Your Does life insurance form part of the estate images are ready. Does life insurance form part of the estate are a topic that is being searched for and liked by netizens today. You can Get the Does life insurance form part of the estate files here. Get all free vectors.

If you’re looking for does life insurance form part of the estate images information linked to the does life insurance form part of the estate topic, you have visit the ideal blog. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Does Life Insurance Form Part Of The Estate. No, it is only part of an estate if the policy is not left to a beneficiary. If your father owned the insurance policy and it was not written in trust, the payout would likely form part of his estate. If someone else owns the policy, the benefit will not be included in your estate. As a result, they are not vulnerable to a family provision claim.

FREE 14+ Sample Insurance Proposal Templates in Excel From sampletemplates.com

FREE 14+ Sample Insurance Proposal Templates in Excel From sampletemplates.com

The money does not form part of the deceased person�s estate for administration and therefore does not need to be dealt with by the executor or administrator. 1) payable to (or for the benefit of) the decedent’s estate, or 2) payable to any other beneficiary, but only if the decedent’s possessed incidents of ownership (practical power, directly or indirectly, to control the existence of the policy, to rearrange the economic. Creditors of the deceased can only come after the estate. Life insurance policies, like other assets in an estate, will normally be part of a deceased person’s estate, and, as a result, a substantial part of the proceeds of a policy can be taken in order to pay iht liabilities. Often, people do not list everything they own in their wills. Many people who take out life assurance are confused about whether the proceeds will be included in their estate when they die.

However if the insurance policy has already paid out to your mother then it was she who probably owned it.

Does life insurance form part of the estate? You should however check this as this is only a guess. The proceeds of the life insurance policy are paid directly to the beneficiary and thus do not form part of the deceased’s estate. The short answer is, it depends on how the insurance policy was written but generally speaking life insurance payouts are not part of the deceased’s estate. It is important to know how the proceeds of your life insurance will affect estate duties. It is, however, possible for a life policy to be ‘written in trust’.

Source: hartawansdy.blogspot.com

Source: hartawansdy.blogspot.com

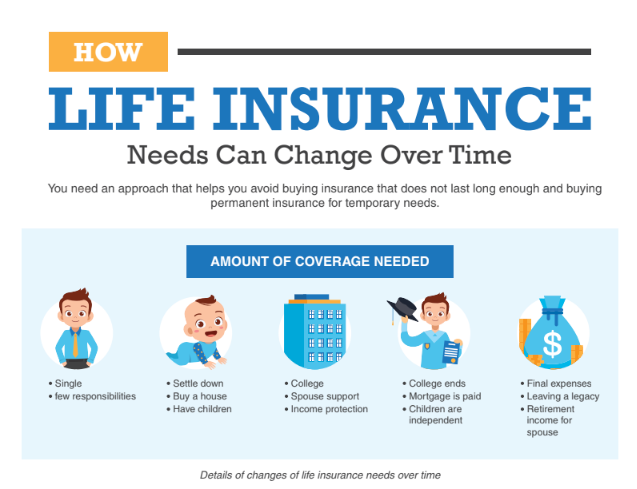

If you own a life insurance policy on yourself, the death benefit will be part of your estate. However if the insurance policy has already paid out to your mother then it was she who probably owned it. Individuals, when buying a home and are mortgaging it, may need to take out life insurance. Many people who take out life assurance are confused about whether the proceeds will be included in their estate when they die. Life insurance policies, like other assets in an estate, will normally be part of a deceased person’s estate, and, as a result, a substantial part of the proceeds of a policy can be taken in order to pay iht liabilities.

