Your Does life insurance pay if you die of cancer images are available. Does life insurance pay if you die of cancer are a topic that is being searched for and liked by netizens today. You can Find and Download the Does life insurance pay if you die of cancer files here. Download all royalty-free photos and vectors.

If you’re searching for does life insurance pay if you die of cancer pictures information linked to the does life insurance pay if you die of cancer interest, you have come to the right site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

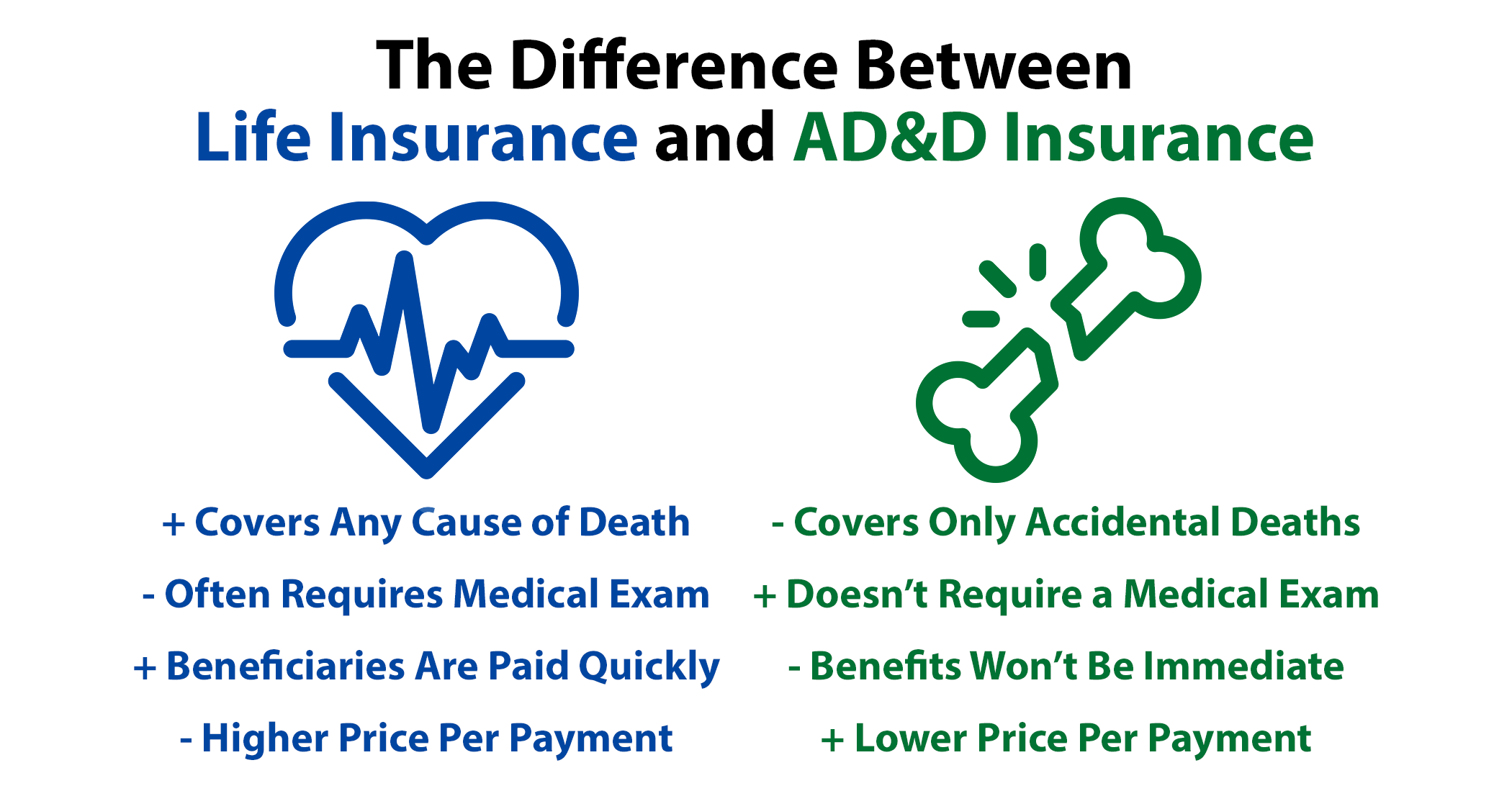

Does Life Insurance Pay If You Die Of Cancer. Whole life insurance pays out a lump sum at whatever age you die. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. As mentioned above, life insurance pays out for death by natural causes. A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed.

