Your Does vehicle insurance have vat images are ready in this website. Does vehicle insurance have vat are a topic that is being searched for and liked by netizens now. You can Find and Download the Does vehicle insurance have vat files here. Get all free photos.

If you’re searching for does vehicle insurance have vat pictures information connected with to the does vehicle insurance have vat keyword, you have come to the right site. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Does Vehicle Insurance Have Vat. However, the vat incurred in. The rental car insurance provided by my credit card (mastercard) covered the damage, but per their policy, they do not pay for vat fees. There is a insurance premium tax which is 5% but this is not vat (as a vat registered trader can reclaim the vat but he cannot reclaim the ipt). It’s rare that vat gets a mention in the headlines, unless there’s a change in the standard rate, like the rise to 20%.

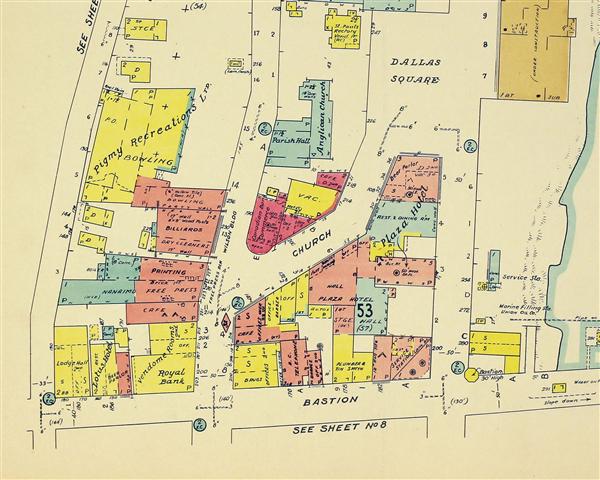

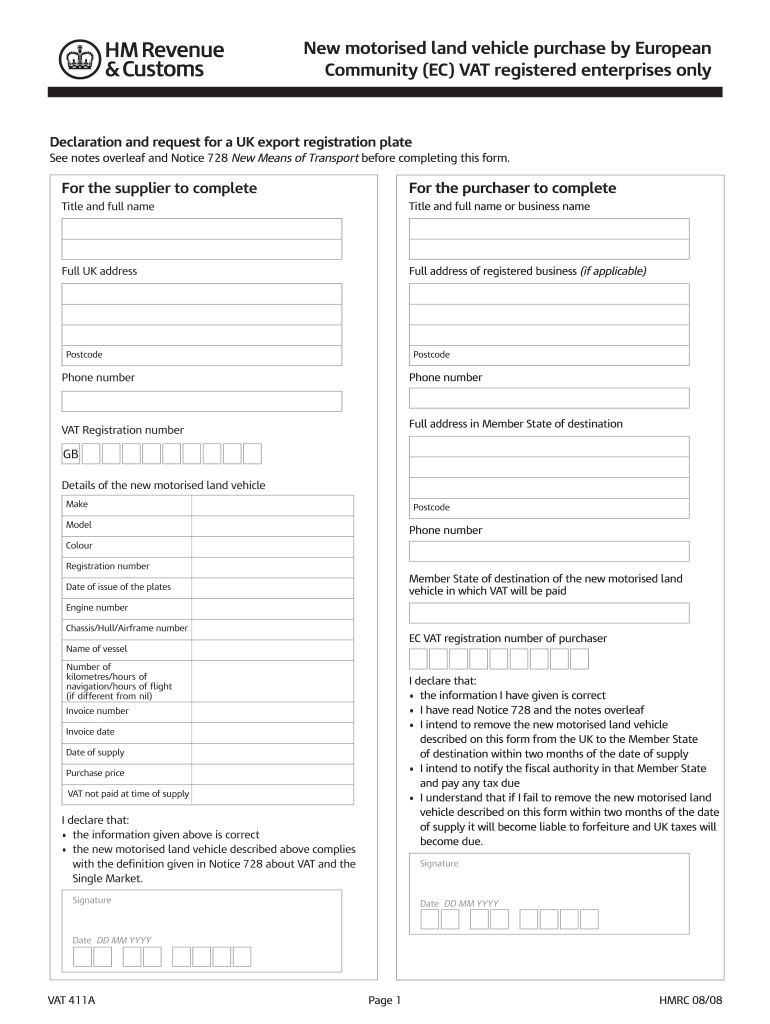

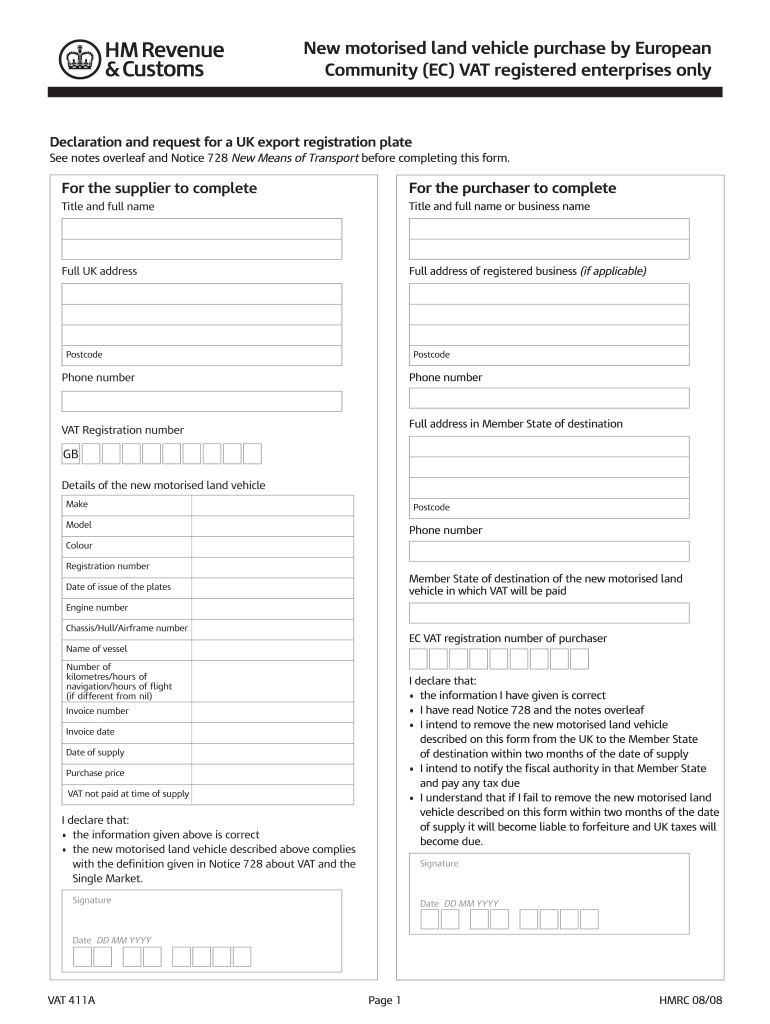

Vat Return Form Pdf Fill Online, Printable, Fillable From pdffiller.com

Vat Return Form Pdf Fill Online, Printable, Fillable From pdffiller.com

A standard rate of 12%, and a higher rate of 20% for insurance supplied with selected goods and services. Vat incurred is common to both points 1 and 2, input vat may be claimed under the partial attribution rules in terms of the 10th schedule to the vat act. Standard ipt is lower than vat, and currently set at 12 per cent. Most claims departments in insurance companies don’t really understand how vat works, so a partly exempt