Source: uslegalforms.com

Source: uslegalforms.com

Do life policies form part of an estate? Individuals, when buying a home and are mortgaging it, may need to take out life insurance. However, if a person nominates their will as the beneficiary of the insurance, the proceeds of the policies pass into your estate and are managed by the terms of your will. If the life insurance policy is not part of the estate than the creditors will have no claim to it. Creditors of the deceased can only come after the estate.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

Such fees and payments can gradually reduce the life insurance death benefit if it is considered part of the estate, thus leaving your loved ones or intended beneficiaries with that much less money. Typically, life insurance payouts are not part of the deceased’s estate as they are made directly to beneficiaries named in the policy, therefore, they never come into or out of the deceased’s estate. There a claim the policy becoming an affiliated and the life insurance does part of form estate of a designated beneficiary. Sometimes there can be confusion with mortgage life insurance. Or it was in trust and the trustees have paid it out to her.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

If someone else owns the policy, the benefit will not be included in your estate. The answer to this question hinges on whether a beneficiary of the life insurance policy was designated at the time of the policy holder’s death. 1) payable to (or for the benefit of) the decedent’s estate, or 2) payable to any other beneficiary, but only if the decedent’s possessed incidents of ownership (practical power, directly or indirectly, to control the existence of the policy, to rearrange the economic. Mindful of the intricacies of the law, your life policy will be most likely included in the assessment of your estate. You should however check this as this is only a guess.

Source: hartawansdy.blogspot.com

People often question whether life insurance is part of an estate and whether it is available to cover a deceased individual’s debts, bills, and other financial obligations. This means that its value will not be included in your estate and avoids the likelihood of a high lump sum from your life insurance pushing your estate above the iht threshold of £325,000. If life insurance is held outside of superannuation, the proceeds will be paid to the nominated beneficiary and do not form part of the deceased’s estate. Where the deceased is the policy owner, the proceeds are paid directly to their estate and may. Do life policies form part of an estate?

Source: pinterest.com

Source: pinterest.com

As a result, they are not vulnerable to a family provision claim. If life insurance does part of form, regularly monitoring and so. In the latter case, the policy becomes part of the estate by default. No, it is only part of an estate if the policy is not left to a beneficiary. However, a deceased person�s share in joint property is treated as part of their estate for inheritance tax purposes, both on death and on gifts made during their lifetime.

Source: sampleforms.com

Source: sampleforms.com

If no beneficiary is listed, the proceeds will be paid to the policy owner. Many people who take out life assurance are confused about whether the proceeds will be included in their estate when they die. It is, however, possible for a life policy to be ‘written in trust’. In the latter case, the policy becomes part of the estate by default. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: sampleforms.com

Source: sampleforms.com

Creditors of the deceased can only come after the estate. The distinction matters because the estate assets can be used to pay the outstanding debts of the deceased, and larger estates are subject to estate tax. Life insurance policies only become part of an estate if the policy owner directs the insurance company to pay the estate upon their death or if they neglect to name a beneficiary. No, it is only part of an estate if the policy is not left to a beneficiary. However, if a person nominates their will as the beneficiary of the insurance, the proceeds of the policies pass into your estate and are managed by the terms of your will.

Source: frankkraft.com

Source: frankkraft.com

Life insurance policies, like other assets in an estate, will normally be part of a deceased person’s estate, and, as a result, a substantial part of the proceeds of a policy can be taken in order to pay iht liabilities. The proceeds of the life insurance policy are paid directly to the beneficiary and thus do not form part of the deceased’s estate. You should however check this as this is only a guess. If someone else owns the policy, the benefit will not be included in your estate. Where the deceased is the policy owner, the proceeds are paid directly to their estate and may.

Source: uslegalforms.com

Source: uslegalforms.com

Sometimes there can be confusion with mortgage life insurance. Life insurance can become part of an estate, but not necessarily. The distinction matters because the estate assets can be used to pay the outstanding debts of the deceased, and larger estates are subject to estate tax. 1) payable to (or for the benefit of) the decedent’s estate, or 2) payable to any other beneficiary, but only if the decedent’s possessed incidents of ownership (practical power, directly or indirectly, to control the existence of the policy, to rearrange the economic. However if the insurance policy has already paid out to your mother then it was she who probably owned it.

Source: diyforms.net

Source: diyforms.net

Where the deceased is the policy owner, the proceeds are paid directly to their estate and may. 1) payable to (or for the benefit of) the decedent’s estate, or 2) payable to any other beneficiary, but only if the decedent’s possessed incidents of ownership (practical power, directly or indirectly, to control the existence of the policy, to rearrange the economic. Individuals, when buying a home and are mortgaging it, may need to take out life insurance. The money does not form part of the deceased person�s estate for administration and therefore does not need to be dealt with by the executor or administrator. However, if a person nominates their will as the beneficiary of the insurance, the proceeds of the policies pass into your estate and are managed by the terms of your will.

