Your E and o insurance for real estate appraisers images are available in this site. E and o insurance for real estate appraisers are a topic that is being searched for and liked by netizens today. You can Download the E and o insurance for real estate appraisers files here. Download all free images.

If you’re looking for e and o insurance for real estate appraisers images information related to the e and o insurance for real estate appraisers keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

E And O Insurance For Real Estate Appraisers. Best for experienced appraisers mcgowan: Appraiser makes a mistake in the valuation process of a home. Landy insurance is a leading u.s. Firms with up to 20 appraisers are eligible.

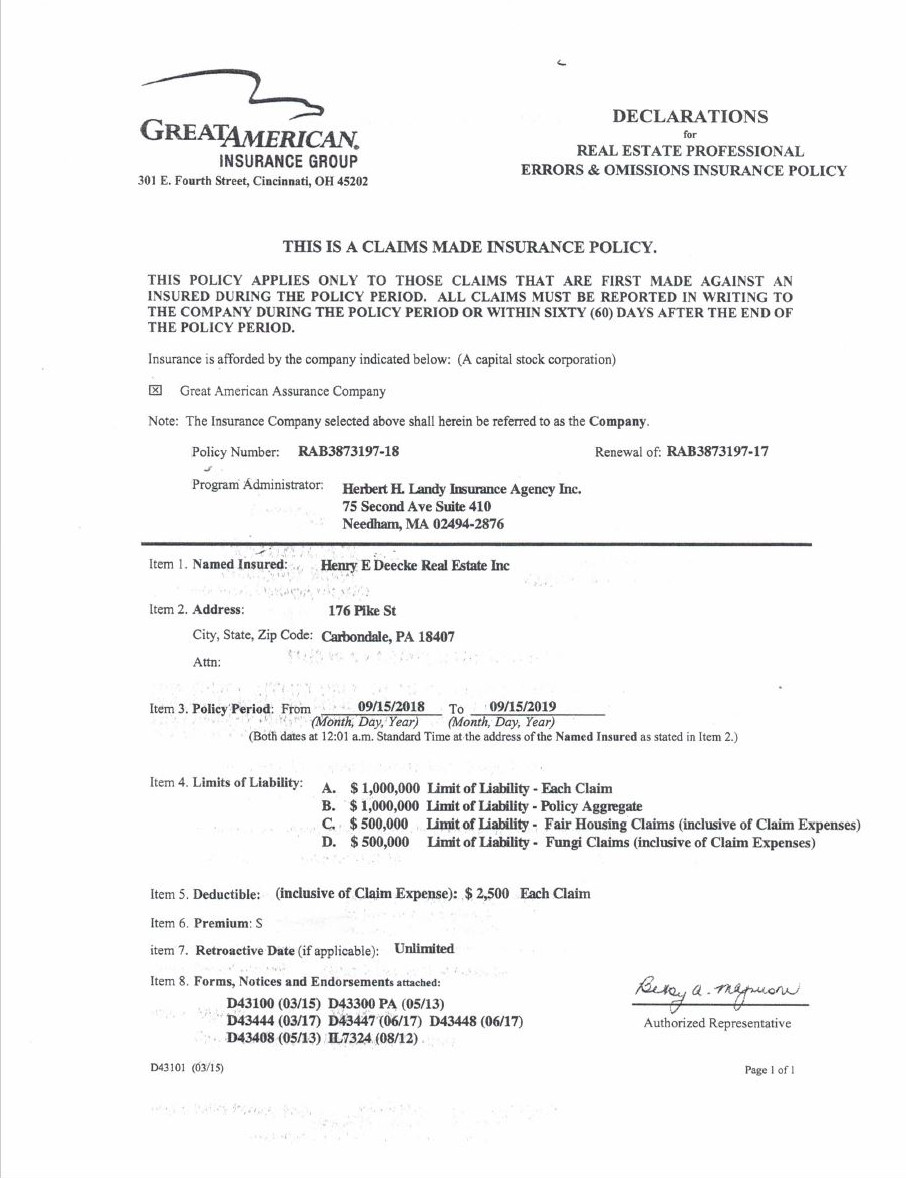

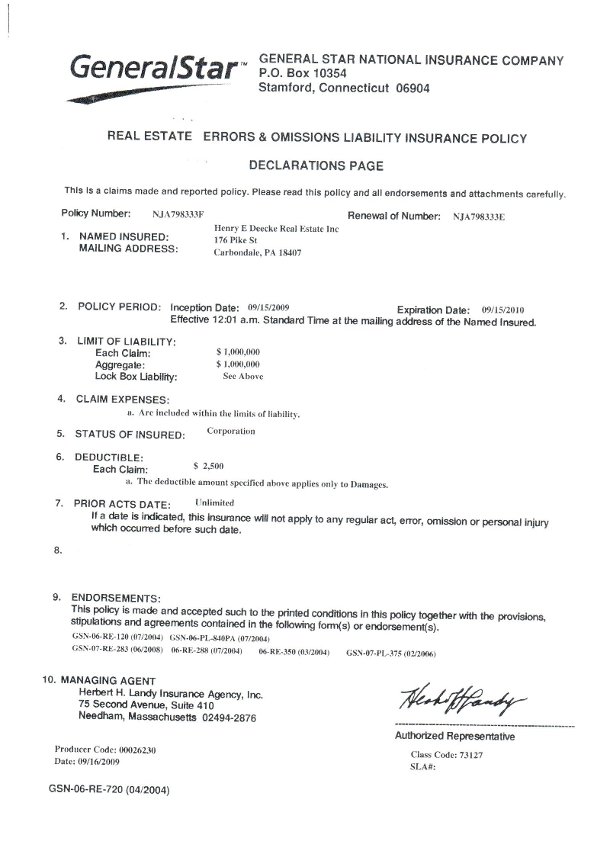

Real Estate Appraisers E&O Insurance From landy.com

Real Estate Appraisers E&O Insurance From landy.com

Appraiser e&o insurance lia is the strongest name in providing quality errors and omissions insurance. Real estate appraisers insurance with coverages available for both residential and commercial real estate appraisers, as well as appraiser trainees who have passed the exam, mcgowan program administrators real estate appraisers errors and omissions insurance provides the protection you need. Providing real estate appraisal services comes with risk. Best for experienced appraisers mcgowan: Real estate appraiser e&o insurance program highlights minimum premium: Best for comprehensive coverage lia:

Appraisers can budget for their e&o premium, but not the sudden financial impact of an e&o claim without a solid insurance policy.

