Your During replacement of life insurance images are available. During replacement of life insurance are a topic that is being searched for and liked by netizens today. You can Download the During replacement of life insurance files here. Download all royalty-free photos and vectors.

If you’re searching for during replacement of life insurance images information connected with to the during replacement of life insurance keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

During Replacement Of Life Insurance. A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. When replacing life insurance what are the duties of the replacement? Life insurance during policy change. The wysh life and health insurance company term life product application asks certain lifestyle and health questions to help avoid requiring a medical exam.

How Does Malaysia Life Insurance Work? From imoney.my

How Does Malaysia Life Insurance Work? From imoney.my

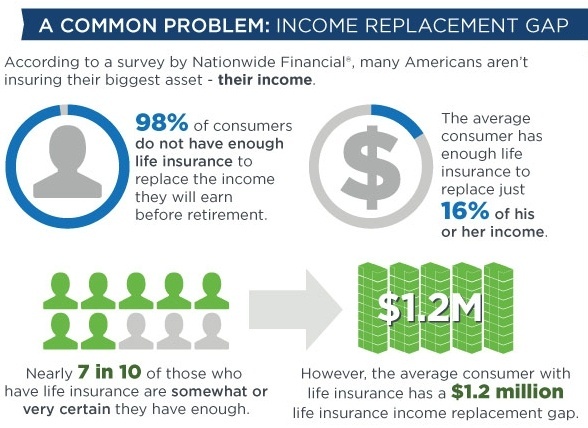

Here is a checklist of things to consider and ask about when replacing a life insurance policy besides the new life insurance policy premium. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. It is important to note that the cost of an individual life insurance policy depends on the age of the insured. (5) proposed life insurance that is to replace life insurance under a binding or conditional receipt issued by the same company; Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn.

Icc21.sl.term(03.2021), terminal illness adb rider:

Or, when a term conversion privilege is exercised among corporate affiliates; There is a pretty fine line that you need to be aware of between life insurance replacement (permitted) and life insurance twisting (prohibited). It is important to note that the cost of an individual life insurance policy depends on the age of the insured. Depending on what state you live in, there could be a suicide clause in your policy. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. The income replacement approach is a method of determining the amount of life insurance you should purchase.

Source: culvercpagroup.com

Source: culvercpagroup.com

Term life insurance is often the lowest priced coverage option, but it is temporary. It is important to note that the cost of an individual life insurance policy depends on the age of the insured. An agent�s advertisements for life insurance must be approved by.? When replacement occurs, the existing insurer must provide the policyowner with a policy summary for the existing life insurance within ten days of receiving the written communication advising of the proposed replacement and the replacement notice. It is, however, a practice that can lead to ethical lapses.

Source: thebridgechronicle.com

Source: thebridgechronicle.com

There is a pretty fine line that you need to be aware of between life insurance replacement (permitted) and life insurance twisting (prohibited). Depending on what state you live in, there could be a suicide clause in your policy. A) designate a new producer for a replaced policy b) send a copy of the notice regarding replacement to the department of insurance c) obtain a list of all life insurance policies that will be replaced d) guarantee a replacement for each existing policy the replacing insurance company must require from the producer a list of the applicant’s life insurance or annuity. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. What is the definition of a life insurance replacement?

Source: insurancesamadhan.com

Source: insurancesamadhan.com

(choose from the following options) 1. Life insurance during policy change. You have the right, within thirty (30) days after delivery of a replacement policy, to return it to the. (5) proposed life insurance that is to replace life insurance under a binding or conditional receipt issued by the same company; Being replaced by the same insurer pursuant to a program filed with and approved by the commissioner;

Source: sigortatower.com

Source: sigortatower.com

Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. The insurer must provide a copy of the life insurance buyer�s guide to all prospective buyers when? It is, however, a practice that can lead to ethical lapses. There is no one replacement rule in life insurance, but there are some replacement guidelines and explanations.

Source: briansoinsurance.com

Source: briansoinsurance.com

The wysh life and health insurance company term life product application asks certain lifestyle and health questions to help avoid requiring a medical exam. When replacing life insurance what are the duties of the replacement? Under your existing policy, the period of time during which the issuing company could deny coverage. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. A common circumstance in which a life insurance policy will not pay out is in the case of suicide.

Source: imoney.my

Source: imoney.my

The insurance company for your new policy does not. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. Depending on the insurer’s requirements, the premium could be higher than that of a term life insurance plan. (5) proposed life insurance that is to replace life insurance under a binding or conditional receipt issued by the same company; If there is such a clause, and if you were to commit suicide within the specified time frame, your beneficiary would only get.