Does Life Insurance Pay for Funeral Expenses? Preplan From rfhr.com

Does Life Insurance Pay for Funeral Expenses? Preplan From rfhr.com

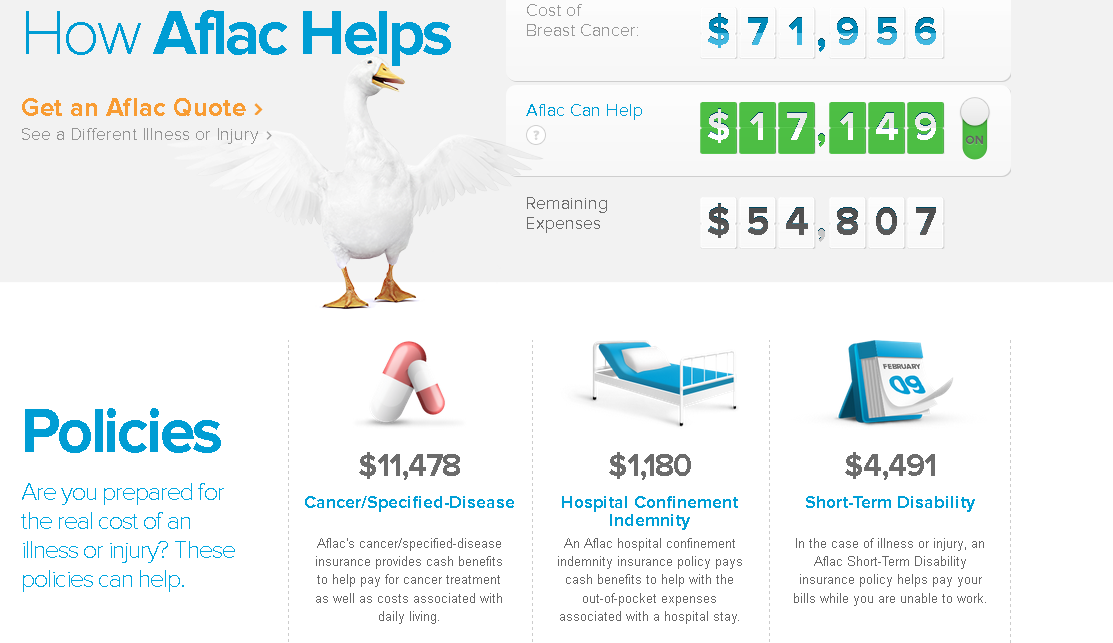

Does life insurance pay out if you die of cancer? Sometimes it only pays out if you die during a certain period of time. If the nominee is a criminal. As long as your beneficiaries have a bank routing number or mailing address to receive paper checks, you can rest assured they will be. Cancer cover can pay up to $250,000 if you’re diagnosed with cancer (of a specified criteria). Depending on your diagnosis, its severity, and your treatment history, you can qualify for some types of life insurance coverage, but your rates may be high.

It generally takes at least a couple of years to obtain a medically underwritten policy after a cancer diagnosis, especially if over stage 2.

However, not many know that there certain types of death that are not covered by life insurance policies. Life insurance does cover death by cancer. Most insurance policies today will indeed cover a death caused by cancer, so your loved ones will be financially protected after you’re gone. Most cancer survivors can qualify for standard term or whole life insurance policies, and cancer patients should be able to buy guaranteed issue life insurance. You don�t have to pay income tax on the initial policy proceeds when you�re the beneficiary of a life insurance policy. What is life insurance for cancer patients?

