Your Dp3 insurance definition images are ready in this website. Dp3 insurance definition are a topic that is being searched for and liked by netizens now. You can Download the Dp3 insurance definition files here. Download all free images.

If you’re looking for dp3 insurance definition pictures information connected with to the dp3 insurance definition keyword, you have visit the right blog. Our site always provides you with hints for seeing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

Dp3 Insurance Definition. It provides excellent coverage for landlords who are looking to get excellent insurance for their rental properties. The dp3 refers to an insurance policy covering a residential building, usually rented to others. A dp3 insurance policy is for investment properties with two to three units in which the homeowner does not reside. In some cases, a dp3 policy also covers appliances and furnishings on the insured property.

DP1 View Discontinued Cameras Cameras SIGMA Corporation From sigma-global.com

DP1 View Discontinued Cameras Cameras SIGMA Corporation From sigma-global.com

It’s an open peril policy, meaning it covers a comprehensive list of possible damages and the full replacement value of any damaged property. With a dp2 or dp3 policy, fair rental value is included within your landlord insurance. Florida dwelling fire insurance (dp3) a florida dwelling fire (dp3) policy not only covers the landlords’ florida property. Like the dp2, it’s also a replacement value policy. It provides excellent coverage for landlords who are looking to get excellent insurance for their rental properties. This means your insurer pays your rental income if a covered peril makes your property uninhabitable.

The dp3 insurance policy is considered the best insurance policy for rentals in the united states.

The dp3 refers to an insurance policy covering a residential building, usually rented to others. An open peril policy generally coverage is given for any type of damage outside of the perils explicitly not included in. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. A dp3 policy covers all perils except perils explicitly stated in your policy. Like the dp2, it’s also a replacement value policy. Also referred to as dwelling fire form 3, this insurance is suitable for residential homes that are not occupied by the owner.

Source: youtube.com

Source: youtube.com

It provides excellent coverage for landlords who are looking to get excellent insurance for their rental properties. With a dp2 or dp3 policy, fair rental value is included within your landlord insurance. The dp3 refers to an insurance policy covering a residential building, usually rented to others. The dwelling must be the principle residence of the insured. A dp3 policy covers all perils except perils explicitly stated in your policy.

Source: youtube.com

Source: youtube.com

Dp3 takes dp2 one step further with the ability to continue operation with the failure of an active or static component, even with the total loss of the equipment in a compartment to fire or flood. Dp1 policies and dp3 policies are both dwelling fire policies, but there are a few notable differences between dp3 and dp1 coverage. The selection of cover then determines the. Dp3 takes dp2 one step further with the ability to continue operation with the failure of an active or static component, even with the total loss of the equipment in a compartment to fire or flood. An open peril policy generally coverage is given for any type of damage outside of the perils explicitly not included in.

Source: androidheadlines.com

Source: androidheadlines.com

As the owner of the property, you may ultimately be responsible for your tenants and any accidents occurring on the property. Your insurance company will pay your rental income if one or more of the eighteen perils makes your property unlivable or uninhabitable. The dp3 insurance policy is considered the best insurance policy for rentals in the united states. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. As the owner of the property, you may ultimately be responsible for your tenants and any accidents occurring on the property.

Source: abbreviationfinder.org

Source: abbreviationfinder.org

Like the dp2, it’s also a replacement value policy. The dwelling must be the principle residence of the insured. It provides excellent coverage for landlords who are looking to get excellent insurance for their rental properties. Like the dp2, it’s also a replacement value policy. A dp3 insurance policy is for investment properties with two to three units in which the homeowner does not reside.

Source: arrowheadgrp.com

Source: arrowheadgrp.com

Dp3 rental home insurance policy. Dp3 takes dp2 one step further with the ability to continue operation with the failure of an active or static component, even with the total loss of the equipment in a compartment to fire or flood. Because the property is an income source, landlords need to maintain. An open peril policy generally coverage is given for any type of damage outside of the perils explicitly not included in. Dwelling fire (dp3) when you own a home and rent it out, you want to make sure you protect that investment against incidents like accidents, natural disasters, or theft which can leave you vulnerable to paying large sums of money if you aren’t.

Source: emmi-dulce.blogspot.com

The selection of cover then determines the. Los productores de dp3 conformaron el 11,3% de la muestra, su edad promedio fue de 50 anos y escolaridad de ocho anos, algunos de. A dp3 policy, also known as a special dwelling policy, is the most extensive form of dwelling fire coverage. The dp3 rental home insurance policy is considered the best insurance policy for rental properties in the united states. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage.

Source: kk2.ne.jp

Source: kk2.ne.jp

The dp3 refers to an insurance policy covering a residential building, usually rented to others. Dwelling fire dp3 quick reference guide please note: The dwelling must be the principle residence of the insured. A dp3 policy, also known as a special dwelling policy, is the most extensive form of dwelling fire coverage. The dp3 refers to an insurance policy covering a residential building, usually rented to others.

Source: sigma-global.com

Source: sigma-global.com

The dp3 refers to an insurance policy covering a residential building, usually rented to others. Monroe, dade, broward, and palm beach counties operate on unique territory requirements. The dp3 insurance policy is considered the best insurance policy for rentals in the united states. An open peril policy generally coverage is given for any type of damage outside of the perils explicitly not included in. A dp3 insurance policy is for investment properties with two to three units in which the homeowner does not reside.

