivers with the lowest level of credit and the highest is over $1,500 annually. One way you may want to employ when increasing your rate is by adding more value to the services you offer. Your age plays a major role in the rate you’ll pay for car insurance:

Source: news.onlineautoinsurance.com

Source: news.onlineautoinsurance.com

What is the real effective change rate? We understand that certain credit events can impact your rate negatively, but may not entirely reflect how risky you are (like divorce, for example). The maximum life insurance nonforfeiture interest rate is based on the average Individual rate changes currently are subject to a 10% cap, excluding coverage changes, mitigation adjustments, rate changes for sinkhole loss coverage, assessments and. This will soften the impact of any rate change.

Source: homeinsuranceking.com

Source: homeinsuranceking.com

Most premium rates for option a, option b, and option c will decrease. Justify your increase with a simple phrase but don’t spend too much time on it. While both individuals could say they�re in the 25% bracket, the one with the higher income has an effective tax rate of 18% ($90,000 in tax. Differences in accident and theft claims for different regions within the same city account for dramatic rate changes from zip code to. “territorial rating,” as the method is known, is used in most states to calculate a base rate used as the starting point for drivers buying insurance.

Source: gulfportschools.org

Justify your increase with a simple phrase but don’t spend too much time on it. A measure termed effective duration has been developed to express the sensitivity of the present value of the expected cash flows with respect to interest rate changes; The american rescue plan has made some important changes to health insurance subsidies, which continue to be in effect for 2022 coverage: Compare rates the differences in premiums are even greater if you smoke. “territorial rating,” as the method is known, is used in most states to calculate a base rate used as the starting point for drivers buying insurance.

Source: postal-reporter.com

Source: postal-reporter.com

Reversals in the age of roof factors, with a rate change of +8.8% effective for new business on september 1, 2021. Differences in accident and theft claims for different regions within the same city account for dramatic rate changes from zip code to. Your age plays a major role in the rate you’ll pay for car insurance: Again, use simple sentences which are direct to the point. Compare rates the differences in premiums are even greater if you smoke.

Source: heritage.org

Source: heritage.org

“territorial rating,” as the method is known, is used in most states to calculate a base rate used as the starting point for drivers buying insurance. Auto premiums often start dropping after you turn 25. The current filing is for annual certification of the rates. Some panels you can send your request via email and others have a more formal process; On your companies’ letterhead via fax.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title effective rate change insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.