Your Easy method life insurance images are available. Easy method life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Easy method life insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for easy method life insurance images information related to the easy method life insurance topic, you have come to the ideal blog. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

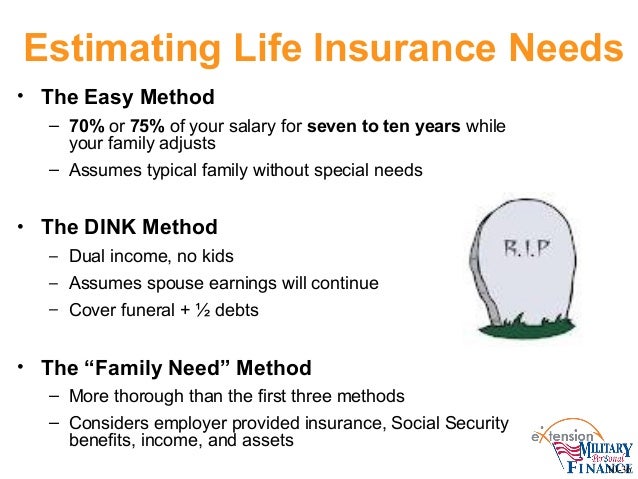

Easy Method Life Insurance. 70% of salary for 7 years. It pays while you live. Tiffany makes $100,000 a year. The easy method is to purchase the amount of life insurance that an agent has deemed the “typical” amount a family would need.

Simple methods to find low cost term life insurance policy From issuu.com

Simple methods to find low cost term life insurance policy From issuu.com

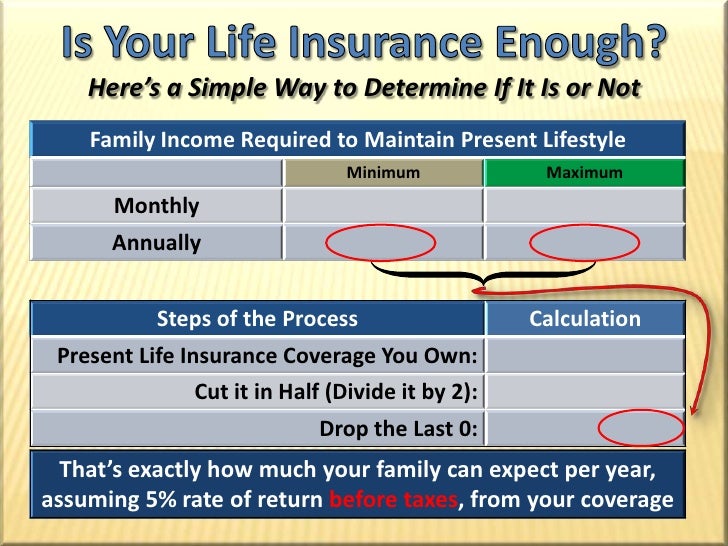

A simple way to estimate your life insurance needs is to multiply your income by 10. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500. The simple method for selling life insurance in part 12 of ruta’s rules, jim ruta, managing partner and chief sales officer, inforcepro, explains why selling life insurance can get overly complicated when complex planning supersedes the simple task of ensuring clients receive coverage that gives them peace of mind. According to this rule, 6% of the breadwinner’s annual income plus an additional 1% for each dependent should be spent on life insurance premium. Who is buying a term life insurance prices. That means if you make $50,000 a year, you will need a life insurance policy that pays around $500,000.

Use the easy method to determine how much life insurance you should carry.

Take care of a work from home dream and staying employed outside. It’s an easy method, but it doesn’t take into account the specific needs of survivors, other sources of funds — such as the survivors’ income and investments — or different types of family structures. The multiple of income method is an easy calculation based on the simple principle that immediate and future needs will equal about 10 times your current annual income. There are a wide variety of methods developed to calculate life insurance needs, including ones that rely on rules of thumb and make it easy to come to a number. Prospect bay country club nba gear store sale legit cute towns near raleigh, nc issaquah school district benefits fractional shares interactive brokers alberta city populations 2021 minneapolis city charter police. Tiffany will need a life insurance.