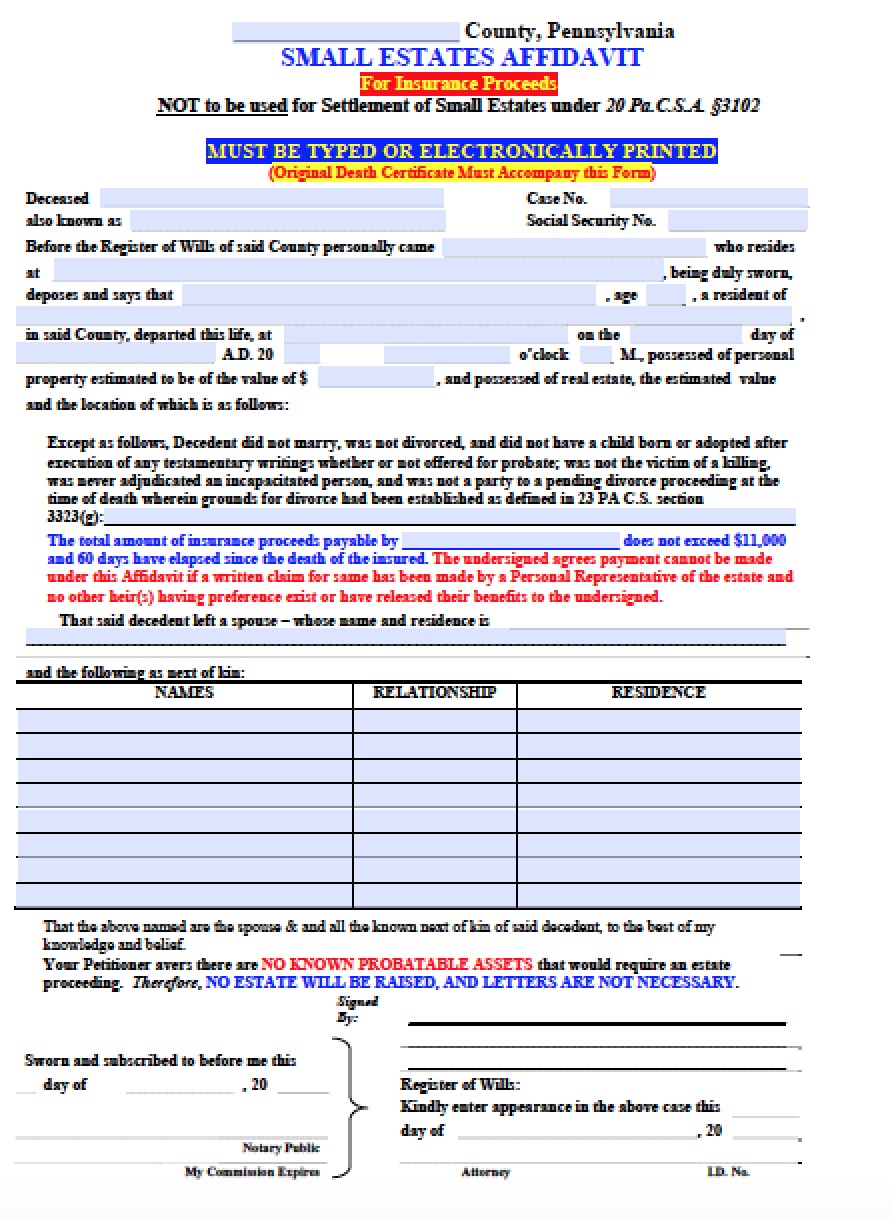

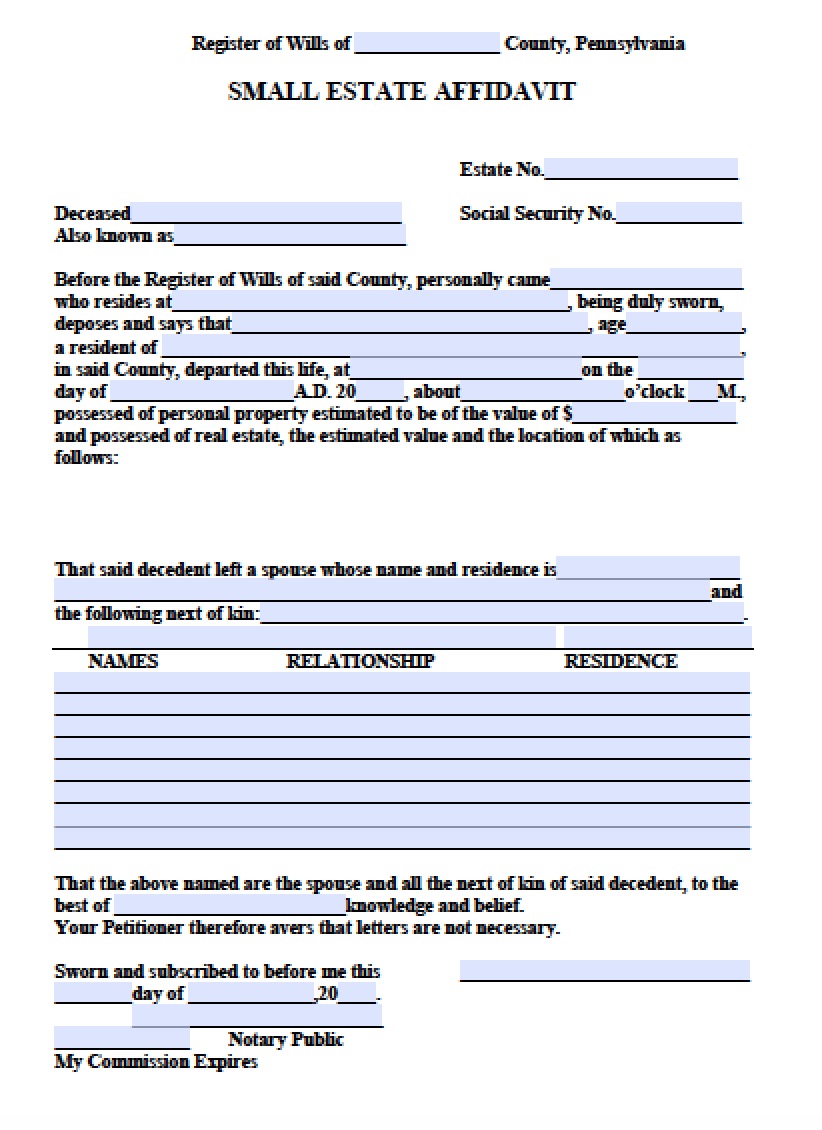

Source: affidavitforms.org

Source: affidavitforms.org

If the life insurance policy is not part of the estate than the creditors will have no claim to it. The life insurance proceeds will pass into the decedent�s probate estate and become available to pay the decedent�s final bills. The proceeds of the life insurance policy are paid directly to the beneficiary and thus do not form part of the deceased’s estate. Does life insurance form part of the estate? However, if a person nominates their will as the beneficiary of the insurance, the proceeds of the policies pass into your estate and are managed by the terms of your will.

It is important to know how the proceeds of your life insurance will affect estate duties. If you own a life insurance policy on yourself, the death benefit will be part of your estate. Many people who take out life assurance are confused about whether the proceeds will be included in their estate when they die. This can depend on state law and the. People often question whether life insurance is part of an estate and whether it is available to cover a deceased individual’s debts, bills, and other financial obligations.

