Your Economic impact on insurance industry images are ready. Economic impact on insurance industry are a topic that is being searched for and liked by netizens today. You can Get the Economic impact on insurance industry files here. Get all free images.

If you’re searching for economic impact on insurance industry images information linked to the economic impact on insurance industry keyword, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Economic Impact On Insurance Industry. C (2011), insurance market activity and economic growth: The insurance industry prices products based on past loss experience, relying on statistics and probabilities. The impact of insurance activities on economic. Like most other industries affected by the pandemic, insurance companies have been forced to consider how they operate and to focus on becoming more agile and digital.

Blockchain in insurance from theory to reality From blog.accubits.com

Blockchain in insurance from theory to reality From blog.accubits.com

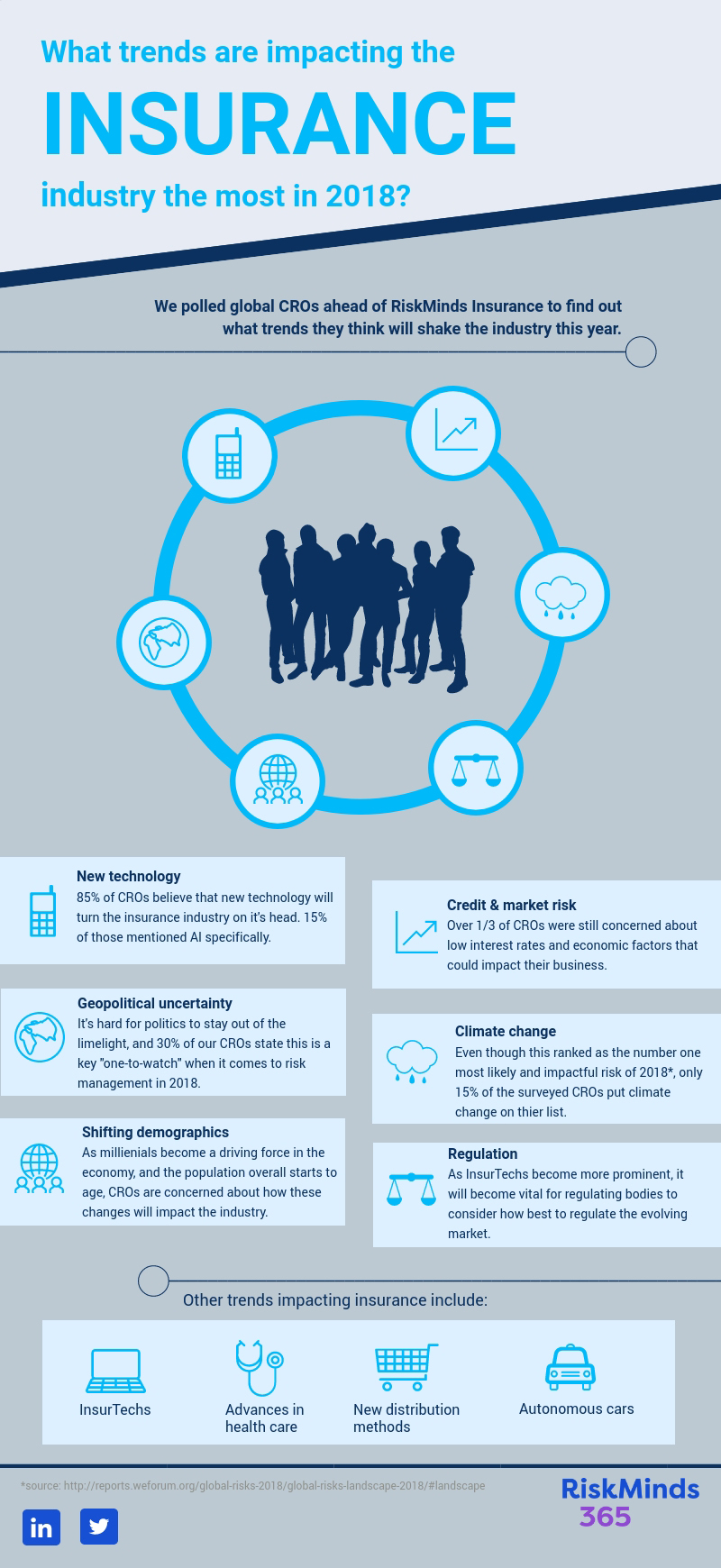

Economic factors affecting insurance industry can either enhance or hinder the thriving of insurance firms. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. • stricter regulatory oversight and new reporting requirements will force insurers to rethink how they manage performance and tell their story to capital markets. The insurance industry has not escaped its impact but insurers have responded quickly to the crisis. Suggests for the insurance industry.”. Like most other industries affected by the pandemic, insurance companies have been forced to consider how they operate and to focus on becoming more agile and digital.