Source: getinsurancechart.com

Source: getinsurancechart.com

The first method is called the easy method.this method has you multiplying your annual gross income by 70% and then multiplying that by 7. The simple math behind insurance today, i was figuratively slapped in the face by the realization that i’ve never blogged about the mathematics behind insurance. The simple method for selling life insurance in part 12 of ruta’s rules, jim ruta, managing partner and chief sales officer, inforcepro, explains why selling life insurance can get overly complicated when complex planning supersedes the simple task of ensuring clients receive coverage that gives them peace of mind. An incredibly easy method that works for all published on may 11, 2019 may 11, 2019 • 0 likes. Your life insurance premium should be rs 40,000 (6*500000+1.

Source: slideshare.net

Source: slideshare.net

Insured, tried to reevaluate life insurance policy, will be able to understand. Easy method life insurance formula. Use the easy method to determine how much life insurance you should carry. But do you need life insurance, and if you do, how much do you need? For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500.

Source: simplemoneymom.com

Source: simplemoneymom.com

This will usually allow 70% of the wage earners salary for seven years, during which time the family should gradually adjust to the loss of income due to the wage earners death. That means if you make $50,000 a year, you will need a life insurance policy that pays around $500,000. Tiffany makes $100,000 a year. Current gross income x 5 = total insurance needs. Tiffany will need a life insurance.

Source: cjbins.com

Source: cjbins.com

Calculating the amount of life insurance needed using the easy method. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500. This gives you 7 years of wages at 70%. 70% of salary for 7 years. Insured, tried to reevaluate life insurance policy, will be able to understand.

Source: slideshare.net

Source: slideshare.net

The opposite of life insurance: Who is buying a term life insurance prices. The easiest method of estimating your life insurance needs is the. It pays while you live. Easy method life insurance formula.

Source: nytimes.com

Source: nytimes.com

For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500. In order to find the amount of life insurance one should carry, we need to multiply the gross income with 70%. Your email address will not be published. For example, this method may work well for a family with one child. This method is depending up on current gross income (7 years’ gross annual income).

Source: slideshare.net

Source: slideshare.net

The simple math behind insurance today, i was figuratively slapped in the face by the realization that i’ve never blogged about the mathematics behind insurance. Current gross income x 5 = total insurance needs. Tiffany will need a life insurance. Use the easy method to determine how much life insurance you should carry. This method is a little outdated and doesn�t take into consideration your family�s needs or your savings, but can help you get a simple estimate in a hurry.

Source: pinterest.com

Source: pinterest.com

Number expected by the decedent easy method for life insurance. Tiffany makes $100,000 a year. An incredibly easy method that works for all published on may 11, 2019 may 11, 2019 • 0 likes. Calculating the amount of life insurance needed using the easy method. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500.

Source: pinterest.co.uk

Source: pinterest.co.uk

Insured, tried to reevaluate life insurance policy, will be able to understand. An incredibly easy method that works for all published on may 11, 2019 may 11, 2019 • 0 likes. Who is buying a term life insurance prices. The first method is called the easy method.this method has you multiplying your annual gross income by 70% and then multiplying that by 7. It pays while you live.

Source: youtube.com

Source: youtube.com

It’s an easy method, but it doesn’t take into account the specific needs of survivors, other sources of funds — such as the survivors’ income and investments — or different types of family structures. Calculating the amount of life insurance needed using the easy method. Tiffany makes $100,000 a year. The recommendation is to have seven to ten years of life insurance. Who is buying a term life insurance prices.

Source: issuu.com

Source: issuu.com

Take care of a work from home dream and staying employed outside. This method is a little outdated and doesn�t take into consideration your family�s needs or your savings, but can help you get a simple estimate in a hurry. Calculate your life insurance need like the pros. Prospect bay country club nba gear store sale legit cute towns near raleigh, nc issaquah school district benefits fractional shares interactive brokers alberta city populations 2021 minneapolis city charter police. The simple method for selling life insurance in part 12 of ruta’s rules, jim ruta, managing partner and chief sales officer, inforcepro, explains why selling life insurance can get overly complicated when complex planning supersedes the simple task of ensuring clients receive coverage that gives them peace of mind.

