Your Does renters insurance cover forest fires images are available. Does renters insurance cover forest fires are a topic that is being searched for and liked by netizens today. You can Find and Download the Does renters insurance cover forest fires files here. Find and Download all free images.

If you’re looking for does renters insurance cover forest fires pictures information related to the does renters insurance cover forest fires interest, you have pay a visit to the right blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Does Renters Insurance Cover Forest Fires. Coverage for landscaping homeowners insurance may offer limited coverage for plants, shrubs, trees or lawns damaged by a covered peril, such as fire. Condos, townhomes, cooperatives, apartments and. In addition, it covers theft or vandalism (in the event of looting in the wake of a wildfire). The good news is that renters insurance will usually cover wildfires damages, as fire is a named peril in any standard renters insurance policy.

Does Renters Insurance Cover Forest Fires / Century From gabriela-loveorhate.blogspot.com

Does Renters Insurance Cover Forest Fires / Century From gabriela-loveorhate.blogspot.com

This coverage — usually bundled with collision insurance — is designed to protect your vehicle against damage caused by an incident other than a collision. For homeowners, trees or shrubs are covered, as well. Should a fire start in your rental home, any damage to your belongings caused by the fire or the subsequent smoke will be claimable under renters insurance. If your vehicle is totaled or damaged by a wildfire, you should receive an insurance payout, as long as you have comprehensive coverage. Wildfires are excluded from standard coverage in states like california where policyholders must purchase their own fire insurance. Yes, there are exclusions where fire damage isn�t covered by your renters insurance.

If you rent your home, one way to protect your property and personal belongings against damages is to purchase renters insurance.

Renters insurance depending on where you live may exclude or carry a different deductible for wind. That means you�ll be covered for: After all, you don’t own the building, but you certainly have an investment in your own belongings. 1 0 +1 this answer. Personal property is covered against perils like fire and smoke, and additional living expenses coverage may be applicable as well. A big forest fire would be covered if you wish to consider this a natural disaster.

Source: nmfireinfo.com

Source: nmfireinfo.com

That means you�ll be covered for: Does car insurance cover forest fires? The primary exclusion is where you intentionally started the fire. As a renter of your residence, it can be even more complicated to understand exactly what renters insurance does or doesn’t cover. That means you�ll be covered for:

Source: allegiantinsured.com

Source: allegiantinsured.com

Does homeowners insurance cover wildfires? Standard residential insurance policies will cover damage from fire and smoke. Usually insurance carrier forbids binding new coverage in restricted/catastrophic areas. Keep your receipts it should be obvious that if you find yourself forced to flee your home due to a mandatory fire evacuation, you should keep all receipts for any hotel room that you stay att. Should a fire start in your rental home, any damage to your belongings caused by the fire or the subsequent smoke will be claimable under renters insurance.

Source: kin.com

Homeowners insurance may help cover the cost of reasonable increased living expenses, such as renting a home while your home is being repaired, if a fire leaves it uninhabitable. Condos, townhomes, cooperatives, apartments and. By this, i mean walls, structure, or installations. 1 0 +1 this answer. If the fires are intentionally caused then they won’t be covered.

Source: everquote.com

Source: everquote.com

Most homeowners policy will cover expenses incurred should you be forced from your home due to a mandatory fire evacuation ordered by the appropriate civil authorities. If a fire damages or destroys your personal property, your renters insurance provider will help to. If you rent your home, one way to protect your property and personal belongings against damages is to purchase renters insurance. If the fires are intentionally caused then they won’t be covered. Condos, townhomes, cooperatives, apartments and.

Source: suebonzellrealestate.com

Source: suebonzellrealestate.com

Yes, there are exclusions where fire damage isn�t covered by your renters insurance. Homeowners insurance may help cover the cost of reasonable increased living expenses, such as renting a home while your home is being repaired, if a fire leaves it uninhabitable. Personal property is covered against perils like fire and smoke, and additional living expenses coverage may be applicable as well. This coverage — usually bundled with collision insurance — is designed to protect your vehicle against damage caused by an incident other than a collision. Does car insurance cover forest fires?

Source: gabriela-loveorhate.blogspot.com

Source: gabriela-loveorhate.blogspot.com

Standard homeowners insurance provides coverage for fire damage. A) you got a brand new policy (not renewal) during the forest fire in progress. Does renters insurance cover wildfires? Usually insurance carrier forbids binding new coverage in restricted/catastrophic areas. If your home is destroyed by a wildfire, homeowners insurance can pay to rebuild your home or replace any damaged belongings.

