Your Dp3 insurance vs ho6 images are ready in this website. Dp3 insurance vs ho6 are a topic that is being searched for and liked by netizens today. You can Find and Download the Dp3 insurance vs ho6 files here. Get all royalty-free photos and vectors.

If you’re searching for dp3 insurance vs ho6 pictures information connected with to the dp3 insurance vs ho6 interest, you have visit the ideal site. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

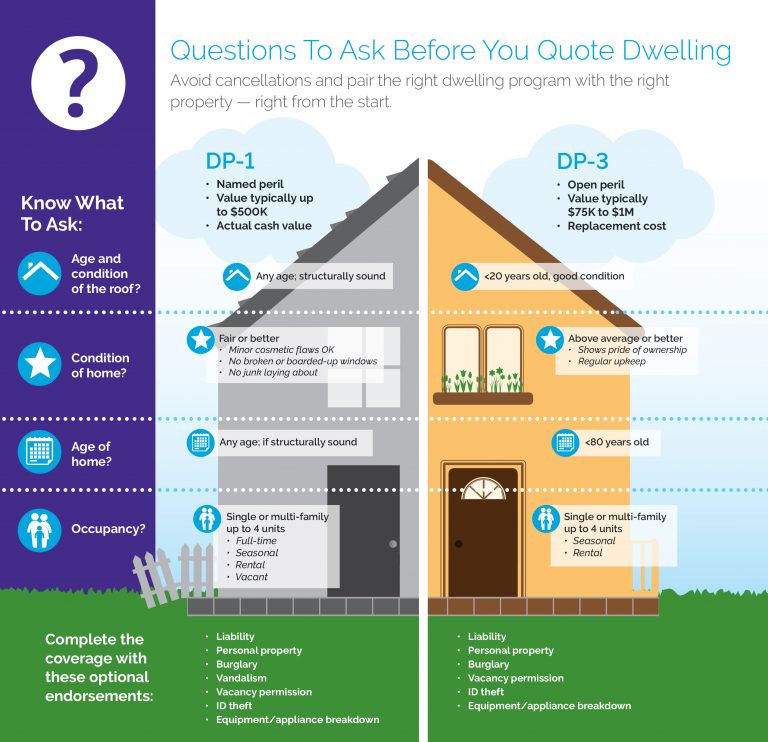

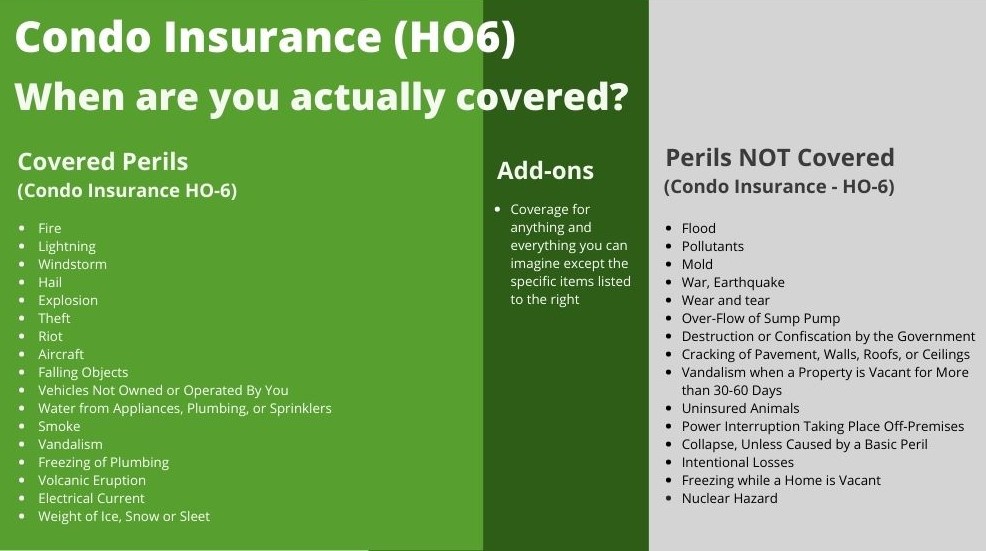

Dp3 Insurance Vs Ho6. Need to review the ccr�s on the condo assn. Dp2 policy is average protection the three most common rental insurance policies are the dp1, dp2, and dp3. An ho3 policy provides more robust coverage than a dp3 policy. If you added some beautiful granite countertops, get those covered on your ho6.

