Your Does renters insurance cover lost items images are ready in this website. Does renters insurance cover lost items are a topic that is being searched for and liked by netizens now. You can Download the Does renters insurance cover lost items files here. Find and Download all free photos and vectors.

If you’re looking for does renters insurance cover lost items images information connected with to the does renters insurance cover lost items keyword, you have visit the right site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

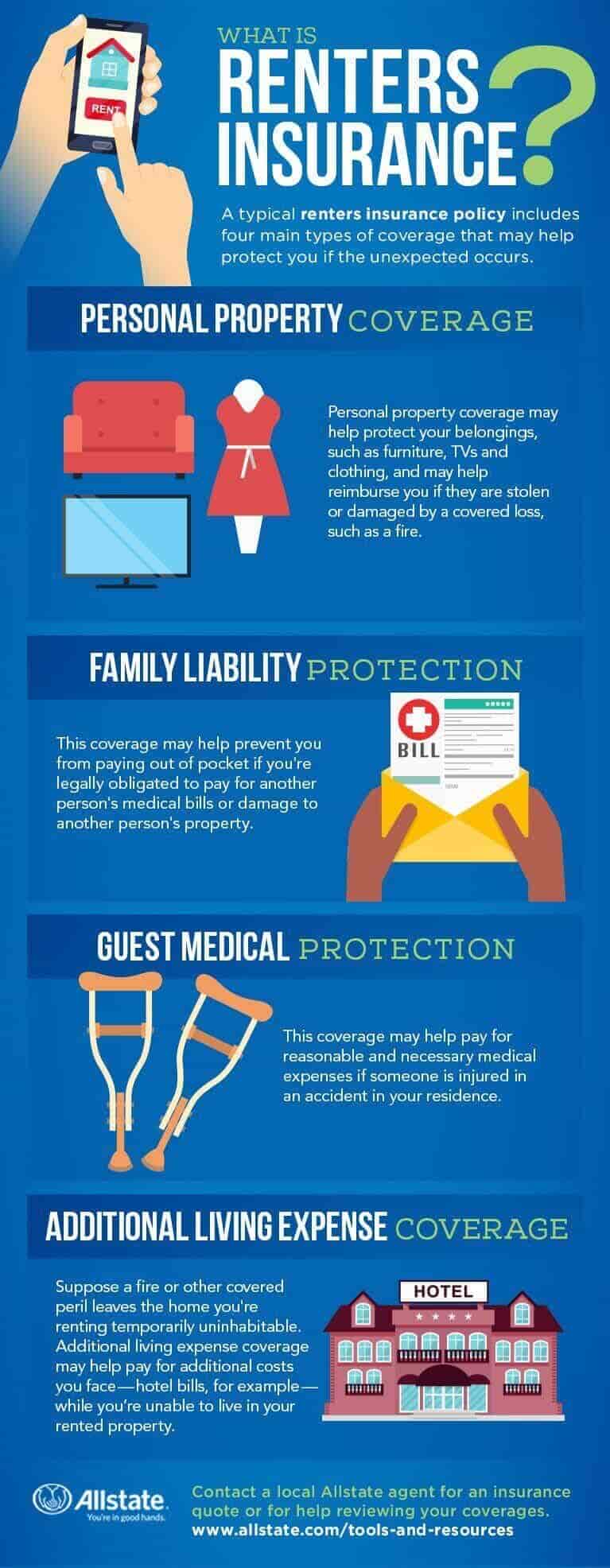

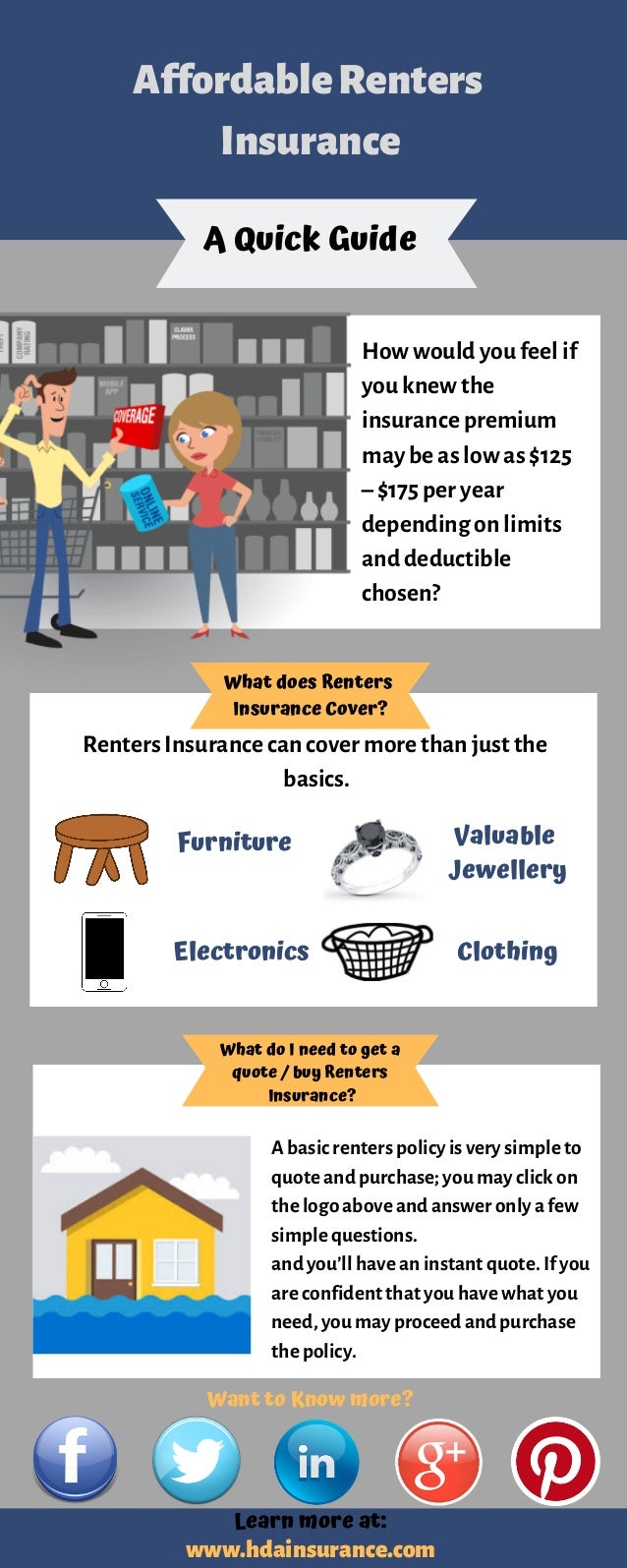

Does Renters Insurance Cover Lost Items. Common named perils include theft, as well as fire or windstorm damage. That means in the event of a covered loss, your insurer will help cover the costs if you’re held responsible for injuring another person or damaging another person’s property, including your. If smoke or other perils damage your belongings, or if your property is stolen, renters insurance may cover your loss. However, if that same camera was stolen or destroyed in a fire, flood, or other named peril, it would be covered.

Can Homeowners or Renters Insurance Cover Lost Items? From gantins.com

Can Homeowners or Renters Insurance Cover Lost Items? From gantins.com

A renters insurance policy can help cover the expenses, up to your limits, to help replace your personal property and help you with temporary living expenses if your apartment is damaged by a covered loss and you cannot stay there. The good news is the answer is yes. Depending on the policy, other covered incidents can also include: Housing while repairs are made — this is called a “loss of use rider Instead, those policies help cover specific risks, known as perils. Yes, your renters insurance policy would cover lost or stolen items, as long as the cause of the loss was a named peril.

Renters insurance includes loss of use coverage that helps you if a covered peril damages your apartment and is inhabitable.

