Your Donald is the primary insured of a life insurance images are ready in this website. Donald is the primary insured of a life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Donald is the primary insured of a life insurance files here. Find and Download all free photos.

If you’re looking for donald is the primary insured of a life insurance images information related to the donald is the primary insured of a life insurance interest, you have come to the ideal site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

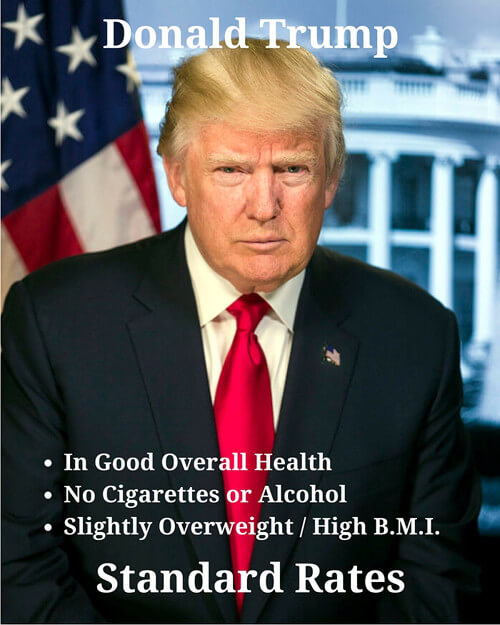

Donald Is The Primary Insured Of A Life Insurance. Then the primary beneficiary (or in this case her/his heirs) will receive the death benefit. If you’re married or have children, it’s important that you know what these rules are. The value reflected in the policy, called a death benefit, might reflect the insured’s net worth, income or other financial obligations. Can be converted to permanent coverage without evidence of insurability coverage can be different for each child premiums on this rider are not required until the limiting age is reached increases the policy�s overall cash value

Many Americans don�t have life insurance or a will, survey From takechargecapital.com

Many Americans don�t have life insurance or a will, survey From takechargecapital.com

Subsequently, question is, can an insurance agent be a beneficiary? Who cashes moneygram money orders. Then the primary beneficiary (or in this case her/his heirs) will receive the death benefit. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. You may owe cost sharing. Donald is the primary insured of a life insurance policy and adds a children’s term rider.

I don’t want to accept the money.”.

If the primary beneficiary is deceased, the money is split between the other primary beneficiaries. First, you can’t name a minor as the beneficiary. They must have reached the age of majority, 18 or 21, which will vary based upon what state they reside in. I don’t want to accept the money.”. If the primary beneficiary is deceased, the money is split between the other primary beneficiaries. Since the owner of the policy provided that the primary beneficiary would receive the death benefit as long as the primary beneficiary survived the owner;

Source: noclutter.cloud

Source: noclutter.cloud

The primary insured rider provides additional annual renewable term (art) life insurance on you, the insured. Life insurance assigns a particular monetary value to an individual’s life. The primary beneficiary is the person (or persons) who will receive the proceeds of the life insurance policy when the insured person dies. Person whose life is insured. The insured, the policy owner and the beneficiary(s).

Source: cheapsr22.us

Source: cheapsr22.us

The article explains that an individual who’s designated as a beneficiary of a life insurance policy has a right to disclaim the proceeds. Since the owner of the policy provided that the primary beneficiary would receive the death benefit as long as the primary beneficiary survived the owner; Donald is the primary insured of a life insurance policy and adds a children�s term rider. However, when the primary beneficiary disclaims the proceeds, he or she. However, the primary beneficiary will not receive any proceeds if he or she dies before the death of the named insured.

Source: o.canada.com

Source: o.canada.com

However, the primary beneficiary will not receive any proceeds if he or she dies before the death of the named insured. Each of these are defined below with examples of the common designations. The primary insured rider provides additional annual renewable term (art) life insurance on you, the insured. In any life insurance policy, the insured is the person on whom the protection is purchased. In effect, the beneficiary is telling the life insurance company “thanks, but no thanks.

The value reflected in the policy, called a death benefit, might reflect the insured’s net worth, income or other financial obligations. The primary duties of an insured in an insurance contract are as follows: They are both involved in an. The primary beneficiary of a life insurance policy is the one who would receive the money if the insured person passed away. Three basic life insurance roles.

