Your Does term life insurance cover accidental death images are ready in this website. Does term life insurance cover accidental death are a topic that is being searched for and liked by netizens today. You can Download the Does term life insurance cover accidental death files here. Get all royalty-free vectors.

If you’re looking for does term life insurance cover accidental death pictures information connected with to the does term life insurance cover accidental death topic, you have visit the ideal blog. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Does Term Life Insurance Cover Accidental Death. Term insurance premium is the lowest amongst all types of life insurance plans. Read on to know all about the policy. Permanent life insurance will also provide coverage for accidental death for the. An accidental death insurance policy is one of the many additional benefits that you can add to your term insurance plan.

Accidental Life Insurance Accidental Death From truebluelifeinsurance.com

Accidental Life Insurance Accidental Death From truebluelifeinsurance.com

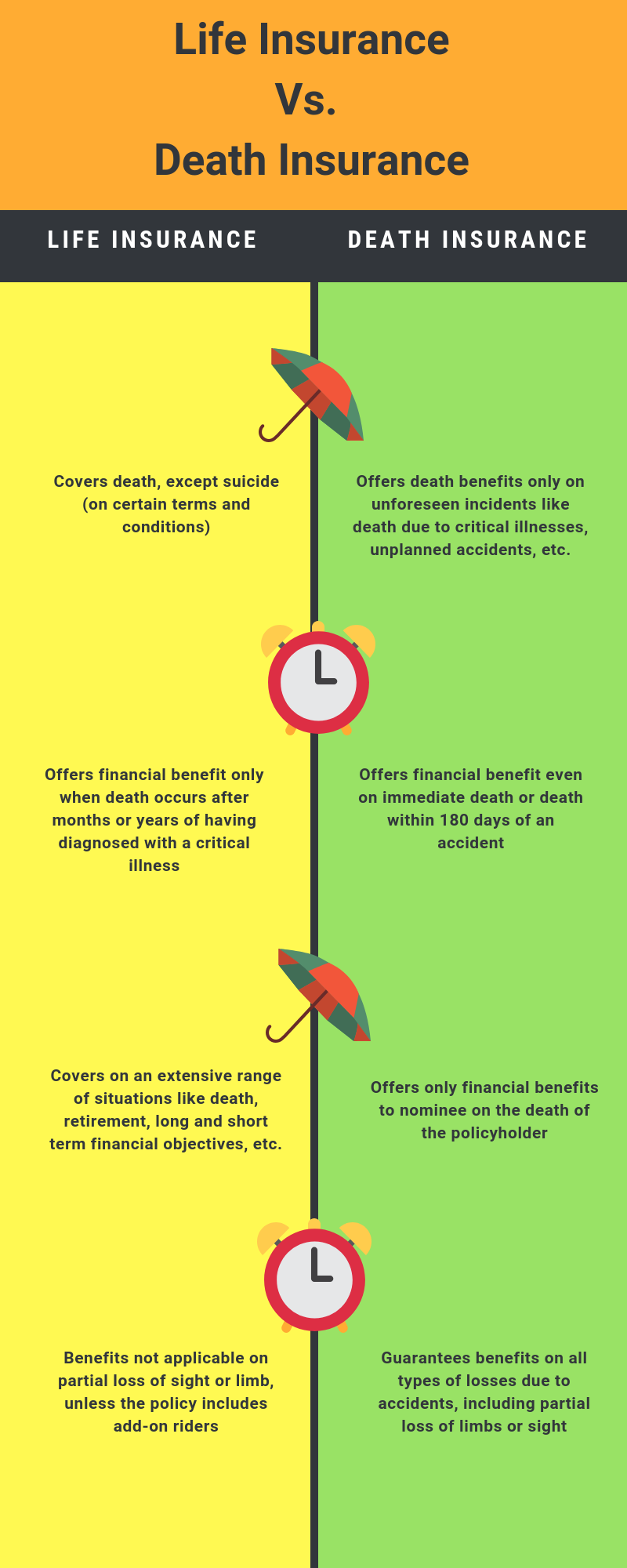

Term life insurance policies that cover accidental death can provide insurance coverage for 10, 20 or 25 years, or however long is specified in the policy. An accidental death insurance policy is one of the many additional benefits that you can add to your term insurance plan. Typically pays out regardless of how you die, with very few exceptions. The main difference between term life insurance and accidental death life insurance (adb) is when the coverage pays out: An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue. Term insurance premium is the lowest amongst all types of life insurance plans.

However, all benefits paid out on a term life policy are subject to the terms, conditions and exclusions stated in the insurance contract.

