Your E o insurance for it consultants images are ready in this website. E o insurance for it consultants are a topic that is being searched for and liked by netizens today. You can Get the E o insurance for it consultants files here. Find and Download all free vectors.

If you’re searching for e o insurance for it consultants images information related to the e o insurance for it consultants topic, you have come to the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

E O Insurance For It Consultants. Insurance costs for e&o coverage can depend on your: Lawyers, financial advisors, professional consultants, insurance agents, accountants, real estate agents, engineers, developers, architects, and even lenders can all have a need for e&o insurance. It protects you from lawsuits claiming a mistake you made or something you left out caused a client financial distress. Consultant errors & omissions insurance—also known as consulting services errors & omissions insurance, or consultants e&o—protects all types of professional consultants.

Webinar E&O Insurance Explained Film Ontario Members From youtube.com

Webinar E&O Insurance Explained Film Ontario Members From youtube.com

We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges. E&o policies may cover defense costs within the policy limit or (preferably) in addition to the limit. E&o insurance is recommended if consultants provide professional services for a fee (i.e. E&o insurance is also known as professional liability insurance, or sometimes malpractice insurance. For a better idea of e&o insurance premiums and costs, get a quote today. Business consultants need e&o insurance if they are providing advice to clients for compensation and the following list is just a small sampling of the types of e&o insurance available through aligned insurance brokers:

Errors and omissions insurance protects professionals (like lawyers, accountants, engineers, consultants and agents) from any actions that might make them liable against claims of negligence or failing to perform their duties.

Insurance costs for e&o coverage can depend on your: We offer professional liability coverage for consultants that can help protect you from claims that could cost you your business. It consultant insurance is a form of errors and omissions insurance that has been created specifically to provide coverage for this exact situation. For protection against this type of liability, it professionals buy technology errors and omissions insurance (tech e&o), a package that includes both professional liability insurance and cyber liability insurance. It protects you from lawsuits claiming a mistake you made or something you left out caused a client financial distress. A proprietary 40 point tech e&o inspection.

Source: agent.colburnfinancial.com

Source: agent.colburnfinancial.com

Errors and omissions insurance protects professionals (like lawyers, accountants, engineers, consultants and agents) from any actions that might make them liable against claims of negligence or failing to perform their duties. Errors and omissions insurance (e&o) is a type of professional liability insurance that protects a business from customer claims of negligence or inadequate work related to the professional advice and services they provide. It covers lawsuits related to work performance, such as claims that your advice caused financial harm. We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges. E&o insurance is also known as professional liability insurance, or sometimes malpractice insurance.

Source: archcitytitle.com

Source: archcitytitle.com

It protects you from lawsuits claiming a mistake you made or something you left out caused a client financial distress. If an it consultant recommends insecure software and the client�s data is exposed, the client could sue. We offer professional liability coverage for consultants that can help protect you from claims that could cost you your business. E&o, also called professional liability insurance, is crucial for it consulting and other professional services. Apcc gold members get great rates on the liability insurance that their clients demand!

To safeguard your assets and protect your hard work, a professional liability policy, also known as errors & omissions (e&o), specifically designed for your consulting profession is needed. For protection against this type of liability, it professionals buy technology errors and omissions insurance (tech e&o), a package that includes both professional liability insurance and cyber liability insurance. Errors and omissions insurance protects professionals (like lawyers, accountants, engineers, consultants and agents) from any actions that might make them liable against claims of negligence or failing to perform their duties. Most tech companies purchase technology errors and omissions insurance (tech e&o), which has cyber liability insurance built in. Get competitive coverage on errors & omissions and general liability insurance.

Source: youtube.com

Source: youtube.com

Most tech companies purchase technology errors and omissions insurance (tech e&o), which has cyber liability insurance built in. Liability and e&o insurance for independent it consultants. Learn more or get a free quote, by contacting the lms prolink administrators at the bottom of the embedded chart. Professional liability insurance also known as errors and omissions insurance (e&o) and malpractice insurance insures you and your business, subject to the policy, from financial liabilities that arise as a result of errors and failures that occur while providing services expected and related to your profession. E&o insurance usually renews in the month of october for most agents, which is quickly approaching.

