Your Does life insurance have to pay debt images are ready. Does life insurance have to pay debt are a topic that is being searched for and liked by netizens today. You can Find and Download the Does life insurance have to pay debt files here. Get all royalty-free photos.

If you’re searching for does life insurance have to pay debt pictures information related to the does life insurance have to pay debt topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Does Life Insurance Have To Pay Debt. Can a life insurance policy be used to pay off debt? Yes, the death benefit from a life insurance policy can be used to pay off debt. This can depend on state law and the insurance company�s payment policies, but the bottom line is the same. Whether or not your life insurance will be garnished for debt depends on the state you live in.

Whole Life Insurance Loan Whole Life Insurance Policy From entresuaspalavras.blogspot.com

Whole Life Insurance Loan Whole Life Insurance Policy From entresuaspalavras.blogspot.com

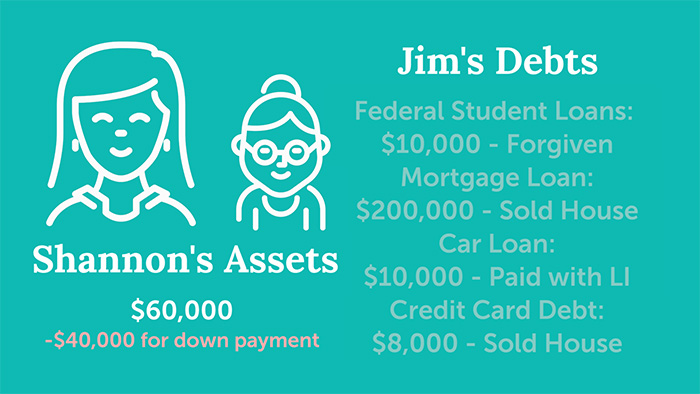

The money from your life insurance payout will become part of your estate and enter probate with the rest of your assets and property. Can debt collectors take life insurance money? My husband died and left me with $25,000 in credit card he also left me a life insurance policy in the amount of $55,000. After your father�s debts are paid, the life insurance money, along with his other assets, are divided among his heirs. “what?” use an insurance policy to pay off credit card debt? The money can’t be seized by creditors, and you don’t have to worry about taxes or liens.

Can creditors seize my life insurance proceeds?

Do i have to use the life insurance policy money to pay off credit card debt. Can a life insurance policy be used to pay off debt? After your father�s debts are paid, the life insurance money, along with his other assets, are divided among his heirs. I want to file bankruptcy as i don’t make enough working to pay off the credit card debt. The short answer is that if you don’t have any debt, there is a good chance that you don’t need life insurance. Can creditors seize my life insurance proceeds?

Source: pinterest.com

Source: pinterest.com

“what?” use an insurance policy to pay off credit card debt? You�re not responsible for the debts of others,. In other words, creditors cannot garnish the benefits of your policy to pay for your outstanding debts. In 2021, that amount is $11.7 million, so the good news is that the average person won’t have to pay these taxes. Yes, it can be done.

Source: highponytailhats.com

Source: highponytailhats.com

In this case, creditors can be paid off with these funds. Can creditors seize my life insurance proceeds? In other words, creditors cannot garnish the benefits of your policy to pay for your outstanding debts. You don’t want to saddle your family with expenses they. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

October 29, 2010 by steve rhode. In this case, creditors can be paid off with these funds. If your life insurance policy’s beneficiaries have all passed on before you, there are two possible ways your payout with be dealt with: If you have a straightforward term life insurance policy and you outlive it, essentially, you will forfeit all of the premiums that were paid during that term. If there isn�t enough money in the estate to pay all.

Source: lifeant.com

Source: lifeant.com

You�re not responsible for the debts of others,. In fact, it’s one of the many reasons why people buy life insurance. If you receive life insurance proceeds that are payable directly to you, you don�t have to use them to pay the debts of your parent or another relative. If there isn�t enough money in the estate to pay all. Can creditors seize my life insurance proceeds?

Source: pinterest.com

Source: pinterest.com

Therefore, spending money on life insurance each month would likely be a waste of money. Beneficiaries of life insurance policies are usually not required to pay any debts owed by the deceased estate, whether it’s secured or unsecured debt. These assets go to the named beneficiaries and aren�t. Without debt, it’s unlikely that your family would go into a financial crisis if you were to pass away. My husband died and left me with $25,000 in credit card he also left me a life insurance policy in the amount of $55,000.