DP3 vs. HO3 Homeowners Insurance Insurance Group From morganinsgroup.net

DP3 vs. HO3 Homeowners Insurance Insurance Group From morganinsgroup.net

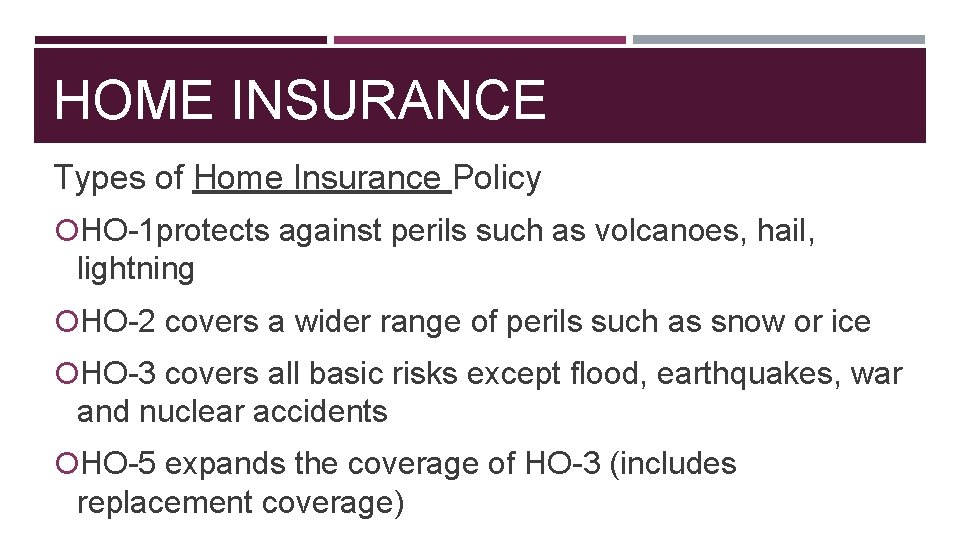

The ho3 policy is a mixture of named perils and open perils coverage. An ho3 policy provides more robust coverage than a dp3 policy. Automated registering and licensing system. All in can be over $100,000 in coverage. However, most insurance companies offer optional riders that you can add on to include personal. Another difference is what portions of the property each policy covers.

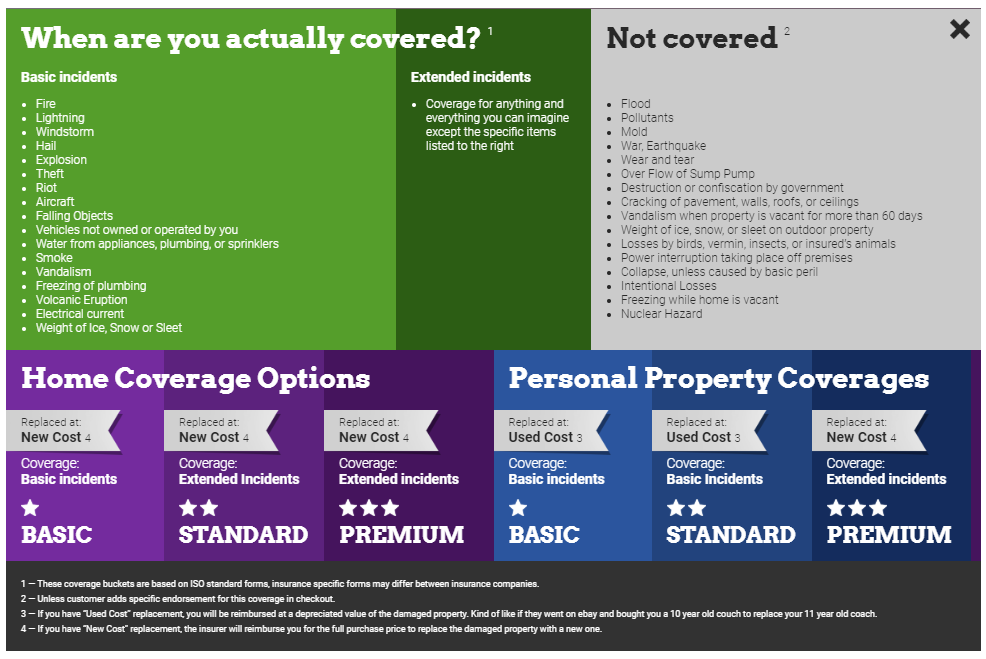

Our ho3 product provides insurance related to most perils, such as fire, lightning and theft.