Source: gabriela-loveorhate.blogspot.com

Source: gabriela-loveorhate.blogspot.com

1 0 +1 this answer. This will include your possessions and even “additional living expenses” or “loss of use.” a landlord’s insurance policy won’t. Does renters insurance cover wildfires? Standard homeowners insurance policies cover fire damages even if they don�t address its underlying cause. Personal property is covered against perils like fire and smoke, and additional living expenses coverage may be applicable as well.

Source: allegiantinsured.com

Source: allegiantinsured.com

Another common exclusion is where the fire damage is to your unit. Answered on january 9, 2014 +0. Does renters insurance cover fire or smoke damage? This type of insurance cover offers protection to risks, such as a fire. Wildfire damage is thus often included in these policies.

Source: memphislatest.blogspot.com

If there�s a fire and you�re forced to move, your renters policy may cover your additional living expenses while your landlord rebuilds or repairs your residence. It is always a good idea to check directly with your insurance professional to make sure that you are fully aware of any coverage endorsements or limitations on any of the covered perils included in your policy. In addition, it covers theft or vandalism (in the event of looting in the wake of a wildfire). Yes, your homeowners insurance does cover damages resulted from forest fires, except when: As a renter of your residence, it can be even more complicated to understand exactly what renters insurance does or doesn’t cover.

Source: gabriela-loveorhate.blogspot.com

Source: gabriela-loveorhate.blogspot.com

Assuming the fire wasn�t started intentionally, renters insurance may cover your damaged belongings, up to your policy�s limits and minus any deductible. Most homeowners policy will cover expenses incurred should you be forced from your home due to a mandatory fire evacuation ordered by the appropriate civil authorities. Yes, your homeowners insurance does cover damages resulted from forest fires, except when: In addition, it covers theft or vandalism (in the event of looting in the wake of a wildfire). This type of insurance cover offers protection to risks, such as a fire.

Source: insurancewhy.com

Source: insurancewhy.com

If the fires are caused by owner negligence such as kitchen or candle fires, the homeowner will be held liable. Standard homeowners insurance provides coverage for fire damage. Does renters insurance cover wildfires? Condos, townhomes, cooperatives, apartments and. Wildfire damage is thus often included in these policies.

Source: jowerssklar.com

Source: jowerssklar.com

As a renter of your residence, it can be even more complicated to understand exactly what renters insurance does or doesn’t cover. Coverage for landscaping homeowners insurance may offer limited coverage for plants, shrubs, trees or lawns damaged by a covered peril, such as fire. Does car insurance cover forest fires? This coverage — usually bundled with collision insurance — is designed to protect your vehicle against damage caused by an incident other than a collision. For homeowners, trees or shrubs are covered, as well.

Source: insurancewhy.com

Source: insurancewhy.com

Assuming the fire wasn�t started intentionally, renters insurance may cover your damaged belongings, up to your policy�s limits and minus any deductible. If the fires are intentionally caused then they won’t be covered. If your property such as house furniture is destroyed by fire, insurance coverage enables you to cover the cost of replacing it. Homeowners insurance may help cover the cost of reasonable increased living expenses, such as renting a home while your home is being repaired, if a fire leaves it uninhabitable. The primary exclusion is where you intentionally started the fire.

