Your Does life insurance cover natural death images are ready. Does life insurance cover natural death are a topic that is being searched for and liked by netizens today. You can Download the Does life insurance cover natural death files here. Find and Download all free images.

If you’re searching for does life insurance cover natural death images information connected with to the does life insurance cover natural death topic, you have pay a visit to the right site. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

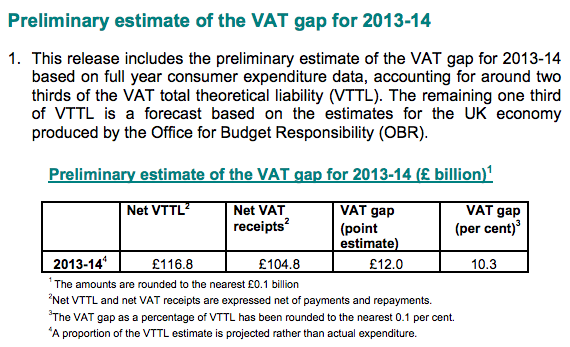

Does Life Insurance Cover Natural Death. Cancer is considered a “natural cause” of death, which comprehensive life insurance policies, such as term life or whole life, cover. Death due to natural calamities like earthquake, tsunami etc. However, it is common for someone diagnosed with cancer to seek out a life insurance policy, and at that point in time it is very difficult to obtain coverage. Standard life insurance policies cover deaths as long as the policy is active at the time of death and it happens after the policy’s contestability period.

Accidental Death and Dismemberment Insurance Adam S From askadamskutner.com

Accidental Death and Dismemberment Insurance Adam S From askadamskutner.com

While it’s always best to check your policy to make sure, most life insurance policies will pay out for any accidental death, regardless of cause. The life insurance should cover this type of circumstance. This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death. Suicide in the first two years. When you fill out a life insurance application, it will ask about certain health conditions (unless it is a guaranteed issue policy, which does not ask about your health). Death due to natural calamities like earthquake, tsunami etc.

According to reports, many who took the experimental gene therapy from donald trump’s “operation warp speed”.

