Your Dp1 insurance images are ready. Dp1 insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Dp1 insurance files here. Download all free images.

If you’re looking for dp1 insurance images information related to the dp1 insurance keyword, you have come to the right site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Dp1 Insurance. In the united states, most landlords have three standard policy types available to insure their rental properties. Not every home needs, or is eligible for, the full coverage of a homeowners policy. Dp1 insurance offers the least coverage of the dwelling policies. These perils typically include damage from:

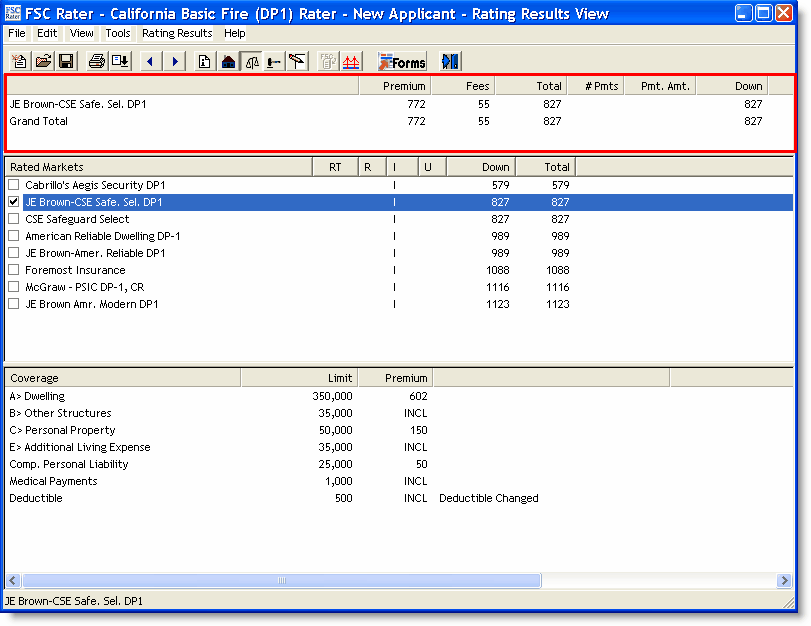

