Your Does life insurance pay out for suicidal death uk images are ready in this website. Does life insurance pay out for suicidal death uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Does life insurance pay out for suicidal death uk files here. Download all royalty-free photos and vectors.

If you’re searching for does life insurance pay out for suicidal death uk images information linked to the does life insurance pay out for suicidal death uk keyword, you have come to the ideal blog. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

Does Life Insurance Pay Out For Suicidal Death Uk. But if either the suicide or contestability applies, the payout isn’t guaranteed. Many life insurance policies contain a suicide clause or provision. When policyholders commit suicide, life insurance companies can deny payment to beneficiaries. Does life insurance cover suicide?

G Gle Does Life Insurance Pay for Suicidal Death All News From onsizzle.com

G Gle Does Life Insurance Pay for Suicidal Death All News From onsizzle.com

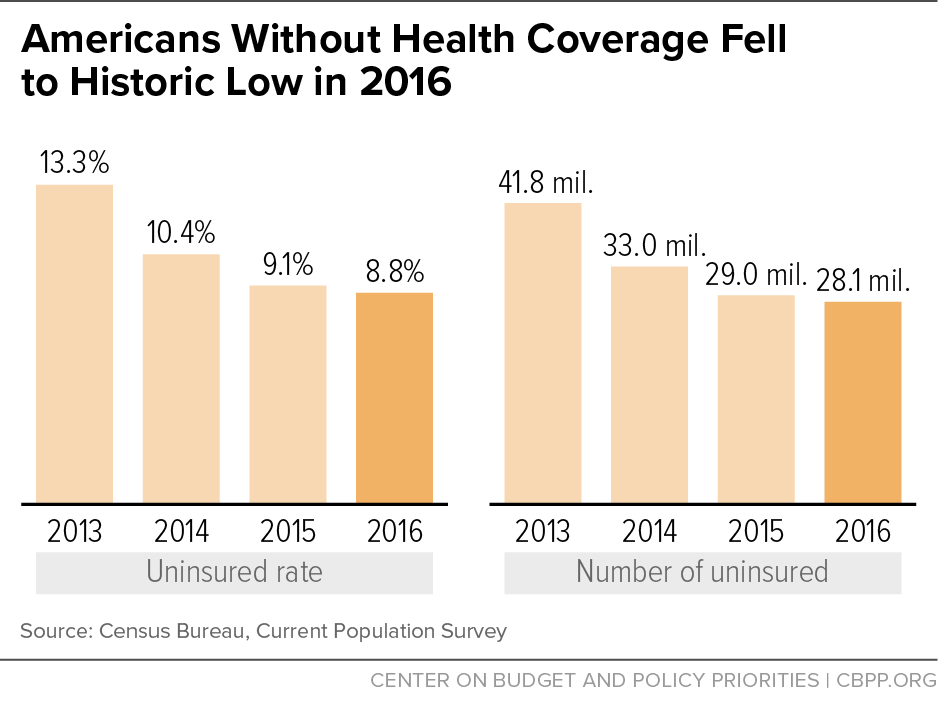

Most life insurance providers in the uk will pay out in the event of suicide, however be aware that most policies will have a �suicide clause�. First, does life insurance pay for suicidal death? For example, the premiums will need to have been paid, you will need to have provided accurate information during the application, and you won�t be covered if within the first year of the policy you die as a result of suicide, or an event where in our. Insurers paid out more than 97% of term life insurance claims in 2018, according to the association of british insurers (�term� refers to life insurance policies which run for a set time period, usually until retirement). If a suicide happens more than two years after getting a life insurance policy, the life insurance policy will pay out death benefit to. The latest figures are from 2018 and show that 97.4% of all life insurance claims were paid, with over £2.88 billion getting paid out in total.

Lerato sengadi and amor vittone expose the gloomy position of the estranged wife

The key determining factor is that death from suicide can’t occur within the first two years a policy is opened. The key determining factor is that death from suicide can’t occur within the first two years a policy is opened. Many life insurance policies contain a suicide clause or provision. According to moneysupermarket data correct as of august 2019 what is critical illness cover? Companies will typically not pay a death benefit if the policyholder commits suicide. Assisted suicide could void your life insurance the first point here, as conner explains, is that “ uk insurers don’t exclude suicide as a form of death.

Source: insuranceglitz.com

Source: insuranceglitz.com

As long as the terms of the policy are met, an insurance company will pay. Yes, but it�s worth remembering that the cash sum is contingent on the claim being valid; Assisted suicide could void your life insurance the first point here, as conner explains, is that “ uk insurers don’t exclude suicide as a form of death. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage. The suicide clause is the period of time following the start of the policy in which a pay out won’t be made if the cause of death is suicide.