Our errors & omissions program for real estate appraisal firms provides the modern, flexible insurance coverage these professionals need to operate in today’s real estate market. General liability, professional liability (e&o) and workers� compensation. This is a broad definition and changes with the situation. Real estate appraisers e&o insurance individual appraisers e&o insurance providing real estate appraisal services comes with risk. Landy offers a $0 deductible in most states, $100,000 bodily injury and property damage bi/pd and free lifetime retirement, death & disability coverage. Since 1978 we have been known for our stability, reliability and integrity.

Source: appraisers.norman-spencer.com

Source: appraisers.norman-spencer.com

Real estate appraiser e&o insurance program highlights minimum premium: Top 5 providers of appraiser e&o insurance coverwallet: Landy insurance is a leading u.s. Since 1978 we have been known for our stability, reliability and integrity. It also pays any required settlement costs that result from a lawsuit.

Firms with up to 20 appraisers are eligible. Assignments now come through appraisal management. Improperly assessing the value of a property which in turn causes a financial loss to the buyer of a property, seller or the lender. Genstar offers coverage to real estate appraisers. Provider of real estate appraisers errors and omissions (e&o) insurance.

Source: orep.org

Source: orep.org

Colorado law requires real estate appraisers to carry e&o insurance. Real estate appraisers e&o insurance individual appraisers e&o insurance providing real estate appraisal services comes with risk. What�s more, target�s clients receive expert legal representation! Real estate appraiser e&o insurance program highlights minimum premium: Landy insurance is a leading u.s.