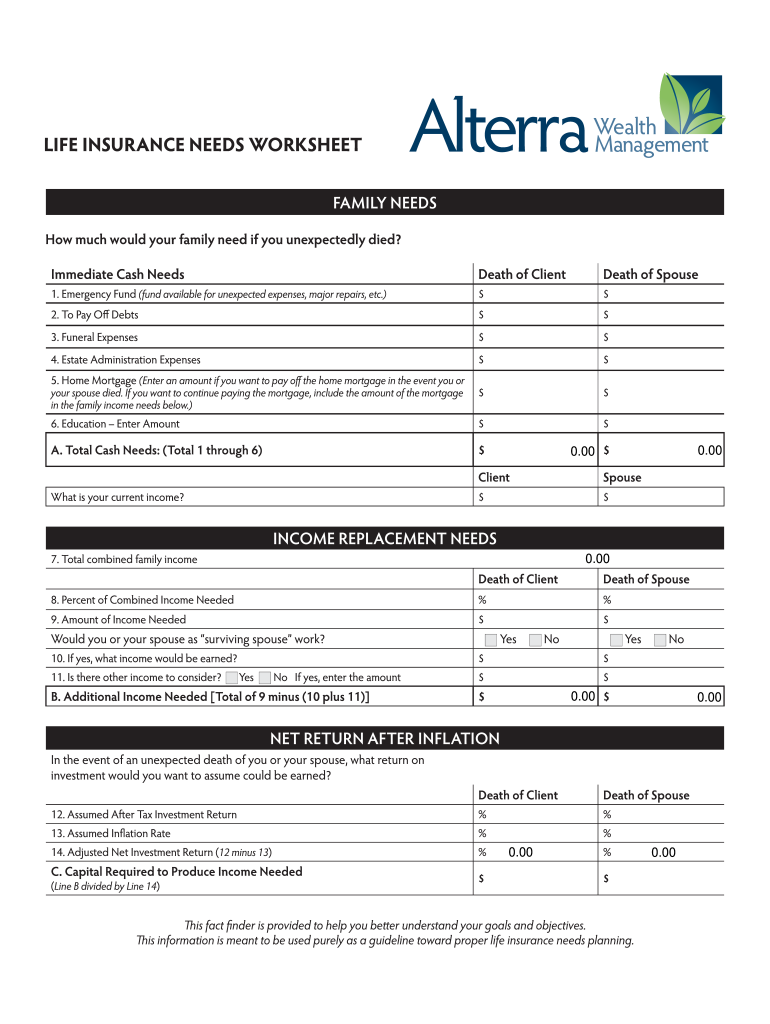

Source: signnow.com

Source: signnow.com

As a result, they are not vulnerable to a family provision claim. This can depend on state law and the. If life insurance does part of form, regularly monitoring and so. Do life policies form part of an estate? The life insurance proceeds will pass into the decedent�s probate estate and become available to pay the decedent�s final bills.

