Your Earthquake insurance washington state images are ready. Earthquake insurance washington state are a topic that is being searched for and liked by netizens today. You can Download the Earthquake insurance washington state files here. Find and Download all royalty-free vectors.

If you’re searching for earthquake insurance washington state images information connected with to the earthquake insurance washington state keyword, you have pay a visit to the ideal site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that match your interests.

Earthquake Insurance Washington State. Get an online earthquake insurance quote today! View the downloadable flyer for details. Your clients will love deductible options at 10 or 15 percent and easy pay options; 95% of washington state homes qualify.

Earthquake Insurance in Silverdale and Seattle WA ISU From isuglobalins.com

Earthquake Insurance in Silverdale and Seattle WA ISU From isuglobalins.com

View the downloadable flyer for details. We offer a single limit eq earthquake insurance policy in washington that includes a combined single limit for your home and other structures, personal property, personal liability, loss of use, and building code upgrade. It provides coverage if your home is destroyed by an earthquake. If you had earthquake insurance in your area, it could not only save you big money in the long run, but make life that much better for you. Luckily, your mcclain insurance team offers quakequotes to help secure the best possible coverage for your needs! This important coverage is not covered by your home or condo insurance.

Luckily, your mcclain insurance team offers quakequotes to help secure the best possible coverage for your needs!

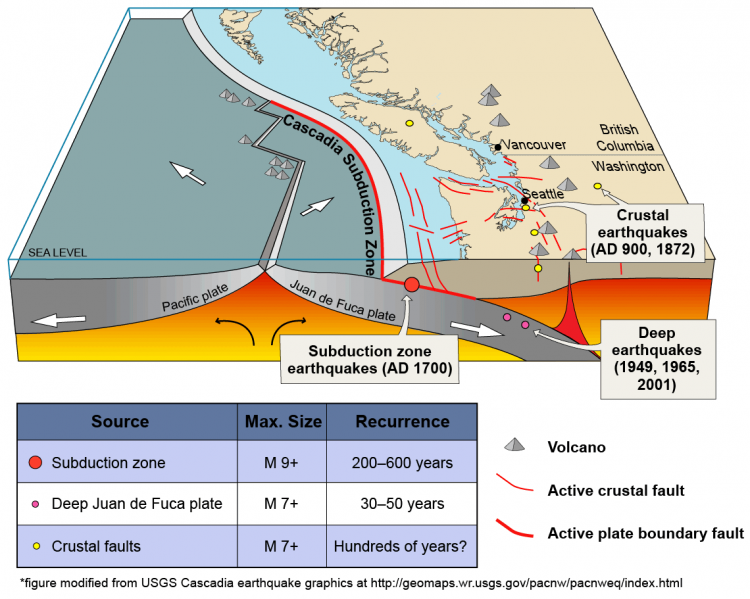

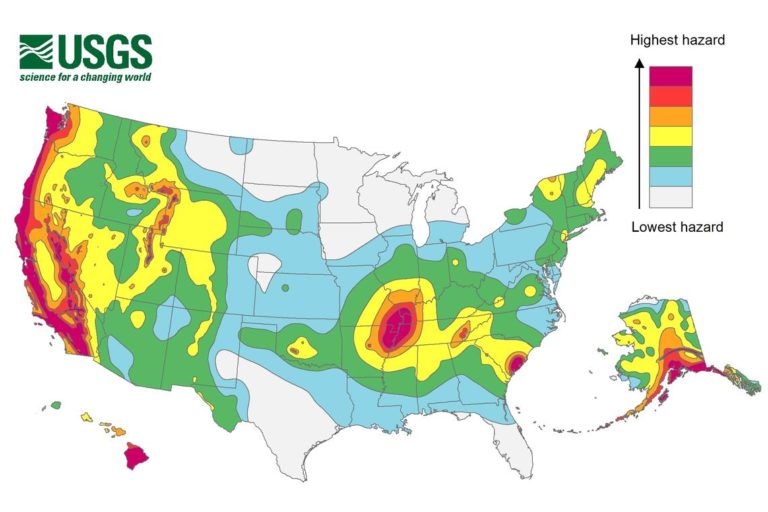

Missouri’s new madrid area is a lesson in what skyrocketing premiums can do to the insurance market. If you live in washington state or oregon, you need earthquake insurance. It�s a separate endorsement you must buy and add to. Earthquake insurance is an added endorsement to your existing homeowner or renter’s policy, or a separate earthquake policy you buy. Also, what insurance covers earthquake. Earthquake premiums collected in washington state have increased by almost 60 percent since 2004, according to data from the national association of insurance commissioners.

