Your Dwelling building insurance coverage images are available. Dwelling building insurance coverage are a topic that is being searched for and liked by netizens today. You can Find and Download the Dwelling building insurance coverage files here. Get all free photos and vectors.

If you’re looking for dwelling building insurance coverage pictures information connected with to the dwelling building insurance coverage interest, you have pay a visit to the right site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Dwelling Building Insurance Coverage. Dwelling coverage is the part of a homeowners insurance policy that covers the physical structure of your home, including other structures on the property. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Dwelling coverage, also known as dwelling insurance or coverage a, is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your house in the event it’s damaged by a covered peril, like a fire, windstorm, or a lightning strike. The dwelling portion of your condo policy pays to replace your belongings and furniture after certain disasters.

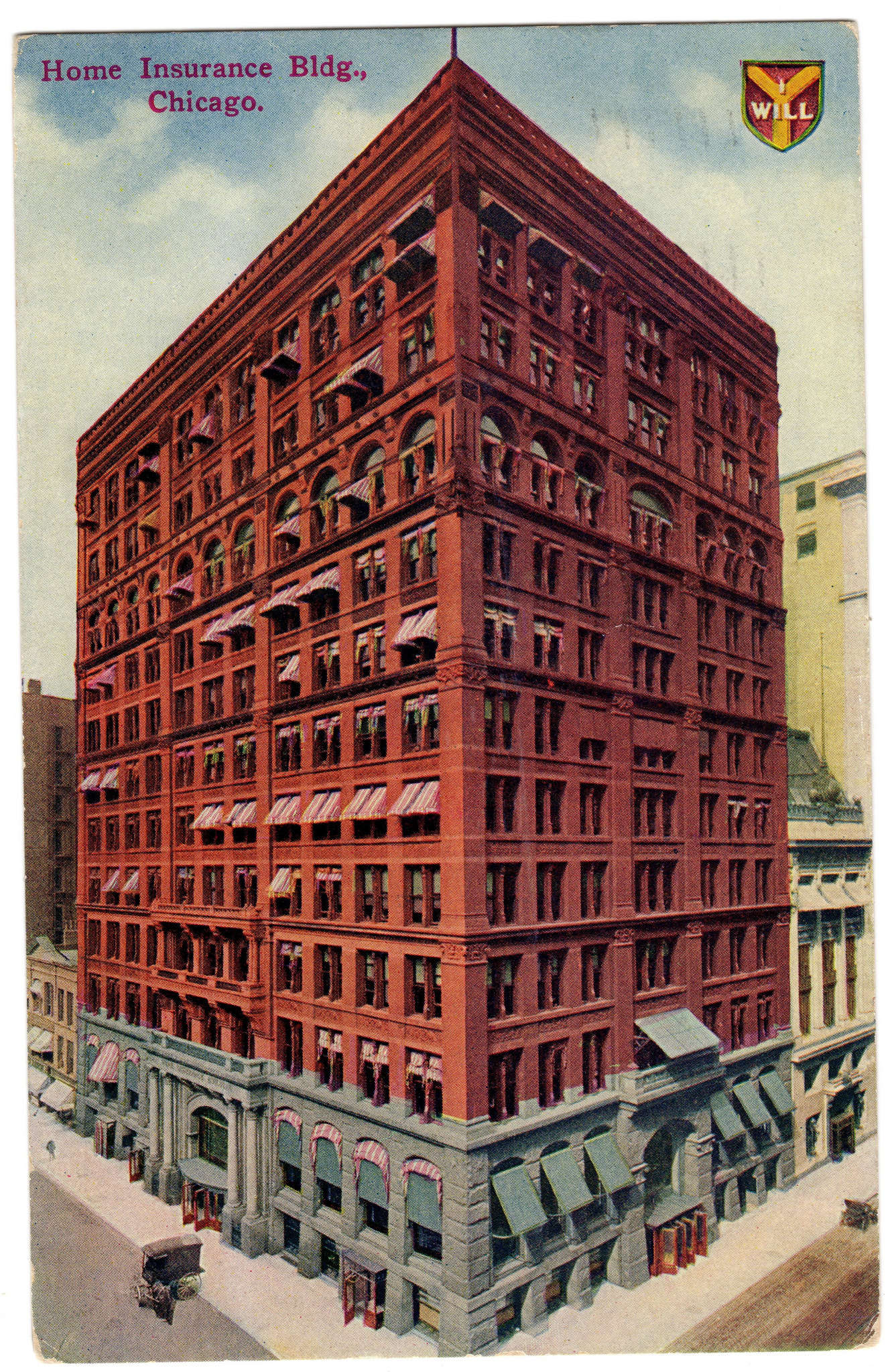

Home Insurance Building HISTORY From history.com

Home Insurance Building HISTORY From history.com

Coverage a of your standard homeowner’s insurance policy which is known as the dwelling coverage is going to protect the main dwelling of your property against physical damage caused to the residence including any interior fireplaces, flooring, bathrooms, or structures that may be attached to it on top of the same foundation, e.g. Dwelling insurance is a policy that provides coverage to the physical structure of a home and any structure attached to it, including sheds, garages, and patios. It can also pay to rebuild a home if it is damaged by a covered loss. However these are generally items that are fixed, or can’t easily be removed, and. Your house and connected structures, such as an attached garage,. This coverage protects your home you live in, plus any attached structures (your garage, for example), from perils listed in your insurance policy.