A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. If smoke or other perils damage your belongings, or if your property is stolen, renters insurance may cover your loss. Renters insurance covers theft of your personal items from your car parked on your rental property, but it doesn�t cover theft of the car itself. Instead, those policies help cover specific risks, known as perils. Typically, the standard coverage included in a homeowners, condo or renters insurance policy does not cover the cost of lost items. Loss of use coverage is typically not the type of coverage where you decide on an amount you�ll need.

Source: insurancegenie.co

Source: insurancegenie.co

You lose it, your renters insurance won�t kick in to cover the loss. Renters insurance will often help cover some of the costs of debris removal after a covered loss. Does renters insurance cover car theft? The good news is the answer is yes. If you have $ 10,000 worth of stolen belongings but only have $ 5,000 worth of personal property coverage, your renters insurance will only pay up to.

Source: dtainsure.com

Source: dtainsure.com

However, if that same camera was stolen or destroyed in a fire, flood, or other named peril, it would be covered. Items get lost, that is life, but accidentally losing important items does not fall under a rental insurance policy. Renters insurance is designed to offer you protection for your belongings, and that coverage doesn’t change just because you are traveling. Insurance for renters will cover the damage or destruction of your personal items when they are ruined as a result of an event covered in your policy. If someone breaks into your home, your renters insurance covers the loss of your items from theft.

Source: bobvila.com

Source: bobvila.com

Yes, your renters insurance policy would cover lost or stolen items, as long as the cause of the loss was a named peril. Covered events can include fires, wind damage. Typically, the standard coverage included in a homeowners, condo or renters insurance policy does not cover the cost of lost items. Yes, your renters insurance policy would cover lost or stolen items, as long as the cause of the loss was a named peril. Your renters insurance will cover it!

Source: in.pinterest.com

Source: in.pinterest.com

This is covered under personal property limits. However, if that same camera was stolen or destroyed in a fire, flood, or other named peril, it would be covered. Renters insurance is designed to offer you protection for your belongings, and that coverage doesn’t change just because you are traveling. This is covered under personal property limits. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril.

Source: slideshare.net

Source: slideshare.net

Renters insurance also covers property if it�s stolen while not at home — like a computer taken from a renter�s car. Istockphoto.com your coverage is dependent on your policy: That means in the event of a covered loss, your insurer will help cover the costs if you’re held responsible for injuring another person or damaging another person’s property, including your. Items get lost, that is life, but accidentally losing important items does not fall under a rental insurance policy. You may still be covered for property stolen if it occurs away from home.

Source: bobvila.com

Source: bobvila.com

Renters insurance will often help cover some of the costs of debris removal after a covered loss. Renters insurance also covers much more than just your personal property, like liability coverage. Does renters insurance cover car theft? If someone breaks into your home, your renters insurance covers the loss of your items from theft. If you leave without it, i.e.

Source: allstate.com

Source: allstate.com

Renters insurance also covers much more than just your personal property, like liability coverage. Renters insurance policies normally include personal property coverage if items are damaged or lost by a covered peril. If you have $ 10,000 worth of stolen belongings but only have $ 5,000 worth of personal property coverage, your renters insurance will only pay up to. This is covered under personal property limits. Does renters insurance cover items lost or stolen at the airport?

Source: slideshare.net

Source: slideshare.net

You may still be covered for property stolen if it occurs away from home. Renters insurance will often help cover some of the costs of debris removal after a covered loss. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril. Depending on the policy, other covered incidents can also include: A renters insurance policy can help cover the expenses, up to your limits, to help replace your personal property and help you with temporary living expenses if your apartment is damaged by a covered loss and you cannot stay there.

Source: simplyinsurance.com

Source: simplyinsurance.com

Renters insurance also provides coverage to help protect you against claims that others make against you. You may still be covered for property stolen if it occurs away from home. Renters insurance comes in handy if: A typical renters insurance policy includes three types of coverage that help protect you, your belongings and your living arrangements after a covered loss. If you leave without it, i.e.