If you are the named insurance person on a term life insurance policy, and your cause of death is accidental, the death benefit would be paid out on your life insurance. Pays out only if your death is accidental. It is essential to ask the insurance agent, “does term insurance cover accidental death”, before purchase of a term insurance policy. With the inclusion of an accidental death insurance rider, the benefits of a term plan can be increased even more. Does term insurance cover accidental death? At the end of the term, you can decide if you’d like to renew based on your needs and current state.

Source: coverfox.com

Source: coverfox.com

Term insurance does pay in the event of an accidental death as well. Pays out only if your death is accidental. The following list is an overview of the types of deaths that a typical term life insurance plan does and does not cover: 1 crore upon payment of just rs. You could have stage 3 cancer and get accidental life insurance.

Source: youtube.com

Source: youtube.com

Life insurance covers most types of death,. Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident. Except for death due to suicide in the first year of buying the policy, all types of death is covered by term life insurance including accidental death. The future generali flexi online term, which provides cover for rs. There can be age restrictions that can limit you from being able to apply, as some.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

Term life covers more causes of. Since insurance companies don’t have to pay out if you die of natural causes your health condition isn’t going to matter. It is essential to ask the insurance agent, “does term insurance cover accidental death”, before purchase of a term insurance policy. 16 a day, allows for inclusion of riders such as the accidental death cover. With the inclusion of an accidental death insurance rider, the benefits of a term plan can be increased even more.

Source: financialexpress.com

Source: financialexpress.com

1 crore upon payment of just rs. Life insurance has variety of plans that covers individual requirement like death cover, short and long term financial investment goals, retirement solutions, etc. The following are the causes of death that are typically eligible for a term insurance payout: The main difference between term life insurance and accidental death life insurance (adb) is when the coverage pays out: If you are the named insurance person on a term life insurance policy, and your cause of death is accidental, the death benefit would be paid out on your life insurance.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

Term insurance coverage is the plan that provides you insurance cover in your lifetime and death benefit in times of eventuality. Life insurance has variety of plans that covers individual requirement like death cover, short and long term financial investment goals, retirement solutions, etc. Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning,. Term life insurance, on the other hand, protects your loved ones if you die within the coverage term — generally 10, 15, 20 or 30 years.

Source: simplyinsurance.com

Source: simplyinsurance.com

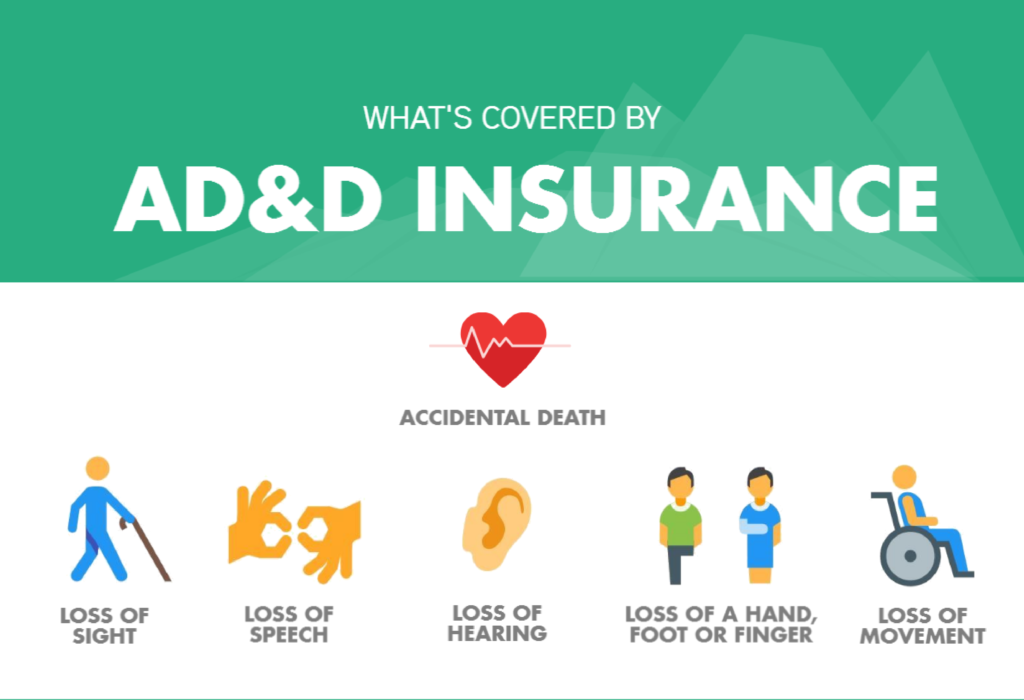

The following are the causes of death that are typically eligible for a term insurance payout: Term insurance premium is the lowest amongst all types of life insurance plans. The following list is an overview of the types of deaths that a typical term life insurance plan does and does not cover: An accidental death insurance policy in india is one of the many additional benefits that you can add to your term insurance plan. Ad&d pays only if a death is accidental, or you suffer a severe injury.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

It covers some predetermined damages specified in the policy agreement, such as amputation, fractures, burns, wounds, or disabilities. There can be age restrictions that can limit you from being able to apply, as some. Deaths covered in a term insurance plan. An accidental death insurance policy is one of the many additional benefits that you can add to your term insurance plan. The future generali flexi online term, which provides cover for rs.

