Your E o insurance texas images are available in this site. E o insurance texas are a topic that is being searched for and liked by netizens today. You can Get the E o insurance texas files here. Get all free images.

If you’re searching for e o insurance texas pictures information linked to the e o insurance texas topic, you have visit the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

E O Insurance Texas. E&o insurance in texas another important insurance policy offered by our firm is the errors and omissions insurance (e&o). Higher e&o limits to protect your assets, prevent claims. The package can include general liability. Find the top rated 2022 plans & save!

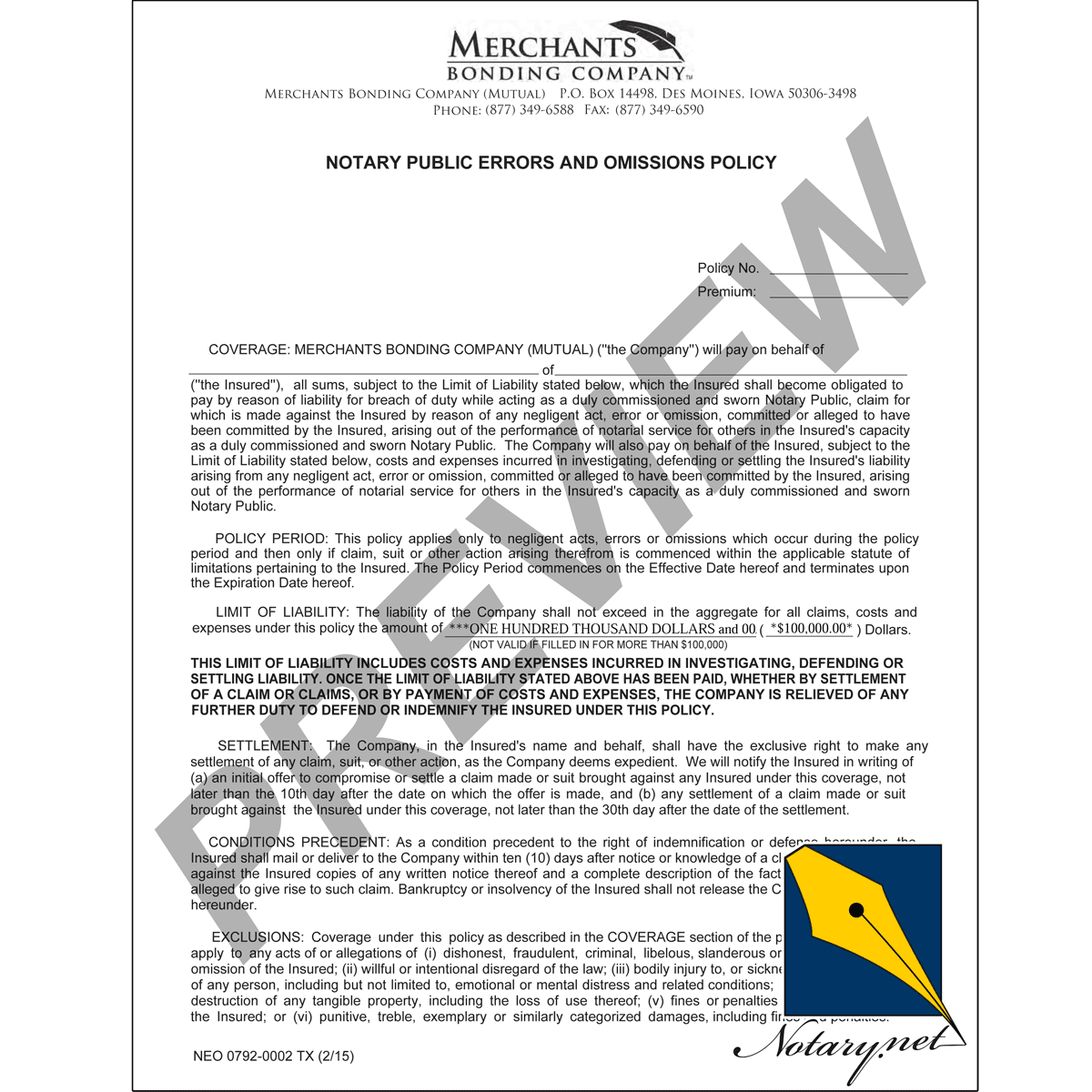

Texas Group Notary Public Errors & Omissions Insurance From notarypublicunderwriters.com

Texas Group Notary Public Errors & Omissions Insurance From notarypublicunderwriters.com

What is the importance of e&o insurance? We offer e&o insurance from various highly rated insurance companies. Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. Also known as professional liability insurance, this insurance protects your business against claims that an error was committed during provision/delivery of your professional services. Our goal is to provide you with excellent service by providing you with e&o coverage promptly at a reasonable cost. Errors and omissions (e&o) insurance provides coverage for businesses or individuals for when they are held responsible for a service provided, or failure to provide a service, that did not have the expected results.