Source: express.co.uk

Source: express.co.uk

Lerato sengadi and amor vittone expose the gloomy position of the estranged wife Death benefit our criteria we’ll pay this if the life covered dies during the policy term. The average payout on a life insurance policy in 2018 was. Why do life insurance policies have suicide clauses? Life insurance will not pay death benefits if death by suicide happens within the suicide clause timeframe.

Source: express.co.uk

Source: express.co.uk

First, does life insurance pay for suicidal death? According to moneysupermarket data correct as of august 2019 what is critical illness cover? First, does life insurance pay for suicidal death? How do life insurance payouts work for suicide? This clause exists to protect the insurer and is designed to stop vulnerable individuals from suicide, for the purpose of securing a life insurance pay out.

Lerato sengadi and amor vittone expose the gloomy position of the estranged wife The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. Many life insurance policies contain a suicide clause or provision. Accidental death and dismemberment insurance explained how to. This period is typically two years.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

If a suicide happens more than two years after getting a life insurance policy, the life insurance policy will pay out death benefit to. Lerato sengadi and amor vittone expose the gloomy position of the estranged wife Although there is much misconception to the contrary, the reality is that yes, life insurance will pay out in the case of suicide. Overall protection payout rates across all insurers. We explain how suicide is treated by life insurers, and what life insurance providers can ask.

Source: lovemoney.com

Source: lovemoney.com

Each year the association of british insurers (abi) publishes average payout rate statistics from across all insurers. Assisted suicide could void your life insurance the first point here, as conner explains, is that “ uk insurers don’t exclude suicide as a form of death. If this happens, the policy will end. As long as the terms of the policy are met, an insurance company will pay. When policyholders commit suicide, life insurance companies can deny payment to beneficiaries.

Source: reddit.com

Source: reddit.com

But if either the suicide or contestability applies, the payout isn’t guaranteed. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage. And coverage can cost as little as $1 a day. This clause exists to protect the insurer and is designed to stop vulnerable individuals from suicide, for the purpose of securing a life insurance pay out. How do life insurance payouts work for suicide?

Source: spews.org

Source: spews.org

Lerato sengadi and amor vittone expose the gloomy position of the estranged wife And coverage can cost as little as $1 a day. The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. As long as the terms of the policy are met, an insurance company will pay. When policyholders commit suicide, life insurance companies can deny payment to beneficiaries.

Source: youtube.com

Source: youtube.com

Lerato sengadi and amor vittone expose the gloomy position of the estranged wife In general, life insurance covers suicide. Life insurance suicidal death clause explained. How do life insurance payouts work for suicide? If you’re considering buying a life insurance policy, insurance will cover a wide set of issues, including suicide.

