Your Does renters insurance have to be in your name images are ready. Does renters insurance have to be in your name are a topic that is being searched for and liked by netizens today. You can Get the Does renters insurance have to be in your name files here. Download all royalty-free photos and vectors.

If you’re looking for does renters insurance have to be in your name pictures information related to the does renters insurance have to be in your name topic, you have visit the right site. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Does Renters Insurance Have To Be In Your Name. If your residence burns to the ground this is the coverage that is going to buy you all new stuff (clothes, furniture, electronics, and everything else you own). When renting property, it’s a good idea to carry renters insurance. Your renters policy will state exactly what you�re insured against. There are a number of ways to accomplish this, of course, but every roommate needs to be listed on renters insurance.

Insurance Registration Does Your Car Insurance and From easypaleorecipes123.blogspot.com

Insurance Registration Does Your Car Insurance and From easypaleorecipes123.blogspot.com

Renters insurance is tied to individuals, not the physical properties where those individuals live. Generally speaking, your renters insurance policy defines the named insured of the policy as “named insured, resident spouse, and resident relatives.” so your sister would be covered under your policy while you live together. Your family may be implicitly covered by your policy. In the insurance world, it�s known as named peril coverage. Yes, your roommate needs to be named in the policy to have coverage. You�ll just need to provide your landlord�s contact information, including their name, address and email.

The purpose of renters insurance is to protect your personal property and finances.

Such policies are not expensive, but they can make things much easier on both landlords and tenants when they are in place as part of a successful tenancy. That said, it does benefit landlords when tenants have financial protection. There are a number of ways to accomplish this, of course, but every roommate needs to be listed on renters insurance. Renters insurance should have “personal property coverage” included in it. If they’re not covered and there’s a loss, there’s no coverage for their property or their liability. If they’re not listed, they’re not covered.