Commercial or business property coverage, and the standard bop form.

This means, you have options. Extensive coverage up to $3 million tailored specifically for real estate. Errors and omissions insurance, or (e&o) coverage is a kind of liability insurance. Texas e&o liability insurance (professional liability insurance) protects businesses and individuals from damages and legal defense expenses caused by negligence, errors, or omissions in performing their professional duties. To purchase a policy, first enter the expiration date of your texas notary commission. Texas notary public errors & omissions insurance safeguards you from lawsuits.

Source: findwallpaper.net

Source: findwallpaper.net

Texas e&o insurance for title and escrow we offer errors and omissions (e&o) insurance to title agents, escrow agents and title abstractors in texas. Texas e&o insurance for title and escrow we offer errors and omissions (e&o) insurance to title agents, escrow agents and title abstractors in texas. The most careful of notaries can be sued for errors, whether intentional or not. Contact us today if you�d like a review or quote on your errors & omissions (e&o) insurance to make sure you�re covered. Sometimes the term is used interchangeably with “professional liability insurance” or “professional malpractice insurance”, but there are some subtle differences.

Source: idaplikasi.com

Source: idaplikasi.com

The most careful of notaries can be sued for errors, whether intentional or not. As your texas realtors® risk management e&o partner, cres gives you more value from your errors and omissions insurance: Texas notary public errors & omissions insurance safeguards you from lawsuits. Partner with iiat to get exclusive access to professional liability insurance. 8323 southwest freeway, suite 350.

Source: notary.net

Source: notary.net

Texas errors and omissions (e&o) insurance. An errors & omissions insurance policy provided to you through texas general insurance will keep you financially safe during these unavoidable situations and help you prevent the embarrassment and loss of business due to a costly claim against your texas company. Texas e&o liability insurance (professional liability insurance) protects businesses and individuals from damages and legal defense expenses caused by negligence, errors, or omissions in performing their professional duties. Notary public errors & omissions policies are underwritten by universal surety of america and jack diestelhorst, license #747874 is the licensed agent. Here are a few suggestions on what to evaluate:

Source: notaryrotary.com

Source: notaryrotary.com

For doctors, dentists, etc., it is called malpractice insurance. This e&o insurance coverage is professional liability errors and omissions for insurance agents in texas and can be purchased as a stand alone policy or as part of package. That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you. Ad see new 2022 insurance to see if you could save in texas. Contact us today if you�d like a review or quote on your errors & omissions (e&o) insurance to make sure you�re covered.

Source: suprains.com

Source: suprains.com

It can help with costly lawsuits up to the policy limit, as well as settlements out of court. Texas e & o insurance what is errors and omissions insurance? Ad see new 2022 insurance to see if you could save in texas. Where a notary bond protects the notary�s client, e & o (errors & omissions) insurance protects you (the notary). Partner with iiat to get exclusive access to professional liability insurance.

Source: insuranceforagentsonline.com

Source: insuranceforagentsonline.com

Texas errors and omissions (e&o) insurance. Ad see new 2022 insurance to see if you could save in texas. It can help with costly lawsuits up to the policy limit, as well as settlements out of court. Notary public errors & omissions policies are underwritten by universal surety of america and jack diestelhorst, license #747874 is the licensed agent. With cres e&o + claimprevent®, enjoy more coverage and services for your e&o investment:

Source: hirschinsuranceagency.com

Source: hirschinsuranceagency.com

Find the top rated 2022 plans & save! Extensive coverage up to $3 million tailored specifically for real estate. Partner with iiat to get exclusive access to professional liability insurance. Cres insurance is now a texas association of real estate licensees (tar) errors and omissions risk management partner. Ad compare the best coverage online in minutes.

Source: nationalnotary.org

Texas e&o liability insurance (professional liability insurance) protects businesses and individuals from damages and legal defense expenses caused by negligence, errors, or omissions in performing their professional duties. Errors and omissions insurance, or (e&o) coverage is a kind of liability insurance. Cres insurance is now a texas association of real estate licensees (tar) errors and omissions risk management partner. Notary errors & omissions insurance protects you from any mistakes you may make. Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage.