Source: worthright.com

Source: worthright.com

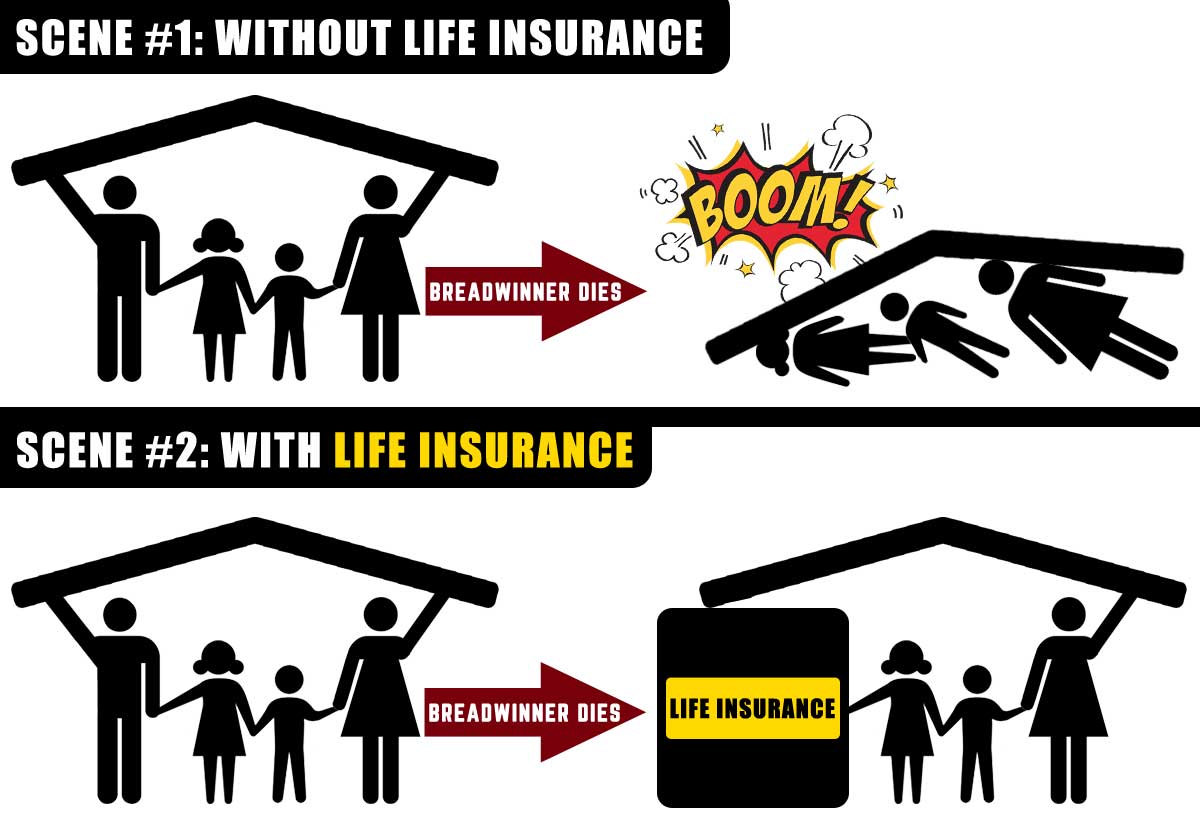

This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death. Life insurance is an agreement between you and an insurance provider that states that you will make premium payments to the insurance company, and should you pass away during the coverage period, they will pay a death benefit to your beneficiaries. However, there are a few things to keep in mind. So, if you have a term insurance or are planning to buy one it is important for you to know which death cases are not covered in your term insurance policy. Life insurance does cover death by cancer.

Source: verywellhealth.com

Source: verywellhealth.com

Cancer cover can pay up to $250,000 if you’re diagnosed with cancer (of a specified criteria). However, it is common for someone diagnosed with cancer to seek out a life insurance policy, and at that point in time it is very difficult to obtain coverage. The internal revenue service doesn�t consider death benefits to be income. Life insurance is helpful for two main reasons: However, there are certain qualifications in order to be eligible for them.

Source: rfhr.com

Source: rfhr.com

There are life insurance policies available specifically if you are cancer survivor. Which would be required, and to what degree, will depend upon the specific insurance company and your individual circumstances. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. Life insurance after a cancer diagnosis is more expensive, and you may have limited coverage options, but both cancer patients and survivors will be able to purchase policies. How life insurance policies are designed.

