Your Does life insurance pay for suicidal death in california images are ready. Does life insurance pay for suicidal death in california are a topic that is being searched for and liked by netizens now. You can Download the Does life insurance pay for suicidal death in california files here. Find and Download all royalty-free vectors.

If you’re searching for does life insurance pay for suicidal death in california images information related to the does life insurance pay for suicidal death in california topic, you have pay a visit to the right site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

Does Life Insurance Pay For Suicidal Death In California. Five states allow assisted suicide: If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. If the suicide occurs within the excluded period, the life insurance company won’t pay the death benefit.

Memorial Day Free Burgers, Pizza And More For Military From the-military-guide.com

Memorial Day Free Burgers, Pizza And More For Military From the-military-guide.com

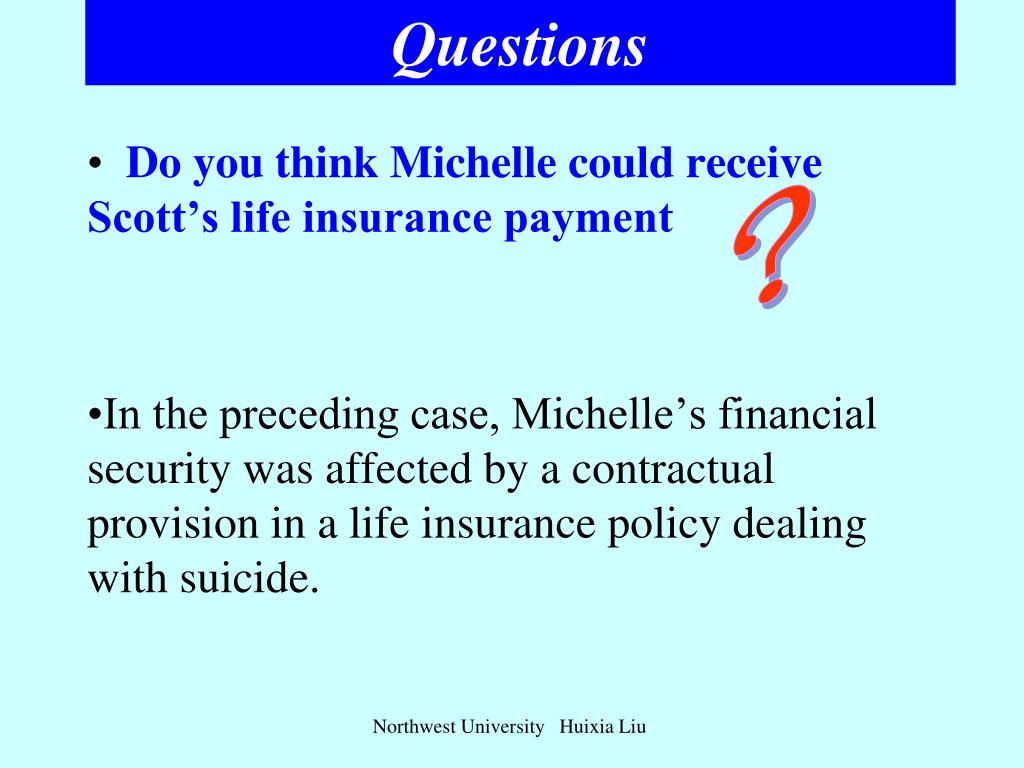

If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. If you’re the beneficiary of the life insurance. While most people are familiar with insurance companies refusing to pay life insurance if a person dies by suicide within two years of taking out a policy, experts were surprised to learn that cbc. Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. We offer the financial protection and security of $10,000, $15,000, $25,000, $50,000, $75,000, or $100,000 in term life and ad. Life insurance covers suicide, and your beneficiaries will receive the death benefit unless the death occurs during the contestability period—typically the first two years of.

Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage.