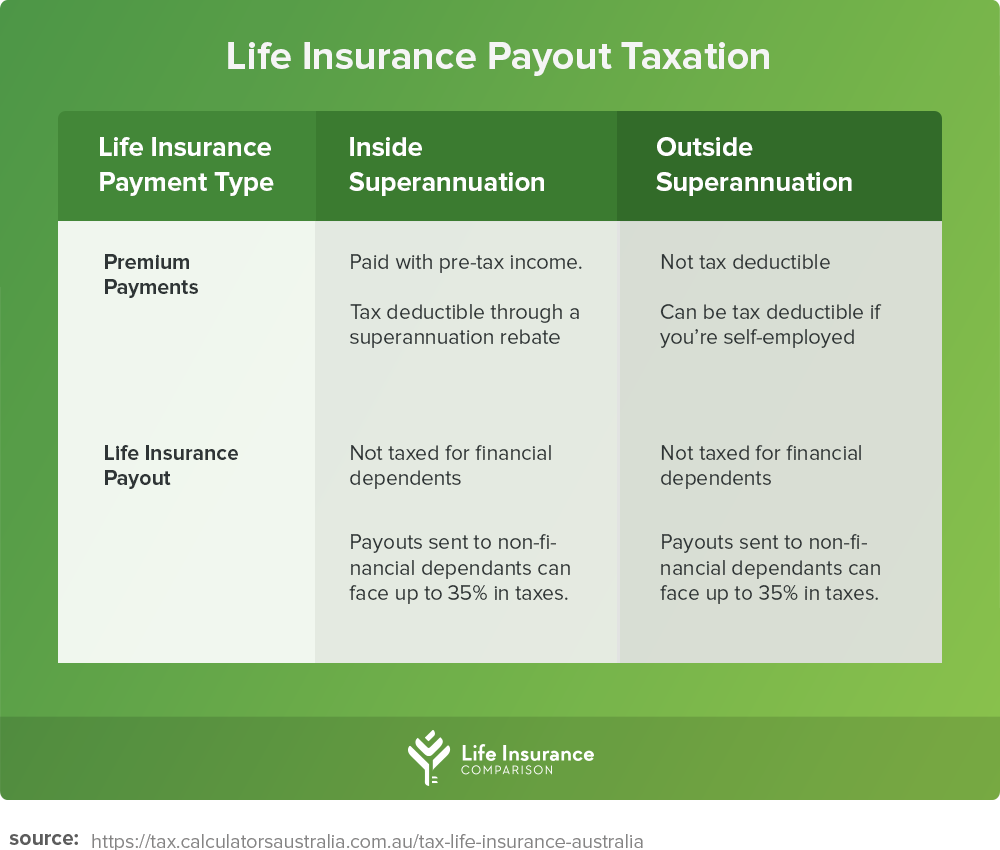

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

This also applies in cases where, in our reasonable opinion, the. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage. After the exclusionary period, if a policyholder dies by suicide, the policy pays a death benefit to the beneficiary just as it. For example, the premiums will need to have been paid, you will need to have provided accurate information during the application, and you won�t be covered if within the first year of the policy you die as a result of suicide, or an event where in our. Most life insurance providers in the uk will pay out in the event of suicide, however be aware that most policies will have a �suicide clause�.

Source: mindstick.com

Source: mindstick.com

In short, yes, life insurance policies will pay benefits for suicide deaths. The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. If you’re considering buying a life insurance policy, insurance will cover a wide set of issues, including suicide. Most insurance companies include a suicidal clause in their policies because they limit the payments of benefits. Lerato sengadi and amor vittone expose the gloomy position of the estranged wife

Most insurance companies include a suicidal clause in their policies because they limit the payments of benefits. The suicide clause is the period of time following the start of the policy in which a pay out won’t be made if the cause of death is suicide. Life insurance policies won�t cover a suicide. The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. Accidental death and dismemberment insurance explained how to.

Source: easybestrecipes129.blogspot.com

Source: easybestrecipes129.blogspot.com

The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. For example, the premiums will need to have been paid, you will need to have provided accurate information during the application, and you won�t be covered if within the first year of the policy you die as a result of suicide, or an event where in our. According to moneysupermarket data correct as of august 2019 what is critical illness cover? In general, life insurance covers suicide. Assisted suicide could void your life insurance the first point here, as conner explains, is that “ uk insurers don’t exclude suicide as a form of death.

Source: onsizzle.com

Source: onsizzle.com

After the exclusionary period, if a policyholder dies by suicide, the policy pays a death benefit to the beneficiary just as it. The suicide clause is the period of time following the start of the policy in which a pay out won’t be made if the cause of death is suicide. When a policy holder dies of suicide during the exclusionary period, there will be no payout to the beneficiaries. In short, yes, life insurance policies will pay benefits for suicide deaths. Life insurance will not pay death benefits if death by suicide happens within the suicide clause timeframe.

Source: bestlifequote.com

Source: bestlifequote.com

If you choose to end your own life, whatever the circumstances, the most likely outcome is. In short, yes, life insurance policies will pay benefits for suicide deaths. So if, at the time of your death, you are earning £50,000 a year from your company, then your dependents can expect to receive between £100,000 and £200,000 from the company. According to moneysupermarket data correct as of august 2019 what is critical illness cover? This period is typically two years.

Source: easybestrecipes129.blogspot.com

Source: easybestrecipes129.blogspot.com

Death benefit our criteria we’ll pay this if the life covered dies during the policy term. Overall protection payout rates across all insurers. But if either the suicide or contestability applies, the payout isn’t guaranteed. And coverage can cost as little as $1 a day. After the exclusionary period, if a policyholder dies by suicide, the policy pays a death benefit to the beneficiary just as it.

Source: reddit.com

Source: reddit.com

The average payout on a life insurance policy in 2018 was. This clause exists to protect the insurer and is designed to stop vulnerable individuals from suicide, for the purpose of securing a life insurance pay out. According to moneysupermarket data correct as of august 2019 what is critical illness cover? If this happens, the policy will end. If death from suicide occurs after this period, then the life insurance policy will pay out as it would for death from illness or other insured causes.

Source: infographicszone.com

Source: infographicszone.com

If you choose to end your own life, whatever the circumstances, the most likely outcome is. The suicide clause sets out where you wouldn�t be covered and each insurance company has its own clause. And coverage can cost as little as $1 a day. Accidental death and dismemberment insurance explained how to. If death from suicide occurs after this period, then the life insurance policy will pay out as it would for death from illness or other insured causes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does life insurance pay out for suicidal death uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.