Your Double indemnity life insurance images are available in this site. Double indemnity life insurance are a topic that is being searched for and liked by netizens today. You can Download the Double indemnity life insurance files here. Find and Download all free photos.

If you’re searching for double indemnity life insurance images information linked to the double indemnity life insurance keyword, you have visit the right site. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

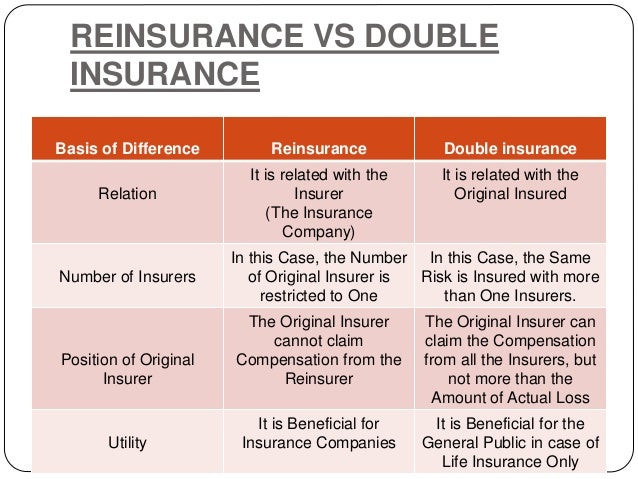

Double Indemnity Life Insurance. Double indemnity clauses are found most often in life insurance policies. When these benefits are double the standard compensation, this is known as a “double indemnity” claim. With life insurance double indemnity, you can actually create a larger payment for them if you die from an accidental death. Double indemnity is a clause or provision in a life insurance or accident policy whereby the company agrees to pay the stated multiple (e.g., double, (1).

"Goldie Offed Her Husband Over His DoubleIndemnity Life From redbubble.com

"Goldie Offed Her Husband Over His DoubleIndemnity Life From redbubble.com

Double indemnity clauses can provide many benefits to grieving families, but it is important to have proper knowledge of how insurance carriers. Double indemnity is an accidental death clause in the life insurance policy. Dietrichson for life insurance money with a double indemnity clause. These clauses stipulate that the insurance carrier agrees to pay twice the policy limit amount in the event of an accidental death. When these benefits are double the standard compensation, this is known as a “double indemnity” claim. Life insurance and accident policies often include a double indemnity clause, under which the insurance company agrees to pay twice the policy amount in case of an accidental death.

A standard policy provides a certain amount of financial protection when the insured dies from almost any cause.

The double indemnity provision in a life insurance policy generally speaking, however, it refers to an agreement commonly found in life insurance policies. Double indemnity is a clause or provision in a life insurance or accident policy whereby the company agrees to pay the stated multiple (e.g., double, (1). The double indemnity provision in a life insurance policy generally speaking, however, it refers to an agreement commonly found in life insurance policies. This agreement establishes that in the event of an accidental death, the insurance company must pay double the amount stated in the contract. Very often, this additional payment will be double or. With life insurance double indemnity, you can actually create a larger payment for them if you die from an accidental death.

Source: mahalaxmilife.com.np

Source: mahalaxmilife.com.np

A double indemnity life insurance policy is a life insurance policy which effectively would result in double payment in the case that the individual holding the policy suffers an accidental death. Double indemnity is an accidental death clause in the life insurance policy. With life insurance double indemnity, you can actually create a larger payment for them if you die from an accidental death. A term of an insurance policy by which the insurance company promises to pay the insured or the beneficiary twice the amount of coverage if loss occurs due to a particular cause or set of circumstances. Most life insurance providers define an accidental death as a death that occurs specifically as a result of an accident —.

Source: cnbctv18.com

Source: cnbctv18.com

Both life insurance and accident policies regularly include double indemnity clauses. In the case of the accidental death of the insured, the. Double indemnity is a provision in some life insurance contracts that requires Double indemnity is a term used in life insurance and accidental death and dismemberment policies. Very often, this additional payment will be double or.