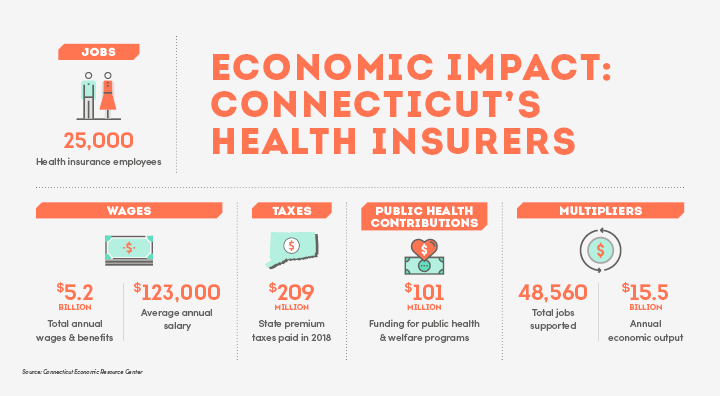

Economic impact of insurance industry on state of illinois:

Insurance companies help finance economic development projects. The insurance industry has not escaped its impact but insurers have responded quickly to the crisis. Overall, global premiums are expected to rise by +5.1%. Have more than $1.4 trillion invested in the economy. In 2018, the total annual profit of the insurance industry was gh ȼ202 million while total premium was gh ȼ2.9 billion. The economic significance of insurance markets in developing countries.

Source: youtube.com

Source: youtube.com

The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector. Insurance companies help finance economic development projects. The impact of insurance activities on economic. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability.

Source: cbia.com

Source: cbia.com

The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector. Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. Overall, global premiums are expected to rise by +5.1%. As the broader economy recovers and responds to the pandemic, insurers. The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector.

Source: informaconnect.com

Source: informaconnect.com

Keeping this important industry operating is another way insurance positively contributes to the economy. Some examples affecting the insurance industry are obvious (for example, climate change) and others can arise from developments in other sectors (such as autonomous vehicles). Empirical validation in the tunisian context. Insurance companies help finance economic development projects. Keeping this important industry operating is another way insurance positively contributes to the economy.

Source: tomorrowmakers.com

Source: tomorrowmakers.com

The average daily benefit paid by life insurers is gh ȼ1.9 million and average daily claim is gh ȼ1.1 million. In 2018, the total annual profit of the insurance industry was gh ȼ202 million while total premium was gh ȼ2.9 billion. Suggests for the insurance industry.”. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. A key indicator of a healthy economy is reflected through its gdp growth.

Source: blog.accubits.com

Source: blog.accubits.com

• the insurance industry suffered far less economic and reputational damage than many observers initially feared in the first days of the pandemic. The sharing economy serves as a technology marketplace to match users and providers for goods and services. Economic factors affecting insurance industry can either enhance or hinder the thriving of insurance firms. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. This new economy is growing at a tremendous pace and creating challenging demands on the insurance industry.

Source: mn.gov

The insurance industry prices products based on past loss experience, relying on statistics and probabilities. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. Thus, if the economy is not doing well, the insurance sector will. Keeping this important industry operating is another way insurance positively contributes to the economy. Insurance has a real effect on the global economy, of course, through the sheer

Source: xprimm.com

Source: xprimm.com

It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. Insurers pay claims whenever there is a covered loss described in the insurance contract. C (2011), insurance market activity and economic growth: The average daily benefit paid by life insurers is gh ȼ1.9 million and average daily claim is gh ȼ1.1 million. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month)