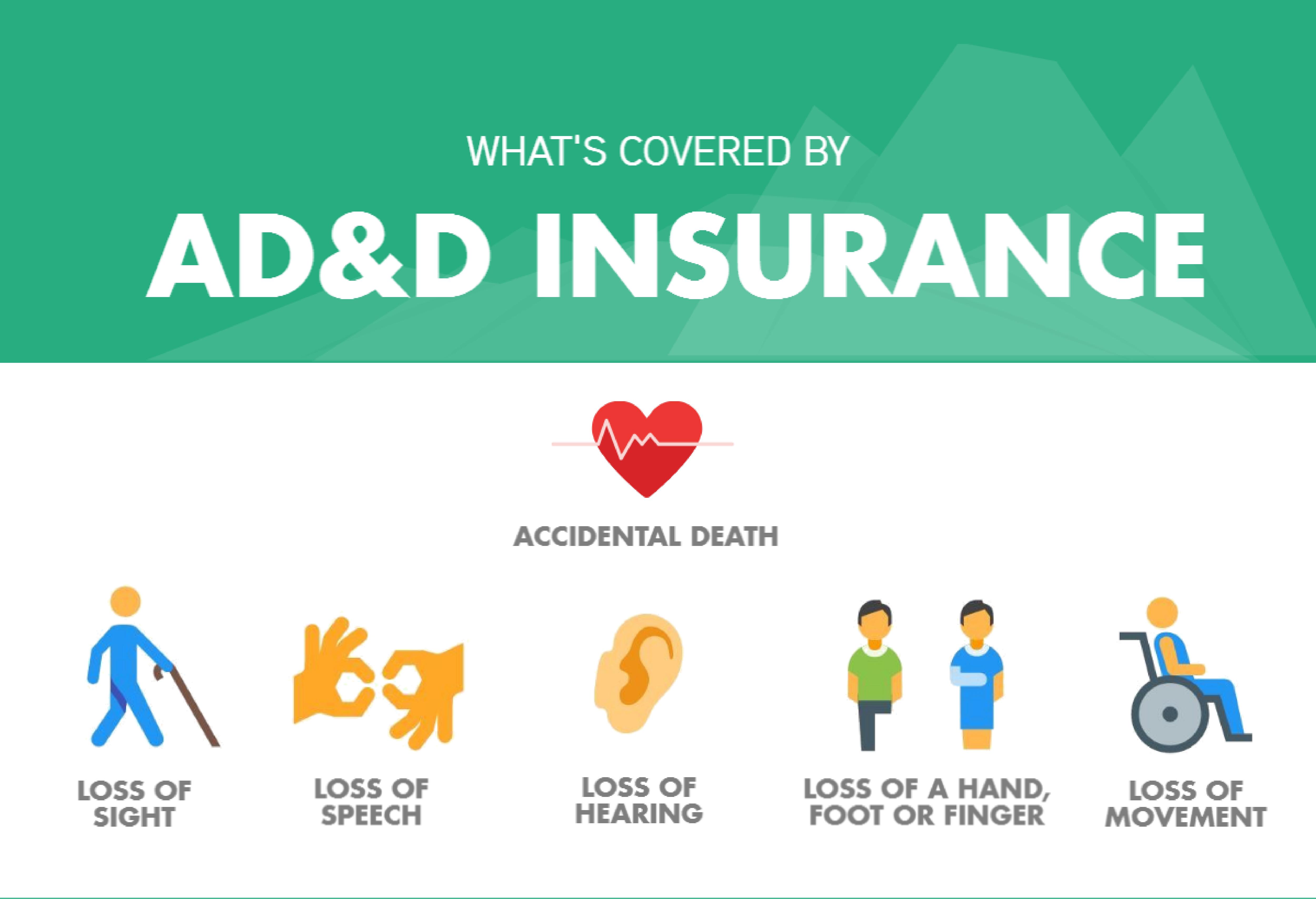

The main difference between accidental death and life insurance is that accidental death coverage will pay out if there is accidental injury or illness (including heart attack, stroke, cancer) that causes your death. Cancer is considered a “natural cause” of death, which comprehensive life insurance policies, such as term life or whole life, cover. Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. Life insurance pays out the death benefit to your beneficiaries for most causes of death. Unlike whole or permanent life insurance, a term life benefit is only guaranteed for a period of time, or term, determined when the insurance was initially approved. This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death.

Source: garnerltd.com

Source: garnerltd.com

Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. The life insurance should cover this type of circumstance. In an event where an insured person faces a natural death, the insurer is legally obligated to provide their nominees with all the death benefits as specified on the policy document.19 fév. Suicide in the first two years. Does life insurance cover natural disasters?

Source: 25financial.com

Source: 25financial.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A specific exclusion offered in lieu of a surcharge for a particularly hazardous occupation such as private aviation. Life insurance covers death due to natural causes. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. Yes, the accidental death benefit on a life insurance policy would pay out if the policyholder died in a natural disaster.

Source: cotzenlaw.com

Source: cotzenlaw.com

If you’re wondering if your life insurance policy can include accidental death, the answer is yes. A term insurance plan does cover death due to natural causes. Suicide in the first two years. Life insurance pays out the death benefit to your beneficiaries for most causes of death. If you die of a heart attack, cancer, an infection, kidney failure, stroke, old age, or.

Source: youtube.com

Source: youtube.com

When you fill out a life insurance application, it will ask about certain health conditions (unless it is a guaranteed issue policy, which does not ask about your health). The death can be due to diseases or a medical condition which ultimately results in the death of the policy. Cancer is considered a “natural cause” of death, which comprehensive life insurance policies, such as term life or whole life, cover. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. Accidental death and dismemberment insurance, or ad&d, is designed to cover accidents.

Source: cpp.ca

Source: cpp.ca

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. Suicide in the first two years. According to reports, many who took the experimental gene therapy from donald trump’s “operation warp speed”. Does life insurance cover natural disasters?

Source: spews.org

Source: spews.org

Standard life insurance policies cover deaths as long as the policy is active at the time of death and it happens after the policy’s contestability period. Life insurance policies can refuse payouts for the jabbed because covid vaccines are “medical experiments” by: Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. However, it is common for someone diagnosed with cancer to seek out a life insurance policy, and at that point in time it is very difficult to obtain coverage. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100.