Source: moneyunder30.com

Source: moneyunder30.com

What is life insurance for cancer patients? Cancer patients may have a shortened lifespan, which increases the likelihood that their insurance company will have to pay a claim. Many life insurance policies include terminal illness cover. And the good news is that most life insurance policies do in fact pay if your death is caused by cancer. Depending on your diagnosis, its severity, and your treatment history, you can qualify for some types of life insurance coverage, but your rates may be high.

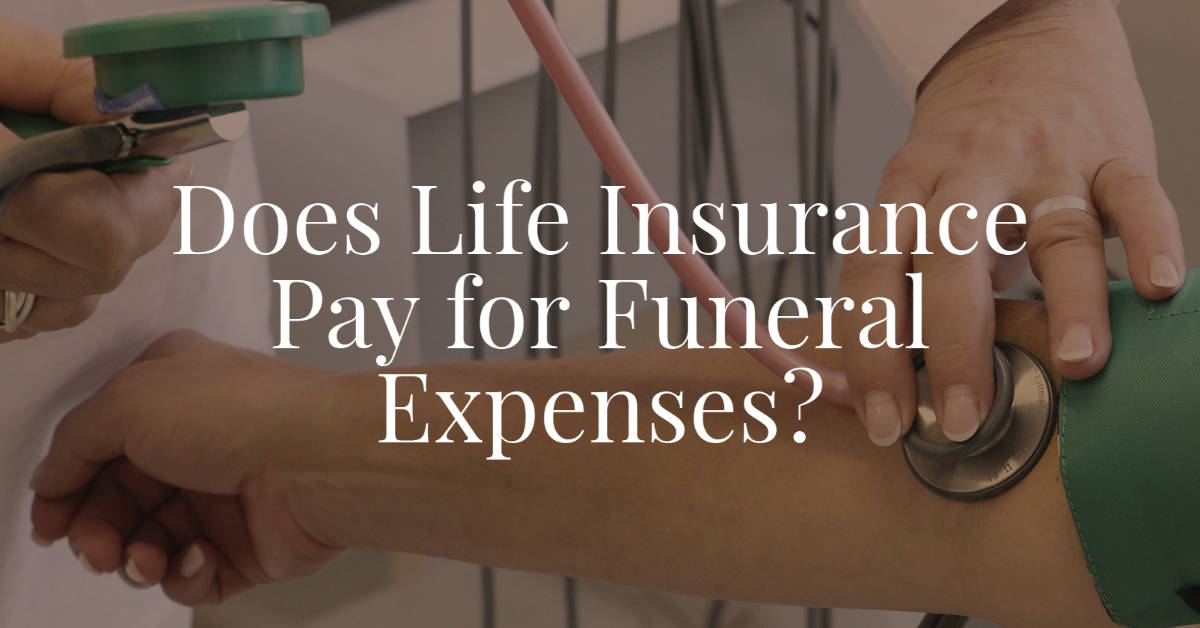

Source: 1life.co.za

Source: 1life.co.za

So, if you have a term insurance or are planning to buy one it is important for you to know which death cases are not covered in your term insurance policy. However, there are certain qualifications in order to be eligible for them. Insurance companies consider cancer a natural cause of death, which is what comprehensive life insurance policies (term and whole life) typically cover. If the nominee is a criminal. This is called the policy term.

Source: aswesawit.com

Source: aswesawit.com

Most insurance policies today will indeed cover a death caused by cancer, so your loved ones will be financially protected after you’re gone. As long as your beneficiaries have a bank routing number or mailing address to receive paper checks, you can rest assured they will be. Cancer patients may have a shortened lifespan, which increases the likelihood that their insurance company will have to pay a claim. Your beneficiaries will receive the payout from your policy if you die from a motor vehicle accident, drowning, or any other accidental tragedy. Family income benefit is a type of life insurance which will pay out a regular income to your loved ones if you die, rather than a one off lump sum payment.

Source: webbfg.com

Source: webbfg.com

Life insurance is a type of insurance that pays out when you die. This includes people who are incarcerated or unemployed, nonprofit organizations, and charities. Which would be required, and to what degree, will depend upon the specific insurance company and your individual circumstances. Standard life insurance policies cover deaths as long as the policy is active at the time of death and it happens after the policy’s contestability period. The internal revenue service doesn�t consider death benefits to be income.