Source: creditdonkey.com

Source: creditdonkey.com

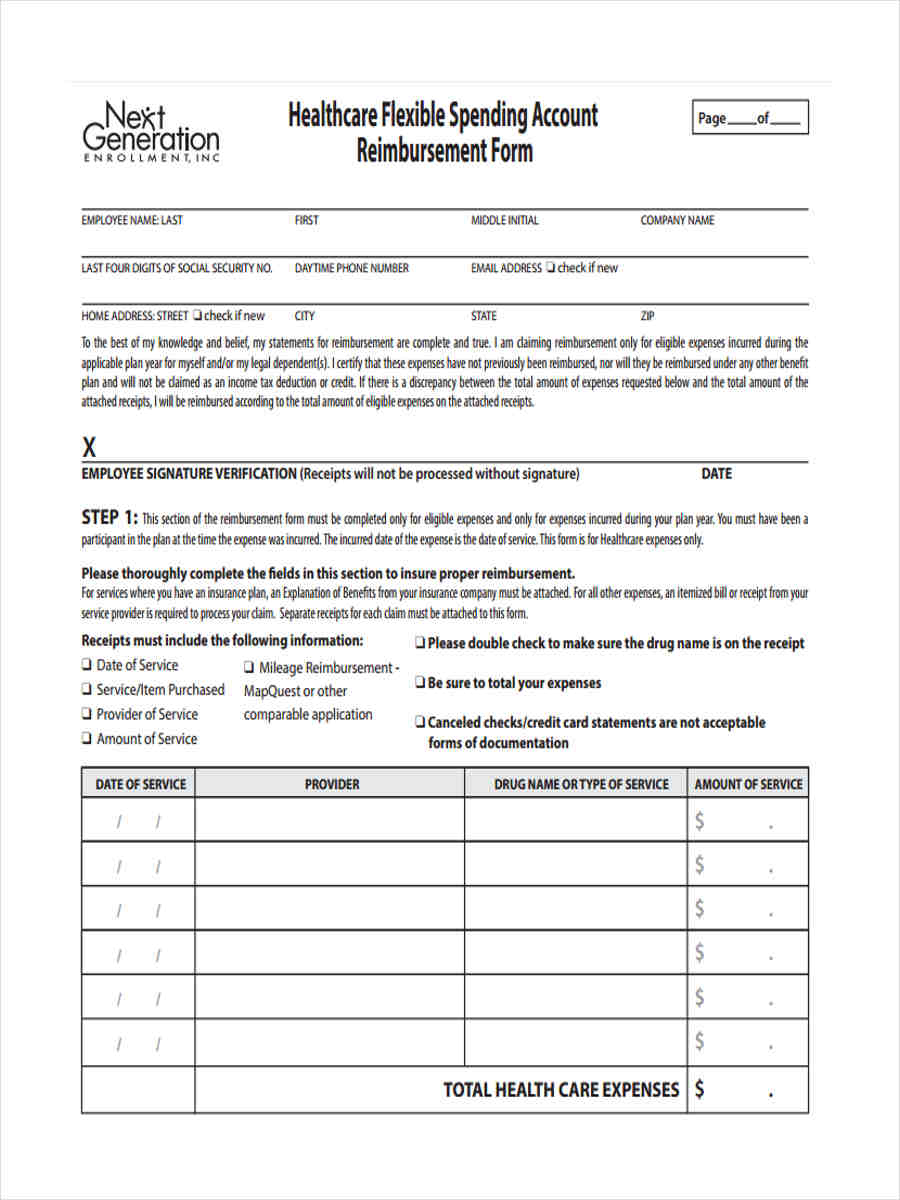

You may not think you need renters insurance if your landlord has property insurance, but this isn’t true. Your landlord listing a property manager or landlord as an additional insured is never a good idea unless you’re renting for commercial purposes. What are some named perils your renters policy may cover? Rather than adding her to your policy, however, ask your friend to take out her own renters insurance. Tenant insurance (also known as renter’s insurance or contents insurance) is insurance coverage catered to those that are tenants of a property.

Source: 52editions.com

Source: 52editions.com

Such policies are not expensive, but they can make things much easier on both landlords and tenants when they are in place as part of a successful tenancy. Any family member who is part of your household should be insured under your renters insurance policy, even if you don’t have a lease. Contents insurance covers loss or damage to your property due to a insured risk. Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. In any situation where you are living in a home that you do not own, you can purchase renters insurance to make sure you and your personal belongings are covered!

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

We briefly touched upon named perils vs all risks earlier. Contents insurance covers loss or damage to your property due to a insured risk. That said, it does benefit landlords when tenants have financial protection. Renters insurance also typically won’t cover damage to cars or a roommate’s property, so pay attention to the names listed on the policy. Yes, your roommate needs to be named in the policy to have coverage.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

When does renters insurance apply? There are several benefits for both you and your tenants, and really no significant downsides. Renters insurance policies cover the tenant and their guests and fill the gaps where the landlord’s property insurance does not cover. Renters insurance coverage is meant for your belongings and the property of others in your apartment. That said, it does benefit landlords when tenants have financial protection.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Insuring the actual cash value gives you coverage for the market price of an item had you. Your family may be implicitly covered by your policy. It’s often not clear that renters insurance also covers your valuables—computer, iphone, bicycle, diamond ring, etc—even when you’re not at home. This means that the following people don’t need to be listed as an additional insured: If they’re not listed, they’re not covered.

Source: ervadocelembrancinhas.blogspot.com

Source: ervadocelembrancinhas.blogspot.com

Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. Such policies are not expensive, but they can make things much easier on both landlords and tenants when they are in place as part of a successful tenancy. Renters insurance also typically won’t cover damage to cars or a roommate’s property, so pay attention to the names listed on the policy. Providers of rental insurance range from established insurance names, such as state farm and allstate, to newcomers like lemonade. Typically it includes three parts:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If your residence burns to the ground this is the coverage that is going to buy you all new stuff (clothes, furniture, electronics, and everything else you own). Renters insurance policies take the sting out of having to temporarily relocate by covering the cost of a living space, some of your food,. What does renters insurance not cover? That said, it does benefit landlords when tenants have financial protection. You may be wondering about the named perils your renters insurance policy may cover.