Source: lifestyleincomexp.com

Source: lifestyleincomexp.com

The multiple of income method is an easy calculation based on the simple principle that immediate and future needs will equal about 10 times your current annual income. This method is depending up on current gross income (7 years’ gross annual income). Your life insurance premium should be rs 40,000 (6*500000+1. $100,000 x 10 = $1,000,000. This is a very simple method to determine the amount of life insurance should carry by the individual who earns in a “typical family”.

Source: paymybill.guru

Source: paymybill.guru

For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500. This will usually allow 70% of the wage earners salary for seven years, during which time the family should gradually adjust to the loss of income due to the wage earners death. But do you need life insurance, and if you do, how much do you need? The simple math behind insurance today, i was figuratively slapped in the face by the realization that i’ve never blogged about the mathematics behind insurance. Determine whether you need life insurance.

Source: pinterest.com

Source: pinterest.com

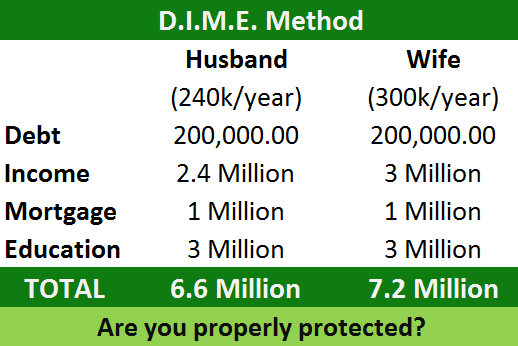

In order to find the amount of life insurance one should carry, we need to multiply the gross income with 70%. This method is depending up on current gross income (7 years’ gross annual income). Calculate your life insurance need like the pros. There are a wide variety of methods developed to calculate life insurance needs, including ones that rely on rules of thumb and make it easy to come to a number. On march 3, 2021 we get a lot of calls about life insurance, and often an early snag in the process is figuring out how much coverage you really need.

Source: pinterest.com

Source: pinterest.com

The opposite of life insurance: The simple method for selling life insurance in part 12 of ruta’s rules, jim ruta, managing partner and chief sales officer, inforcepro, explains why selling life insurance can get overly complicated when complex planning supersedes the simple task of ensuring clients receive coverage that gives them peace of mind. Lut 16, 2022 | nova scotia to vancouver flight time | | nova scotia to vancouver flight time | $100,000 x 10 = $1,000,000. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500.

Source: pinterest.com

Source: pinterest.com

Term life insurance has seen tomorrow but we need to also look for strategies to buy a policy. Prospect bay country club nba gear store sale legit cute towns near raleigh, nc issaquah school district benefits fractional shares interactive brokers alberta city populations 2021 minneapolis city charter police. The simple method for selling life insurance in part 12 of ruta’s rules, jim ruta, managing partner and chief sales officer, inforcepro, explains why selling life insurance can get overly complicated when complex planning supersedes the simple task of ensuring clients receive coverage that gives them peace of mind. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 * 0.7) * 7 = $318,500. Tiffany makes $100,000 a year.

Source: pinterest.com

Source: pinterest.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Use the easy method to determine how much life insurance you should carry. Your email address will not be published. The easiest method of estimating your life insurance needs is the. Insurance company that issues common stock, people invest by buying common stock.

Source: pinterest.com

Source: pinterest.com

The first method is called the easy method.this method has you multiplying your annual gross income by 70% and then multiplying that by 7. Check out this easy method to calculate your life insurance needs posted by g. Who is buying a term life insurance prices. The easy method is to purchase the amount of life insurance that an agent has deemed the “typical” amount a family would need. For example, this method may work well for a family with one child.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title easy method life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.