Landy insurance is a leading u.s. It’s not a generic policy. We offer errors and omissions insurance (e&o) to real estate appraisers in north carolina who perform residential and commercial appraisals. Real estate appraisers insurance with coverages available for both residential and commercial real estate appraisers, as well as appraiser trainees who have passed the exam, mcgowan program administrators real estate appraisers errors and omissions insurance provides the protection you need. The most common small business insurance policies real estate appraisers carry are:

Source: appraisalservicesga.com

Source: appraisalservicesga.com

Appraisers who purchase their insurance also enjoy a whole host of benefits to help them save money and increase business. Unrivaled customer service the quality of our insurance coverage is unmistakable on staff & in house legal team advocates and educators for the appraisal industry Real estate appraiser e&o coverage helps protect your business from claims that a mistake was made in the professional services given. We offer errors and omissions insurance (e&o) to real estate appraisers in tennessee who perform residential and commercial appraisals. The average cost to defend a claim can run about $20,000 to $30,000, and that does not include any indemnity payment, which drives the cost even higher.

Source: realestatecareerhq.com

Source: realestatecareerhq.com

What�s more, target�s clients receive expert legal representation! Assignments now come through appraisal management. General liability, professional liability (e&o) and workers� compensation. Serves as the program administrator. There are other specialty coverages available based on their specific operations.

Source: friendlyappraiser.com

Source: friendlyappraiser.com

Since 1978 we have been known for our stability, reliability and integrity. Program features for real estate appraisers An inaccurate estimate could lead to a lawsuit with tremendous financial repercussions for your small business. Appraiser errors and omissions (e&o) insurance is also referred to as professional liability. Best for comprehensive coverage lia:

Source: landy.com

Source: landy.com

We offer errors and omissions insurance (e&o) to real estate appraisers in north carolina who perform residential and commercial appraisals. Program features for real estate appraisers Appraiser makes a mistake in the valuation process of a home. We have access to e&o programs that most insurance brokers don’t, to ensure you get the best protection at the best price. E&o insurance can protect your real estate appraiser business from a claim such as:

Source: appraisers.norman-spencer.com

Source: appraisers.norman-spencer.com

We offer errors and omissions insurance (e&o) to real estate appraisers in tennessee who perform residential and commercial appraisals. An inaccurate estimate could lead to a lawsuit with tremendous financial repercussions for your small business. Visit us to learn more about one of the best e&o policies on the market. Appraisers who purchase their insurance also enjoy a whole host of benefits to help them save money and increase business. Unrivaled customer service the quality of our insurance coverage is unmistakable on staff & in house legal team advocates and educators for the appraisal industry

Source: workingre.com

Source: workingre.com

In all 50 states and us territories*. Failure to provide “professional” services. Top 5 providers of appraiser e&o insurance coverwallet: In all 50 states and us territories*. Real estate appraisers e&o insurance individual appraisers e&o insurance providing real estate appraisal services comes with risk.

Source: burnsandwilcox.com

Source: burnsandwilcox.com

Since 1978 we have been known for our stability, reliability and integrity. This is a broad definition and changes with the situation. Program features for real estate appraisers Landy offers a $0 deductible in most states, $100,000 bodily injury and property damage bi/pd and free lifetime retirement, death & disability coverage. Serves as the program administrator.

Source: aliains.com

Source: aliains.com

The coverage is available to individual appraisers and to firms that employ multiple appraisers. Landy insurance is a leading u.s. Coverage specifically for residential appraisers cres e&o has been created specifically for appraisers who specialize in residential properties. Real estate appraisers play the essential role of determining property value for both lenders and buyers. General liability, professional liability (e&o) and workers� compensation.

Source: deeckeappraisals.com

Source: deeckeappraisals.com

Landy offers a $0 deductible in most states, $100,000 bodily injury and property damage bi/pd and free lifetime retirement, death & disability coverage. Landy insurance is a leading u.s. Real estate appraisers play the essential role of determining property value for both lenders and buyers. Appraiser makes a mistake in the valuation process of a home. Assignments now come through appraisal management.