Source: mabeyinsurance.com

Source: mabeyinsurance.com

Earthquakes, riots, and pests are a few things that renters insurance doesn’t cover. Your family may be implicitly covered by your policy. Renters insurance should have “personal property coverage” included in it. Your landlord will get a description of your renters policy via email or regular mail shortly after you add them as an interested party. Renters insurance policies take the sting out of having to temporarily relocate by covering the cost of a living space, some of your food,.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Renters insurance is protection for a renters property, not a landlords. This means that the following people don’t need to be listed as an additional insured: There are a number of ways to accomplish this, of course, but every roommate needs to be listed on renters insurance. Your landlord listing a property manager or landlord as an additional insured is never a good idea unless you’re renting for commercial purposes. Generally speaking, your renters insurance policy defines the named insured of the policy as “named insured, resident spouse, and resident relatives.” so your sister would be covered under your policy while you live together.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If your residence burns to the ground this is the coverage that is going to buy you all new stuff (clothes, furniture, electronics, and everything else you own). Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. Contents insurance covers loss or damage to your property due to a insured risk. Your landlord listing a property manager or landlord as an additional insured is never a good idea unless you’re renting for commercial purposes. If they’re not covered and there’s a loss, there’s no coverage for their property or their liability.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Renters insurance is a type of insurance policy that covers your personal property if damaged or stolen. I�ll get into the longer answer to this question below. Contents insurance covers loss or damage to your property due to a insured risk. We briefly touched upon named perils vs all risks earlier. If your residence burns to the ground this is the coverage that is going to buy you all new stuff (clothes, furniture, electronics, and everything else you own).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Insuring the actual cash value gives you coverage for the market price of an item had you. Renters insurance coverage is meant for your belongings and the property of others in your apartment. Does renters insurance cover theft? This means that the following people don’t need to be listed as an additional insured: When renting property, it’s a good idea to carry renters insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You may be wondering about the named perils your renters insurance policy may cover. Answer even if your name is not on a lease, you can still qualify to purchase renters insurance. That said, it does benefit landlords when tenants have financial protection. If they’re not listed, they’re not covered. The short answer to this question is yes, many insurance providers will allow you to share a renters insurance policy with a roommate.

Source: abbateins.com

Source: abbateins.com

Yes, you should always require tenants to have renters insurance. The entire renters insurance thing could use a rethink and a reboot, which is kinda our whole deal here at lemonade. Your renters policy will state exactly what you�re insured against. Adding a renters insurance interested party is typically free. Typically it includes three parts:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Insuring the actual cash value gives you coverage for the market price of an item had you. This means that the following people don’t need to be listed as an additional insured: In any situation where you are living in a home that you do not own, you can purchase renters insurance to make sure you and your personal belongings are covered! Renters insurance coverage is meant for your belongings and the property of others in your apartment. Your renters policy will state exactly what you�re insured against.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You may not think you need renters insurance if your landlord has property insurance, but this isn’t true. There are a number of ways to accomplish this, of course, but every roommate needs to be listed on renters insurance. We briefly touched upon named perils vs all risks earlier. Tenant insurance (also known as renter’s insurance or contents insurance) is insurance coverage catered to those that are tenants of a property. Adding a renters insurance interested party is typically free.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This means that the following people don’t need to be listed as an additional insured: Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. The entire renters insurance thing could use a rethink and a reboot, which is kinda our whole deal here at lemonade. Generally speaking, your renters insurance policy defines the named insured of the policy as “named insured, resident spouse, and resident relatives.” so your sister would be covered under your policy while you live together. Renters insurance also typically won’t cover damage to cars or a roommate’s property, so pay attention to the names listed on the policy.

Source: easypaleorecipes123.blogspot.com

Source: easypaleorecipes123.blogspot.com

Finally, there might be some small print regarding pets. Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. Renters insurance is a type of insurance policy that covers your personal property if damaged or stolen. It’s often not clear that renters insurance also covers your valuables—computer, iphone, bicycle, diamond ring, etc—even when you’re not at home. You may be wondering about the named perils your renters insurance policy may cover.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does renters insurance have to be in your name by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.