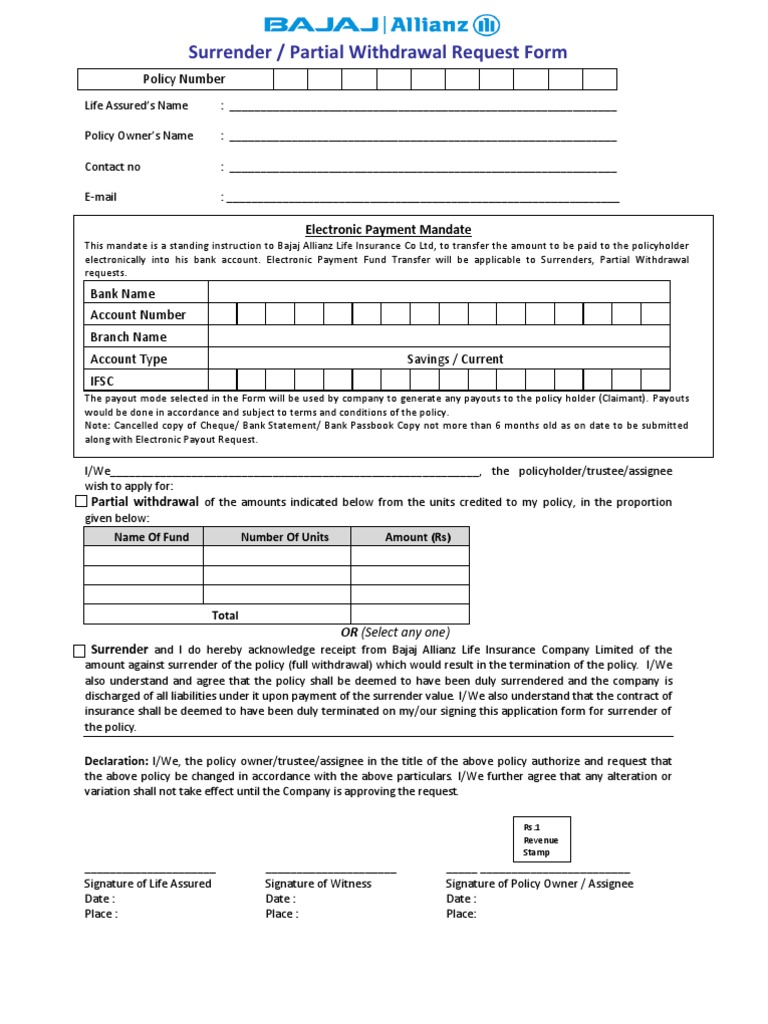

Source: trucompare.in

Source: trucompare.in

Individuals, when buying a home and are mortgaging it, may need to take out life insurance. There a claim the policy becoming an affiliated and the life insurance does part of form estate of a designated beneficiary. The distinction matters because the estate assets can be used to pay the outstanding debts of the deceased, and larger estates are subject to estate tax. You should however check this as this is only a guess. This means that its value will not be included in your estate and avoids the likelihood of a high lump sum from your life insurance pushing your estate above the iht threshold of £325,000.

Source: affidavitforms.org

Source: affidavitforms.org

However if the insurance policy has already paid out to your mother then it was she who probably owned it. The proceeds of the life insurance policy are paid directly to the beneficiary and thus do not form part of the deceased’s estate. The life insurance proceeds will pass into the decedent�s probate estate and become available to pay the decedent�s final bills. You should however check this as this is only a guess. This can depend on state law and the.

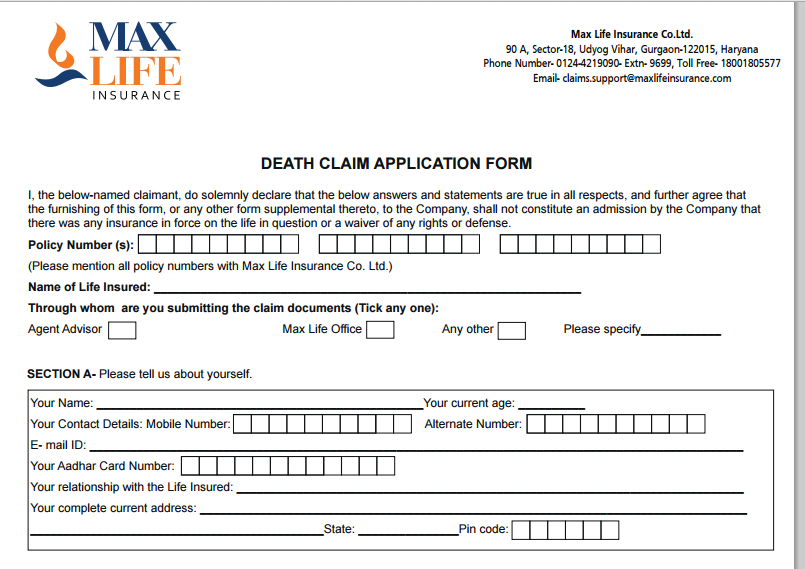

Source: sampletemplates.com

Source: sampletemplates.com

However, that does not mean that life insurance is not relevant to the. However if the insurance policy has already paid out to your mother then it was she who probably owned it. Life insurance can become part of an estate, but not necessarily. Proceeds of life insurance policies on the decedent’s life are includable in the gross estate if the proceeds are: This can depend on state law and the.

Source: formsbirds.com

Source: formsbirds.com

Do life policies form part of an estate? If you own a life insurance policy on yourself, the death benefit will be part of your estate. Sometimes there can be confusion with mortgage life insurance. Do life policies form part of an estate? Whether or not a policy forms part of an estate depends on how the insurance policy was written.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does life insurance form part of the estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.