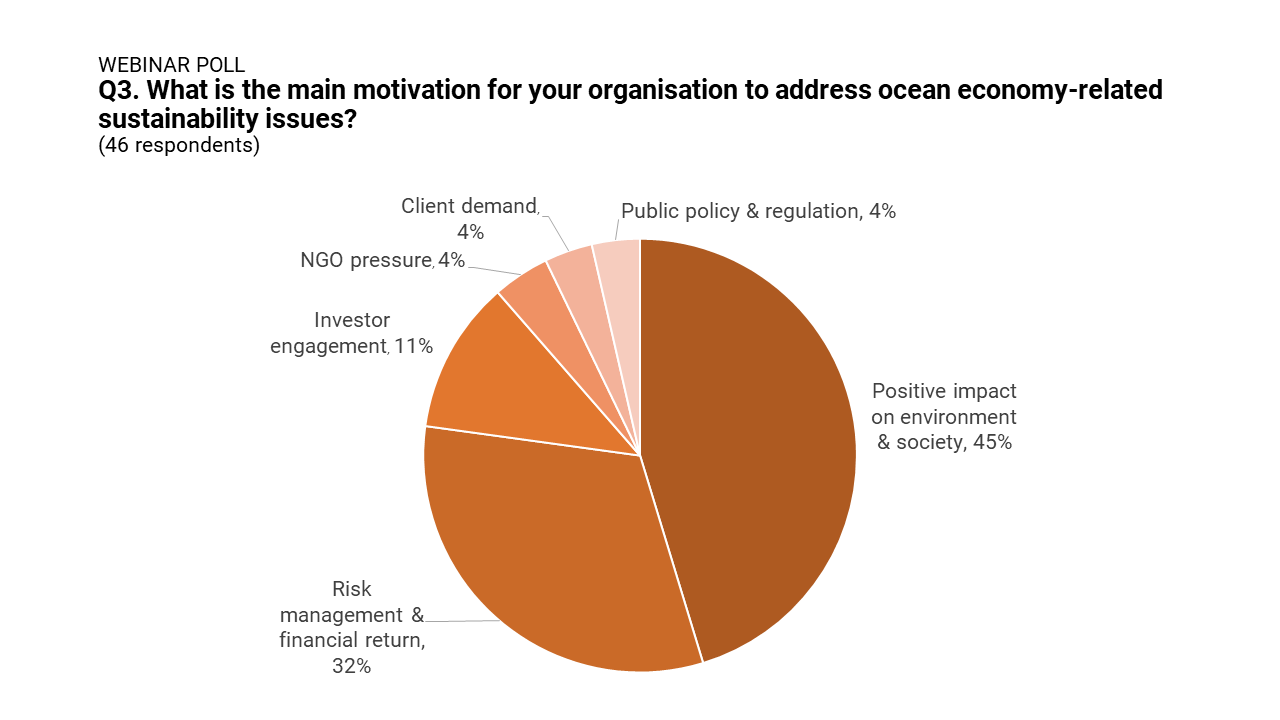

Source: unepfi.org

Source: unepfi.org

The sharing economy serves as a technology marketplace to match users and providers for goods and services. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. Like most other industries affected by the pandemic, insurance companies have been forced to consider how they operate and to focus on becoming more agile and digital. Thus, if the economy is not doing well, the insurance sector will. This new economy is growing at a tremendous pace and creating challenging demands on the insurance industry.

Source: globaldata.com

Source: globaldata.com

The insurance industry has not escaped its impact but insurers have responded quickly to the crisis. It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. Insurance companies help finance economic development projects. Impact on global economicgrowth higher likelihoodof event oct �18 forecast. In 2018, the total annual profit of the insurance industry was gh ȼ202 million while total premium was gh ȼ2.9 billion.

Source: ig.com

Source: ig.com

Insurance companies help finance economic development projects. • stricter regulatory oversight and new reporting requirements will force insurers to rethink how they manage performance and tell their story to capital markets. This new economy is growing at a tremendous pace and creating challenging demands on the insurance industry. The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector. Insurance companies help finance economic development projects.