Source: kaia.com

Source: kaia.com

An e&o policy can cover legal fees and settlement costs associated with these claims, even if a mistake wasn’t made. E&o insurance is also known as professional liability insurance, or sometimes malpractice insurance. Should a client allege that you were professionally negligent by failing to perform professional duties as promised in your contract, this is the coverage you need. E&o insurance is recommended if consultants provide professional services for a fee (i.e. Lawyers, financial advisors, professional consultants, insurance agents, accountants, real estate agents, engineers, developers, architects, and even lenders can all have a need for e&o insurance.

Source: notaryrotary.com

Source: notaryrotary.com

The only source of protection for such claims is professional liability insurance (also known as e&o). Insurance costs for e&o coverage can depend on your: Best for failure to deliver promised services accusations of negligence work errors and oversights get quotes learn more E&o insurance usually renews in the month of october for most agents, which is quickly approaching. E&o insurance from travelers can be customized to protect you and your company from the unique risks you face while working in your profession.

Source: supplies.notaries.com

Source: supplies.notaries.com

We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges. Lawyers, financial advisors, professional consultants, insurance agents, accountants, real estate agents, engineers, developers, architects, and even lenders can all have a need for e&o insurance. E&o insurance will cover your legal fees and court costs, as well as any settlements that are reached. Errors and omissions insurance for consultants and other tech professionals costs a median of $61 per month, or $728 annually. We offer professional liability coverage for consultants that can help protect you from claims that could cost you your business.

Source: slideshare.net

Source: slideshare.net

E&o insurance will cover your legal fees and court costs, as well as any settlements that are reached. It protects you from lawsuits claiming a mistake you made or something you left out caused a client financial distress. For a better idea of e&o insurance premiums and costs, get a quote today. Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business against lawsuits. E&o insurance from travelers can be customized to protect you and your company from the unique risks you face while working in your profession.

Source: theandrewagency.com

Source: theandrewagency.com

This insurance protects a company, or an individual, against a lawsuit. E&o, also called professional liability insurance, is crucial for it consulting and other professional services. Liability and e&o insurance for independent it consultants. This insurance protects a company, or an individual, against a lawsuit. We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges.

Source: youtube.com

Source: youtube.com

We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges. It consultant insurance is a form of errors and omissions insurance that has been created specifically to provide coverage for this exact situation. If an it consultant recommends insecure software and the client�s data is exposed, the client could sue. Get free quotes and compare insurance policies with techinsurance E&o insurance is recommended if consultants provide professional services for a fee (i.e.

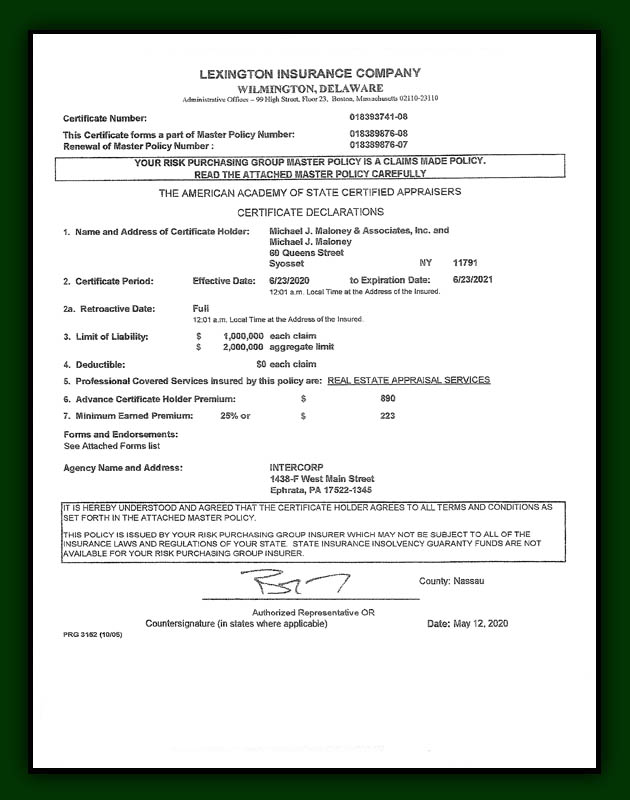

Source: burbridgeappraisals.com

Source: burbridgeappraisals.com

For a better idea of e&o insurance premiums and costs, get a quote today. E&o policies may cover defense costs within the policy limit or (preferably) in addition to the limit. E&o insurance will cover your legal fees and court costs, as well as any settlements that are reached. Best for failure to deliver promised services accusations of negligence work errors and oversights get quotes learn more Learn more or get a free quote, by contacting the lms prolink administrators at the bottom of the embedded chart.

