Your Does the joint take insurance images are ready. Does the joint take insurance are a topic that is being searched for and liked by netizens today. You can Get the Does the joint take insurance files here. Download all free images.

If you’re searching for does the joint take insurance images information related to the does the joint take insurance topic, you have pay a visit to the right blog. Our website always gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

Does The Joint Take Insurance. The policy is typically held jointly by the employer and the contractor , although other parties such as funders may also wish to be included. A joint life insurance plan is an insurance policy that offers coverage to the spouse of the primary policyholder. A joint names policy is type of insurance often required by construction contracts. In general, insurers cannot split a joint policy so it will need to be cancelled and new individual policies taken out.

Rag Joint From p-s-t.com

Rag Joint From p-s-t.com

In other words, joint insurance relates to claims on the works, not existing structures even where there is a requirement for the employer to take out joint names insurance. Here’s why you should buy a joint life insurance policy. That said you are contractually obliged to fill in the ‘assumption question’ blanks which fundamentally appear on home insurance. It could be cheaper than taking two single life insurance policies out although there’s only one payout, on the first policyholder’s death. Blue cross blue shield ppo, bluechoice ppo, hmo, hmoi, hmo advantage, blue cross high performance network, blue precision hmo, medicare advantage, mmai plan (some physicians) The partners of the joint venture should obtain indemnification protection in the joint venture agreement and be added as “additional insured” on the joint venture’s general liability and umbrella liability.

At this point the policy ends and there’s no payout if the surviving partner were to die.

The policy is typically held jointly by the employer and the contractor , although other parties such as funders may also wish to be included. The coverage is extended to the partner irrespective of their employment status. If you do not have all your insurance information at time of visit, i.e., policy number and address of insurance; Health insurance please provide us with your complete insurance information and bring your insurance card to all of your appointments. A �joint� life insurance policy covers two lives, which sounds obvious but it’s important to note that the cover usually operates on a �first death� basis. At this point the policy ends and there’s no payout if the surviving partner were to die.

Source: lifeinsuranceinuk.co.uk

Source: lifeinsuranceinuk.co.uk

A handful of life insurance policies offer a ”separation option”, meaning the policy can be split and continue without either policyholder having to go through the underwriting procedure again. A �joint� life insurance policy covers two lives, which sounds obvious but it’s important to note that the cover usually operates on a �first death� basis. On their website, the joint provides this overview of services: A joint life insurance plan is an insurance policy that offers coverage to the spouse of the primary policyholder. We will contact your insurance company and determine your benefits for you, assisting with any forms and answering questions that come up in the process.

Source: ipposi.ie

Source: ipposi.ie

When people talk about joint car insurance, they usually mean one of the following: They do not take insurance, but the prices are very reasonable, they offer packages, and you can use your hsa/fsa card. In general, insurers cannot split a joint policy so it will need to be cancelled and new individual policies taken out. The wordings of individual contracts will ensure that case law will continue. Option b, which is where the employer takes out and maintains the joint names all risks insurance of the works

Source: shop.c-sgroup.co.uk

Source: shop.c-sgroup.co.uk

34 reviews of the joint chiropractic i have been having a lot of back pain and needed a chiropractor with late hours, so i stumbled upon the joint. The staff is friendly and dr. Health insurance please provide us with your complete insurance information and bring your insurance card to all of your appointments. 34 reviews of the joint chiropractic i have been having a lot of back pain and needed a chiropractor with late hours, so i stumbled upon the joint. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works;

Source: ciel.org

Source: ciel.org

We will contact your insurance company and determine your benefits for you, assisting with any forms and answering questions that come up in the process. In some cases, an insurer might note the interest of the builder on the policy, but this will not be sufficient to meet the requirements of a building contract that requires a joint names policy to be put in place. The simple answer to the question posed is ‘yes you can’ take out a joint insurance policy if you so wish, and there are some good reasons to do so. The coverage is extended to the partner irrespective of their employment status. The staff is friendly and dr.

Source: infallibleinroad.co.uk

Source: infallibleinroad.co.uk

Most standard building insurers will only put a policy in the name of the homeowner. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works; In some cases, an insurer might note the interest of the builder on the policy, but this will not be sufficient to meet the requirements of a building contract that requires a joint names policy to be put in place. In general, insurers cannot split a joint policy so it will need to be cancelled and new individual policies taken out. Here’s why you should buy a joint life insurance policy.