Source: catchingsounds.com

Source: catchingsounds.com

Each of these are defined below with examples of the common designations. There can be more than one primary beneficiary, with each one getting a certain percent of the death benefit. The article explains that an individual who’s designated as a beneficiary of a life insurance policy has a right to disclaim the proceeds. However, when the primary beneficiary disclaims the proceeds, he or she. That individual is the policy’s insured party.

Source: indian24betapp.com

Source: indian24betapp.com

When an insured under a life insurance policy died? If you’re married or have children, it’s important that you know what these rules are. There’s usually a base amount minimum and the policy must be permanent. What is the advantage of adding this rider? The primary insured rider face amount can’t exceed four times the base policy face amount.

Source: donaldweiss.com

Source: donaldweiss.com

When an insured under a life insurance policy died? Donald is the primary insured of a life insurance policy and adds a children’s term rider. However, when the primary beneficiary disclaims the proceeds, he or she. You may owe cost sharing. First, you can’t name a minor as the beneficiary.

Source: gandhiselimlaw.com

Source: gandhiselimlaw.com

They are both involved in an. Then the primary beneficiary (or in this case her/his heirs) will receive the death benefit. They must have reached the age of majority, 18 or 21, which will vary based upon what state they reside in. The primary duties of an insured in an insurance contract are as follows: Provide funds to help pay taxes

Source: capitolbenefits.com

Source: capitolbenefits.com

The value reflected in the policy, called a death benefit, might reflect the insured’s net worth, income or other financial obligations. The primary duties of an insured in an insurance contract are as follows: If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. Donald is the primary insured of a life insurance policy and adds a children’s term rider. Who cashes moneygram money orders.

Source: mintgenie.livemint.com

Source: mintgenie.livemint.com

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later. The primary beneficiary of a life insurance policy is the one who would receive the money if the insured person passed away. 2) the insured is the person whose life is being covered against the risk under the policy. Donald is the primary insured of a life insurance policy and adds a children�s term rider. The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits.

Source: youtube.com

Source: youtube.com

I don’t want to accept the money.”. The article explains that an individual who’s designated as a beneficiary of a life insurance policy has a right to disclaim the proceeds. If there are no living beneficiaries the proceeds will go to the estate of the insured. You may owe cost sharing. They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

Pat is insured with a life insurance policy and karen is his primary beneficiary. You may owe cost sharing. Upon written request to your life carrier. However, when the primary beneficiary disclaims the proceeds, he or she. The article explains that an individual who’s designated as a beneficiary of a life insurance policy has a right to disclaim the proceeds.

Source: takechargecapital.com

Source: takechargecapital.com

Person who collects the death benefit when the insured person dies. Which policy provision will protect the rights of the contingent beneficiary to receive the policy benefits. Once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan. You can choose just about anyone you want to be a beneficiary of your life insurance policy, primary or contingent, with two exceptions. Generally there are three parties to a life insurance policy:

Source: apptronica.co.uk

Source: apptronica.co.uk

If the primary beneficiary is deceased, the money is split between the other primary beneficiaries. The primary insured rider provides additional annual renewable term (art) life insurance on you, the insured. Provide funds to help pay taxes Subsequently, question is, can an insurance agent be a beneficiary? If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary.

Source: insurancefouryou.com

Source: insurancefouryou.com

The insured, the policy owner and the beneficiary(s). They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later. Which policy provision will protect the rights of the contingent beneficiary to receive the policy benefits. The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. Generally there are three parties to a life insurance policy:

Source: youtube.com

Source: youtube.com

They are both involved in an. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. Subsequently, question is, can an insurance agent be a beneficiary? You may owe cost sharing. The primary insured rider provides additional annual renewable term (art) life insurance on you, the insured.

Source: revisi.net

Source: revisi.net

When an insured under a life insurance policy died? But first, let�s talk about what a named insured is and why they are so important to an insurance policy. Who cashes moneygram money orders. Provide funds to help pay taxes Three basic life insurance roles.

Source: pinterest.com

Source: pinterest.com

Each of these are defined below with examples of the common designations. The article explains that an individual who’s designated as a beneficiary of a life insurance policy has a right to disclaim the proceeds. If you’re married or have children, it’s important that you know what these rules are. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. What is the advantage of adding this rider?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title donald is the primary insured of a life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.