Your E o insurance colorado images are ready. E o insurance colorado are a topic that is being searched for and liked by netizens now. You can Find and Download the E o insurance colorado files here. Download all free photos.

If you’re looking for e o insurance colorado pictures information related to the e o insurance colorado keyword, you have come to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

E O Insurance Colorado. Covers past and future loan transactions; Williams underwriting group a division of assuredpartners nl, llc (wug) is pleased to announce our continued relationship with the colorado association of realtors (car) under our independent real estate e&o program. Why do i need e&o insurance coverage? That’s why there is notary errors & omissions (e&o) insurance.

Errors and Omissions Insurance ExecuSummit. ExecuSummit From eandoconference.com

Errors and Omissions Insurance ExecuSummit. ExecuSummit From eandoconference.com

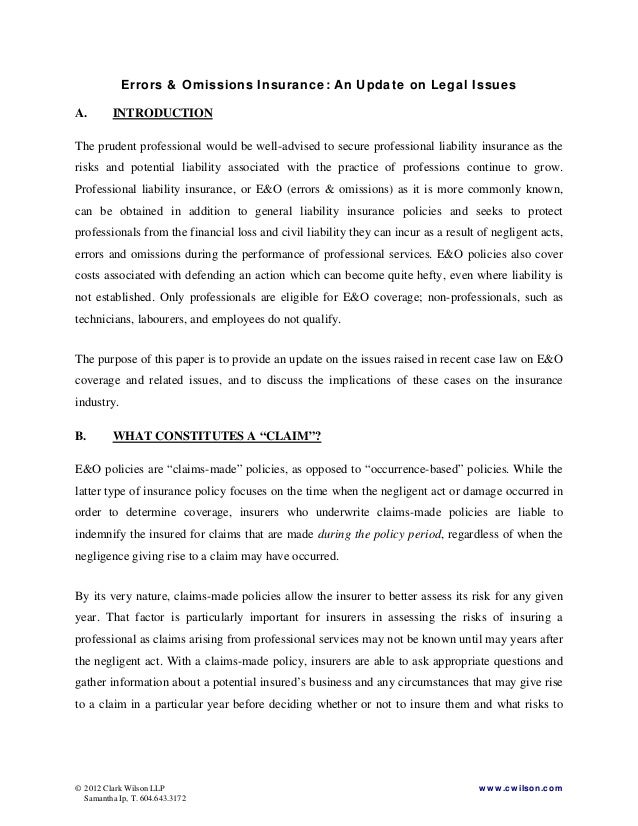

Colorado renewal information for all programs for january 1, 2022 now available! Errors and omissions quote request errors & omissions (e&o) insurance is a form of liability coverage that protects your business from claims of professional negligence. Brokers & agents (varied) attorneys ; Colorado now requires a minimum of $100,000 in e&o professional liability insurance coverage per licensed mortgage broker for each covered claim. Colorado mortgage broker e&o policy details. Why do i need e&o insurance coverage?

Errors & omissions insurance for colorado businesses lawsuits, once a measure of last resort, are now commonplace in settling disputes.

The division has contracted with rice insurance services, llc to administer the group e&o insurance program for real estate brokers. Online insurance quotes for your errors & omissions (e&o) insurance in denver and throughout the state of colorado. Colorado notary errors & omissions (e&o) insurance protects you financially if you are sued for making an unintentional mistake, or if a false claim is filed against you. In some industries, like real estate, errors and omissions (e&o) insurance is required. Considering the fact that these cases can be lengthy, the potential cost to the business can sometimes be catastrophic. Colorado now requires a minimum of $100,000 in e&o professional liability insurance coverage per licensed mortgage broker for each covered claim.

Source: blog.chandlerknowlescpa.com

Source: blog.chandlerknowlescpa.com

Errors & omissions insurance for colorado businesses lawsuits, once a measure of last resort, are now commonplace in settling disputes. That’s why there is notary errors & omissions (e&o) insurance. Colorado e&o insurance can protect you from losses even if you haven�t made a mistake. The program is designed specifically for colorado. Colorado springs, colorado e & o insurance.