Source: moneysupermarket.com

Source: moneysupermarket.com

Standard life insurance policies cover deaths as long as the policy is active at the time of death and it happens after the policy’s contestability period. The exception to this is death by suicide within the first two years of owning the policy. If you die after the term of the policy has finished, your loved ones will not get. Depending on your diagnosis, its severity, and your treatment history, you can qualify for some types of life insurance coverage, but your rates may be high. What is life insurance for cancer patients?

Source: quotacy.com

Source: quotacy.com

You might consider adding an accelerated death benefit, which gives your beneficiaries early access to your death benefit if you’re diagnosed with a terminal illness. As mentioned above, life insurance pays out for death by natural causes. Luckily, the answer to this question is usually yes. It can provide money for your family after you die. If you qualify for life insurance after a cancer diagnosis, consider adding certain policy riders.

Source: thewiseguyph.com

Source: thewiseguyph.com

If you die after the term of the policy has finished, your loved ones will not get. The internal revenue service doesn�t consider death benefits to be income. It can provide money for your family after you die. It can pay off debts left behind, such as a mortgage. If you buy a life insurance policy and die the day after it becomes 100% inforce (activated by the insurance company) the policy will pay out to your beneficiaries.

Source: samshockaday.com

Source: samshockaday.com

You don�t have to pay income tax on the initial policy proceeds when you�re the beneficiary of a life insurance policy. Life insurance is an agreement between you and an insurance provider that states that you will make premium payments to the insurance company, and should you pass away during the coverage period, they will pay a death benefit to your beneficiaries. The exception to this is death by suicide within the first two years of owning the policy. A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed. This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death.

Source: spikysnail.com

Source: spikysnail.com

If you qualify for life insurance after a cancer diagnosis, consider adding certain policy riders. Life insurance is an agreement between you and an insurance provider that states that you will make premium payments to the insurance company, and should you pass away during the coverage period, they will pay a death benefit to your beneficiaries. As mentioned above, life insurance pays out for death by natural causes. Which would be required, and to what degree, will depend upon the specific insurance company and your individual circumstances. Many life insurance policies include terminal illness cover.

Source: telegraph.co.uk

Source: telegraph.co.uk

Most cancer survivors can qualify for standard term or whole life insurance policies, and cancer patients should be able to buy guaranteed issue life insurance. It can pay off debts left behind, such as a mortgage. Most cancer survivors can qualify for standard term or whole life insurance policies, and cancer patients should be able to buy guaranteed issue life insurance. If the nominee is a criminal. Life insurance is helpful for two main reasons:

Source: affordablecebu.com

Source: affordablecebu.com

This includes people who are incarcerated or unemployed, nonprofit organizations, and charities. Can you get life insurance with a cancer diagnosis? Luckily, the answer to this question is usually yes. This is called the policy term. It can provide money for your family after you die.

Source: inspiredbysavannah.com

Source: inspiredbysavannah.com

Life insurance is an agreement between you and an insurance provider that states that you will make premium payments to the insurance company, and should you pass away during the coverage period, they will pay a death benefit to your beneficiaries. How life insurance policies are designed. Cancer cover can pay up to $250,000 if you’re diagnosed with cancer (of a specified criteria). What is life insurance for cancer patients? If the premium is not paid in this.

Source: triagecancer.org

Source: triagecancer.org

The exception to this is death by suicide within the first two years of owning the policy. If the nominee is a criminal. This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death. A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed. Depending on your diagnosis, its severity, and your treatment history, you can qualify for some types of life insurance coverage, but your rates may be high.

Source: cotzenlaw.com

Source: cotzenlaw.com

A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed. Whole life insurance pays out a lump sum at whatever age you die. Any living person or active entity you list as your beneficiary is eligible to receive life insurance if you die for any reason not listed above. Can you get life insurance with a cancer diagnosis? What is life insurance for cancer patients?

Source: samshockaday.com

Source: samshockaday.com

This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death. However, there are a few things to keep in mind. If you die after the term of the policy has finished, your loved ones will not get. Life insurance is helpful for two main reasons: It can pay off debts left behind, such as a mortgage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does life insurance pay if you die of cancer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.