Updated on tuesday, august 27 2019 all damage and loss claims are paid at replacement cost. It also provides coverage for: But it differs from a ho3 policy in that a dp3 policy offers limited or no coverage for the’ personal property, like furniture. Need to review the ccr�s on the condo assn. A dp3 policy covers structural damage, rental coverage, and personal liability is also included in some dp3 policies. Ho5 provides greater limits for expensive items like jewelry and electronics.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

Ho5 provides greater limits for expensive items like jewelry and electronics. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest. An ho3 policy provides more robust coverage than a dp3 policy. What is the difference between a dp2 and dp3 policy? Dp 1 dp 2 dp 3 ho 2 ho 3 ho 5 ho 8 ho 4 ho 6 basic broad special broad form special form comp.

Source: youngalfred.com

Source: youngalfred.com

The funds you will have for the tenants to rent another place or stay at a hotel while your damaged house is fixed or rebuilt. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Second, locate your insurance policy and review the coverage limits for your condo, villa, or townhome and more specifically, the coverage form the policy is placed on (you should see either: Ho3 policies are a basic type of homeowner’s insurance policy. The three most common rental insurance policies are the dp1, dp2, and dp3.

Source: tgsinsurance.com

Source: tgsinsurance.com

If an ho1 policy doesn’t use replacement cost, it will pay out at actual cash value (acv). The ho3 policy is a mixture of named perils and open perils coverage. Minimum coverage a (coverage for the dwelling) $15,000 no maximum coverage a $2,000,000 no coverage b: Ho6, ho3, dp3, or dp1). Ho3 and dp3 policies are both insurance policies for residential buildings, but there are some notable differences between the two.

Source: eliquinnett.blogspot.com

Source: eliquinnett.blogspot.com

The funds you will have for the tenants to rent another place or stay at a hotel while your damaged house is fixed or rebuilt. In this scenario, the roof and siding fall under coverage a, while the large shed and detached garage are excluded unless you purchased extra coverage b when buying your dp3 policy. Form modified form contents unit owners Ho5 provides greater limits for expensive items like jewelry and electronics. As that will help determine how much dwelling coverage is needed.

Source: youngalfred.com

Source: youngalfred.com

Content coverage is provided against named perils and pays out by acv. You’ll notice the biggest difference in dp3 vs. Form modified form contents unit owners Our ho3 product provides insurance related to most perils, such as fire, lightning and theft. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest.

Source: morganinsgroup.net

Source: morganinsgroup.net

The second biggest difference is dp3’s inclusion of the roof surfacing payment schedule endorsement, which covers the roof for its actual cash value coverage only when it’s damaged by The ho3 policy is a mixture of named perils and open perils coverage. Other structures (buildings or structures that are not the primary structure) covered causes of loss all causes of loss, with certain exclusions no loss settlement replacement cost no coverage amount Content coverage is provided against named perils and pays out by acv. If an ho1 policy doesn’t use replacement cost, it will pay out at actual cash value (acv).

Source: trustedchoice.com

Source: trustedchoice.com

Ho3 policies are a basic type of homeowner’s insurance policy. Personal liability coverage and medical payments to others. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. A dp3 policy generally doesn’t cover any personal belongings, and any credits that might later be applicable (such as premium discounts for having a security system) won’t apply. If an ho1 policy doesn’t use replacement cost, it will pay out at actual cash value (acv).

Source: michelleferrignoagent.blogspot.com

Source: michelleferrignoagent.blogspot.com

However, damage from fire and weather events as well as premise liability is covered, and with olympus, policyholders can also enjoy coverage for theft of building materials (typically excluded from. The three most common rental insurance policies are the dp1, dp2, and dp3. Minimum coverage a (coverage for the dwelling) $15,000 no maximum coverage a $2,000,000 no coverage b: But it differs from a ho3 policy in that a dp3 policy offers limited or no coverage for the’ personal property, like furniture. What is the difference between a dp2 and dp3 policy?