Similar to the suicide clause, the contestability period is a set period—usually two years—during which time the insurance company can contest your claim as a way of denying the death benefit. Life insurance covers suicide, and your beneficiaries will receive the death benefit unless the death occurs during the contestability period—typically the first two years of. 2.when the insured�s policy is provided by employer. Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. Similar to the suicide clause, the contestability period is a set period—usually two years—during which time the insurance company can contest your claim as a way of denying the death benefit. Is suicide covered in life insurance?

Source: stingypig.ca

Source: stingypig.ca

Why do life insurance policies have suicide clauses? Does life insurance cover a suicidal death? Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. Apart from suicide, life insurance companies can refuse to pay for other factors during the contestability period. Does life insurance pay for suicidal death?

Source: youtube.com

Source: youtube.com

Such a certificate will indicate if the deceased died by suicide. Does life insurance cover suicide? However, some insurers such as future generali do have a policy to pay the nominee 80 per cent of the premiums paid as death benefit, if the policyholder commits suicide within a year of the. Similar to the suicide clause, the contestability period is a set period—usually two years—during which time the insurance company can contest your claim as a way of denying the death benefit. Does life insurance pay for suicidal death?

Source: lifenews.com

Source: lifenews.com

Is suicide covered in life insurance? Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage. Does life insurance pay for suicidal death? Does life insurance cover a suicidal death? The suicidal death cover of a term life insurance plan is only applicable if the policy has been issued for 12 months or twelve months after the revival.

Source: reddit.com

Source: reddit.com

Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. We explain how suicide is treated by life insurers, and what life insurance providers can ask. Why do life insurance policies have suicide clauses? Suicidal death if the policyholder commits suicide within the first year of the policy term, then the nominee will not get the death benefit. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage.

Source: abcnews.go.com

Source: abcnews.go.com

However, most insurers provide suicide coverage from the second year onwards from the date of purchase of the policy, subject to terms and conditions. If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage. Does life insurance cover suicide? Similar to the suicide clause, the contestability period is a set period—usually two years—during which time the insurance company can contest your claim as a way of denying the death benefit.

Source: mfpclassiccars.com

Source: mfpclassiccars.com

As defined in their suicide clause, insurance companies will typically not pay a death benefit if the covered person dies by suicide within the first two years of coverage—commonly known as the. Does life insurance pay for suicidal death? Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. Whenever an insured person replaces an existing life insurance policy with a new one, the time clock for the suicide clause is set back to zero and starts over again. California, colorado, oregon, washington and vermont.

Source: berrillwatson.com.au

Source: berrillwatson.com.au

For example, aegon life insurance iterm plan offers to pay back 80% of the premium paid even if suicide is committed within one year of the commencement of the policy or renewal of the policy. The life insurance suicide clause is enforceable during the first two years of owning a term or permanent life insurance policy. We explain how suicide is treated by life insurers, and what life insurance providers can ask. Why do life insurance policies have suicide clauses? If you’re the beneficiary of the life insurance.

Source: blogpapi.com

Source: blogpapi.com

If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. Does life insurance cover suicide? For example, aegon life insurance iterm plan offers to pay back 80% of the premium paid even if suicide is committed within one year of the commencement of the policy or renewal of the policy. There are few exceptions because after this waiting period, a life insurance policy�s suicide clause and contestability clause expire. Why do life insurance policies have suicide clauses?

Source: the-military-guide.com

Source: the-military-guide.com

We explain how suicide is treated by life insurers, and what life insurance providers can ask. Life insurance will not pay death benefits if death by suicide happens within the suicide clause timeframe. Does life insurance pay for suicidal death? However, your beneficiary�s claim can still be denied if you failed. A few insurance companies have come up with specific term plans that don’t offer death benefits but offer to pay back a part of the total premium paid until death.

Source: annualreports.com

Source: annualreports.com

Does life insurance cover a suicidal death? In the case of accidental death, the amount of your accidental death benefit matches your life insurance coverage. For example, aegon life insurance iterm plan offers to pay back 80% of the premium paid even if suicide is committed within one year of the commencement of the policy or renewal of the policy. Life insurance pays out money in a lump sum or in regular payments to your family or nominated beneficiaries to help them cope financially in the event of your death. Is suicide covered in life insurance?