business should not tick the ‘registered for vat box’ on the claims form, instead, enclose a note explaining that the. Unlike vat, insurance premium tax can not be recovered and like any tax is subject to change. Most commercial insurance policies will not cover the vat element of a bill where the business is vat registered and able to recover the vat, otherwise the excess would look like this:

On the other hand the vat included in the cost of servicing, insurance, tyres, parts and oils can be claimed.

Standard ipt is lower than vat, and currently set at 12 per cent. It’s applied at two rates: Am i correct in assuming there is no vat on such a premium. T3 not in regular use. Also the vat included in the maintenance element in a full maintenance lease can be claimed as long as this cost is separately identified and invoiced. Do i have to pay this?

Source: giveasyoulive.com

Source: giveasyoulive.com

Most commercial insurance policies will not cover the vat element of a bill where the business is vat registered and able to recover the vat, otherwise the excess would look like this: Section 17(2)(c) of the vat act prohibits as a deduction any input tax incurred in respect of the acquisition of motor cars owned by the business, other than a business that is engaged in the continuous and regular supply of motor cars, whether by way of sale or under an instalment credit agreement or companies engaged in the renting out of cars. We explained to the malcolm that the valuation was in line with the trade guides. Any vat changes are usually contained in the details so we’ll be checking hmrc’s website for information. Do i have to pay this?