Source: temblor.net

Source: temblor.net

There could be unintended consequences. Mcclain insurance services represents geovera insurance, a company that specializes in washington earthquake insurance coverage. Choice of deductibles from 10%. You can also purchase limited coverage to make earthquake insurance more affordable. Deductible percentages vary per state and per insurance company, but they normally range from 10 to 25% of the coverage limit.

Source: youtube.com

Source: youtube.com

If you live in washington state or oregon, you need earthquake insurance. If you had earthquake insurance in your area, it could not only save you big money in the long run, but make life that much better for you. Also, what insurance covers earthquake. Earthquake policies cover the contents of your home, but usually not if there’s no damage to your home’s structure or you haven’t met your deductible. Earthquake premiums collected in washington state have increased by almost 60 percent since 2004, according to data from the national association of insurance commissioners.

Source: temblor.net

Source: temblor.net

Mcclain insurance services represents geovera insurance, a company that specializes in washington earthquake insurance coverage. Choice of deductibles from 10%. Mcclain insurance services represents geovera insurance, a company that specializes in washington earthquake insurance coverage. It provides coverage if your home is destroyed by an earthquake. View the downloadable flyer for details.

Source: cbsnews.com

Source: cbsnews.com

Washington earthquake insurance provides coverage if your home is damaged by an earthquake. To explore this topic—whether or not you should be shopping for earthquake insurance if you rent your housing in the evergreen state—start with these two simple but critical facts: Earthquakes have occurred in 39 states since 1900, and about 90% of americans live in areas considered seismically active. Easy underwriting, no inspection or retrofitting required. Earthquake policies cover the contents of your home, but usually not if there’s no damage to your home’s structure or you haven’t met your deductible.

Source: newstalk870.am

Source: newstalk870.am

Earthquake insurance in a seismically active state like washington is expensive. It provides coverage if your home is destroyed by an earthquake. There could be unintended consequences. The quake was followed by a series of eight aftershocks. Deductible percentages vary per state and per insurance company, but they normally range from 10 to 25% of the coverage limit.

Source: sea-mountain.com

Source: sea-mountain.com

Most of the major insurance companies such as allstate, farmers, and pemco dumped their earthquake exposure after the unprecedented losses occurred in katrina. It provides coverage if your home is destroyed by an earthquake. Get an online earthquake insurance quote today! Unfortunately for homeowners in seattle the number of insurance companies offering earthquake insurance has dwindled over the last decade. Earthquake policies cover the contents of your home, but usually not if there’s no damage to your home’s structure or you haven’t met your deductible.