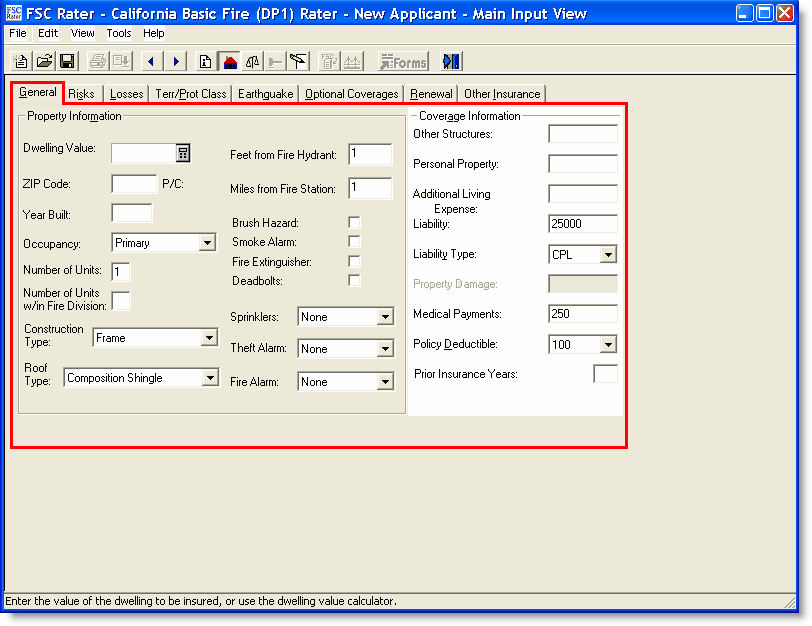

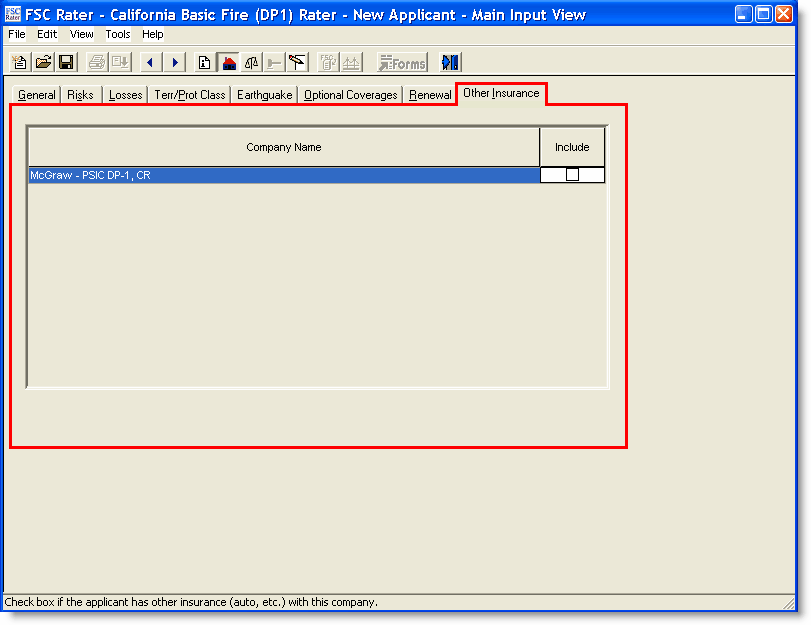

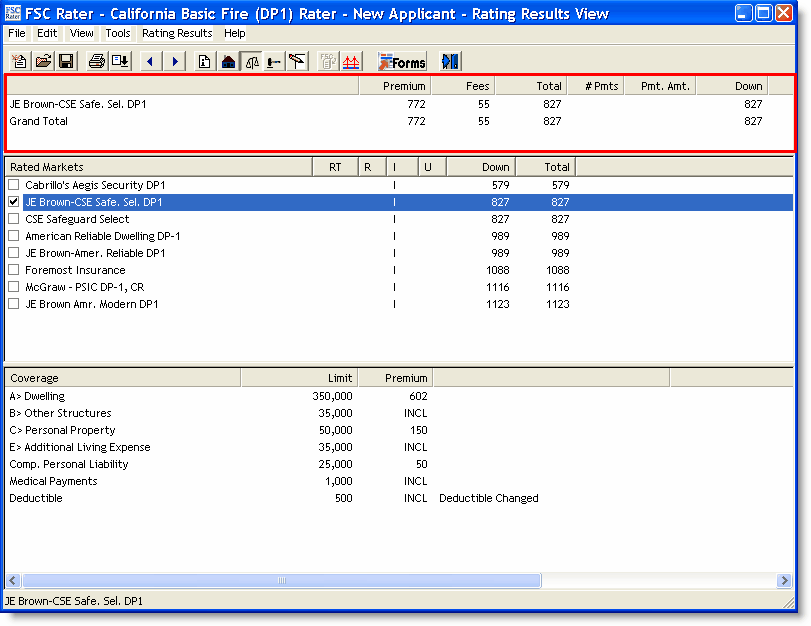

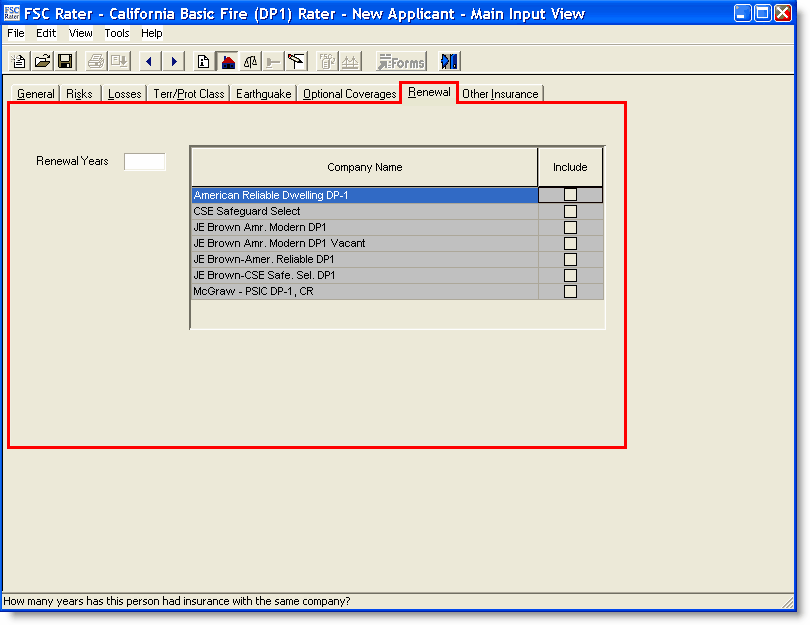

DP1 Section 1 From help.vertafore.com

DP1 Section 1 From help.vertafore.com

It contains no bells and whistles. Click to see full answer. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states. Get a dp1 insurance policy quote in minutes with steadily. The dp1 is the first, followed by the dp2 and the dp3. The selection of cover then determines the policy issued and to some degree the insurer.

The dp1 insurance policy is the most basic insurance policy available for primary homes or rental properties.