The specific definition of ‘fixtures and fittings’ will be up to your insurer;

When referring to dwelling coverage, sometimes called coverage a, a dwelling is the building you live in. When referring to dwelling coverage, sometimes called coverage a, a dwelling is the building you live in. Dwelling insurance covers any repairs that are necessary to the insured home or condo. All of your personal possessions fall into this coverage and this number is also tied to your dwelling coverage number. Dwelling insurance, also known as dwelling coverage or coverage a, is the portion of your homeowners policy that covers repairing or rebuilding your home after it�s damaged by a covered peril, such as fire. Dwelling, other structures, personal property, loss of use, personal liability protection, and medical payments.

Source: pinterest.com

Source: pinterest.com

Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire. Dwelling coverage is simply one part of that package. Dwelling coverage is the part of a homeowners insurance policy that may help pay to rebuild or repair the physical structure of your home if it�s damaged by a covered hazard. Dwelling insurance, also known as dwelling coverage or coverage a, is the portion of your homeowners policy that covers repairing or rebuilding your home after it�s damaged by a covered peril, such as fire. The ratio can vary between insurers but in most cases it is 50% to 70% of your dwelling coverage.

Source: revisi.net

Source: revisi.net

Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Also known as main structure coverage, dwelling coverage is the part of your home insurance that pays to repair or rebuild your home’s physical structure (think: Dwelling coverage is the part of a homeowners insurance policy that may help pay to rebuild or repair the physical structure of your home if it�s damaged by a covered hazard. Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire. Decking, garages, or a porch.

Source: la.curbed.com

Source: la.curbed.com

Dwelling coverage refers to the coverage in your basic ho3 ( homeowners) policy that covers your home, or in insurance lingo, dwelling. Dwelling coverage, also known as dwelling insurance or coverage a, is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your house in the event it’s damaged by a covered peril, like a fire, windstorm, or a lightning strike. Your house and connected structures, such as an attached garage,. Also known as main structure coverage, dwelling coverage is the part of your home insurance that pays to repair or rebuild your home’s physical structure (think: The specific definition of ‘fixtures and fittings’ will be up to your insurer;

Source: jhmrad.com

Source: jhmrad.com

Also known as main structure coverage, dwelling coverage is the part of your home insurance that pays to repair or rebuild your home’s physical structure (think: Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater. When referring to dwelling coverage, sometimes called coverage a, a dwelling is the building you live in. However these are generally items that are fixed, or can’t easily be removed, and. It covers the home itself —not the contents or land.

Source: pinterest.com

Source: pinterest.com

Walls, floors, roof, windows, support beams, and foundation) when a covered incident damages it. The extent of your dwelling coverage depends on what’s already covered by your condo association policy. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Dwelling insurance covers any repairs that are necessary to the insured home or condo. Ontario insurers typically offer coverage of up to 10% of the amount of insurance on your dwelling to insure building fixtures and fittings temporarily removed from the premises for repair or seasonal storage.

Source: homesfeed.com

Source: homesfeed.com

Dwelling coverage is simply one part of that package. Walls, floors, roof, windows, support beams, and foundation) when a covered incident damages it. Perils insured for both dwelling and contents are fire, lightning, and removal of the property from the premises to further protect it from damage from the perils. Liability coverage, for instance, doesn�t. What does dwelling coverage do?

Source: carportcentral.com

Source: carportcentral.com

Typically, a normal condo insurance policy does not cover your personal property, so this. Typically, a normal condo insurance policy does not cover your personal property, so this. This coverage protects your home you live in, plus any attached structures (your garage, for example), from perils listed in your insurance policy. Most likely the highest coverage limit in your homeowners insurance policy, dwelling coverage pays to rebuild your home if it burns down, is destroyed by a tornado, is crushed by falling trees or otherwise damaged by covered hazards. Ontario insurers typically offer coverage of up to 10% of the amount of insurance on your dwelling to insure building fixtures and fittings temporarily removed from the premises for repair or seasonal storage.