Source: exemplegroupes.blogspot.com

Source: exemplegroupes.blogspot.com

Fair rental value coverage is essential for landlords, and it’s one of the things that sets dp2 and dp3 policies apart from standard homeowners insurance. Meaning everything listed above would typically be covered unless your policy documents state exclusions. Systems may also be required to be watertight depending on the vessel and damage to one system must not affect the backup. Dp3 takes dp2 one step further with the ability to continue operation with the failure of an active or static component, even with the total loss of the equipment in a compartment to fire or flood. The dp3 is popular because it is an open peril policy that covers losses to the building�s structure, loss of use�or rental coverage , and customarily personal liability as well.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

A dp3 insurance policy is for investment properties with two to three units in which the homeowner does not reside. The policy typically protects the home from perils such as windstorm, hail, smoke, fire, vehicles amongst other perils. Dp3 takes dp2 one step further with the ability to continue operation with the failure of an active or static component, even with the total loss of the equipment in a compartment to fire or flood. It is not the most basic insurance, but it’s not the best. Because the property is an income source, landlords need to maintain.

Source: ebay.co.uk

Source: ebay.co.uk

Fair rental value coverage is essential for landlords, and it’s one of the things that sets dp2 and dp3 policies apart from standard homeowners insurance. In some cases, a dp3 policy also covers appliances and furnishings on the insured property. Florida dwelling fire insurance (dp3) a florida dwelling fire (dp3) policy not only covers the landlords’ florida property. The most prominent difference between a dp1 and a dp3 policy is that a dp1 is a named peril policy, whereas a dp3 is an open peril policy. Dp3 rental home insurance policy.

Systems may also be required to be watertight depending on the vessel and damage to one system must not affect the backup. Florida dwelling fire insurance (dp3) a florida dwelling fire (dp3) policy not only covers the landlords’ florida property. Dp1 policies and dp3 policies are both dwelling fire policies, but there are a few notable differences between dp3 and dp1 coverage. The dp3 is usually an open perils policy. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

The dp3 is usually an open perils policy. Dwelling fire dp3 quick reference guide please note: Dp1 policies and dp3 policies are both dwelling fire policies, but there are a few notable differences between dp3 and dp1 coverage. Meaning everything listed above would typically be covered unless your policy documents state exclusions. Monroe, dade, broward, and palm beach counties operate on unique territory requirements.

Source: salonstaffrecruitment.co.uk

A dp3 policy covers all perils except perils explicitly stated in your policy. As the owner of the property, you may ultimately be responsible for your tenants and any accidents occurring on the property. A dp3 insurance policy is for investment properties with two to three units in which the homeowner does not reside. Systems may also be required to be watertight depending on the vessel and damage to one system must not affect the backup. Monroe, dade, broward, and palm beach counties operate on unique territory requirements.

Source: kin.com

Source: kin.com

Fair rental value coverage is essential for landlords, and it’s one of the things that sets dp2 and dp3 policies apart from standard homeowners insurance. As the owner of the property, you may ultimately be responsible for your tenants and any accidents occurring on the property. The dp3 is usually an open perils policy. Your insurance company will pay your rental income if one or more of the eighteen perils makes your property unlivable or uninhabitable. Florida dwelling fire insurance (dp3) a florida dwelling fire (dp3) policy not only covers the landlords’ florida property.

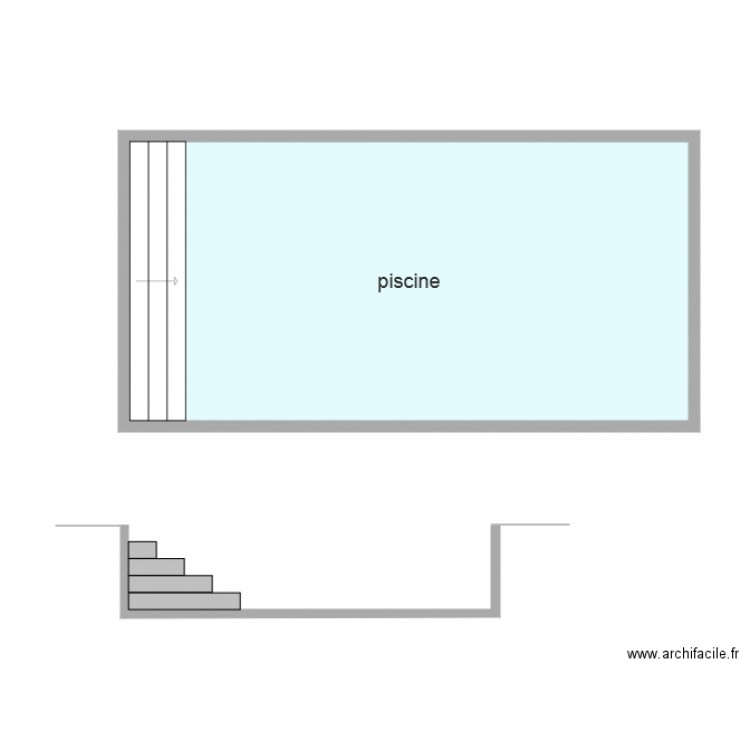

Source: prezi.com

Source: prezi.com

A dp3 policy, also known as a special dwelling policy, is the most extensive form of dwelling fire coverage. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. The dp3 refers to an insurance policy covering a residential building, usually rented to others. Like the dp2, it’s also a replacement value policy. Florida dwelling fire insurance (dp3) a florida dwelling fire (dp3) policy not only covers the landlords’ florida property.

Source: androidheadlines.com

Source: androidheadlines.com

The dp3 rental home insurance policy is considered the best insurance policy for rental properties in the united states. The dp3 refers to an insurance policy covering a residential building, usually rented to others. The dp3 insurance policy is considered the best insurance policy for rentals in the united states. Los productores de dp3 conformaron el 11,3% de la muestra, su edad promedio fue de 50 anos y escolaridad de ocho anos, algunos de. This means your insurer pays your rental income if a covered peril makes your property uninhabitable.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dp3 insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.