Your Does renters insurance cover electronics images are available. Does renters insurance cover electronics are a topic that is being searched for and liked by netizens now. You can Find and Download the Does renters insurance cover electronics files here. Download all free vectors.

If you’re searching for does renters insurance cover electronics pictures information connected with to the does renters insurance cover electronics interest, you have come to the ideal blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Does Renters Insurance Cover Electronics. Does renters insurance cover damage to electronics? Fortunately, you can get affordable renters insurance (also called apartment insurance) to help protect you in situations like these. Although the coverage is similar to homeowners insurance, key differences include: (check your device�s warranty, however, to see if the necessary repairs are covered by.

How to Compare Renters Insurance Quotes NICRIS Insurance From nicrisinsurance.com

How to Compare Renters Insurance Quotes NICRIS Insurance From nicrisinsurance.com

If any of your items are stolen or damaged by a covered peril , your insurer will reimburse you for them. A renters insurance policy will cover your personal electronic equipment up to the amount you select for property & valuables when signing up. Most renters insurance policies only cover expensive electronics up to $2,500, but there are a few options for how to increase coverage. If your electronics just stop working, is broken, it probably will not be covered. While your renters policy does cover some water damage, damage caused by a severe weather event (like many natural disasters) will not be covered by a renters policy. So after all that, are electronics covered by renters insurance?

Yes, most consumer electronics are covered by renters insurance.

Most renters insurance coverage for electronics is around $2,500. Generally, your electronics will be covered by the personal property property division of your renters insurance policy. Can i insure my electronics? Yes, most consumer electronics are covered by renters insurance. After reading about renters insurance coverage,. So, in the event of any theft or damage, they’ll.

Source: frasescafeinicas.blogspot.com

Source: frasescafeinicas.blogspot.com

While your renters policy does cover some water damage, damage caused by a severe weather event (like many natural disasters) will not be covered by a renters policy. (check your device�s warranty, however, to see if the necessary repairs are covered by. If your electronics or jewelry exceed these limits, you. What does renters insurance cover? If someone breaks into your place, renters insurance policy would pay for your stolen personal property — electronics, jewelry, firearms or silverware — but only up to the amount of coverage listed in your policy limits and after the deductible amount is met.

Source: triplecrowncorp.com

Source: triplecrowncorp.com

Fortunately, you can get affordable renters insurance (also called apartment insurance) to help protect you in situations like these. Renters insurance covers all your electronics — including your television, your sound system, and portable electronics like your phone or tablet — under your personal property coverage. Renters insurance is designed to reimburse you the current value or replacement value of items which are damaged due to an unforeseen event such as fire, water damage, etc. In order to get coverage for floods or hurricanes , you typically need to get coverage from the national flood insurance program (nfip) via the federal government. Does renters insurance cover damage to electronics?

Source: lifelanes.progressive.com

Source: lifelanes.progressive.com

Just like anything else in life, there are exceptions, but as you can see those exceptions are narrow and have solid reasoning behind them. So after all that, are electronics covered by renters insurance? You might want to purchase additional coverage or riders to insure your more valuable items. This part of your policy will cover the cost to replace your personal belongings, like your electronics, in the event they are damaged or lost due to a “covered peril.” Yes, most consumer electronics are covered by renters insurance.

Source: gadgetreview.com

Source: gadgetreview.com

After reading about renters insurance coverage,. Renters insurance generally provides protection against certain risks, often described as perils in a policy. However, renters insurance does not cover accidental damage to your laptop. The renters insurance rate in the u.s. Jewelry limits are usually lower, at $1,500.

Source: frasescafeinicas.blogspot.com

Source: frasescafeinicas.blogspot.com

Although the coverage is similar to homeowners insurance, key differences include: If your electronics just stop working, is broken, it probably will not be covered. Yes, renters insurance protects all of your important possessions including your electronics like your computer or. Renters insurance does not cover the structure, or dwelling, where the tenant lives. A typical homeowners or renters insurance policy will include “contents coverage,” or coverage that will help to replace your personal property should your belongings be damaged by a covered cause.

Source: blogpapi.com

Source: blogpapi.com

In addition, renters insurance does not cover repairs to a laptop or electronic device if a part breaks or it simply stops working. Damage to the building is the landlord�s responsibility and would likely be covered through a landlord insurance plan. A renters insurance policy will cover your personal electronic equipment up to the amount you select for property & valuables when signing up. Renters insurance applies to your personal belongings that exist between the four walls of your rented dwelling. Most renters insurance coverage for electronics is around $2,500.

Source: frasescafeinicas.blogspot.com

Source: frasescafeinicas.blogspot.com

This is especially valuable in the case of items such as electronics and computers, which depreciate quickly but. Does personal property renters insurance cover electronics? Does renters insurance cover damage to electronics? In order to get coverage for floods or hurricanes , you typically need to get coverage from the national flood insurance program (nfip) via the federal government. A renters insurance policy will cover costs to replace your personal belongings, like your furniture, electronics, computer equipment, your clothes, jewelry and appliances.