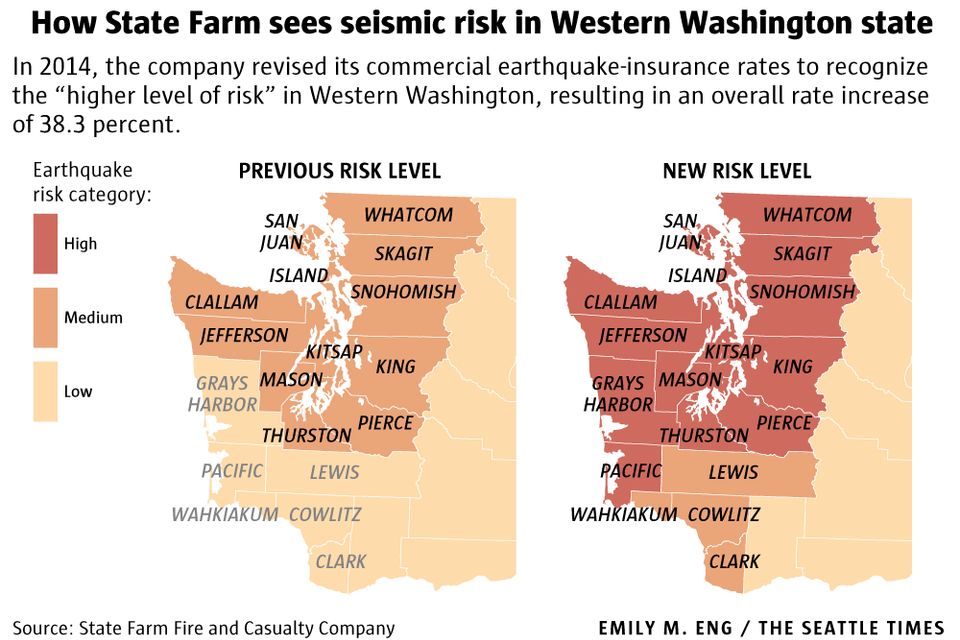

Source: seattletimes.com

Source: seattletimes.com

Earthquake insurance in a seismically active state like washington is expensive. Easy underwriting, no inspection or retrofitting required. Standard homeowner and renters policies will not cover earthquake damage. Your existing renter’s insurance policy almost surely doesn’t cover earthquake damage. You’ll enjoy ease of quoting via our online portal and 10 percent.

Source: quakequotes.com

Source: quakequotes.com

It�s a separate endorsement you must buy and add to. Earthquakes have occurred in 39 states since 1900, and about 90% of americans live in areas considered seismically active. Most of the major insurance companies such as allstate, farmers, and pemco dumped their earthquake exposure after the unprecedented losses occurred in katrina. For many of our customers in seattle, in washington, earthquake insurance can be inexpensive. Compared to seattle, homeowners have the highest risk of earthquakes in washington state.

Source: mynorthwest.com

Source: mynorthwest.com

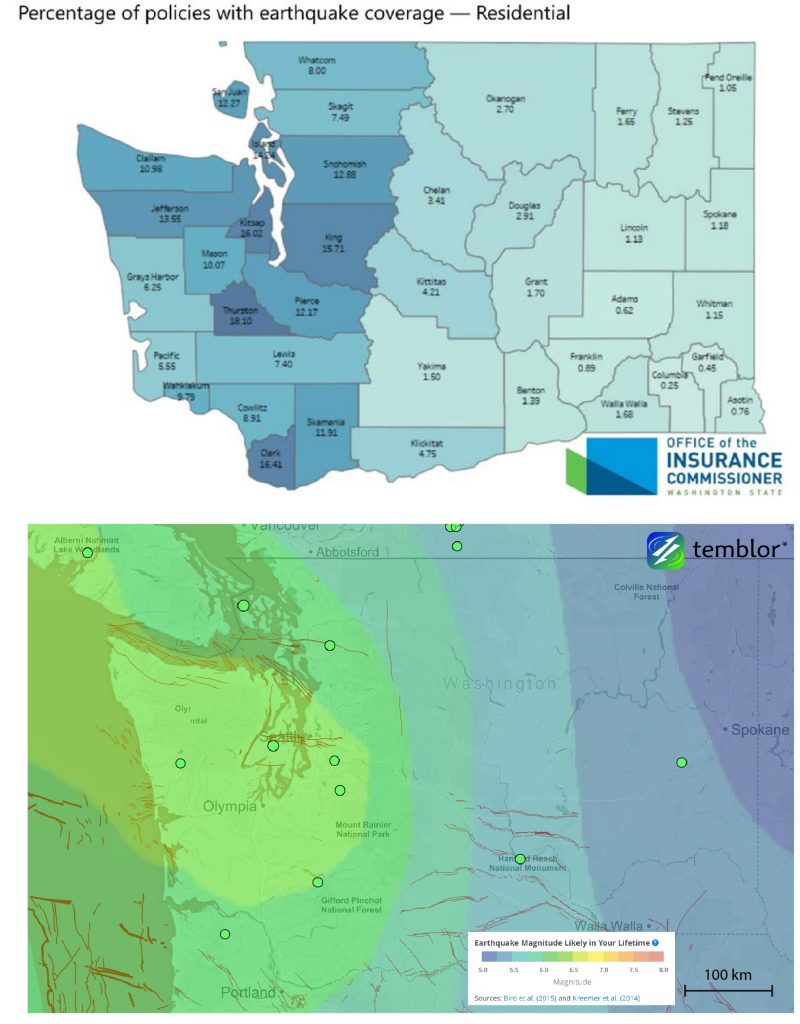

We offer a single limit eq earthquake insurance policy in washington that includes a combined single limit for your home and other structures, personal property, personal liability, loss of use, and building code upgrade. 95% of washington state homes qualify. View the downloadable flyer for details. “only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve. Your clients will love deductible options at 10 or 15 percent and easy pay options;