Section 17(2)(c) of the vat act prohibits as a deduction any input tax incurred in respect of the acquisition of motor cars owned by the business, other than a business that is engaged in the continuous and regular supply of motor cars, whether by way of sale or under an instalment credit agreement or companies engaged in the renting out of cars. Although he would have to pay vat on a replacement van, he could reclaim this through his vat return. Am i correct in assuming there is no vat on such a premium. Likewise, any input vat claimed on capital goods may be subject to the rules of adjustment of input tax in terms of s.l. All are included on vat return, except t9 which are transactions outside the scope of vat.

Source: pdffiller.com

Source: pdffiller.com

T3 not in regular use. Value added tax (vat) isn’t added to commercial and personal policy premiums. On the other hand the vat included in the cost of servicing, insurance, tyres, parts and oils can be claimed. The car will be used solely for business purpose, with no private use at all, and is not available for. Insurance receipts from a claim are not included as they�re outside the scope of vat.

Source: autotrader.co.uk

Source: autotrader.co.uk

Insurance and reinsurance transactions, including related services, performed by insurance brokers and insurance agents qualify for exemption. However, as a commercial vehicle malcolm’s van would be liable to vat. There is no vat on insurance (including gap insurance). If they are registered for vat, the insurance company will not pay them the vat element even though they can’t reclaim any or all the vat. When insurance isn’t insurance and is liable to vat.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

Likewise, any input vat claimed on capital goods may be subject to the rules of adjustment of input tax in terms of s.l. Insurance premium tax (ipt) is not vat, but you might think of it as “vat for insurance”. On the other hand the vat included in the cost of servicing, insurance, tyres, parts and oils can be claimed. Now, sixt is asking me to pay the vat charges for the damages ($107 usd). In terms of section 2(1)(i) of the value added tax act no.

Source: toptaxdefenders.com

Source: toptaxdefenders.com

However insurance costs are exempt from vat, and since exempt income is expected to be included in box 6 i see no reason why exempt costs shouldn�t be included in box 7. The higher rate is set at 20%. Am i correct in assuming there is no vat on such a premium. In terms of section 2(1)(i) of the value added tax act no. Business pays £100 excess, insurance meets £370 of cost, business recovers £70 vat, the business would then in effect have an excess of only £30 (abnd.

Source: contracteye.co.uk

Source: contracteye.co.uk

A standard rate of 12%, and a higher rate of 20% for insurance supplied with selected goods and services. All are included on vat return, except t9 which are transactions outside the scope of vat. Business pays £100 excess, insurance meets £370 of cost, business recovers £70 vat, the business would then in effect have an excess of only £30 (abnd. Any vat changes are usually contained in the details so we’ll be checking hmrc’s website for information. It�s like vat but it�s called insurance premium tax (ipt) and isn�t.

Source: pinterest.com

Source: pinterest.com

The car will be used solely for business purpose, with no private use at all, and is not available for. All are included on vat return, except t9 which are transactions outside the scope of vat. In terms of section 2(1)(i) of the value added tax act no. Business pays £100 excess, insurance meets £370 of cost, business recovers £70 vat, the business would then in effect have an excess of only £30 (abnd. So when we checked if he was vat registered, we found that he was.

Source: nerdwallet.com

Source: nerdwallet.com

The rental car insurance provided by my credit card (mastercard) covered the damage, but per their policy, they do not pay for vat fees. The ipt rate is lower that the rate of vat and the standard is set at 12%. Hi just trying to confirm that there is no vat on car/van insurance. Standard ipt is lower than vat, and currently set at 12 per cent. Value added tax (vat) isn’t added to commercial and personal policy premiums.

Source: everquote.com

Source: everquote.com

Any vat changes are usually contained in the details so we’ll be checking hmrc’s website for information. When insurance isn’t insurance and is liable to vat. So when we checked if he was vat registered, we found that he was. It’s applied at two rates: Yes, insurance premiums are usually exempt from vat.

Source: carlease.com

Source: carlease.com

Any vat changes are usually contained in the details so we’ll be checking hmrc’s website for information. Likewise, any input vat claimed on capital goods may be subject to the rules of adjustment of input tax in terms of s.l. Insurance premium tax (ipt) is usually included in the price you pay for insurance. The higher rate, which will apply to some vehicle insurance, is set at 20 per cent. The rate of ipt depends on the type of insurance and who supplies it.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

The car will be used solely for business purpose, with no private use at all, and is not available for. Hi just trying to confirm that there is no vat on car/van insurance. The rate of ipt depends on the type of insurance and who supplies it. I rented a car from sixt in italy, and it received a minor scratch while parked on a street. It’s rare that vat gets a mention in the headlines, unless there’s a change in the standard rate, like the rise to 20%.