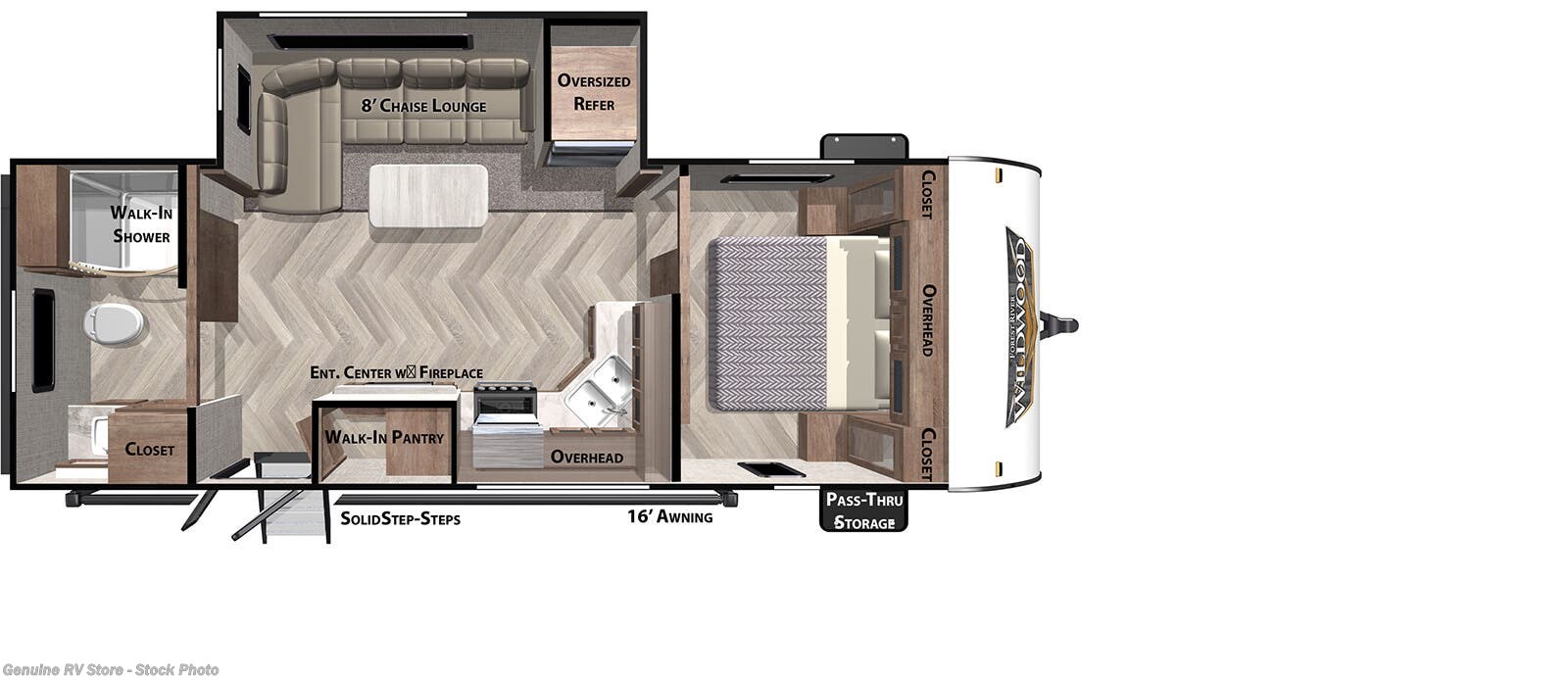

Source: outdoorsy.com

Source: outdoorsy.com

The fire could be the result of a cooking incident, electrical appliance, etc., so long as you did not purposely start it, you�re protected. If you rent your home, one way to protect your property and personal belongings against damages is to purchase renters insurance. If you have a usaa homeowners or renters insurance policy in one of those states, you can enroll in the program. Your policy can also cover the increased cost of living, like temporary lodging or restaurant meals, while your house is being rebuilt. If your home is destroyed by a wildfire, homeowners insurance can pay to rebuild your home or replace any damaged belongings.

Source: insurancewhy.com

Source: insurancewhy.com

The good news is that renters insurance will usually cover wildfires damages, as fire is a named peril in any standard renters insurance policy. That’s all in the standard california renters insurance policy. Yes, your homeowners insurance does cover damages resulted from forest fires, except when: Another common exclusion is where the fire damage is to your unit. It ultimately depends on the language of your policy, but in most cases, renters insurance will cover damage from a wildfire just like it would any other type of fire.

Source: gabriela-loveorhate.blogspot.com

Source: gabriela-loveorhate.blogspot.com

If your home is destroyed by a wildfire, homeowners insurance can pay to rebuild your home or replace any damaged belongings. Wildfires are excluded from standard coverage in states like california where policyholders must purchase their own fire insurance. Does renters insurance cover wildfires? Does renters insurance cover wildfires? For homeowners, trees or shrubs are covered, as well.

Source: gabriela-loveorhate.blogspot.com

Source: gabriela-loveorhate.blogspot.com

In addition, it covers theft or vandalism (in the event of looting in the wake of a wildfire). Standard homeowners insurance provides coverage for fire damage. For homeowners, trees or shrubs are covered, as well. If your vehicle is totaled or damaged by a wildfire, you should receive an insurance payout, as long as you have comprehensive coverage. Your insurance policy likely covers losses and damages from forest fires.

Source: rentecdirect.com

Source: rentecdirect.com

That means you�ll be covered for: The fire could be the result of a cooking incident, electrical appliance, etc., so long as you did not purposely start it, you�re protected. A big forest fire would be covered if you wish to consider this a natural disaster. This type of insurance cover offers protection to risks, such as a fire. Does renters insurance cover wildfires?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does renters insurance cover forest fires by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.