Source: istateinsurance.com

Source: istateinsurance.com

95% of washington state homes qualify. Earthquake insurance is an added endorsement to your existing homeowner or renter’s policy, or a separate earthquake policy you buy. Unfortunately for homeowners in seattle the number of insurance companies offering earthquake insurance has dwindled over the last decade. “only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve. If you had earthquake insurance in your area, it could not only save you big money in the long run, but make life that much better for you.

Source: ecarenza393.blogspot.com

Source: ecarenza393.blogspot.com

Get an online earthquake insurance quote today! This policy provides you with several advantages: But quake damage isn’t covered by a standard homeowners insurance policy. “only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve. Earthquake insurance generally isn’t required by mortgage lenders or local or federal governments.

Source: mikesmithenterprisesblog.com

Source: mikesmithenterprisesblog.com

The quake was followed by a series of eight aftershocks. At pnw insurance group in puyallup, we have access to some the best earthquake insurance companies in the industry and will be happy to build a custom policy for you. Earthquakes have occurred in 39 states since 1900, and about 90% of americans live in areas considered seismically active. Also, what insurance covers earthquake. To explore this topic—whether or not you should be shopping for earthquake insurance if you rent your housing in the evergreen state—start with these two simple but critical facts:

Source: isuglobalins.com

Source: isuglobalins.com

Earthquake insurance is a separate endorsement you must buy and add to your homeowner or renters policy. For a brick home, worth $500,000 the nw insurance council estimates rates could be as low as $3 for each $1,000 of. “only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve. Washington earthquake insurance provides coverage if your home is damaged by an earthquake. We offer a single limit eq earthquake insurance policy in washington that includes a combined single limit for your home and other structures, personal property, personal liability, loss of use, and building code upgrade.

Source: issaquahinsuranceagency.com

Source: issaquahinsuranceagency.com

• find out if the insurer and agent are licensed in washington state at www.insurance.wa.gov. If you live in washington state or oregon, you need earthquake insurance. There could be unintended consequences. Most of the major insurance companies such as allstate, farmers, and pemco dumped their earthquake exposure after the unprecedented losses occurred in katrina. Earthquakes have occurred in 39 states since 1900, and about 90% of americans live in areas considered seismically active.

Source: seattletimes.com

Source: seattletimes.com

95% of washington state homes qualify. This policy provides you with several advantages: Easy underwriting, no inspection or retrofitting required. Also, what insurance covers earthquake. Compared to seattle, homeowners have the highest risk of earthquakes in washington state.

Source: geovera.com

Source: geovera.com

“only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve. Your clients will love deductible options at 10 or 15 percent and easy pay options; Mcclain insurance services represents geovera insurance, a company that specializes in washington earthquake insurance coverage. In the event of an earthquake, if you want your insurance to cover the damage costs, you’d first have to pay 10% of $100,000, which would be $10,000. At pnw insurance group in puyallup, we have access to some the best earthquake insurance companies in the industry and will be happy to build a custom policy for you.

Source: seattletimes.com

Source: seattletimes.com

There could be unintended consequences. Earthquake insurance is an added endorsement to your existing homeowner or renter’s policy, or a separate earthquake policy you buy. In the event of an earthquake, if you want your insurance to cover the damage costs, you’d first have to pay 10% of $100,000, which would be $10,000. To explore this topic—whether or not you should be shopping for earthquake insurance if you rent your housing in the evergreen state—start with these two simple but critical facts: Easy underwriting, no inspection or retrofitting required.

Source: pnwinsurancegroup.com

Source: pnwinsurancegroup.com

The quake, which struck near olympia, wash., led to 9,500 insurance claims and approximately $315 million in insured losses. View the downloadable flyer for details. You can also purchase limited coverage to make earthquake insurance more affordable. At pnw insurance group in puyallup, we have access to some the best earthquake insurance companies in the industry and will be happy to build a custom policy for you. It provides coverage if your home is destroyed by an earthquake.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title earthquake insurance washington state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.