Source: pinterest.com

Source: pinterest.com

Just consult with a tax expert on any potential income tax implications of tapping into whole life insurance to pay off debt. Without debt, it’s unlikely that your family would go into a financial crisis if you were to pass away. Yes, life insurance can go to pay debts. Can debt collectors take life insurance money? This can depend on state law and the insurance company�s payment policies, but the bottom line is the same.

Source: eastendagency.com

Source: eastendagency.com

You don’t want to saddle your family with expenses they. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Beneficiaries of life insurance policies are usually not required to pay any debts owed by the deceased estate, whether it’s secured or unsecured debt. In this case, creditors can be paid off with these funds. Does a life insurance beneficiary have to pay taxes life from lifeinsurance.satukara.com

Source: pinterest.com

Source: pinterest.com

Therefore, spending money on life insurance each month would likely be a waste of money. Yes, the death benefit from a life insurance policy can be used to pay off debt. The life insurance proceeds don�t have to be used to pay the. If you receive life insurance proceeds that are payable directly to you, you don�t have to use them to pay the debts of your parent or another relative. They may include cash on hand, bank accounts, real estate, vehicles and the like.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

The money can’t be seized by creditors, and you don’t have to worry about taxes or liens. If your life insurance policy’s beneficiaries have all passed on before you, there are two possible ways your payout with be dealt with: Can a life insurance policy be used to pay off debt? The purpose of life insurance is to relieve financial stress which your heirs or beneficiaries will endure. In this case, creditors can be paid off with these funds.

Source: texasrepubliclifesolutions.com

Source: texasrepubliclifesolutions.com

In other words, creditors cannot garnish the benefits of your policy to pay for your outstanding debts. The life insurance proceeds don�t have to be used to pay the. After your father�s debts are paid, the life insurance money, along with his other assets, are divided among his heirs. If you�re the named beneficiary on a life insurance policy, that money is yours to do with as you wish. Can a life insurance policy be used to pay off debt?

Source: fundingcloudnine.com

Source: fundingcloudnine.com

If you have whole life insurance, also called permanent life insurance, you may have additional options to pay off debt. Therefore, spending money on life insurance each month would likely be a waste of money. The life insurance proceeds don�t have to be used to pay the. They may include cash on hand, bank accounts, real estate, vehicles and the like. Do i have to use the life insurance policy money to pay off credit card debt.

Source: iii.org

Source: iii.org

The purpose of life insurance is to relieve financial stress which your heirs or beneficiaries will endure. If you have whole life insurance, also called permanent life insurance, you may have additional options to pay off debt. After your father�s debts are paid, the life insurance money, along with his other assets, are divided among his heirs. Without debt, it’s unlikely that your family would go into a financial crisis if you were to pass away. Whether or not your life insurance will be garnished for debt depends on the state you live in.

Source: fundingcloudnine.com

Source: fundingcloudnine.com

I want to file bankruptcy as i don’t make enough working to pay off the credit card debt. They may include cash on hand, bank accounts, real estate, vehicles and the like. You�re not responsible for the debts of others,. However, you should be aware that the obligation to pay your funeral costs will generally rest with your next of kin, not with your estate. If you�re the named beneficiary on a life insurance policy, that money is yours to do with as you wish.

Source: debt.ca

Source: debt.ca

If you receive life insurance proceeds that are payable directly to you, you don�t have to use them to pay the debts of your parent or another relative. If they were to die unexpectedly, they don’t want to leave behind debt that their loved ones need to worry about. October 29, 2010 by steve rhode. If your father named his estate as the beneficiary of his life insurance, the proceeds from the policy are paid to the estate. If you�re the named beneficiary on a life insurance policy, that money is yours to do with as you wish.

Source: quotacy.com

Source: quotacy.com

If you receive life insurance proceeds that are payable directly to you, you don�t have to use them to pay the debts of your parent or another relative. In fact, it’s one of the many reasons why people buy life insurance. If your life insurance policy’s beneficiaries have all passed on before you, there are two possible ways your payout with be dealt with: But as you probably know, some assets — including the life insurance policies and lifetime annuity you received — bypass probate altogether and go directly to the beneficiary. If there isn�t enough money in the estate to pay all.