Source: orcuttgroup.com

Source: orcuttgroup.com

This opens in a new window. There are other independent brokers who offer e&o insurance in our state, but these are the primary two companies. Click on your program to the left for more information. Why do i need e&o insurance coverage? Colorado mortgage broker e&o policy details.

Source: issuu.com

Source: issuu.com

A notary bond protects the public from financial harm caused by a notary. Colorado errors and omissions insurance (also know as colorado e&o insurance) is an insurance policy that protects you in the instance of an unintentional error or omission while performing your duties. 309 inverness way s, englewood, co 80112. Colorado notary errors & omissions (e&o) insurance protects you financially if you are sued for making an unintentional mistake, or if a false claim is filed against you. Considering the fact that these cases can be lengthy, the potential cost to the business can sometimes be catastrophic.

Source: designjewelrys.blogspot.com

Source: designjewelrys.blogspot.com

Colorado now requires a minimum of $100,000 in e&o professional liability insurance coverage per licensed mortgage broker for each covered claim. Notary journals and notary stamps are shipped separately. Get a quote & buy your e&o online The state further mandates an annual aggregate limit of at least $300,000.00 per licensed individual, and a deductible of $5,000 or less. Online insurance quotes for your errors & omissions (e&o) insurance in denver and throughout the state of colorado.

Source: blog.suretysolutions.com

Source: blog.suretysolutions.com

Colorado mortgage brokers should therefore review their e&o insurance fully, including all exclusions and endorsements, to make sure that the appropriate coverage is provided. Notary journals are usually delivered within three to five business days. Considering the fact that these cases can be lengthy, the potential cost to the business can sometimes be catastrophic. Don’t make the mistake of assuming you are covered by your employer. Q who are the primary providers of broker e&o insurance in colorado?

Source: mylittlerosebud.blogspot.com

Source: mylittlerosebud.blogspot.com

Covers past and future appraisals; Colorado springs, colorado e & o insurance. Covers past and future loan transactions; Notary journals are usually delivered within three to five business days. Group e&o policies some licensed brokerage firms carry a group e&o policy that provides coverage to all brokers associated with that firm for the duration of their employment/association with that firm.

Source: activerain.com

Source: activerain.com

A notary bond protects the public from financial harm caused by a notary. Coverage available for real estate sales, property management, and other activities; Colorado renewal information for all programs for january 1, 2022 now available! Errors and omissions quote request errors & omissions (e&o) insurance is a form of liability coverage that protects your business from claims of professional negligence. The good news is that you can protect yourself, and your colorado or denver business and reputation, by investing in professional liability coverage, also known as errors and omissions (e&o) insurance.

Source: mylittlerosebud.blogspot.com

Source: mylittlerosebud.blogspot.com

Risc provides the state group errors & omissions insurance programs for licensed colorado real estate brokers, appraisers, and mortgage loan originators. The program is designed specifically for colorado. Errors and omissions quote request errors & omissions (e&o) insurance is a form of liability coverage that protects your business from claims of professional negligence. Best rating of a+ (superior) designed to. Errors and omissions quote request errors & omissions (e&o) insurance is a form of liability coverage that protects your business from claims of professional negligence.

Source: eandoconference.com

Source: eandoconference.com

E&o premiums vary based on the type of product or service you need coverage for, your company’s financial stability and the policy’s limits. Why do i need e&o insurance coverage? Risc provides the state group errors & omissions insurance programs for licensed colorado real estate brokers, appraisers, and mortgage loan originators. Nna e&o policies cover, up to your policy coverage amount: Errors and omissions insurance protects you, the notary public, for.