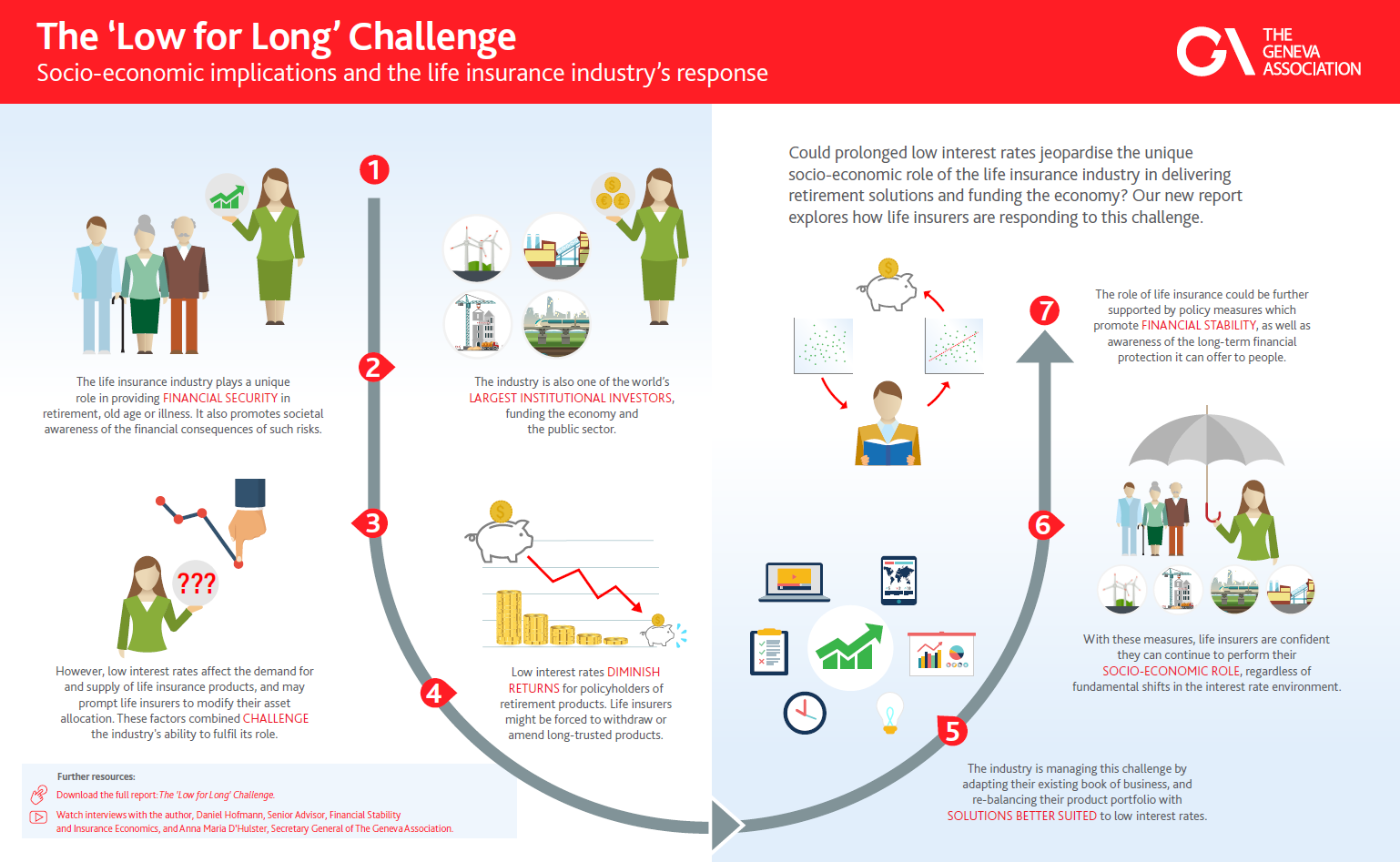

Source: genevaassociation.org

Source: genevaassociation.org

• the insurance industry suffered far less economic and reputational damage than many observers initially feared in the first days of the pandemic. 2016 study the illinois insurance industry is exceptionally robust and competitive. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Unsurprisingly, the us (+5.3%) and china (+13.4%) are likely to be the two growth engines. The importance of the insurance industry for an economy can only in part be measured by the sheer size of its business, the number of its employees in a given country, the assets under management, or its contribution to the national gdp.