Source: pinterest.com

Source: pinterest.com

If you have a term insurance policy, outliving the term of the plan may not benefit you. They may include cash on hand, bank accounts, real estate, vehicles and the like. With riders such as the return of premium or accelerated death benefits, you get the most protection in the event you outlive. Does life insurance have to pay debt. If you have a term insurance policy, outliving the term of the plan may not benefit you.

Source: vittana.org

Source: vittana.org

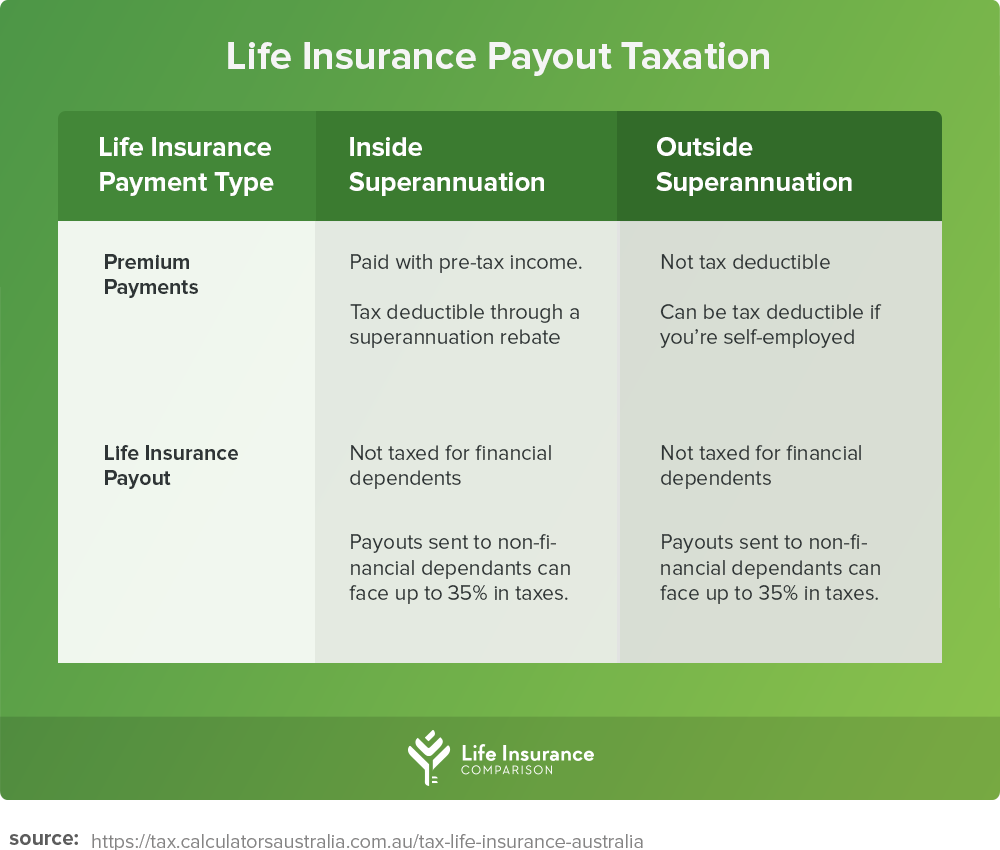

The money from your life insurance payout will become part of your estate and enter probate with the rest of your assets and property. For example, in some states, life insurance is protected from creditors; After your father�s debts are paid, the life insurance money, along with his other assets, are divided among his heirs. Just consult with a tax expert on any potential income tax implications of tapping into whole life insurance to pay off debt. How life insurance can protect from debt risks by janet gray on april 2, 2018 using a personal line of credit to pay tuition could leave you liable

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

The short answer is that if you don’t have any debt, there is a good chance that you don’t need life insurance. These assets go to the named beneficiaries and aren�t. Whether or not your life insurance will be garnished for debt depends on the state you live in. Can a life insurance policy be used to pay off debt? With riders such as the return of premium or accelerated death benefits, you get the most protection in the event you outlive.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does life insurance have to pay debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.