Source: emmallina.blogspot.com

Source: emmallina.blogspot.com

For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. Irrespective of what the reason is, the sum assured or cover amount would be paid on the insured’s death (natural or accidental, or death due to some illness). However, all benefits paid out on a term life policy are subject to the terms, conditions and exclusions stated in the insurance contract. If you are the named insurance person on a term life insurance policy, and your cause of death is accidental, the death benefit would be paid out on your life insurance. Term insurance does pay in the event of an accidental death as well.

Source: gmlawyers.com

Source: gmlawyers.com

Does term insurance cover accidental death? For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. Pays out only if your death is accidental. Term life covers more causes of. An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue.

Source: garnerltd.com

Source: garnerltd.com

Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident. The following list is an overview of the types of deaths that a typical term life insurance plan does and does not cover: Term insurance follows a simple structure. Pays out only if your death is accidental. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning,.

Source: coaching.financialfreedom-llc.com

Source: coaching.financialfreedom-llc.com

Your loved ones won’t receive a pay out if you pass away due to any other cause. Term insurance follows a simple structure. The following list is an overview of the types of deaths that a typical term life insurance plan does and does not cover: Permanent life insurance will also provide coverage for accidental death for the. Accidental life insurance gives a lump sum payout known as an accidental death.

Source: fidelitylife.com

Source: fidelitylife.com

However, all benefits paid out on a term life policy are subject to the terms, conditions and exclusions stated in the insurance contract. Life insurance covers most types of death,. An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue. Term insurance follows a simple structure. Term insurance premium is the lowest amongst all types of life insurance plans.

Source: jpricemcnamara.com

Source: jpricemcnamara.com

There can be age restrictions that can limit you from being able to apply, as some. With the inclusion of an accidental death insurance rider, the benefits of a term plan can be increased even more. If your death is ruled an accident, you can receive benefits through your life insurance policy, and also have an additional amount paid out to your beneficiaries through the accidental death benefit included in your life insurance plan. If you have specific questions, reach out to a policygenius agent for free to learn more about deaths covered by term life insurance. Moreover, many term life insurance plans come with an additional accidental death benefit rider under which extra sum assured is paid to the beneficiary of the policy along with the basic sum assured in case of accidental demise of the insured person.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

Term plans also provide coverage in case of the death of the insured due to an accident. The following are the causes of death that are typically eligible for a term insurance payout: Permanent life insurance will also provide coverage for accidental death for the. Does term insurance cover accidental death? Term insurance follows a simple structure.

Source: insurancenewsdesk.com

Source: insurancenewsdesk.com

At the end of the term, you can decide if you’d like to renew based on your needs and current state. Cover accidents typically are from exceptional circumstances, such as exposure to the elements, traffic. Except for death due to suicide in the first year of buying the policy, all types of death is covered by term life insurance including accidental death. The premium amount for such plans may differ and. Pays out only if your death is accidental.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

There can be age restrictions that can limit you from being able to apply, as some. The following are the causes of death that are typically eligible for a term insurance payout: If you are the named insurance person on a term life insurance policy, and your cause of death is accidental, the death benefit would be paid out on your life insurance. Term life insurance plans provide various advantages, including simplicity, low premiums for high coverage, protecting your family from debt, and so on. At the end of the term, you can decide if you’d like to renew based on your needs and current state.

Source: leaplife.com

Source: leaplife.com

Accidental drug overdose, motor vehicle accident, poisoning,. If you have specific questions, reach out to a policygenius agent for free to learn more about deaths covered by term life insurance. The future generali flexi online term, which provides cover for rs. Since insurance companies don’t have to pay out if you die of natural causes your health condition isn’t going to matter. With the inclusion of an accidental death insurance rider, the benefits of a term plan can be increased even more.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. The premium amount for such plans may differ and. Does term insurance cover accidental death? There are although some plans available that offer return on premiums paid if the policy holder survives the term. Accidental death insurance is a form of life insurance that will cover death from an unexpected accident.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does term life insurance cover accidental death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.