Source: simplyinsurance.com

Source: simplyinsurance.com

You’ll notice the biggest difference in dp3 vs. Typically, condo owners own an individual unit and not usually the entire building; And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies. The dp3 refers to an insurance policy covering a residential building, usually rented to others. However, most insurance companies offer optional riders that you can add on to include personal.

Source: amig.com

Source: amig.com

All in can be over $100,000 in coverage. Other structures (buildings or structures that are not the primary structure) covered causes of loss all causes of loss, with certain exclusions no loss settlement replacement cost no coverage amount However, most insurance companies offer optional riders that you can add on to include personal. The largest difference between the two types of policies are that an ho3 policy is specifically for a house that is owner occupied and an ho6 policy was created for a condo unit owner. Ho3 vs ho6 homeowners policy the largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo.

Source: eliscartaodevisita.blogspot.com

Source: eliscartaodevisita.blogspot.com

The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. If you own a second home and t reside there on a limited basis then a dp3 policy is likely right for you. Ho5 provides greater limits for expensive items like jewelry and electronics. In this scenario, the roof and siding fall under coverage a, while the large shed and detached garage are excluded unless you purchased extra coverage b when buying your dp3 policy. The ho6 policies tend to be fully named peril policies.

Source: youngalfred.com

Source: youngalfred.com

You’ll notice the biggest difference in dp3 vs. Ho3 vs ho6 homeowners policy the largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. Personal liability coverage and medical payments to others. It also provides coverage for: The ho6 policies tend to be fully named peril policies.

Source: thosearevirals.blogspot.com

Source: thosearevirals.blogspot.com

Typically, condo owners own an individual unit and not usually the entire building; Form modified form contents unit owners The second biggest difference is dp3’s inclusion of the roof surfacing payment schedule endorsement, which covers the roof for its actual cash value coverage only when it’s damaged by The dp3 refers to an insurance policy covering a residential building, usually rented to others. The three most common rental insurance policies are the dp1, dp2, and dp3.

Source: friday-csodakmarpedigleteznek.blogspot.com

Source: friday-csodakmarpedigleteznek.blogspot.com

Dp 1 dp 2 dp 3 ho 2 ho 3 ho 5 ho 8 ho 4 ho 6 basic broad special broad form special form comp. Second, locate your insurance policy and review the coverage limits for your condo, villa, or townhome and more specifically, the coverage form the policy is placed on (you should see either: Ho3 policies are a basic type of homeowner’s insurance policy. You can chose a payout at acv, or at replacement cost for a. Ho3 vs ho6 homeowners policy the largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo.

Source: thosearevirals.blogspot.com

Source: thosearevirals.blogspot.com

The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. However, damage from fire and weather events as well as premise liability is covered, and with olympus, policyholders can also enjoy coverage for theft of building materials (typically excluded from. Ho3 vs ho6 homeowners policy the largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. All in can be over $100,000 in coverage.

Source: activerain.com

Minimum coverage a (coverage for the dwelling) $15,000 no maximum coverage a $2,000,000 no coverage b: Guest medical coverage is included as well. Liability coverage normally starts at a minimum of $100,000. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. You can chose a payout at acv, or at replacement cost for a.