Unrivaled customer service the quality of our insurance coverage is unmistakable on staff & in house legal team advocates and educators for the appraisal industry Providing e&o insurance to real estate appraisers for over 19 years, orep has the expertise and experience to provide appraisers with quality insurance at affordable prices. This policy pays to defend you when a customer alleges you made an error or gave bad advice. Real estate appraisers e&o insurance individual appraisers e&o insurance providing real estate appraisal services comes with risk. Colorado law requires real estate appraisers to carry e&o insurance.

Source: deeckeappraisals.com

Source: deeckeappraisals.com

Provider of real estate appraisers errors and omissions (e&o) insurance. No fdic exclusion (except in ca & ny) $3,000 per claim / $15,000 aggregate available for defense of regulatory board investigations. E&o insurance can protect your real estate appraiser business from a claim such as: Real estate appraiser e&o coverage helps protect your business from claims that a mistake was made in the professional services given. Providing e&o insurance to real estate appraisers for over 19 years, orep has the expertise and experience to provide appraisers with quality insurance at affordable prices.

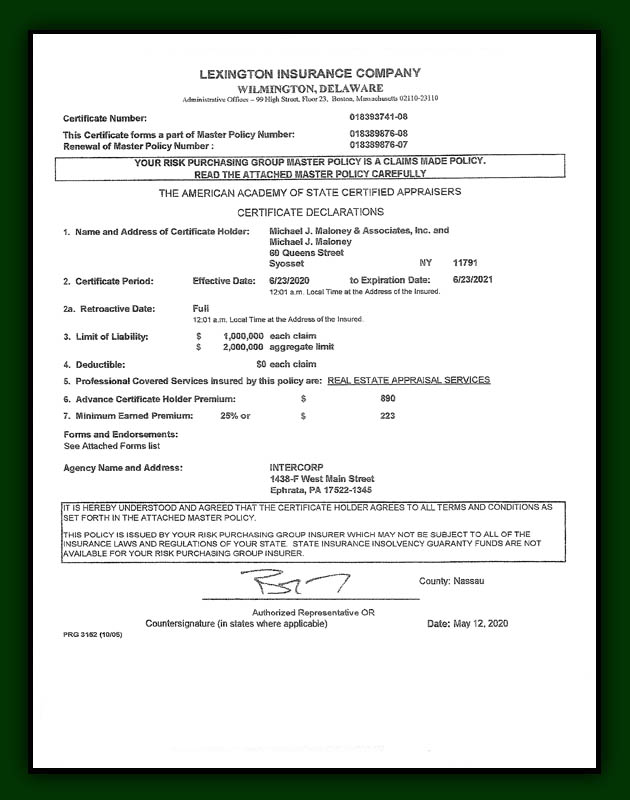

Source: mjmaloneyappraisals.com

Source: mjmaloneyappraisals.com

There are other specialty coverages available based on their specific operations. Program features for real estate appraisers Visit us to learn more about one of the best e&o policies on the market. This type of insurance can help if an: E&o insurance can protect your real estate appraiser business from a claim such as:

Source: mcgowanprograms.com

Source: mcgowanprograms.com

Failure to provide “professional” services. Landy offers a $0 deductible in most states, $100,000 bodily injury and property damage bi/pd and free lifetime retirement, death & disability coverage. Landy insurance is a leading u.s. Improperly assessing the value of a property which in turn causes a financial loss to the buyer of a property, seller or the lender. Appraisers can budget for their e&o premium, but not the sudden financial impact of an e&o claim without a solid insurance policy.

Source: friendlyappraiser.com

Source: friendlyappraiser.com

We offer errors and omissions insurance (e&o) to real estate appraisers in tennessee who perform residential and commercial appraisals. Real estate appraiser e&o insurance program highlights minimum premium: We provide the colorado state group appraisal e&o program, which exceeds the state’s minimum requirements. We have access to e&o programs that most insurance brokers don’t, to ensure you get the best protection at the best price. Program features for real estate appraisers

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title e and o insurance for real estate appraisers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.