Source: everquote.com

Source: everquote.com

That’s what your auto insurance is for. Renters insurance policies normally include personal property coverage if items are damaged or lost by a covered peril. While renters insurance may cover losses to items stolen from your car, it won’t cover your vehicle; Renters insurance also provides coverage to help protect you against claims that others make against you. A standard renters insurance policy would typically cover these kinds of.

Source: gantins.com

Source: gantins.com

Renters insurance covers theft of your personal items from your car parked on your rental property, but it doesn�t cover theft of the car itself. Depending on the policy, other covered incidents can also include: You may still be covered for property stolen if it occurs away from home. If you leave without it, i.e. Yes, your renters insurance policy would cover lost or stolen items, as long as the cause of the loss was a named peril.

Source: youtube.com

Source: youtube.com

Renters insurance comes in handy if: The good news is, the coverage expands beyond the four walls of your rental. Renters insurance also covers property if it�s stolen while not at home — like a computer taken from a renter�s car. Insurance for renters will cover the damage or destruction of your personal items when they are ruined as a result of an event covered in your policy. Items get lost, that is life, but accidentally losing important items does not fall under a rental insurance policy.

Source: udellfamilyinsurance.com

Source: udellfamilyinsurance.com

“renters insurance covers your personal property if it is damaged or stolen, medical and legal bills if you are found liable for damaging someone’s property or injuring them, and temporary living expenses if your rental home is currently uninhabitable.” “renters insurance covers your personal property if it is damaged or stolen, medical and legal bills if you are found liable for damaging someone’s property or injuring them, and temporary living expenses if your rental home is currently uninhabitable.” Does renters insurance cover car theft? Renters insurance policies normally include personal property coverage if items are damaged or lost by a covered peril. A standard renters insurance policy would typically cover these kinds of.

Source: pinterest.com

Source: pinterest.com

A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. Depending on the policy, other covered incidents can also include: So, while a camera or other items you own may be covered if they are stolen or damaged in a fire, that coverage typically won�t extend to belongings that you lose or misplace. Renters insurance also covers much more than just your personal property, like liability coverage. You need to split the scene because your.

Source: pinterest.com

Source: pinterest.com

Typically, the standard coverage included in a homeowners, condo or renters insurance policy does not cover the cost of lost items. “if you are traveling and your personal belongings are stolen or damaged by a covered loss, your renters insurance will cover you, even if you are traveling through europe or relaxing on a tropical beach somewhere,” says lozoya. Your renters insurance will cover it! If a volcanic eruption, wildfire, or tornado destroys your things, you’re most likely covered. However, if that same camera was stolen or destroyed in a fire, flood, or other named peril, it would be covered.

Source: blogpapi.com

Source: blogpapi.com

“if you are traveling and your personal belongings are stolen or damaged by a covered loss, your renters insurance will cover you, even if you are traveling through europe or relaxing on a tropical beach somewhere,” says lozoya. The good news is the answer is yes. You may still be covered for property stolen if it occurs away from home. If items are stolen out of your car or elsewhere, your insurance will cover the theft. This is covered under personal property limits.

Source: chnonline.org

Source: chnonline.org

That means in the event of a covered loss, your insurer will help cover the costs if you’re held responsible for injuring another person or damaging another person’s property, including your. The good news is the answer is yes. You may still be covered for property stolen if it occurs away from home. Housing while repairs are made — this is called a “loss of use rider A typical renters insurance policy includes three types of coverage that help protect you, your belongings and your living arrangements after a covered loss.

Source: effectivecoverage.com

Source: effectivecoverage.com

Renters insurance will often help cover some of the costs of debris removal after a covered loss. Yes, your renters insurance policy would cover lost or stolen items, as long as the cause of the loss was a named peril. These rental insurance policies go beyond the covered perils. Renters insurance is designed to offer you protection for your belongings, and that coverage doesn’t change just because you are traveling. Loss of use coverage is typically not the type of coverage where you decide on an amount you�ll need.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does renters insurance cover lost items by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.