Your Dual life insurance definition images are available in this site. Dual life insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Dual life insurance definition files here. Download all royalty-free images.

If you’re looking for dual life insurance definition pictures information related to the dual life insurance definition keyword, you have visit the right blog. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Dual Life Insurance Definition. Definition of multiple protection life insurance policy. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. Definition dual agency — a situation in which an individual may serve as an agent for two parties in the same transaction. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

Indexed Whole Life Insurance Definition From blog.pricespin.net

Indexed Whole Life Insurance Definition From blog.pricespin.net

Tenancy in common or as joint tenants. A life insurance policy is no different than any other type of property and can be owned either under a joint tenancy arrangement or as tenants in common. Add the following to determine the total insurance needs. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer. In life insurance, an alternate beneficiary designated to receive payment, usually in the event that the original beneficiary has died before the insured. Single life insurance policy combining term life insurance and ordinary life insurance.

Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

A life insurance policy is no different than any other type of property and can be owned either under a joint tenancy arrangement or as tenants in common. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. Insurance, a form of insurance which pays a death benefit only upon the death of the last surviving insured person. Toni mccall, real estate agent coldwell banker. In multiple life insurance, there are two terms based on the status of the death of the insured is a collection of joint life and last survivor. If the insured dies during the term period, a multiple of the face amount is paid to the beneficiary.

Source: slideshare.net

Source: slideshare.net

Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. The goal of this approach is to replace the primary breadwinner’s salary for a. For instance, court cases have held that insurance brokers can function as agents of (and therefore owe legal duties to) both insureds and insurers in. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. Definition of dual life insurance ,top life insurance carriers offering lower rates!, definition of dual life insurance.

Source: insurance-companies.co

Source: insurance-companies.co

To a jointly owned life insurance policy. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. However, in case of contingency insurances such as life insurance, dual payment is allowed) Dual insurance (or double insurance as it is also called) arises when the same party is insured with two or more insurers in respect of the same interest in the same subject matter against the same risk and for the same period of time. Single life insurance policy combining term life insurance and ordinary life insurance.

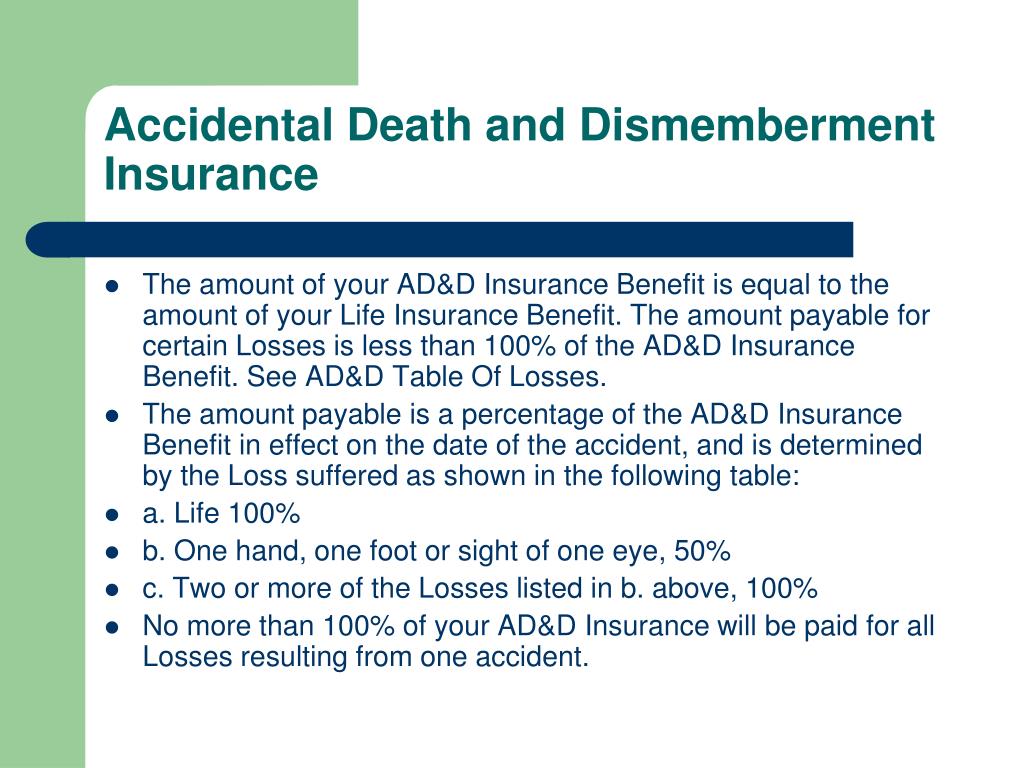

Source: slideserve.com

Source: slideserve.com

To a jointly owned life insurance policy. A provision in most life insurance policies that allows the life insurance company to withhold the death benefit payout if the policyholder dies by. You don’t have to have the same amount of cover, which is important if there is a big difference in income. To a jointly owned life insurance policy. On average, these terms are 5, 10, 15, 20 and 30 years.