Source: lemonade.com

Source: lemonade.com

If any of your items are stolen or damaged by a covered peril , your insurer will reimburse you for them. You might want to purchase additional coverage or riders to insure your more valuable items. You decide the level of renters insurance coverage, which influences your premiums. Without renters insurance, you�ve got no coverage for personal property loss or damage. While your renters policy does cover some water damage, damage caused by a severe weather event (like many natural disasters) will not be covered by a renters policy.

Source: nicrisinsurance.com

Source: nicrisinsurance.com

However, renters insurance does not cover accidental damage to your laptop. The renters insurance rate in the u.s. If your electronics just stop working, is broken, it probably will not be covered. While your renters policy does cover some water damage, damage caused by a severe weather event (like many natural disasters) will not be covered by a renters policy. Renters insurance is designed to reimburse you the current value or replacement value of items which are damaged due to an unforeseen event such as fire, water damage, etc.

Source: mysmartmove.com

Source: mysmartmove.com

You might want to purchase additional coverage or riders to insure your more valuable items. This is especially valuable in the case of items such as electronics and computers, which depreciate quickly but. If lightning struck your building and sent a surge of high voltage through your rental unit, resulting in a gaming console or stereo system that no longer works, you’ll probably be covered after meeting your policy’s deductible. If it was broken by a stranger, i would look at your policy to see if that would be covered. A renters insurance policy will cover costs to replace your personal belongings, like your furniture, electronics, computer equipment, your clothes, jewelry and appliances.

![Renters insurance What’s covered and what’s not [Video] Renters insurance What’s covered and what’s not [Video]](https://s.yimg.com/ny/api/res/1.2/48cWfYESBelPZfA9jFektA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTE5ODA7aD0xMTA5O3NtPTE7aWw9cGxhbmU-/http://l.yimg.com/os/creatr-images/GLB/2017-06-09/f6e1cdf0-4d2d-11e7-adbe-afdf8e9cf12c_Screen-Shot-2017-06-06-at-4-27-27-PM.png.cf.jpg) Source: finance.yahoo.com

Source: finance.yahoo.com

If someone breaks into your place, renters insurance policy would pay for your stolen personal property — electronics, jewelry, firearms or silverware — but only up to the amount of coverage listed in your policy limits and after the deductible amount is met. In order to get coverage for floods or hurricanes , you typically need to get coverage from the national flood insurance program (nfip) via the federal government. (check your device�s warranty, however, to see if the necessary repairs are covered by. Without renters insurance, you�ve got no coverage for personal property loss or damage. First, it�s important to understand how renters insurance covers your belongings.

Source: everquote.com

Source: everquote.com

If lightning struck your building and sent a surge of high voltage through your rental unit, resulting in a gaming console or stereo system that no longer works, you’ll probably be covered after meeting your policy’s deductible. This is especially valuable in the case of items such as electronics and computers, which depreciate quickly but. Generally, your electronics will be covered by the personal property property division of your renters insurance policy. It’s always a good idea to read any insurance policy, of course. For instance, renters insurance may provide coverage for your computer if it�s stolen or ruined in a fire.

Source: omniconrestoration.com

Source: omniconrestoration.com

You can purchase indemnification that will extend to your valuables, and this will often include your electronics, your clothing, and other personal belongings. If your electronics just stop working, is broken, it probably will not be covered. If lightning struck your building and sent a surge of high voltage through your rental unit, resulting in a gaming console or stereo system that no longer works, you’ll probably be covered after meeting your policy’s deductible. Portable electronics, including smartphones, laptops and tablets, are typically covered only up to $1,500 under a standard homeowners policy, according to the property casualty insurers association of america. If someone breaks into your place, renters insurance policy would pay for your stolen personal property — electronics, jewelry, firearms or silverware — but only up to the amount of coverage listed in your policy limits and after the deductible amount is met.

Source: frasescafeinicas.blogspot.com

Source: frasescafeinicas.blogspot.com

Portable electronics, including smartphones, laptops and tablets, are typically covered only up to $1,500 under a standard homeowners policy, according to the property casualty insurers association of america. Renters insurance also does not cover lost or misplaced items. If your electronics just stop working, is broken, it probably will not be covered. Generally, your electronics will be covered by the personal property property division of your renters insurance policy. Does personal property renters insurance cover electronics?

Source: frasescafeinicas.blogspot.com

Source: frasescafeinicas.blogspot.com

If lightning struck your building and sent a surge of high voltage through your rental unit, resulting in a gaming console or stereo system that no longer works, you’ll probably be covered after meeting your policy’s deductible. You paid for ‘em, you own ‘em, and they’re in the space you’re renting. Renters insurance applies to your personal belongings that exist between the four walls of your rented dwelling. But your coverage is capped as part of something called. An electronics endorsement is not additional insurance.