Source: prosightdirect.com

Source: prosightdirect.com

Liability and e&o insurance for independent it consultants. Professional liability insurance also known as errors and omissions insurance (e&o) and malpractice insurance insures you and your business, subject to the policy, from financial liabilities that arise as a result of errors and failures that occur while providing services expected and related to your profession. Apcc gold members get great rates on the liability insurance that their clients demand! Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business against lawsuits. Location number of employees coverage limits history of lawsuits on average, e&o coverage costs about $500 to $1,000 per year, per employee.

It covers lawsuits related to work performance, such as claims that your advice caused financial harm. For a better idea of e&o insurance premiums and costs, get a quote today. Learn more or get a free quote, by contacting the lms prolink administrators at the bottom of the embedded chart. E&o insurance is a type of liability insurance. Get free quotes and compare insurance policies with techinsurance

Source: mentalitch.com

Source: mentalitch.com

It protects you from lawsuits claiming a mistake you made or something you left out caused a client financial distress. Errors and omissions insurance (e&o) is a type of professional liability insurance that protects a business from customer claims of negligence or inadequate work related to the professional advice and services they provide. It consultant insurance is a form of errors and omissions insurance that has been created specifically to provide coverage for this exact situation. Get competitive coverage on errors & omissions and general liability insurance. Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business against lawsuits.

Source: aliains.com

Source: aliains.com

Liability and e&o insurance for independent it consultants. Professional liability insurance also known as errors and omissions insurance (e&o) and malpractice insurance insures you and your business, subject to the policy, from financial liabilities that arise as a result of errors and failures that occur while providing services expected and related to your profession. We’re an insurance company with over 200 years of experience, so we understand that every business faces unique challenges. For protection against this type of liability, it professionals buy technology errors and omissions insurance (tech e&o), a package that includes both professional liability insurance and cyber liability insurance. E&o insurance will cover your legal fees and court costs, as well as any settlements that are reached.

Source: blog.chandlerknowlescpa.com

Source: blog.chandlerknowlescpa.com

Errors and omissions insurance for consultants and other tech professionals costs a median of $61 per month, or $728 annually. It consultants shoulder a lot of responsibility as information technology consultants you are responsible for everything that exists in your client’s computer system. Errors and omissions insurance protects professionals (like lawyers, accountants, engineers, consultants and agents) from any actions that might make them liable against claims of negligence or failing to perform their duties. Should a client allege that you were professionally negligent by failing to perform professional duties as promised in your contract, this is the coverage you need. Get competitive coverage on errors & omissions and general liability insurance.

Source: onlinelearningsolutionsdzukawata.blogspot.com

Source: onlinelearningsolutionsdzukawata.blogspot.com

Errors and omissions insurance protects professionals (like lawyers, accountants, engineers, consultants and agents) from any actions that might make them liable against claims of negligence or failing to perform their duties. We offer professional liability coverage for consultants that can help protect you from claims that could cost you your business. Accounting professionals, including tax preparers and consultants, can be at risk for liability exposure in handling the sensitive financial information necessary to serve their clients. This insurance protects a company, or an individual, against a lawsuit. Insurance costs for e&o coverage can depend on your:

Source: youtube.com

Source: youtube.com

Professional liability insurance also known as errors and omissions insurance (e&o) and malpractice insurance insures you and your business, subject to the policy, from financial liabilities that arise as a result of errors and failures that occur while providing services expected and related to your profession. Best for failure to deliver promised services accusations of negligence work errors and oversights get quotes learn more Most tech companies purchase technology errors and omissions insurance (tech e&o), which has cyber liability insurance built in. Errors and omissions insurance for consultants and other tech professionals costs a median of $61 per month, or $728 annually. Errors and omissions insurance (e&o) professional liability insurance;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title e o insurance for it consultants by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.