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

After the first two years, most life insurance companies will pay out benefits for suicidal death. However, your beneficiary�s claim can still be denied if you failed. There are few exceptions because after this waiting period, a life insurance policy�s suicide clause and contestability clause expire. If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. Does life insurance cover a suicidal death?

Source: mybanktracker.com

Source: mybanktracker.com

For example, aegon life insurance iterm plan offers to pay back 80% of the premium paid even if suicide is committed within one year of the commencement of the policy or renewal of the policy. Exceptions may include deaths during the contestability period — the first one to two years of your enrolment — and suicide. Usually, this clause states that no death benefit will be paid if the insured commits suicide within two years of taking out a policy. Similar to the suicide clause, the contestability period is a set period—usually two years—during which time the insurance company can contest your claim as a way of denying the death benefit. Yes, but a suicide clause specifies that suicide isn’t typically covered in the first two years of insurance policy coverage.

Source: easybestrecipes129.blogspot.com

Source: easybestrecipes129.blogspot.com

Once the insurer is convinced of the conditions, and if the event happens after a year of taking the policy, the benefit will be paid out to the nominee of the deceased assured. Exceptions may include deaths during the contestability period — the first one to two years of your enrolment — and suicide. However, your beneficiary�s claim can still be denied if you failed. Apart from suicide, life insurance companies can refuse to pay for other factors during the contestability period. In the case of accidental death, the amount of your accidental death benefit matches your life insurance coverage.

Source: probatestars.com

Source: probatestars.com

We offer the financial protection and security of $10,000, $15,000, $25,000, $50,000, $75,000, or $100,000 in term life and ad. Does life insurance cover suicide? California, colorado, oregon, washington and vermont. Why do life insurance policies have suicide clauses? As defined in their suicide clause, insurance companies will typically not pay a death benefit if the covered person dies by suicide within the first two years of coverage—commonly known as the.

Source: mfpclassiccars.com

Source: mfpclassiccars.com

Life insurance will not pay death benefits if death by suicide happens within the suicide clause timeframe. This also applies in cases where, in our reasonable opinion, the. If the suicide occurs within the excluded period, the life insurance company won’t pay the death benefit. However, most insurers provide suicide coverage from the second year onwards from the date of purchase of the policy, subject to terms and conditions. California, colorado, oregon, washington and vermont.

Source: esmasqeunsentiimiento.blogspot.com

Source: esmasqeunsentiimiento.blogspot.com

If you are accidentally injured, the dismemberment benefit will be a portion of the benefit amount. Life insurance policies will usually cover suicidal death so long as the policy was purchased at least two to three years before the insured died. As defined in their suicide clause, insurance companies will typically not pay a death benefit if the covered person dies by suicide within the first two years of coverage—commonly known as the. 2.when the insured�s policy is provided by employer. Once the insurer is convinced of the conditions, and if the event happens after a year of taking the policy, the benefit will be paid out to the nominee of the deceased assured.

Source: onsizzle.com

Source: onsizzle.com

Once the insurer is convinced of the conditions, and if the event happens after a year of taking the policy, the benefit will be paid out to the nominee of the deceased assured. However, your beneficiary�s claim can still be denied if you failed. In the case of accidental death, the amount of your accidental death benefit matches your life insurance coverage. While most people are familiar with insurance companies refusing to pay life insurance if a person dies by suicide within two years of taking out a policy, experts were surprised to learn that cbc. Does life insurance pay for suicidal death?

Source: reddit.com

Source: reddit.com

Such a certificate will indicate if the deceased died by suicide. This also applies in cases where, in our reasonable opinion, the. For example, aegon life insurance iterm plan offers to pay back 80% of the premium paid even if suicide is committed within one year of the commencement of the policy or renewal of the policy. Does life insurance cover suicide? 1.when the suicide clauses has expired.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does life insurance pay for suicidal death in california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.