Source: mentalfloss.com

Source: mentalfloss.com

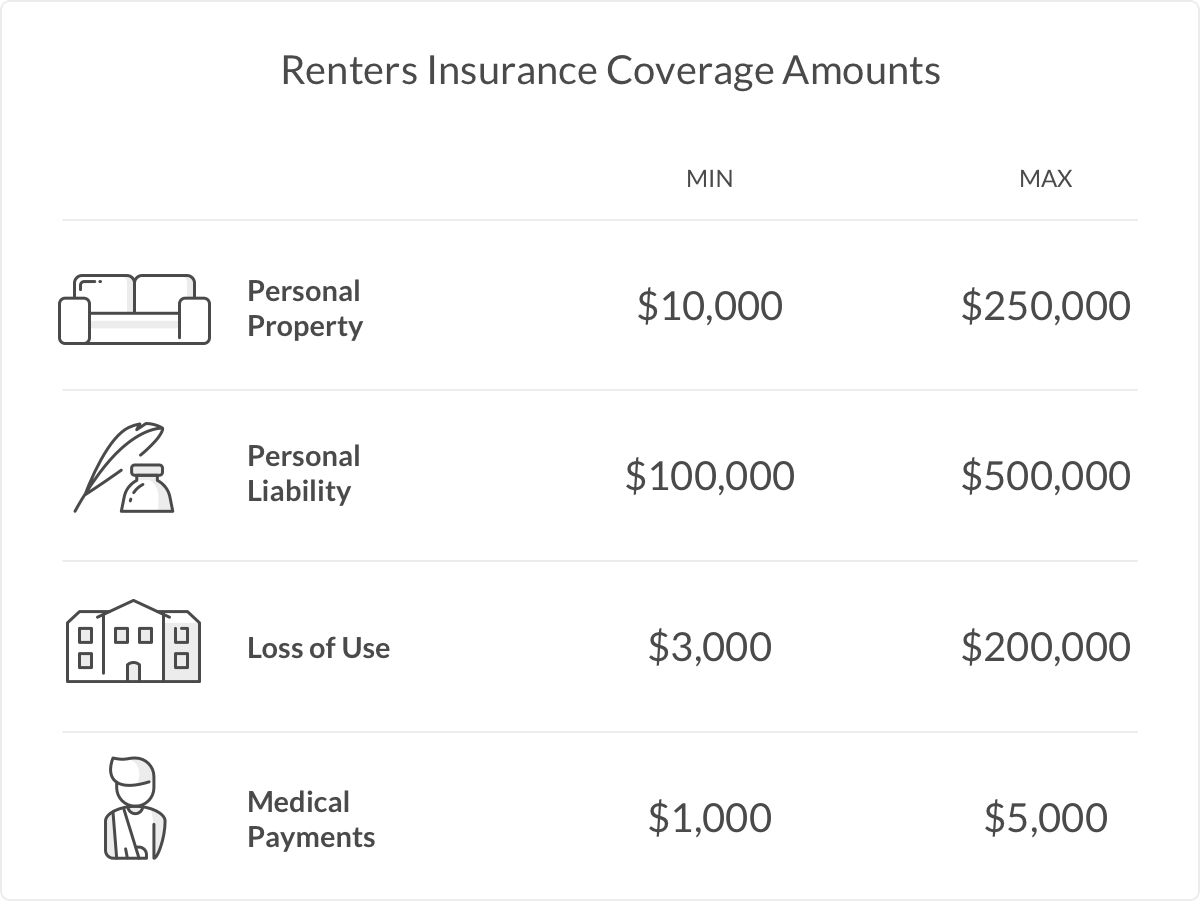

But your coverage is capped as part of something called. Typically, renters insurance covers personal property coverage, personal liability coverage, and loss of use coverage. If any of your items are stolen or damaged by a covered peril , your insurer will reimburse you for them. It’s always a good idea to read any insurance policy, of course. While your renters policy does cover some water damage, damage caused by a severe weather event (like many natural disasters) will not be covered by a renters policy.

Source: progressive.com

Source: progressive.com

In addition, renters insurance does not cover repairs to a laptop or electronic device if a part breaks or it simply stops working. A renters insurance policy will cover costs to replace your personal belongings, like your furniture, electronics, computer equipment, your clothes, jewelry and appliances. Renters insurance generally provides protection against certain risks, often described as perils in a policy. You�ll likely find, however, that there are certain scenarios in which renters. Renters insurance covers all your electronics — including your television, your sound system, and portable electronics like your phone or tablet — under your personal property coverage.

Source: sportingrova.blogspot.com

If your electronics or jewelry exceed these limits, you. If your electronics or jewelry exceed these limits, you. But your coverage is capped as part of something called. A renters insurance policy will cover costs to replace your personal belongings, like your furniture, electronics, computer equipment, your clothes, jewelry and appliances. Costs vary by location and state, such as florida, though.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does renters insurance cover electronics by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.