Source: glistrategies.com

Source: glistrategies.com

A �joint� life insurance policy covers two lives, which sounds obvious but it’s important to note that the cover usually operates on a �first death� basis. The simple answer to the question posed is ‘yes you can’ take out a joint insurance policy if you so wish, and there are some good reasons to do so. A joint policy serves the same basic purpose as other types of life insurance: The licensed chiropractors at the joint will perform a full exam in order to educate each patient on what living well with a healthy spine means for them. They do not take insurance, but the prices are very reasonable, they offer packages, and you can use your hsa/fsa card.

Source: archiexpo.com

Source: archiexpo.com

On their website, the joint provides this overview of services: The staff is friendly and dr. A joint names policy is type of insurance often required by construction contracts. In some cases, an insurer might note the interest of the builder on the policy, but this will not be sufficient to meet the requirements of a building contract that requires a joint names policy to be put in place. Ibji providers participate in the following networks:

Source: healthysmilesmuskegondentist.com

Source: healthysmilesmuskegondentist.com

A joint names policy is normally taken out by the property owner and the builder. Here’s why you should buy a joint life insurance policy. A handful of life insurance policies offer a ”separation option”, meaning the policy can be split and continue without either policyholder having to go through the underwriting procedure again. A joint names policy is type of insurance often required by construction contracts. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works;

Source: btimesonline.com

Source: btimesonline.com

We will contact your insurance company and determine your benefits for you, assisting with any forms and answering questions that come up in the process. The wordings of individual contracts will ensure that case law will continue. It provides your loved ones with financial support if you pass away. A joint names insurance policy covers the existing structure (es) and contract works (cw) on reinstatement value for the duration of the works. Since their recommendation will vary from person to person, the joint offers multiple plans that are both affordable and convenient without the hassles of insurance billing, copays, deductibles, or declined reimbursements.

Source: moneytothemasses.com

Source: moneytothemasses.com

Boyer is very helpful and good at what he does. Here’s why you should buy a joint life insurance policy. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works; No insurance hassles — $0 copays; Since their recommendation will vary from person to person, the joint offers multiple plans that are both affordable and convenient without the hassles of insurance billing, copays, deductibles, or declined reimbursements.

Source: freyssinet.co.uk

Source: freyssinet.co.uk

Care is needed with the terminology on joint names clauses. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works; Here’s why you should buy a joint life insurance policy. A joint names insurance policy covers the existing structure (es) and contract works (cw) on reinstatement value for the duration of the works. In other words, joint insurance relates to claims on the works, not existing structures even where there is a requirement for the employer to take out joint names insurance.

Source: insurancefouryou.com

A joint names policy is type of insurance often required by construction contracts. Health insurance please provide us with your complete insurance information and bring your insurance card to all of your appointments. Blue cross blue shield ppo, bluechoice ppo, hmo, hmoi, hmo advantage, blue cross high performance network, blue precision hmo, medicare advantage, mmai plan (some physicians) They do not take insurance, but the prices are very reasonable, they offer packages, and you can use your hsa/fsa card. The partners of the joint venture should obtain indemnification protection in the joint venture agreement and be added as “additional insured” on the joint venture’s general liability and umbrella liability.

Source: discogs.com

Source: discogs.com

Health insurance please provide us with your complete insurance information and bring your insurance card to all of your appointments. Here’s why you should buy a joint life insurance policy. It provides your loved ones with financial support if you pass away. In general, insurers cannot split a joint policy so it will need to be cancelled and new individual policies taken out. Care is needed with the terminology on joint names clauses.

Source: genius.com

Source: genius.com

Boyer is very helpful and good at what he does. Boyer is very helpful and good at what he does. A joint names policy is normally taken out by the property owner and the builder. That said you are contractually obliged to fill in the ‘assumption question’ blanks which fundamentally appear on home insurance. The simple answer to this question is no, you don’t.

Source: txphealthcare.com

Source: txphealthcare.com

The partners of the joint venture should obtain indemnification protection in the joint venture agreement and be added as “additional insured” on the joint venture’s general liability and umbrella liability. This means the chosen amount of cover is paid out if the first person dies, during the length of the policy, after which the policy would end. Option a, which is where the contractor takes out and maintains joint names all risks insurance of the works; The policy is typically held jointly by the employer and the contractor , although other parties such as funders may also wish to be included. Boyer is very helpful and good at what he does.