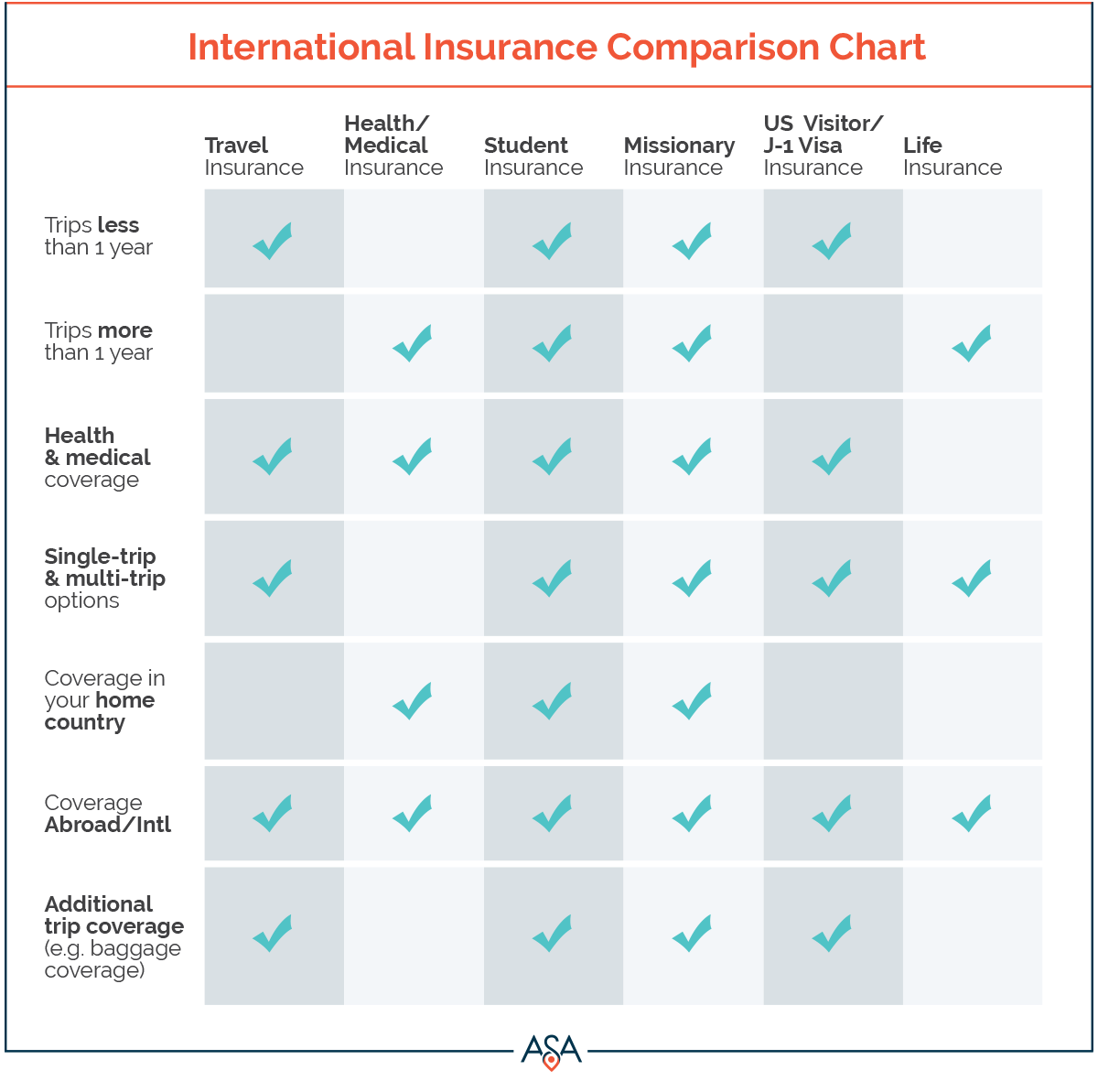

Source: asaincor.com

Source: asaincor.com

Updated on tuesday, august 27 2019 all damage and loss claims are paid at replacement cost. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. Ho3 and dp3 policies are both insurance policies for residential buildings, but there are some notable differences between the two. However, damage from fire and weather events as well as premise liability is covered, and with olympus, policyholders can also enjoy coverage for theft of building materials (typically excluded from. Other structures (buildings or structures that are not the primary structure) covered causes of loss all causes of loss, with certain exclusions no loss settlement replacement cost no coverage amount

Source: tgsinsurance.com

Source: tgsinsurance.com

Form modified form contents unit owners An ho3 policy provides more robust coverage than a dp3 policy. Ho3 policies are a basic type of homeowner’s insurance policy. However, damage from fire and weather events as well as premise liability is covered, and with olympus, policyholders can also enjoy coverage for theft of building materials (typically excluded from. Our ho3 product provides insurance related to most perils, such as fire, lightning and theft.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dp3 insurance vs ho6 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.