Source: blog.chandlerknowlescpa.com

Source: blog.chandlerknowlescpa.com

If you are not insured, you will have to pay these defense costs out of your own pocket. Texas notary public errors & omissions insurance safeguards you from lawsuits. Texas notary errors & omissions (e&o) insurance protects you financially if you are sued for making an unintentional mistake, or if a false claim is filed against you. This e&o insurance coverage is professional liability errors and omissions for insurance agents in texas and can be purchased as a stand alone policy or as part of package. Now is the time to examine and strengthen your e&o risk management program before the wave hits.

Source: notarypublicunderwriters.com

Source: notarypublicunderwriters.com

Ad compare the best coverage online in minutes. For doctors, dentists, etc., it is called malpractice insurance. What is the importance of e&o insurance? We offer e&o insurance from various highly rated insurance companies. Here are a few suggestions on what to evaluate:

Source: dagleyins.com

Source: dagleyins.com

8323 southwest freeway, suite 350. Texas e&o insurance for title and escrow we offer errors and omissions (e&o) insurance to title agents, escrow agents and title abstractors in texas. An errors & omissions insurance policy provided to you through texas general insurance will keep you financially safe during these unavoidable situations and help you prevent the embarrassment and loss of business due to a costly claim against your texas company. We offer e&o insurance from various highly rated insurance companies. Errors and omissions (e&o) insurance provides coverage for businesses or individuals for when they are held responsible for a service provided, or failure to provide a service, that did not have the expected results.

Source: idaplikasi.com

Source: idaplikasi.com

Our goal is to provide you with excellent service by providing you with e&o coverage promptly at a reasonable cost. Our goal is to provide you with e&o coverage from a highly rated carrier. E&o insurance in texas another important insurance policy offered by our firm is the errors and omissions insurance (e&o). Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. Our goal is to provide you with excellent service by providing you with e&o coverage promptly at a reasonable cost.

Source: tempestadealmaletraseimagens.blogspot.com

Remember though, that e&o coverage is needed to protect you from liability in your activities. How to save money on errors and omissions (e&o) insurance according to insureon the median cost of professional liability insurance is about $710 a year, or $60 a month. Texas e&o insurance for title and escrow we offer errors and omissions (e&o) insurance to title agents, escrow agents and title abstractors in texas. If you are not insured, you will have to pay these defense costs out of your own pocket. That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you.

Source: insuranceforagentsonline.com

Source: insuranceforagentsonline.com

Price listed is a 4 year policy. Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. This e&o insurance coverage is professional liability errors and omissions for insurance agents in texas and can be purchased as a stand alone policy or as part of package. Higher e&o limits to protect your assets, prevent claims. To purchase a policy, first enter the expiration date of your texas notary commission.

Insurance by Dean & Draper”) Source: deandraper.com

Our goal is to provide you with e&o coverage from a highly rated carrier. How to save money on errors and omissions (e&o) insurance according to insureon the median cost of professional liability insurance is about $710 a year, or $60 a month. Our individual coverages are the key to. Now is the time to examine and strengthen your e&o risk management program before the wave hits. Notary errors and omissions insurance is an extremely important tool which protects notaries in texas.

Source: texasgeneralinsurance.com

Source: texasgeneralinsurance.com

Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. Partner with iiat to get exclusive access to professional liability insurance. As your texas realtors® risk management e&o partner, cres gives you more value from your errors and omissions insurance: Texas e&o liability insurance (professional liability insurance) protects businesses and individuals from damages and legal defense expenses caused by negligence, errors, or omissions in performing their professional duties. Cres insurance is now a texas association of real estate licensees (tar) errors and omissions risk management partner.

Source: mypullipbygoodklaudia.blogspot.com

Source: mypullipbygoodklaudia.blogspot.com

Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. Texas e&o insurance for insurance agents (for states other than texas, please select from the menu above) our agency provides errors and omissions (e&o) insurance to texas insurance agents, brokers, and agencies writing any type of p&c, life, health and accident coverage. Ad compare the best coverage online in minutes. Commercial or business property coverage, and the standard bop form. Texas notary public errors & omissions insurance safeguards you from lawsuits.

Source: activerain.com

Source: activerain.com

Remember though, that e&o coverage is needed to protect you from liability in your activities. Higher e&o limits to protect your assets, prevent claims. Insurance industry experts are predicting a surge in e&o claims arising from the weather disasters and the pandemic in 2020. Now is the time to examine and strengthen your e&o risk management program before the wave hits. Partner with iiat to get exclusive access to professional liability insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title e o insurance texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.