Source: vaping360.com

Source: vaping360.com

Most life insurance providers define an accidental death as a death that occurs specifically as a result of an accident —. Double indemnity is an accidental death clause in the life insurance policy. Double indemnity is a clause in a life insurance policy that states the insurance company will pay twice the amount of money stated in the standard life insurance contract if the death of the insured results from an accident. This agreement establishes that in the event of an accidental death, the insurance company must pay double the amount stated in the contract. According to these clauses, insurance carriers agree to pay twice the policy amount in the event of accidental death.

![]() Source: iconfinder.com

Source: iconfinder.com

In the case of life insurance where the principal of. An accidental death is specifically defined within a double indemnity clause as being a death which is neither caused by natural causes nor is caused by some human will. Double indemnity is a clause or provision in a life insurance or accident policy whereby the company agrees to pay the stated multiple (e.g., double, (1). Double indemnity life insurance definition double indemnity life insurance clauses require an insurer to provide a larger payout if the insured died as a result of accidental death. In triple indemnity, three times the face value of the.

Source: fool.com.au

Source: fool.com.au

The accidental death benefit is paid in addition to the death benefit, should the insured�s death occur due to an accident. These clauses stipulate that the insurance carrier agrees to pay twice the policy limit amount in the event of an accidental death. In the case of life insurance where the principal of. When these benefits are double the standard compensation, this is known as a “double indemnity” claim. Although for some years, double indemnity was often a standard provision of most life insurance policies in laurel, maryland and everywhere else.

Source: lavislaw.com

Source: lavislaw.com

The double indemnity provision in a life insurance policy generally speaking, however, it refers to an agreement commonly found in life insurance policies. The double indemnity provision in a life insurance policy generally speaking, however, it refers to an agreement commonly found in life insurance policies. Life insurance and accident policies often include a double indemnity clause, under which the insurance company agrees to pay twice the policy amount in case of an accidental death. A double indemnity life insurance policy is a life insurance policy which effectively would result in double payment in the case that the individual holding the policy suffers an accidental death. Double indemnity provisions can be embedded into life insurance policies providing twice the death benefit if death was deemed accidental.

![]() Source: iconfinder.com

Source: iconfinder.com

Double indemnity clauses can provide many benefits to grieving families, but it is important to have proper knowledge of how insurance carriers. Double indemnity is an accidental death clause in the life insurance policy. The couple are immediately drawn to each other and an affair begins. Both life insurance and accident policies regularly include double indemnity clauses. Double indemnity life insurance definition double indemnity life insurance clauses require an insurer to provide a larger payout if the insured died as a result of accidental death.

Source: redbubble.com

Source: redbubble.com

Double indemnity clauses are found most often in life insurance policies. The term double indemnity refers to a clause in certain life insurance policies that doubles the payout in cases when the death is accidental. Life insurance and accident policies often include a double indemnity clause, under which the insurance company agrees to pay twice the policy amount in case of an accidental death. The couple are immediately drawn to each other and an affair begins. According to these clauses, insurance carriers agree to pay twice the policy amount in the event of accidental death.

Source: pinterest.com

Source: pinterest.com

When these benefits are double the standard compensation, this is known as a “double indemnity” claim. The couple are immediately drawn to each other and an affair begins. 98 double indemnity in life insurance policies event incur such expense as is incidental to securing life insurance. Double indemnity is a provision in some life insurance contracts that requires Very often, this additional payment will be double or.

Source: pinterest.com

Source: pinterest.com

The term double indemnity refers to a clause in certain life insurance policies that doubles the payout in cases when the death is accidental. In the case of life insurance where the principal of. Although for some years, double indemnity was often a standard provision of most life insurance policies in laurel, maryland and everywhere else. While double indemnity can provide a number of benefits to grieving families, not all washington insurance policies honor this agreement. The double indemnity provision in a life insurance policy generally speaking, however, it refers to an agreement commonly found in life insurance policies.