Source: shadebuilder.com

Source: shadebuilder.com

The specific definition of ‘fixtures and fittings’ will be up to your insurer; The ratio can vary between insurers but in most cases it is 50% to 70% of your dwelling coverage. Walls, floors, roof, windows, support beams, and foundation) when a covered incident damages it. All of your personal possessions fall into this coverage and this number is also tied to your dwelling coverage number. This coverage protects your home you live in, plus any attached structures (your garage, for example), from perils listed in your insurance policy.

Source: thebalance.com

Source: thebalance.com

It covers the home itself —not the contents or land. Dwelling insurance, also known as dwelling coverage or coverage a, is the portion of your homeowners policy that covers repairing or rebuilding your home after it�s damaged by a covered peril, such as fire. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Coverage a of your standard homeowner’s insurance policy which is known as the dwelling coverage is going to protect the main dwelling of your property against physical damage caused to the residence including any interior fireplaces, flooring, bathrooms, or structures that may be attached to it on top of the same foundation, e.g. It can also pay to rebuild a home if it is damaged by a covered loss.

Source: bloglovin.com

Source: bloglovin.com

The ratio can vary between insurers but in most cases it is 50% to 70% of your dwelling coverage. What is covered under dwelling insurance? Typically, a normal condo insurance policy does not cover your personal property, so this. The specific definition of ‘fixtures and fittings’ will be up to your insurer; It covers the home itself —not the contents or land.

Source: businessinsider.in

Source: businessinsider.in

Perils insured for both dwelling and contents are fire, lightning, and removal of the property from the premises to further protect it from damage from the perils. Under this coverage, the insurance company shall pay for the expenses of rebuilding or repairing the damaged structure if a covered peril causes the damage. If your building is in an area where these events are likely to occur, you may want. What does dwelling coverage do? Dwelling coverage is much like renters insurance in that it pays to replace your possessions should they be damaged in a covered peril.

Source: curbed.com

Source: curbed.com

Most fires, plumbing/hvac issues and explosions are covered. The dwelling limit is the maximum amount your homeowners insurance company will pay to rebuild your home using. These parts go as followed: Dwelling coverage is simply one part of that package. Walls, floors, roof, windows, support beams, and foundation) when a covered incident damages it.

Source: history.com

Source: history.com

The dwelling portion of your condo policy pays to replace your belongings and furniture after certain disasters. Dwelling coverage is simply one part of that package. This coverage protects your home you live in, plus any attached structures (your garage, for example), from perils listed in your insurance policy. It covers the home itself —not the contents or land. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater.

Source: bfmilitary.com

Source: bfmilitary.com

Dwelling insurance, also known as dwelling coverage or coverage a, is the portion of your homeowners policy that covers repairing or rebuilding your home after it�s damaged by a covered peril, such as fire. The ratio can vary between insurers but in most cases it is 50% to 70% of your dwelling coverage. Coverage a of your standard homeowner’s insurance policy which is known as the dwelling coverage is going to protect the main dwelling of your property against physical damage caused to the residence including any interior fireplaces, flooring, bathrooms, or structures that may be attached to it on top of the same foundation, e.g. Walls, floors, roof, windows, support beams, and foundation) when a covered incident damages it. What is covered under dwelling insurance?

Source: es.wikiarquitectura.com

Source: es.wikiarquitectura.com

Most fires, plumbing/hvac issues and explosions are covered. Decking, garages, or a porch. Dwelling insurance allows you to pick and choose the various coverages to apply to your property. These parts go as followed: Dwelling, other structures, personal property, loss of use, personal liability protection, and medical payments.

Source: choicemetalbuildings.com

Source: choicemetalbuildings.com

Your house and connected structures, such as an attached garage,. Ontario insurers typically offer coverage of up to 10% of the amount of insurance on your dwelling to insure building fixtures and fittings temporarily removed from the premises for repair or seasonal storage. Most fires, plumbing/hvac issues and explosions are covered. Use a replacement cost calculator to enter your information and easily. The dwelling limit is the maximum amount your homeowners insurance company will pay to rebuild your home using.

Source: jamescolincampbell.com

Source: jamescolincampbell.com

Decking, garages, or a porch. Dwelling coverage is the part of a homeowners insurance policy that may help pay to rebuild or repair the physical structure of your home if it�s damaged by a covered hazard. It covers the home itself —not the contents or land. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Here, we will discuss the first in that list:

Source: pinterest.com

Source: pinterest.com

Also known as main structure coverage, dwelling coverage is the part of your home insurance that pays to repair or rebuild your home’s physical structure (think: Your house and connected structures, such as an attached garage,. Coverage a of your standard homeowner’s insurance policy which is known as the dwelling coverage is going to protect the main dwelling of your property against physical damage caused to the residence including any interior fireplaces, flooring, bathrooms, or structures that may be attached to it on top of the same foundation, e.g. If your building is in an area where these events are likely to occur, you may want. Dwelling, other structures, personal property, loss of use, personal liability protection, and medical payments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dwelling building insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.