Source: slideshare.net

Source: slideshare.net

You could get married, or your relationship could break down and you may remarry and have children with a different partner. Obtain a list of all life insurance policies that will be replaced 3. Or, when a term conversion privilege is exercised among corporate affiliates; A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. Compare the costs of replacing your life insurance policy.

Source: agencyone.net

Source: agencyone.net

Icc21.sl.term(03.2021), terminal illness adb rider: Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. It is, however, a practice that can lead to ethical lapses. For example, to cover a joint liability such as a loan or mortgage. Changing your life insurance policy when your family changes.

Source: blog.nationwide.com

Source: blog.nationwide.com

- if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. Changing your life insurance policy when your family changes. Any insurance agent who commits a repeated violation of the insurance code with respect to insurance replacement will be liable for $30,000 an insurer has been found guilty of a code violation regarding replacement. During replacement of life insurance, a replacing insurer must do which of the following? Company and to get refund of all premiums paid.

Source: rickcaseinsurance.com

Source: rickcaseinsurance.com

Obtain a list of all life insurance policies that will be replaced 3. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. (5) proposed life insurance that is to replace life insurance under a binding or conditional receipt issued by the same company; The wysh life and health insurance company term life product application asks certain lifestyle and health questions to help avoid requiring a medical exam.

Source: phoenixprotectiongroup.com

Source: phoenixprotectiongroup.com

Obtain a list of all life insurance policies that will be replaced 3. It assumes that the goal of life insurance is to replace the lost earnings of a family breadwinner who has died. What is the definition of a life insurance replacement? Being replaced by the same insurer pursuant to a program filed with and approved by the commissioner; If there is such a clause, and if you were to commit suicide within the specified time frame, your beneficiary would only get.

Source: ocean.ie

Source: ocean.ie

The income replacement approach is a method of determining the amount of life insurance you should purchase. You could get married, or your relationship could break down and you may remarry and have children with a different partner. It assumes that the goal of life insurance is to replace the lost earnings of a family breadwinner who has died. There is no one replacement rule in life insurance, but there are some replacement guidelines and explanations. For death caused by suicide may have expired or may expire earlier than it will under the proposed

Source: womenindistress.org

Source: womenindistress.org

Obtain a list of all life insurance policies that will be replaced 3. The insurance company for your new policy does not. Icc21.sl.term(03.2021), terminal illness adb rider: Life insurance during policy change. Being replaced by the same insurer pursuant to a program filed with and approved by the commissioner;

Source: herinsgrp.com

Source: herinsgrp.com

If there is such a clause, and if you were to commit suicide within the specified time frame, your beneficiary would only get. (5) proposed life insurance that is to replace life insurance under a binding or conditional receipt issued by the same company; Company and to get refund of all premiums paid. Insurance is subject to underwriting. Depending on the insurer’s requirements, the premium could be higher than that of a term life insurance plan.

Source: partners4prosperity.com

Source: partners4prosperity.com

Term insurance can be set up to coincide with the specified end of child support obligations. A common circumstance in which a life insurance policy will not pay out is in the case of suicide. The income replacement approach is a method of determining the amount of life insurance you should purchase. Any insurance agent who commits a repeated violation of the insurance code with respect to insurance replacement will be liable for $30,000 an insurer has been found guilty of a code violation regarding replacement. The wysh life and health insurance company term life product application asks certain lifestyle and health questions to help avoid requiring a medical exam.

Source: in.pinterest.com

Source: in.pinterest.com

The income replacement approach is a method of determining the amount of life insurance you should purchase. A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. The insurance company for your new policy does not. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. When replacing life insurance what are the duties of the replacement?

Source: youtube.com

Source: youtube.com

Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn. Send a copy of the notice regarding replacement to the department of insurance 2. A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. When replacement occurs, the existing insurer must provide the policyowner with a policy summary for the existing life insurance within ten days of receiving the written communication advising of the proposed replacement and the replacement notice. It is, however, a practice that can lead to ethical lapses.

Source: myfinancialsolutionsusa.com

Source: myfinancialsolutionsusa.com

An agent�s advertisements for life insurance must be approved by.? Being replaced by the same insurer pursuant to a program filed with and approved by the commissioner; It assumes that the goal of life insurance is to replace the lost earnings of a family breadwinner who has died. It is important to note that the cost of an individual life insurance policy depends on the age of the insured. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title during replacement of life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.