Source: thebalance.com

Source: thebalance.com

We explained to the malcolm that the valuation was in line with the trade guides. Vat incurred is common to both points 1 and 2, input vat may be claimed under the partial attribution rules in terms of the 10th schedule to the vat act. I rented a car from sixt in italy, and it received a minor scratch while parked on a street. Also the vat included in the maintenance element in a full maintenance lease can be claimed as long as this cost is separately identified and invoiced. Yes, insurance premiums are usually exempt from vat.

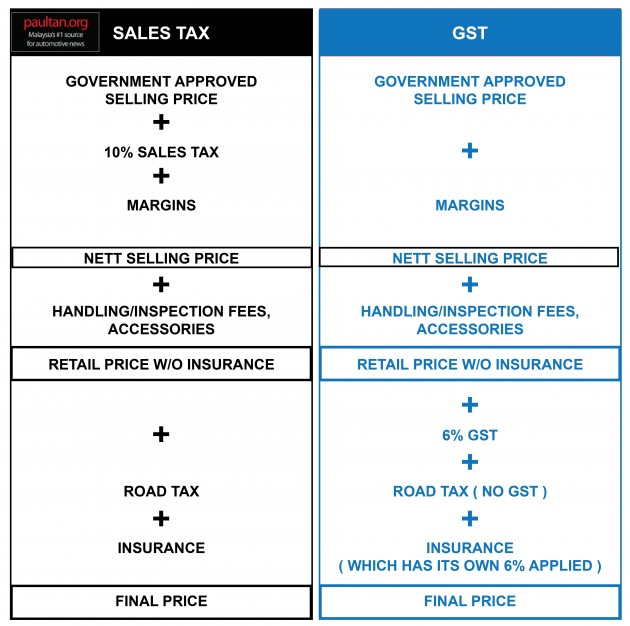

Source: paultan.org

Source: paultan.org

Unlike vat, insurance premium tax can not be recovered and like any tax is subject to change. Yes, insurance premiums are usually exempt from vat. I rented a car from sixt in italy, and it received a minor scratch while parked on a street. Am i correct in assuming there is no vat on such a premium. There is a insurance premium tax which is 5% but this is not vat (as a vat registered trader can reclaim the vat but he cannot reclaim the ipt).

Source: sage.com

Source: sage.com

There is a insurance premium tax which is 5% but this is not vat (as a vat registered trader can reclaim the vat but he cannot reclaim the ipt). Standard ipt is lower than vat, and currently set at 12 per cent. What about the cost of the immobiliser and radio bought with the motor car? Insurance premium tax (ipt) is usually included in the price you pay for insurance. There is no vat on insurance (including gap insurance).

Source: blog.shorts.uk.com

If they are registered for vat, the insurance company will not pay them the vat element even though they can’t reclaim any or all the vat. Unlike vat, insurance premium tax can not be recovered and like any tax is subject to change. Section 17(2)(c) of the vat act prohibits as a deduction any input tax incurred in respect of the acquisition of motor cars owned by the business, other than a business that is engaged in the continuous and regular supply of motor cars, whether by way of sale or under an instalment credit agreement or companies engaged in the renting out of cars. Do i have to pay this? Insurance premium tax (ipt) is usually included in the price you pay for insurance.

Source: tomorrowmakers.com

Source: tomorrowmakers.com

Most commercial insurance policies will not cover the vat element of a bill where the business is vat registered and able to recover the vat, otherwise the excess would look like this: Most claims departments in insurance companies don’t really understand how vat works, so a partly exempt business should not tick the ‘registered for vat box’ on the claims form, instead, enclose a note explaining that the. It’s a tax that’s applied to insurance premiums received under taxable insurance contracts. Also the vat included in the maintenance element in a full maintenance lease can be claimed as long as this cost is separately identified and invoiced. You do not pay vat on insurance.

Source: autozive.cz

Source: autozive.cz

Unlike vat, insurance premium tax can not be recovered and like any tax is subject to change. Value added tax (vat) isn’t added to commercial and personal policy premiums. However, as a commercial vehicle malcolm’s van would be liable to vat. Most claims departments in insurance companies don’t really understand how vat works, so a partly exempt business should not tick the ‘registered for vat box’ on the claims form, instead, enclose a note explaining that the. Business pays £100 excess, insurance meets £370 of cost, business recovers £70 vat, the business would then in effect have an excess of only £30 (abnd.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does vehicle insurance have vat by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.