Source: lifeinvestmentinsurance.com

Source: lifeinvestmentinsurance.com

Are also not covered under the term insurance policy,. A term insurance plan does cover death due to natural causes. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. The main difference between accidental death and life insurance is that accidental death coverage will pay out if there is accidental injury or illness (including heart attack, stroke, cancer) that causes your death. Life insurance policies can refuse payouts for the jabbed because covid vaccines are “medical experiments” by:

Source: brashearsinsurance.com

Source: brashearsinsurance.com

In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. These are just two examples of several circumstances. Does term insurance cover natural death? Death due to natural disaster if a policyholder with a term insurance plan dies due to a natural disaster such as an earthquake, or hurricane, then the nominee will not get the claim from the insurer. The accidental death coverage will pay out if there is an.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

Yes, life insurance does cover natural death. A specific exclusion offered in lieu of a surcharge for a particularly hazardous occupation such as private aviation. Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. Does term insurance cover natural death?

Source: forbes.com

Source: forbes.com

When you fill out a life insurance application, it will ask about certain health conditions (unless it is a guaranteed issue policy, which does not ask about your health). Is suicide covered in life insurance? Does life insurance cover natural disasters? A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: saffordins.com

Source: saffordins.com

The life insurance should cover this type of circumstance. Term insurance plan covers health related death or natural death. In an event where an insured person faces a natural death, the insurer is legally obligated to provide their nominees with all the death benefits as specified on the policy document. This includes if you die from a heart attack, cancer, infectious diseases, kidney failure, stroke, old age, or any other natural death. If you’re wondering if your life insurance policy can include accidental death, the answer is yes.

Source: philkotse.com

Source: philkotse.com

It generally takes at least a couple of years to obtain a medically underwritten policy after a cancer diagnosis, especially if over stage 2. Are also not covered under the term insurance policy,. If you were to have an accidental death while owning a life insurance policy depending on your plan you would be protected because this coverage is built into your policy. Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. The life insurance should cover this type of circumstance.

Source: pinterest.com

Source: pinterest.com

In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. If you die of a heart attack, cancer, an infection, kidney failure, stroke, old age, or. In other words, a guaranteed acceptance life insurance plan will pay full coverage on the amount that you purchase only after two years have passed since the effective date of the policy. Life insurance covers all causes of death except.

Source: postoast.com

Source: postoast.com

Life insurance covers death due to natural causes. Death due to natural disaster if a policyholder with a term insurance plan dies due to a natural disaster such as an earthquake, or hurricane, then the nominee will not get the claim from the insurer. Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. Yes, life insurance companies typically pay death benefits to beneficiaries and loved ones whether the deceased is 20 or 100. Life insurance policies can refuse payouts for the jabbed because covid vaccines are “medical experiments” by:

Source: stingypig.ca

Source: stingypig.ca

A term insurance plan does cover death due to natural causes. If you die of a heart attack, cancer, an infection, kidney failure, stroke, old age, or. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary (s) of the insurance policy will get the sum assured as the death benefit. Under such circumstances, the nominee of the policy holder will be paid the sum assured of the term plan. Unlike whole or permanent life insurance, a term life benefit is only guaranteed for a period of time, or term, determined when the insurance was initially approved.

Source: askadamskutner.com

Source: askadamskutner.com

The life insurance should cover this type of circumstance. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary (s) of the insurance policy will get the sum assured as the death benefit. Life insurance pays out the death benefit to your beneficiaries for most causes of death. The applicant can apply for an exclusion so that, if he dies in a private aviation accident, there will be no death benefit forthcoming. Every insurance policy written by a.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

A term insurance plan does cover death due to natural causes. Every insurance policy written by a. The accidental death coverage will pay out if there is an. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary (s) of the insurance policy will get the sum assured as the death benefit. Term life insurance policies that cover accidental death can provide insurance coverage for.

![Does Life Insurance Cover Natural Death [Get The TRUTH!] Does Life Insurance Cover Natural Death [Get The TRUTH!]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/10/Infografic27-2-LI-Plans-No-Pay-Natural-Death.png) Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

When you fill out a life insurance application, it will ask about certain health conditions (unless it is a guaranteed issue policy, which does not ask about your health). If you die of a heart attack, cancer, an infection, kidney failure, stroke, old age, or. Are also not covered under the term insurance policy,. A term insurance plan does cover death due to natural causes. A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does life insurance cover natural death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.