Source: slideshare.net

Source: slideshare.net

Many people think that life assurance and life insurance are the same thing, yet there is a subtle but key difference between the two: Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. You can also insure yourself for a different amount of serious illness cover than your partner. If the insured dies after the term period has. Definition of multiple protection life insurance policy.

Source: insurance-resource.ca

Source: insurance-resource.ca

Generally there are two ways in which to own property: Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. Definition of dual life insurance ,top life insurance carriers offering lower rates!, definition of dual life insurance. To a jointly owned life insurance policy. Often used by a married couple in estate planning.

Source: slideshare.net

Source: slideshare.net

Covering estate taxes leaving a nest egg for their heirs paying inheritance taxes Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. However, a joint life policy pays out only once, leaving the surviving partner without cover under that policy, whereas single life insurance policies can offer more protection because each partner has. Double insurance is a form of insurance, wherein the individual/company insures a particular property with more than one insurer or with multiple policies from the same insurer. Tenancy in common or as joint tenants.

Source: perfecttimingfamilywealth.com

Source: perfecttimingfamilywealth.com

Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer. Definition of multiple protection life insurance policy. Meaning / definition of dual life insurance. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer.

Source: slideshare.net

Source: slideshare.net

“in plain english,” level term life is a term insurance policy that guarantees the premiums will stay the same for a specific term length. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. Generally there are two ways in which to own property: Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. Definition of dual life insurance ,top life insurance carriers offering lower rates!, definition of dual life insurance.

Source: slideserve.com

Source: slideserve.com

Definition of multiple protection life insurance policy. If the insured dies after the term period has. In multiple life insurance, there are two terms based on the status of the death of the insured is a collection of joint life and last survivor. Single life insurance policy combining term life insurance and ordinary life insurance. However, in case of contingency insurances such as life insurance, dual payment is allowed)

Source: blog.pricespin.net

Source: blog.pricespin.net

Use this calculation when each spouse has a similar income, both currently enjoy good health, and the survivor will continue to work. Many people think that life assurance and life insurance are the same thing, yet there is a subtle but key difference between the two: This means that no matter what your premiums are when you get approved for your policy, it will stay the same until the end of the term. Covering estate taxes leaving a nest egg for their heirs paying inheritance taxes The goal of this approach is to replace the primary breadwinner’s salary for a.

Source: ledrainbow.com.np

Source: ledrainbow.com.np

In life insurance, an alternate beneficiary designated to receive payment, usually in the event that the original beneficiary has died before the insured. Add the following to determine the total insurance needs. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. However, in case of contingency insurances such as life insurance, dual payment is allowed) Three simple and quick calculations that can give you a start towards determining your life insurance needs.

Source: abramsinc.com

Source: abramsinc.com

Definition of dual life insurance ,top life insurance carriers offering lower rates!, definition of dual life insurance. Definition of multiple protection life insurance policy. Double insurance is a form of insurance, wherein the individual/company insures a particular property with more than one insurer or with multiple policies from the same insurer. Generally there are two ways in which to own property: Definition dual agency — a situation in which an individual may serve as an agent for two parties in the same transaction.

Source: zurich.co.uk

Source: zurich.co.uk

Tenancy in common or as joint tenants. Tenancy in common or as joint tenants. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. Generally there are two ways in which to own property: Meaning / definition of dual life insurance.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Add the following to determine the total insurance needs. Definition of multiple protection life insurance policy. Save up to 70% on life insurance now. Insurance, a form of insurance which pays a death benefit only upon the death of the last surviving insured person. You don’t have to have the same amount of cover, which is important if there is a big difference in income.

Source: allstate.com

Source: allstate.com

A provision in most life insurance policies that allows the life insurance company to withhold the death benefit payout if the policyholder dies by. Toni mccall, real estate agent coldwell banker. You can also insure yourself for a different amount of serious illness cover than your partner. To a jointly owned life insurance policy. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

Source: aegonlife.com

Source: aegonlife.com

Tenancy in common or as joint tenants. The goal of this approach is to replace the primary breadwinner’s salary for a. Often used by a married couple in estate planning. Meaning / definition of dual life insurance. Many people think that life assurance and life insurance are the same thing, yet there is a subtle but key difference between the two:

Source: pinterest.com

Source: pinterest.com

Add the following to determine the total insurance needs. Dual insurance (or double insurance as it is also called) arises when the same party is insured with two or more insurers in respect of the same interest in the same subject matter against the same risk and for the same period of time. A joint life insurance policy can be cheaper than two single policies designed to provide the same amount of cover over the same period of time. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer.

Source: insurance-companies.co

Source: insurance-companies.co

Double insurance is a form of insurance, wherein the individual/company insures a particular property with more than one insurer or with multiple policies from the same insurer. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. Definition of multiple protection life insurance policy. Generally there are two ways in which to own property: On average, these terms are 5, 10, 15, 20 and 30 years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dual life insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.