Source: nationalnotary.org

Colorado now requires a minimum of $100,000 in e&o professional liability insurance coverage per licensed mortgage broker for each covered claim. Why do i need e&o insurance coverage? Q who are the primary providers of broker e&o insurance in colorado? Don’t make the mistake of assuming you are covered by your employer. Nna e&o policies cover, up to your policy coverage amount:

Source: hansonlawfirm.com

Source: hansonlawfirm.com

There are other independent brokers who offer e&o insurance in our state, but these are the primary two companies. Colorado renewal information for all programs for january 1, 2022 now available! Colorado e&o insurance can protect you from losses even if you haven�t made a mistake. Coverage available for real estate sales, property management, and other activities; The colorado real estate commission selected risc to provide the state group e&o insurance policy, which is issued by continental casualty company, a cna insurance company.

Source: teamais.net

Source: teamais.net

Colorado mortgage brokers should therefore review their e&o insurance fully, including all exclusions and endorsements, to make sure that the appropriate coverage is provided. Even if the basis of the suit is without merit, you could still face a costly legal bill for defending yourself. We provide real estate e&o insurance in alaska, colorado, iowa, idaho, kentucky, louisiana, mississippi, montana, nebraska, new mexico, north dakota, rhode island, south dakota, and tennessee. Click on your program to the left for more information. Errors and omissions insurance in colorado helps protect businesses that provide advice or professional services to clients.

Source: schinnerer.com

Source: schinnerer.com

Notary journals are usually delivered within three to five business days. Colorado springs, colorado e & o insurance. Notary journals are usually delivered within three to five business days. We ensure brokers who are not direct lenders, and who do not offer reverse mortgages or hard money loans. Errors and omissions insurance protects you, the notary public, for.

Source: oregonrestoration.com

Source: oregonrestoration.com

Contact us today if you�d like a review or quote on your errors & omissions (e&o) insurance to make sure you�re covered. Click on your program to the left for more information. Cres has been a better e&o choice for colorado real estate professionals for more than 25 years. Get a quote & buy your e&o online Best rating of a+ (superior) designed to.

Source: scicteam.com

Source: scicteam.com

Risc provides the state group errors & omissions insurance programs for licensed colorado real estate brokers, appraisers, and mortgage loan originators. A notary bond protects the public from financial harm caused by a notary. Coverage available for real estate sales, property management, and other activities; There are other independent brokers who offer e&o insurance in our state, but these are the primary two companies. 309 inverness way s, englewood, co 80112.

Source: slideshare.net

Source: slideshare.net

It is also important to point out that e&o insurance policies are provided on a claims made basis. A rice insurance services company (risc) and williams underwriting group (williams) are the two primary carriers in colorado. The state further mandates an annual aggregate limit of at least $300,000.00 per licensed individual, and a deductible of $5,000 or less. Colorado’s mandatory e&o insurance requirement for real estate appraisers is fairly new. Notary journals and notary stamps are shipped separately.

Source: crossdesign-x.blogspot.com

Source: crossdesign-x.blogspot.com

Colorado renewal information for all programs for january 1, 2022 now available! Don’t make the mistake of assuming you are covered by your employer. Colorado springs, colorado e & o insurance. Considering the fact that these cases can be lengthy, the potential cost to the business can sometimes be catastrophic. Errors and omissions quote request errors & omissions (e&o) insurance is a form of liability coverage that protects your business from claims of professional negligence.

Source: notaryrotary.com

Source: notaryrotary.com

Colorado notary e&o policies range from $5,000 to $100,000 and can be purchased in terms of 1, 2, 3 or 4 years. Williams underwriting group a division of assuredpartners nl, llc (wug) is pleased to announce our continued relationship with the colorado association of realtors (car) under our independent real estate e&o program. Nna e&o policies cover, up to your policy coverage amount: The program is designed specifically for colorado. Errors & omissions insurance for colorado businesses lawsuits, once a measure of last resort, are now commonplace in settling disputes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title e o insurance colorado by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.