Source: youtube.com

Source: youtube.com

When one dies, it is deemed for tax purposes that their assets are sold, which creates a taxable event. A joint policy serves the same basic purpose as other types of life insurance: They do not take insurance, but the prices are very reasonable, they offer packages, and you can use your hsa/fsa card. Since their recommendation will vary from person to person, the joint offers multiple plans that are both affordable and convenient without the hassles of insurance billing, copays, deductibles, or declined reimbursements. A �joint� life insurance policy covers two lives, which sounds obvious but it’s important to note that the cover usually operates on a �first death� basis.

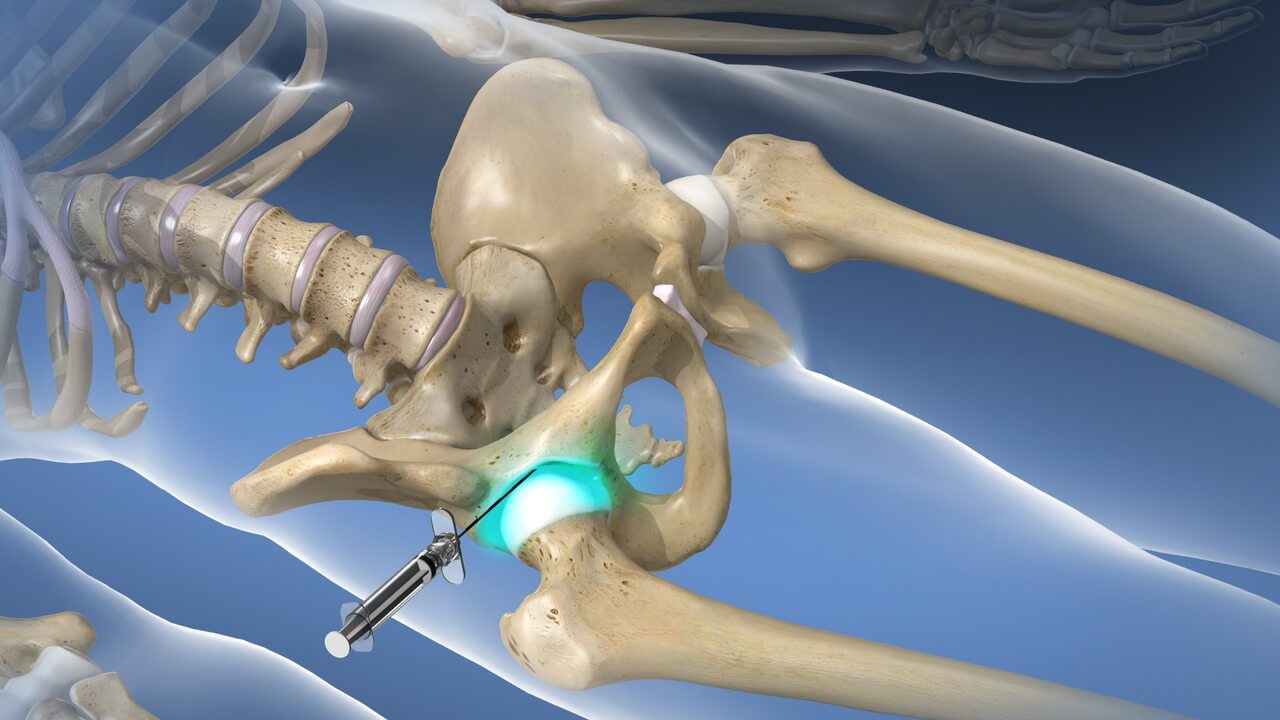

Source: sapnamed.com

Source: sapnamed.com

Most standard building insurers will only put a policy in the name of the homeowner. We will contact your insurance company and determine your benefits for you, assisting with any forms and answering questions that come up in the process. Blue cross blue shield ppo, bluechoice ppo, hmo, hmoi, hmo advantage, blue cross high performance network, blue precision hmo, medicare advantage, mmai plan (some physicians) If you do not have all your insurance information at time of visit, i.e., policy number and address of insurance; A joint policy serves the same basic purpose as other types of life insurance:

Source: oksenate.gov

Source: oksenate.gov

Our policy requires payment in full at the time of treatment, and you will be provided with a superbill to submit to your insurance. There are three different insurance options for joint contracts tribunal insurance: No insurance hassles — $0 copays; Option b, which is where the employer takes out and maintains the joint names all risks insurance of the works Most standard building insurers will only put a policy in the name of the homeowner.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does the joint take insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.