While there are several different types of dwelling fire policies available to property owners, dp1s are one of the most common and most popular among homeowners who need a basic insurance policy. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states. Click to see full answer. Dp 1 dp 2 dp 3 ho 2 ho 3 ho 5 ho 8 ho 4 ho 6 basic broad special broad form special form comp. Covers losses at actual cash value (acv) rather than the more. Form modified form contents unit owners

Source: youngalfred.com

Source: youngalfred.com

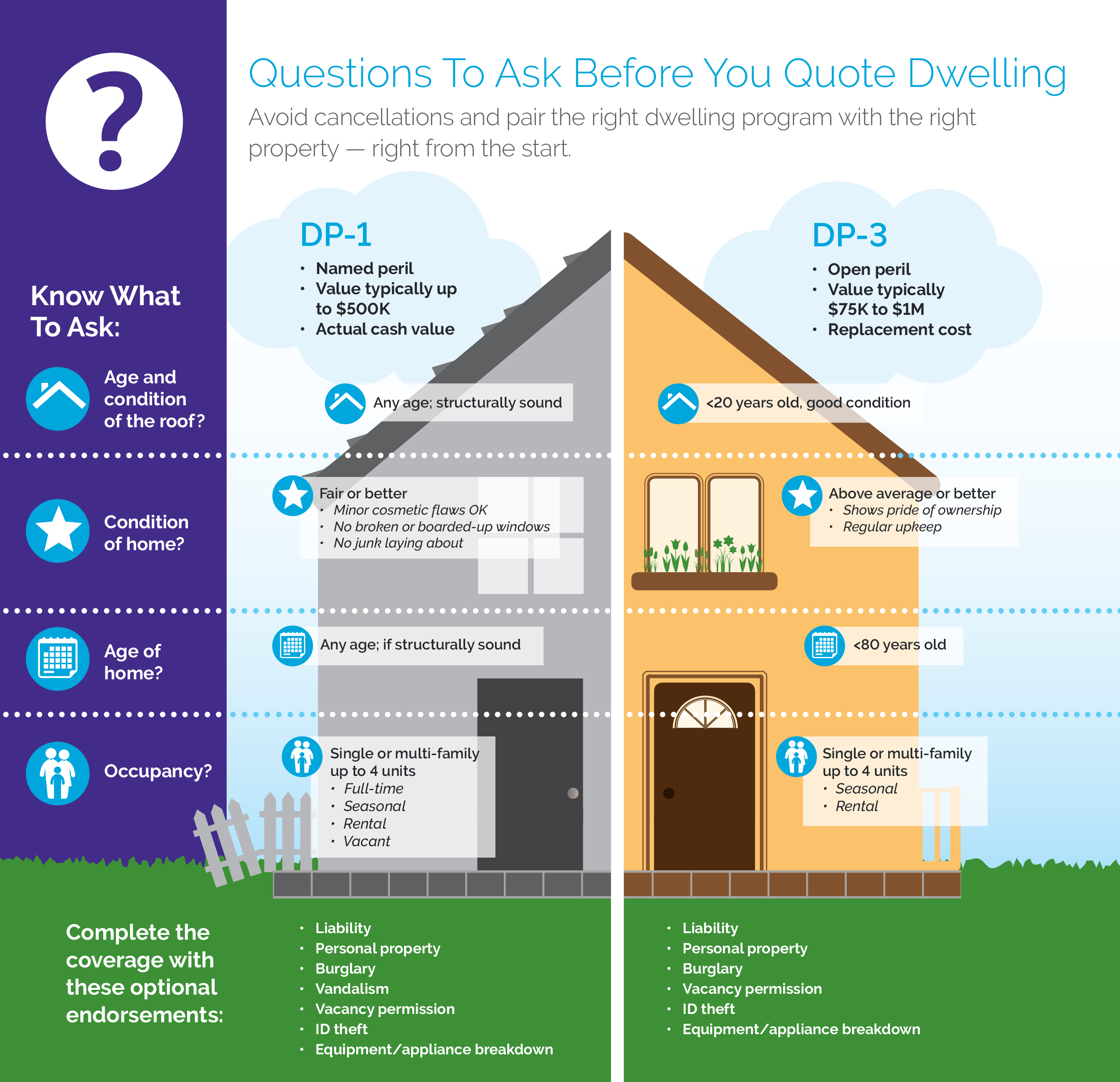

What is gap insurance for cars? Dp1 provides basic insurance coverage. It provides very basic insurance coverage for rental properties. The dp1 is the first, followed by the dp2 and the dp3. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there.

Source: youngalfred.com

Source: youngalfred.com

Another point to note about dp1 insurance is that it does not cover personal property or. Dp1 vs dp3 the dp1 and dp3 are two types of dwelling fire policies. The insurance coverage is restricted to the perils that show up in the policy. Get a dp1 insurance policy quote in minutes with steadily. These perils typically include damage from:

Source: flickriver.com

Source: flickriver.com

The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. What is gap insurance for cars? Dp1 insurance is named risk insurance the dp1 insurance policy is a named perils insurance policy. Wind and hail (34.4 percent) fire and lightning (32.7 percent) water damage and freezing (23.8 percent) theft only accounts for 1% of all claims. Click to see full answer.