Source: cbia.com

Source: cbia.com

The determinants of bank insurance: Some examples affecting the insurance industry are obvious (for example, climate change) and others can arise from developments in other sectors (such as autonomous vehicles). Currently, the insurance industry pays a total cooperate tax of gh ȼ36 million. In fact, the insurance industry relies on the economy for its survival. C (2011), insurance market activity and economic growth:

Source: amateurearthling.org

Source: amateurearthling.org

It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. But insurance is not just about employment and the financial compensation of victims. Impact on global economicgrowth higher likelihoodof event oct �18 forecast. Overall, global premiums are expected to rise by +5.1%. Economic impact of insurance industry on state of illinois:

Source: researchgate.net

Source: researchgate.net

2016 study the illinois insurance industry is exceptionally robust and competitive. Environmental change brings uncertainty and ambiguity into this historical pricing. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) The 28 page complete study can be found at www.katieschoolstudies.org The importance of the insurance industry for an economy can only in part be measured by the sheer size of its business, the number of its employees in a given country, the assets under management, or its contribution to the national gdp.

Source: slideshare.net

Source: slideshare.net

Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Insurers pay claims whenever there is a covered loss described in the insurance contract. Economic factors affecting insurance industry can either enhance or hinder the thriving of insurance firms. A key indicator of a healthy economy is reflected through its gdp growth.

Source: slideshare.net

Source: slideshare.net

As of 2015, there were 192 property/ casualty insurers, 39 life insurers, and 40 health insurers domiciled in illinois. It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. Some may appear suddenly (such as the emergence of the zika virus), while others may slowly evolve over time (for example, the impact of robotics on employment levels). Thus, if the economy is not doing well, the insurance sector will.

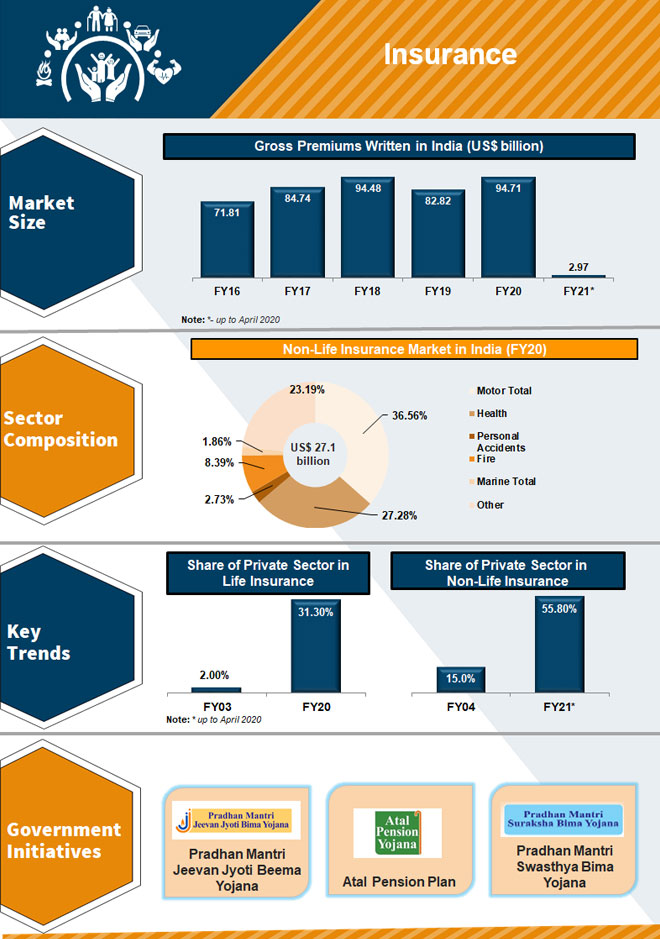

Source: ibef.org

Source: ibef.org

Unsurprisingly, the us (+5.3%) and china (+13.4%) are likely to be the two growth engines. The average daily benefit paid by life insurers is gh ȼ1.9 million and average daily claim is gh ȼ1.1 million. Have more than $1.4 trillion invested in the economy. Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month)

Source: slideshare.net

Source: slideshare.net

The determinants of bank insurance: Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. • stricter regulatory oversight and new reporting requirements will force insurers to rethink how they manage performance and tell their story to capital markets. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. This new economy is growing at a tremendous pace and creating challenging demands on the insurance industry.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title economic impact on insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.