![]() Source: iconfinder.com

Source: iconfinder.com

While double indemnity can provide a number of benefits to grieving families, not all washington insurance policies honor this agreement. Very often, this additional payment will be double or. In the case of life insurance where the principal of. Very often, this additional payment will be double or. When these benefits are double the standard compensation, this is known as a “double indemnity” claim.

Source: redbubble.com

Source: redbubble.com

In addition to the commission paid to the agent, Double indemnity clauses are often found in life insurance policies and are a form of accidental death insurance because it typically requires the insurer to pay double the face value of. Double indemnity clauses can provide many benefits to grieving families, but it is important to have proper knowledge of how insurance carriers. The accidental death benefit is paid in addition to the death benefit, should the insured�s death occur due to an accident. Most life insurance providers define an accidental death as a death that occurs specifically as a result of an accident —.

Source: mahalaxmilife.com

Source: mahalaxmilife.com

Double indemnity is an accidental death clause in the life insurance policy. Double indemnity is an accidental death clause in the life insurance policy. Double indemnity is a term used in life insurance and accidental death and dismemberment policies. In triple indemnity, three times the face value of the. 98 double indemnity in life insurance policies event incur such expense as is incidental to securing life insurance.

Source: slideshare.net

Source: slideshare.net

Double indemnity is an accidental death clause in the life insurance policy. Double indemnity provisions can be embedded into life insurance policies providing twice the death benefit if death was deemed accidental. In triple indemnity, three times the face value of the. These clauses stipulate that the insurance carrier agrees to pay twice the policy limit amount in the event of an accidental death. Double indemnity is a provision in some life insurance contracts that requires

Source: licinternationaluae.com

Source: licinternationaluae.com

Both life insurance and accident policies regularly include double indemnity clauses. With life insurance double indemnity, you can actually create a larger payment for them if you die from an accidental death. They cook up a scheme to murder mr. In triple indemnity, three times the face value of the. According to these clauses, insurance carriers agree to pay twice the policy amount in the event of accidental death.

Source: mahalaxmilife.com.np

Source: mahalaxmilife.com.np

Double indemnity clauses state that the insurance company will pay a specified multiple (double, triple, etc.) of the contract’s face value in the event of accidental death. Although for some years, double indemnity was often a standard provision of most life insurance policies in laurel, maryland and everywhere else. Double indemnity is a clause or provision in a life insurance or accident policy whereby the company agrees to pay the stated multiple (e.g., double, (1). Dietrichson for life insurance money with a double indemnity clause. Double indemnity clauses can provide many benefits to grieving families, but it is important to have proper knowledge of how insurance carriers.

Source: youtube.com

Source: youtube.com

The couple are immediately drawn to each other and an affair begins. In the case of the accidental death of the insured, the. Double indemnity clauses are often found in life insurance policies and are a form of accidental death insurance because it typically requires the insurer to pay double the face value of. Double indemnity clauses are often found in life insurance policies and are a form of accidental death insurance because it typically requires the insurer to pay double the face value of the life policy to the beneficiary in the event of accidental death. 98 double indemnity in life insurance policies event incur such expense as is incidental to securing life insurance.

Source: youtube.com

Source: youtube.com

Double indemnity clauses are often found in life insurance policies and are a form of accidental death insurance because it typically requires the insurer to pay double the face value of the life policy to the beneficiary in the event of accidental death. The term double indemnity refers to a clause in certain life insurance policies that doubles the payout in cases when the death is accidental. Both life insurance and accident policies regularly include double indemnity clauses. While these policies seem straightforward, insurers often deny these claims. Double indemnity clauses are often found in life insurance policies and are a form of accidental death insurance because it typically requires the insurer to pay double the face value of the life policy to the beneficiary in the event of accidental death.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title double indemnity life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.