Source: becomeprolandlord.com

Source: becomeprolandlord.com

The insurance coverage is restricted to the perils that show up in the policy. The dp1 is the first, followed by the dp2 and the dp3. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states. These perils typically include damage from: I am now reconsidering the merrill dp1/2/3 and i am curious to know which.

Source: michelleferrignoagent.blogspot.com

Source: michelleferrignoagent.blogspot.com

Dp 1 dp 2 dp 3 ho 2 ho 3 ho 5 ho 8 ho 4 ho 6 basic broad special broad form special form comp. Click to see full answer. The insurance coverage is restricted to the perils that show up in the policy. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. It provides very basic insurance coverage for rental properties.

Source: youngalfred.com

Source: youngalfred.com

Dp1 insurance offers the least coverage of the dwelling policies. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states. The selection of cover then determines the policy issued and to some degree the insurer. Dp1 provides basic insurance coverage.

Source: google.co.in

Source: google.co.in

The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. The dp1 and dp3 are two types of dwelling fire policies. Our team of trained insurance agents are dp1 experts, available 24/7 on sms, email and phone. Dp1 insurance is named risk insurance the dp1 insurance policy is a named perils insurance policy. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there.

Source: help.vertafore.com

Source: help.vertafore.com

What is gap insurance for cars? The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. Form modified form contents unit owners Besides, what is a dp1 policy? The insurance coverage is restricted to the perils that show up in the policy.

Source: help.vertafore.com

Source: help.vertafore.com

This means that all the perils that are insured are specifically listed (or named) in the policy itself. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. The selection of cover then determines the policy issued and to some degree the insurer. These perils typically include damage from: While dp1 insurance is light on the coverage, bear in mind that the top three homeowners insurance claims are:

Source: activerain.com

These perils typically include damage from: It covers damage caused by the perils named in the policy, and those perils are usually limited to these nine: Dp 1 dp 2 dp 3 ho 2 ho 3 ho 5 ho 8 ho 4 ho 6 basic broad special broad form special form comp. Dp1 vs dp3 the dp1 and dp3 are two types of dwelling fire policies. A dp1 insurance policy is a type of insurance policy that falls into the category of dwelling fire policy.

Source: help.vertafore.com

Source: help.vertafore.com

The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Covers losses at actual cash value (acv) rather than the more. A dp1 insurance policy is a type of insurance policy that falls into the category of dwelling fire policy. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

While there are several different types of dwelling fire policies available to property owners, dp1s are one of the most common and most popular among homeowners who need a basic insurance policy. The insurance coverage is restricted to the perils that show up in the policy. It provides very basic insurance coverage for rental properties. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states. In the united states, most landlords have three standard policy types available to insure their rental properties.

Source: help.vertafore.com

Source: help.vertafore.com

Click to see full answer. It is a named peril policy, which means that it only covers the perils explicitly stated in the policy. The dp1 is the first, followed by the dp2 and the dp3. Covers losses at actual cash value (acv) rather than the more. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states.

Source: aisagency.com

Source: aisagency.com

This means that all the perils that are insured are listed, or named, in the policy itself. It provides very basic insurance coverage for rental properties. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. Covers losses at actual cash value (acv) rather than the more. It provides very basic insurance coverage for rental properties.

Source: acquiremag.com

Source: acquiremag.com

It provides very basic insurance coverage for rental properties. The three forms, dp1, dp2, and dp3, vary in the amount of cover they offer, the way they settle payments, and other endorsements to provide stability and security to landlords. Dp1 vs dp3 the dp1 and dp3 are two types of dwelling fire policies. It covers damage caused by the perils named in the policy, and those perils are usually limited to these nine: I am now reconsidering the merrill dp1/2/3 and i am curious to know which.

Source: thosearevirals.blogspot.com

Source: thosearevirals.blogspot.com

The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. The insurance coverage is restricted to the perils that show up in the policy. The dp1 is used for vacant property insurance and offers the minimum coverage amount while the dp3 is for landlord insurance where the homeowner rents out the property, but does not live there. Click to see full answer. It provides very basic insurance coverage for rental properties.

Source: sigma-rumors.com

Source: sigma-rumors.com

Dp1 insurance is named risk insurance. In the united states, most landlords have three standard policy types available to insure their rental properties. The dp1 insurance policy is the most basic insurance policy available for primary homes or rental properties. It provides very basic insurance coverage for rental properties. The insurance coverage is restricted to the perils that show up in the policy.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

It provides very basic insurance coverage for rental properties. Dp1 insurance is named risk insurance the dp1 insurance policy is a named perils insurance policy. • fire and smoke, • lightning,. It contains no bells and whistles. The dp1 insurance policy is the most basic insurance policy available for rental properties in the united states.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dp1 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.